Asia Pacific real estate faces unprecedented structural and cyclical shifts: LaSalle Investment

Asia Pacific is navigating a cycle unlike any other. While its economies have faced challenges such as supply chain disruptions, elevated inflation, rising interest rates and higher construction costs, real estate capital market liquidity — excluding China and Hong Kong — has proven notably more resilient compared to other regions worldwide.

“We see signs of structural changes and a distinctly different cycle from historical norms in the macroeconomy, as well as in several real estate markets and sectors,” says LaSalle Investment Management’s Insight, Strategy and Analysis Outlook 2025 report released on Dec 12. “A case in point, China could easily be mistaken for Japan 10–20 years ago, struggling with deflationary pressures and an erosion in land prices.”

Certain factors, such as climate change and the rapid advancement of artificial intelligence (AI), are not unique to the Asia-Pacific region. Others, like adjustments in monetary policy, could have an immediate impact on economies and real estate fundamentals.

Read also: Office floor at Visioncrest Orchard released for sale at $54.84 mil

Advertisement

Advertisement

Meanwhile, long-term changes, such as labour market reforms in Japan or supply chain restructuring, may take years or even decades to fully unfold.

These shifts are expected to have a mix of positive and negative impacts on investors, some of which may only become apparent over time.

In China, the plummeting housing market and a multi-decade low in consumer confidence are exerting deflationary pressure on the economy. (Picture: Bloomberg)

Given heightened geopolitical tensions between the US and China, and the absence of impactful structural reforms or larger-scale stimulus packages, the Chinese economy is likely to remain depressed for an extended period. These circumstances should contribute to a challenging environment for China’s residential and commercial real estate markets over the next few years.

With a bias toward raising rates and reflation, Japan is in a considerably different position. That said, the BOJ is emphasising flexibility and predictability after the Japanese stock market experienced historic volatility following the July rate hike.

The snap election on Oct 27 resulted in a surprise defeat for the Liberal Democratic Party (LDP), which lost its outright majority in the Lower House for the first time in 15 years. A degree of political uncertainty is likely until the Upper House election next July.

Japan could muddle through this period if wage growth continues beyond next year and the government deploys more ammunition to boost household spending to cope with the high cost of living.

The BOJ might have to be mindful of raising interest rates too quickly or sharply in the interim, which could be welcome news for real estate investors.

Read also: TE Capital-LaSalle JV completes purchase of VisionCrest Commercial, to carry out enhancements

Advertisement

Advertisement

Singapore’s economy demonstrated resilience for most of 2024, buoyed by an unexpected increase in global demand, particularly within trade-related sectors. (Picture: albert Chua/The Edge Singapore)

Singapore’s economy demonstrated resilience for most of the year, buoyed by an unexpected increase in global demand, particularly within trade-related sectors.

Nevertheless, should the US impose heavy tariffs on Singapore or its key trade partners, there could be a potential slowdown in the recent trade momentum. Conversely, should the US-China geopolitical tensions intensify, Singapore could continue to attract investment inflows diverting from China and Hong Kong, particularly in the wealth management industry.

During the first eight months of the year, there was an 18% increase in the number of family offices. While wage growth is coming off its cyclical peak, the labour market remains healthy. Singapore’s economy is expected to grow by 1%–3% in the next two years, slightly below the historical average. As the growth momentum of several real estate demand drivers decelerates, the potential for rental growth in some of these sectors could be limited.

In Singapore, both occupier fundamentals and capital values are peaking. In the next 12–18 months, the market is likely to experience limited expansionary demand and higher new supply. However, for investors with flexible investment horizons or seeking to preserve wealth over the long term, freehold offices in prime locations, which are scarce, remain an attractive proposition despite cooling fundamentals.

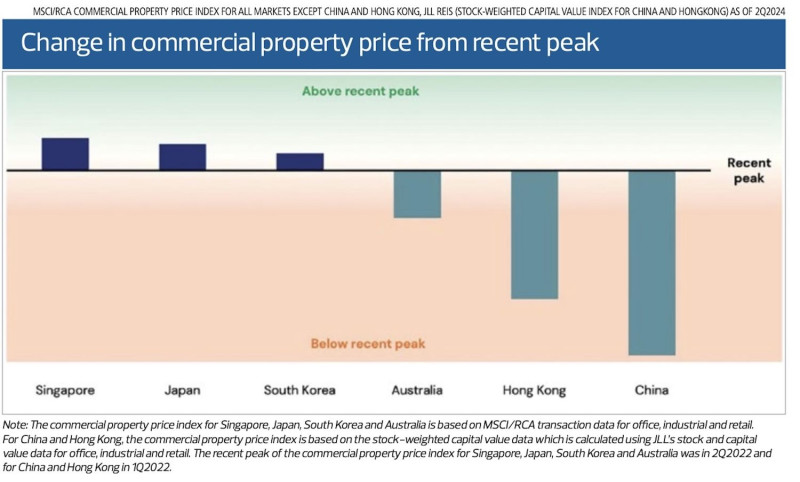

In China, Hong Kong, and Australia, where there are indications of potential structural changes, it is unlikely that market fundamentals will return to their historical norms in the near term.

