June 2024 BTO exercise sees an application rate of 3.1, the highest since May 2023

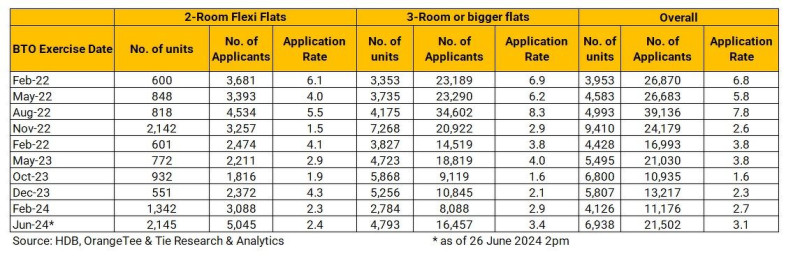

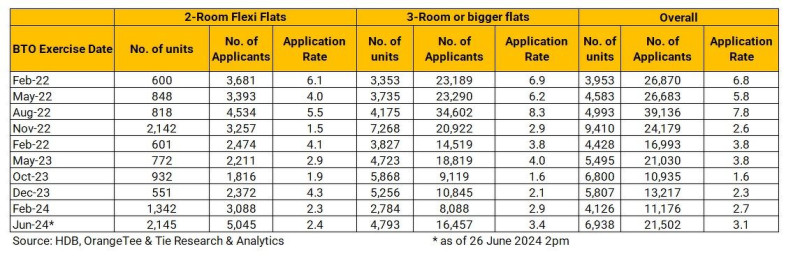

SINGAPORE (EDGEPROP) - The June 2024 Build-to-Order (BTO) exercise, which saw 6,938 flats launched for sale on June 19, closes on June 26 at 11.59pm. HDB data updated as of 2pm on June 26 shows that the number of applications stood at 24,179. This is the highest number of applicants since November 2022, when the application rate was 2.6, says Christine Sun, chief researcher and strategist at Orange Tee & Tie.

The number of applicants works out to an application rate of 3.1 times. This is the highest application rate since the BTO exercise in May 2023, which stood at 3.8. The number of applicants is also more 100% higher than that of the last BTO exercise in February, when over 11,000 applications vied for 4,126 BTO flats. This works out to an application rate of about 2.5.

SRI’s head of research and data analytics, Mohan Sandrasegeran, attributes the sharp jump in applications to the impending change in housing classification of Standard, Plus and Prime flats in the October BTO exercise.

Read also: HDB launches close to 7,000 new flats in June 2024 BTO sales launch

Advertisement

Lee Sze Teck, senior director of data analytics at Huttons Asia, agrees. “This is the last BTO exercise where buyers will face fewer restrictions on the subsequent sale of their flat. Additionally, it is unclear how HDB will categorise flats under the new classification.”

He says another reason for the high demand is the launch of highly attractive BTO projects, such as Tampines GreenTopaz. This project received the highest number of applications, with 214 four-room and 174 five-room units attracting over 2,100 applicants each.

This is likely the last BTO project in a mature estate near an MRT station. It comes with a five-year minimum occupation period (MOP) and is not subject to the new resale restrictions. Additionally, the project is part of a future mixed-use residential development with a shorter waiting time of 37 months. An upcoming Government Land Sales (GLS) plot adjacent to the site will include a sizeable commercial space, offering more amenities for residents.

Sandrasegeran adds that the five-room flats were the most popular within the project, with an application rate of about 12.1 per flat. The overall application rate for the four-room units was about 10.1.

SRI’s head of research and data analytics, Mohan Sandrasegeran, attributes the sharp jump in applications to the impending change in housing classification of Standard, Plus and Prime flats in the October BTO exercise.

Read also: HDB launches close to 7,000 new flats in June 2024 BTO sales launch

Advertisement

Lee Sze Teck, senior director of data analytics at Huttons Asia, agrees. “This is the last BTO exercise where buyers will face fewer restrictions on the subsequent sale of their flat. Additionally, it is unclear how HDB will categorise flats under the new classification.”

