Navigating challenges and leveraging insights in the dynamic cold-chain industry

Singapore's cold-chain real estate market offers a compelling long-term investment opportunity, given the projected increase in demand for high-specification cold-storage facilities over the coming years. However, stringent development regulations and the scarcity of land to develop new facilities in Singapore mean that the upcoming supply of new cold-storage facilities will be limited.

The multi-temperature-controlled facilities, featuring specifications such as varying temperature ranges for different products, are typically built-to-suit to serve a broad range of industries. The cold-chain market in Singapore is critical to the smooth functioning of various industries, including F&B and supermarket chains, pharmaceuticals, and third-party logistics.

For example, Singapore’s robust food import and export market relies heavily on cold-storage facilities. Singapore exports about 60% of its locally manufactured food and imports over 90% of its food supply. As a result, agricultural products typically make up the bulk of items housed in cold-chain facilities here.

Read also: Ageing population, rising healthcare needs to fuel demand for Singapore life sciences real estate: CBRE

Advertisement

E-commerce and online supermarket sales have also driven the growth in the cold-chain perishables market over the past few years. As the demand for perishable food increases in the coming years, we expect to see a sustained demand for ambient, air-conditioned, and chiller food-storage space.

A burgeoning biomedical industry in Singapore has also increased the demand for pharmaceutical cold-chain facilities. We expect to see many pharmaceutical firms step up their investment commitments and real estate requirements in Singapore over the next few years, and this signals the continued demand for more high-specification cold-chain facilities that cater to the needs of this industry.

The growing demand for food-storage space strains Singapore’s limited capacity. A relatively low supply of existing facilities, costly and lengthier construction periods, and complex operational requirements make it challenging to increase the future supply of this niche asset, even as high interest rates exacerbate this issue.

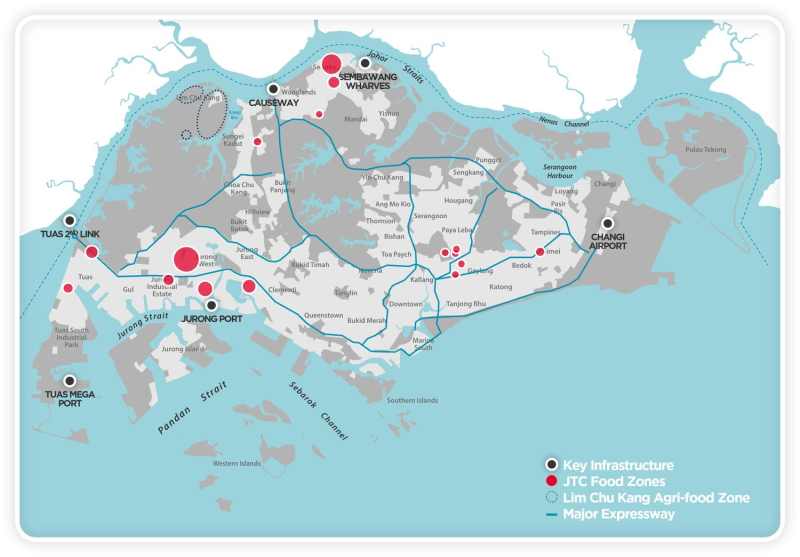

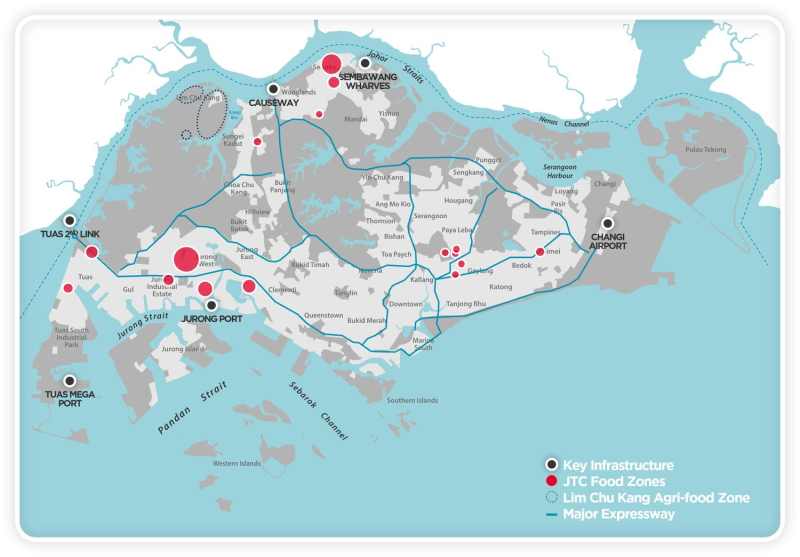

Graphic: JTC, REITS’ ANNUAL REPORTS, CUSHMAN & WAKEFIELD RESEARCH.