Weak business conditions and the downsizing of foreign companies in China and Hong Kong have significantly reduced office demand, casting uncertainty over whether demand will return to pre-pandemic levels. Despite easing financial conditions, low liquidity and weak fundamentals should continue to impact capital values. It is too early to enter these office markets despite discounted prices.

In Australia, the potential increase in return-to-office mandates next year may improve office utilisation. However, it is unlikely to materially improve the supply-demand imbalance over the next three to five years.

Moreover, starting next July, government tenants will have a higher minimum energy rating requirement under the National Australian Built Environment Rating System (NABERS) for new office leases. It is likely to further concentrate demand for prime-grade offices at the expense of secondary-grade offices.

Australia’s office capital values are expected to remain under downward pressure in the coming years due to weak office market fundamentals and a prolonged period of high interest rates. As a result, it may be premature to invest in the Australian office market unless prices are adjusted to reflect these risks.

In Singapore, both occupier fundamentals and capital values are peaking. In the next 12–18 months, the market is likely to experience limited expansionary demand and higher new supply. However, for investors with flexible investment horizons or seeking to preserve wealth over the long term, freehold offices in prime locations, which are scarce, remain an attractive proposition despite cooling fundamentals.

In China, Hong Kong, and Australia, where there are indications of potential structural changes, it is unlikely that market fundamentals will return to their historical norms in the near term.

Weak business conditions and the downsizing of foreign companies in China and Hong Kong have significantly reduced office demand, casting uncertainty over whether demand will return to pre-pandemic levels. Despite easing financial conditions, low liquidity and weak fundamentals should continue to impact capital values. It is too early to enter these office markets despite discounted prices.

In Australia, the potential increase in return-to-office mandates next year may improve office utilisation. However, it is unlikely to materially improve the supply-demand imbalance over the next three to five years.

Moreover, starting next July, government tenants will have a higher minimum energy rating requirement under the National Australian Built Environment Rating System (NABERS) for new office leases. It is likely to further concentrate demand for prime-grade offices at the expense of secondary-grade offices.

Australia’s office capital values are expected to remain under downward pressure in the coming years due to weak office market fundamentals and a prolonged period of high interest rates. As a result, it may be premature to invest in the Australian office market unless prices are adjusted to reflect these risks.

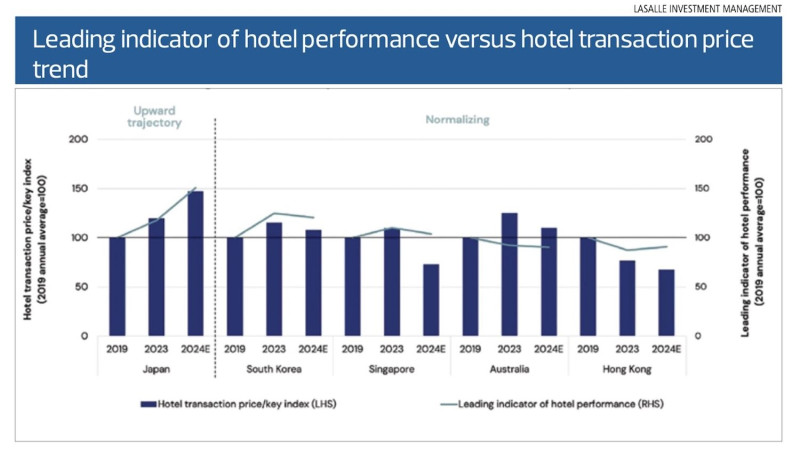

The hotel sector outlooks for China and Japan, the two largest markets in the region, reflect contrasting dynamics. China’s hotel sector, heavily reliant on domestic demand, continues to face challenges from an oversupply of hotels and declining per capita tourism spending. These risks are not adequately offset by declining transaction prices.

In contrast, Japan’s hotel market is on a growth trajectory, driven primarily by domestic demand and, to a lesser extent, by inbound tourism. This growth has pushed hotel transaction prices in Japan to record highs this year. However, performance across segments is expected to vary, influenced by operational challenges such as labour shortages and rising labour costs.

The hotel sector outlooks for China and Japan, the two largest markets in the region, reflect contrasting dynamics. China’s hotel sector, heavily reliant on domestic demand, continues to face challenges from an oversupply of hotels and declining per capita tourism spending. These risks are not adequately offset by declining transaction prices.

In contrast, Japan’s hotel market is on a growth trajectory, driven primarily by domestic demand and, to a lesser extent, by inbound tourism. This growth has pushed hotel transaction prices in Japan to record highs this year. However, performance across segments is expected to vary, influenced by operational challenges such as labour shortages and rising labour costs.