He says another reason for the high demand is the launch of highly attractive BTO projects, such as Tampines GreenTopaz. This project received the highest number of applications, with 214 four-room and 174 five-room units attracting over 2,100 applicants each.

This is likely the last BTO project in a mature estate near an MRT station. It comes with a five-year minimum occupation period (MOP) and is not subject to the new resale restrictions. Additionally, the project is part of a future mixed-use residential development with a shorter waiting time of 37 months. An upcoming Government Land Sales (GLS) plot adjacent to the site will include a sizeable commercial space, offering more amenities for residents.

Sandrasegeran adds that the five-room flats were the most popular within the project, with an application rate of about 12.1 per flat. The overall application rate for the four-room units was about 10.1.

Holland Vista saw the second-highest application rate at about 9.0, Sandrasegeran notes. Its 228 four-room flats attracted over 2,063 applicants. He attributes Holland Vista’s attractiveness to its proximity to Holland Village MRT Station and the One Holland Village shopping mall. Lee also notes that Holland Vista is likely the last plot of land for public housing in Holland Village.

Meanwhile, Tanjong Rhu Riverfront I and II offer riverfront living in the highly coveted Tanjong Rhu precinct. However, Lee notes that their application rates were lower, with first-timer families applying at rates of 0.8 for three-room flats and 1.9 for four-room flats.

Holland Vista saw the second-highest application rate at about 9.0, Sandrasegeran notes. Its 228 four-room flats attracted over 2,063 applicants. He attributes Holland Vista’s attractiveness to its proximity to Holland Village MRT Station and the One Holland Village shopping mall. Lee also notes that Holland Vista is likely the last plot of land for public housing in Holland Village.

Meanwhile, Tanjong Rhu Riverfront I and II offer riverfront living in the highly coveted Tanjong Rhu precinct. However, Lee notes that their application rates were lower, with first-timer families applying at rates of 0.8 for three-room flats and 1.9 for four-room flats.

SRI’s head of research and data analytics, Mohan Sandrasegeran, attributes the sharp jump in applications to the impending change in housing classification of Standard, Plus and Prime flats in the October BTO exercise.

Read also: HDB launches close to 7,000 new flats in June 2024 BTO sales launch

Advertisement

Lee Sze Teck, senior director of data analytics at Huttons Asia, agrees. “This is the last BTO exercise where buyers will face fewer restrictions on the subsequent sale of their flat. Additionally, it is unclear how HDB will categorise flats under the new classification.”

He says another reason for the high demand is the launch of highly attractive BTO projects, such as Tampines GreenTopaz. This project received the highest number of applications, with 214 four-room and 174 five-room units attracting over 2,100 applicants each.

This is likely the last BTO project in a mature estate near an MRT station. It comes with a five-year minimum occupation period (MOP) and is not subject to the new resale restrictions. Additionally, the project is part of a future mixed-use residential development with a shorter waiting time of 37 months. An upcoming Government Land Sales (GLS) plot adjacent to the site will include a sizeable commercial space, offering more amenities for residents.

Sandrasegeran adds that the five-room flats were the most popular within the project, with an application rate of about 12.1 per flat. The overall application rate for the four-room units was about 10.1.

SRI’s head of research and data analytics, Mohan Sandrasegeran, attributes the sharp jump in applications to the impending change in housing classification of Standard, Plus and Prime flats in the October BTO exercise.

Read also: HDB launches close to 7,000 new flats in June 2024 BTO sales launch

Advertisement

Lee Sze Teck, senior director of data analytics at Huttons Asia, agrees. “This is the last BTO exercise where buyers will face fewer restrictions on the subsequent sale of their flat. Additionally, it is unclear how HDB will categorise flats under the new classification.”

He says another reason for the high demand is the launch of highly attractive BTO projects, such as Tampines GreenTopaz. This project received the highest number of applications, with 214 four-room and 174 five-room units attracting over 2,100 applicants each.

