Private housing further moderates to 1.1% q-o-q growth in 2Q2024; URA flash estimates

Private residential property prices saw a quarterly increase of 1.1% in 2Q2024 moderating slightly compared to the 1.4% q-o-q increase in 1Q2024, according to URA flash estimates released today.

The latest statistics indicate that property prices in the non-landed market grew by 0.9% last quarter, inching up relative to the 1% q-o-q increase in 1Q2024.

Overall, the private housing market notched 4,215 sales transactions in 2Q2024, nearly matching the 4,230 transactions recorded in the first three months of this year.

Search for the latest New Launches, to find out the transaction prices and available units

Advertisement

Advertisement

Source: URA

The latest quarterly increase in private housing prices was underpinned by a decline in prices within the Core Central Region (CCR) which saw private non-landed home prices drop 0.2% q-o-q last quarter, compared to the 3.4% q-o-q increase it recorded in 1Q2024.

According to Eugene Lim, key executive officer of ERA Singapore, the contraction in CCR prices may have been partially due to downward price revisions in several CCR projects including Cuscaden reserve and The Residences at W Singapore Sentosa Cove.

He says that the price revisions among some luxury projects in the CCR has sparked much-needed buying activity in the luxury market.

“This is a healthy shift, considering that the CCR market, which typically sees the largest proportion of foreign buyers, has remained suppressed due to the increase in ABSD rates for foreigners in April 2023,” says Lim.

On the other hand, prices in the Rest Central Region (RCR) grew 2.2% in 2Q20224 and higher than the modest 0.3% q-o-q growth that the segment recorded in 1Q2024.

Meanwhile, prices in the Outside Central Region (OCR) grew 0.3% q-o-q in 2Q2024, remaining largely unchanged from the 0.2% q-o-q increase recorded in the previous quarter.

Read also: Is it a Good Deal?: $1,237 psf for a two-storey penthouse in Sentosa

Advertisement

Advertisement

Leonard Tay, head of research at Knight Frank Singapore attributes the price growth in the RCR and OCR to elevated prices in the new launch market, a result of prevailing high construction costs and land prices that were committed 12 to 18 months ago.

The lack of sales in the new launch market could also have put downward pressure on the overall price index, says Christine Sun, chief researcher and strategist at OrangeTee Group.

Based on URA caveats, the number of new home sales (excluding Executive Condos) fell 41.4% q-o-q to 679 units sold in 2Q2024, compared with the 1,158 units sold in 1Q2024.

As for the landed property market, prices moderated further with a recorded quarterly price growth of 1.8% in 2Q2024, compared to the 2.6% q-o-q increase in 1Q2024.

“Demand for landed homes from Singaporeans moving up the housing aspiration ladder remains intact against limited supply in land scarce Singapore”, says Knight Frank’s Tay.

He adds that most landed home sellers have been reluctant to decrease their asking prices and price premiums, causing buyers to snap up available properties that are listed at, or slightly under, their market valuations.

Read also: Final units at Perfect Ten and Pasir Ris 8 sold

Advertisement

Advertisement

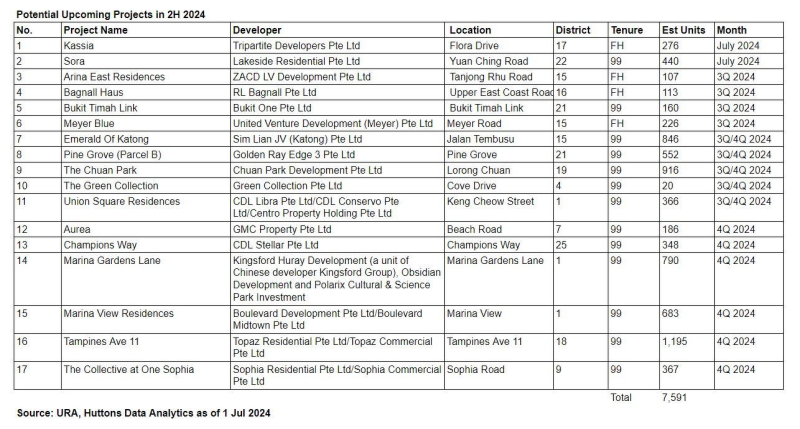

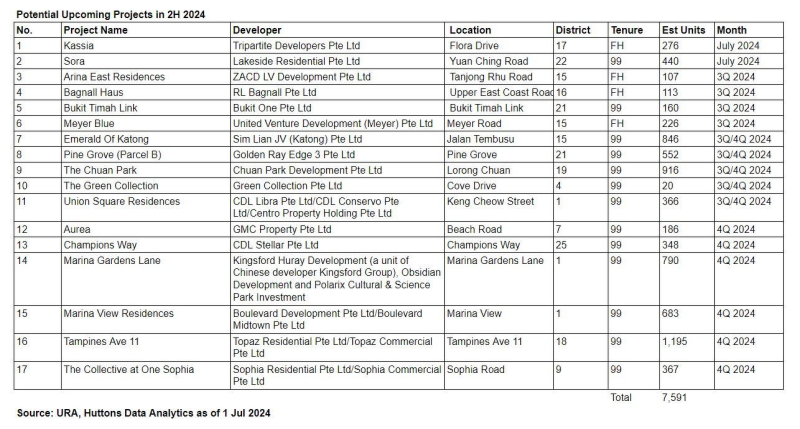

Lee Sze Teck, senior director of data analytics at Huttons Asia, estimates that the market could see up to 16 launch-ready new projects enter the market in 2H2024, injecting a total of 7,571 new units into the market. Upcoming launches include Kassia and SORA this month.

If current market conditions prevail, Lee estimates that developers may sell up to 6,500 new homes for the whole of this year, and an overall price growth of up to 4%.

Check out the latest listings for Cuscaden Reserve, The Residences At W Singapore Sentosa Cove properties

Check out the latest listings for Cuscaden Reserve, The Residences At W Singapore Sentosa Cove properties

Check out the latest listings for Cuscaden Reserve, The Residences At W Singapore Sentosa Cove properties

Check out the latest listings for Cuscaden Reserve, The Residences At W Singapore Sentosa Cove properties