Government launches tender for mixed-use GLS site at Tampines St 94

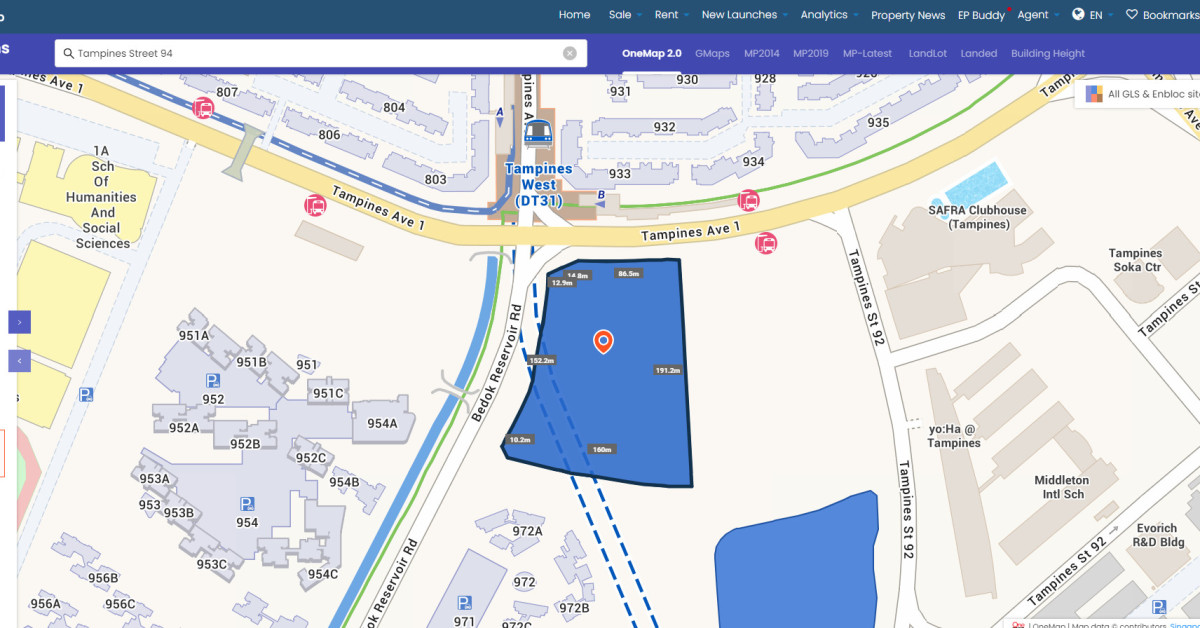

The Housing and Development Board (HDB) has launched the tender for a mixed-use commercial and residential site at Tampines Street 94. The site is listed under the confirmed List of the 1H2024 Government Land Sales (GLS) Programme.

The 252,989 sq ft site has a gross plot ratio of 2.6 with a maximum gross floor area (GFA) of 665,366 sq ft. The new development could yield 585 residential units, with a commercial GFA of approximately 112,980 sq ft.

"The site is a win with its commercial component and its prime location just across from the Tampines West MRT station. The commercial component will come under a single strata owner, giving them better control over the choice of tenants. It will likely consist of a retail component with a mix of tenants that can serve the residents’ needs, including a childcare centre, supermarket and a food court," says Marcus Chu, CEO of ERA Singapore.

Read also: Government releases 19 sites under 2H2024 GLS Programme

Advertisement

The site is next to Tampines West MRT station on the Downtown Line, and it is one stop away from Tampines Regional Centre and Bedok Reservoir, which adds to the overall appeal of the site, says Lee Sze Teck, senior director of data analytics at Huttons Asia. "As it is a mixed-use site, residents will enjoy amenities right at their doorstep. Furthermore there are four primary schools within 1km including the popular St Hilda's Primary School," he says.

Other schools and educational instiutions in the vicinity include Junyuan Primary School, Tampines Primary School, Springfield Secondary School, and Temasek Polytechnic.

"Tampines, being an established housing estate has consistently seen resilient housing demand," says Chu, who adds: "Demand will be well-supported by the workforce in the commercial nodes such as Tampines Regional Centre, Changi Airport and Changi Business Park. Investors can also leverage on the strong tenant pool of these areas, which are easily accessible via the Downtown Line".

Justin Quek, CEO of OrangeTee & Tie, commented that there is a large number of BTO flats in the vicinity which would add to the pedestrian footfall around this area. "The closeness of Tampines West MRT station makes travelling more accessible as well. Moreover, between 2023 to 2027, around 8,800 flats will achieve MOP within Tampines, out of almost 67,000 flats island wide, who may form the part of the customer base for the future project here," he says.

"The last GLS site sold in Tampines was at Tampines Ave 11 which was also a mixed-use site," says Lee, referencing the 545,314 sq ft GLS site that was awarded to a consortium between UOL Group, Singapore Land (SingLand) and CapitaLand Development last June. The consortium submitted a top bid of $1.206 billion, which works out to $885 psf per plot ratio (psf ppr).

The land use zoning for that future mixed-use development comprises a commercial and residential development integrated with a bus interchange, a community club, and a hawker centre. The residential component could yield about 1,190 units.

Read also: Wing Tai Holdings submits top bid of $1,325 psf ppr for residential GLS site at River Valley Green

Advertisement

"The Tampines Ave 11 site is double the size of the Tampines St 94 site and attracted 3 bidders and a top bid of $885 psf ppr. Similarly this site at Tampines St 94 may see not more than 3 bidders and a top bid of $820 to $850 psf ppr to be competitive," says Lee.

This part of Tampines exhibits pent-up demand for private homes in this area as the most recent private home launch in Tampines was Treasures at Tampines back in 2019, says Quek. "The project managed to sell out its 2203 units, and has had several subsale and resale transactions recently. Some of these subsale and resale transactions have also experienced capital appreciation and seen profits," he says.

He expects three to six bidders will participate in the tender for this site, and the highest bid price could range from $900 - $980 psf ppr.

Chu says that the new mixed-use development on Tampines Street 94 will be a palatable "mid-sized development in the OCR" for developers to take on. "The developmental risks and capital outlay would not be as high as large developments nearer or in the city centre. Despite current headwinds, we believe this site remains closely watched by developers and could garner a higher-than-usual number of bids in today’s climate," he says.

The tender for the GLS site at Tampines Street 94 will close on Sept 19.