This is likely the last BTO project in a mature estate near an MRT station. It comes with a five-year minimum occupation period (MOP) and is not subject to the new resale restrictions. Additionally, the project is part of a future mixed-use residential development with a shorter waiting time of 37 months. An upcoming Government Land Sales (GLS) plot adjacent to the site will include a sizeable commercial space, offering more amenities for residents.

Sandrasegeran adds that the five-room flats were the most popular within the project, with an application rate of about 12.1 per flat. The overall application rate for the four-room units was about 10.1.

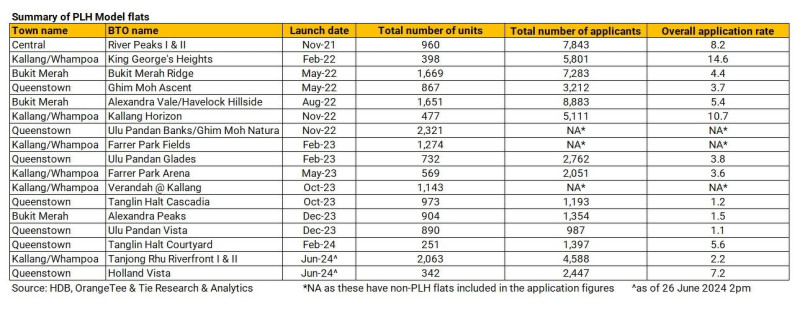

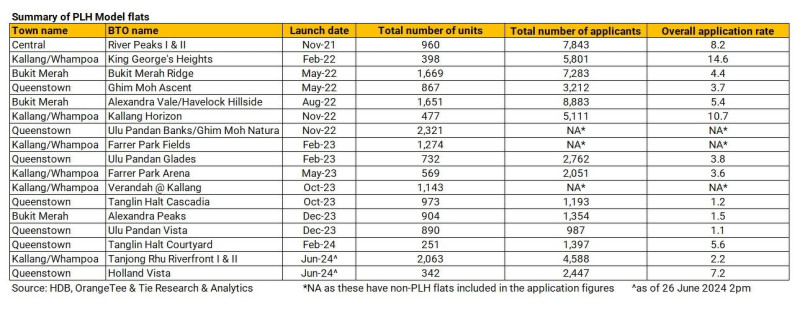

Higher application rates for PLH model flats

The two Prime Location Public Housing (PLH) projects, Holland Vista in Queenstown and Tanjong Rhu Riverfront I and II in Kallang and Whampoa were also popular among applicants, says Huttons Asia’s Lee. Even though both projects have a subsidy clawback rate of 9%, the highest since such flats were introduced, ERA’s key executive officer Eugene Lim says. He adds that applicants were still drawn to the projects due to their attractive locations. Advertisement Moreover, the capital appreciation for such flats is likely to be higher than 9% in future, which may have pushed buyers to proceed with the purchase, says Sun. Holland Vista saw the second-highest application rate at about 9.0, Sandrasegeran notes. Its 228 four-room flats attracted over 2,063 applicants. He attributes Holland Vista’s attractiveness to its proximity to Holland Village MRT Station and the One Holland Village shopping mall. Lee also notes that Holland Vista is likely the last plot of land for public housing in Holland Village.

Meanwhile, Tanjong Rhu Riverfront I and II offer riverfront living in the highly coveted Tanjong Rhu precinct. However, Lee notes that their application rates were lower, with first-timer families applying at rates of 0.8 for three-room flats and 1.9 for four-room flats.

Holland Vista saw the second-highest application rate at about 9.0, Sandrasegeran notes. Its 228 four-room flats attracted over 2,063 applicants. He attributes Holland Vista’s attractiveness to its proximity to Holland Village MRT Station and the One Holland Village shopping mall. Lee also notes that Holland Vista is likely the last plot of land for public housing in Holland Village.

Meanwhile, Tanjong Rhu Riverfront I and II offer riverfront living in the highly coveted Tanjong Rhu precinct. However, Lee notes that their application rates were lower, with first-timer families applying at rates of 0.8 for three-room flats and 1.9 for four-room flats.