Most of the cold-chain facilities are found in the western (estimated 70% of cold-chain stock) and northern regions (20% of cold-chain stock) of Singapore. The western region is a preferred location due to its proximity to major seaports like Jurong Port and Tuas Mega Port as well as key infrastructure developments such as Tuas Second Link.

Read also: Private equity firms TPG, PAG selling shares in Cushman & Wakefield worth US$310.73 mil

Advertisement

The northern region also appeals to cold-chain players as it is near the Singapore Causeway and Sembawang Wharves. The remaining 10% is distributed across the central and eastern regions of Singapore.

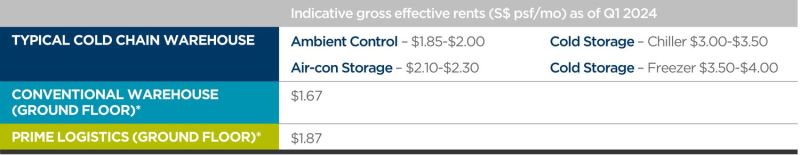

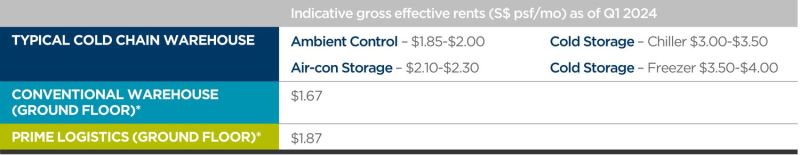

Table: Cushman & Wakefield Research.

Given the limited supply of new cold-storage projects being developed here, we expect to see the average rents for cold-chain facilities notch a yearly increase of 2% to 4% over the next six years, including this year.

The confluence of limited future supply and high leasing demand makes the cold-chain market a real-estate asset class to watch this year. While cold-chain projects may be more operationally intensive, investors who capitalise on this opportunity can look forward to steady long-term cash flows underpinned by a limited supply pipeline.

Brenda Ong is an executive director of logistics & industrial at Cushman & Wakefield Singapore.

Check out the latest listings for Industrial Real Estate properties

Limited stock of cold-chain facilities

Singapore’s stock of cold-storage space consists of a relatively small number of existing facilities. While no official supply statistics are available, Singapore’s cold-chain warehouse capacity is estimated to be over 5.4 million sq ft (in gross floor area or GFA) based on the basket of major properties tracked by Cushman & Wakefield Research. Of this, only 36% (in GFA) of cold-chain stock are multi-user facilities. The majority of cold-chain stock in Singapore is typically held by owner-occupiers given cold-chain facilities’ specialised user requirements.

High development costs

The development of new cold-chain facilities in Singapore involves relatively high construction costs and longer timelines compared to other logistics assets. This is because cold-storage facilities are a complex asset class with varying requirements depending on the needs of the end-user or tenant. The construction of a new cold-storage warehouse in Singapore typically takes about 2½ years. This is about six months longer than a conventional warehouse development which usually takes two years to be completed. Moreover, a greater awareness of sustainability will see energy-efficiency standards take on more prominence for new developments and future asset enhancements. This could increase development periods of future cold-storage projects in Singapore, tightening the supply pipeline, and contribute to stronger rental growth in the short run. In addition, the development of new cold-chain logistics facilities in Singapore faces complex operational requirements that make it a challenge to find suitable industrial sites for new developments. For example, cold-storage facilities that require food processing and manufacturing may be built only within JTC food factory industrial estates and new facilities must conform to prevailing food-safety regulations. Some cold-chain storage facilities that do not involve food processing are permissible outside food factory estates, though this is still subject to approvals. Read also: Office fit-out costs in Singapore rise to $188 psf, highest in Southeast Asia Advertisement These requirements limit the number of potential development sites for cold-storage facilities.An understated asset class to watch

Cold-storage facilities in Singapore already command higher rents compared to conventional warehouse assets, buoyed by their relatively higher initial capital expenditure, operating costs, and limited market supply. Cold-chain warehouse rents in Singapore increased by 13% in 2023. In contrast, overall industrial rents grew by 8.9% over the same 12-month period. The strong leasing demand for cold-chain facilities has also seen them generate yields of 6.5% to 7%, on a par with prime 20- to 30-year leasehold logistics assets.