Stark contrast between China and Japan

The most pronounced signs of structural change can be observed in China and Japan. These two major economies in the region demonstrate the starkest contrast to global trends and stand in sharp contrast to one another. In China, the plummeting housing market and a multi-decade low in consumer confidence are exerting deflationary pressure on the economy. The People’s Bank of China (PBOC) has pushed interest rates to record lows. In contrast, this year, Japan appeared to be exiting its roughly 30-year-long deflationary environment. In March 2024, the Bank of Japan (BOJ) made a historic shift from its unorthodox monetary policy and began to raise policy interest rates. From September to mid-November, China launched its largest economic stimulus campaign since the pandemic, including a substantial package of fiscal measures, policy changes and historically low interest rates. Read also: Two office floors at VisionCrest Orchard up for sale at $119.9 mil Advertisement Advertisement While the latest stimulus measures represent a step in the right direction, they are far from sufficient to address the current economic problems, namely a depressed housing market, lack of consumer and business confidence, indebted local governments, and a shrinking and ageing population.

Trade and Trump 2.0

US President-elect Donald Trump’s victory will likely usher in heightened economic uncertainty and capital market volatility for most Asia Pacific economies. Trump 2.0 may be characterised by aggressive trade policies, pockets of strained geopolitical relationships and a need for strategic adaptation among the region’s governments, businesses and investors. China is particularly vulnerable and, to a lesser extent, Hong Kong. Other Asia Pacific nations will need to balance their relationships with both the US and China. Potential supply chain disruptions in countries such as Australia, Japan, South Korea and Southeast Asian countries linked to China, also cannot be ignored as China remains their largest trading partner. All countries in the region will have to consider whether trade barriers require a domestic policy response, such as stimulus measures. That said, it is too early to tell whether the US will end up imposing tariffs that are as broad or as high as what was pledged on the campaign trail or if the Trump Administration will take the opportunity to negotiate bilateral trade agreements with key trading partners in the region. The 2018–2019 trade war demonstrated that the imposed tariffs can be lower than those proposed if China imports more US goods to narrow the US trade deficit. While the share of exports going to the US varied, total exports of major Asia Pacific economies in value terms generally increased. Looking ahead, the Trump 2.0 era could lead to periodic episodes of capital market volatility. Investors may, therefore, consider focusing on Asia Pacific real estate markets/sectors anchored by domestic demand (e.g. Japan multi-family, Australia industrial) and domestic capital (e.g. Japanese real estate, Seoul office).

Hong Kong – Weighed down by China

Hong Kong’s economic growth has slowed, mainly driven by declining retail sales due to cost-conscious mainland Chinese tourists, a strong Hong Kong dollar and Hong Kong residents diverting spending across the mainland border. These trends are expected to continue in the near to medium term. The territory’s close link to US monetary policy through the US dollar currency peg could provide some relief to capital market liquidity if the US Fed continues to ease interest rates. However, due to its close ties to mainland China, LaSalle Investment maintains “a high degree of caution about the outlook for Hong Kong’s economy and capital market liquidity”.South Korea – Two engines with uneven thrust

South Korea’s economic performance in 2024 resembles a dual-engine plane flying with one engine noticeably underperforming. Exports (particularly of semiconductors) are the powerful primary engine, propelling the country’s economy on the global stage. However, domestic consumption, the second engine, is running at a reduced capacity, limiting the plane’s ability to reach its full potential. This imbalance makes the economy more susceptible to unexpected headwinds. The risk of a potential US-China trade war 2.0 clouds the outlook for South Korea’s exports, particularly the semiconductor exports. While the global AI boom presents a mitigating factor, it may take time for South Korean firms to secure market share in this evolving landscape. The recent developments in domestic politics further complicate the outlook, potentially hindering the effectiveness of fiscal policy support. Nonetheless, the Bank of Korea is taking a proactive monetary policy approach to mitigate some potential external shocks and stimulate domestic demand. Economic growth in South Korea is expected to decelerate next year, suggesting no or limited growth potential even in resilient real estate sectors (e.g., office).Australia – Slowing tailwinds

The tailwinds to Australia’s economic growth momentum are weakening. The government’s objective to reduce net migration by next year could reduce immigration’s contribution to GDP growth from the peak level seen over the past two years. Government spending is projected to reach a record high by the end of 2025 but could slow thereafter as tax revenue declines. The good news is that more jobs are being created, especially in healthcare, keeping the unemployment rate comfortably below the historical average. However, the tight job market contributes to elevated inflation, which remains broad-based and stubbornly above the Reserve Bank of Australia’s (RBA) 2%–3% target. Due to elevated inflation and the low unemployment rate, financial conditions in Australia are expected to remain tight in the near term. Furthermore, even after the July tax cuts, consumer spending is expected to remain tepid by historical standards, as households prioritise savings and debt reduction over discretionary purchases. Next year, economic growth is expected to remain below its historical trend for a third consecutive year, though a recession is unlikely. Amid the decelerating economic growth outlook, the recovery in unfavoured real estate sectors (e.g., office) is likely to be constrained in the near term, while continued strong growth in favoured sectors (e.g., industrial and living) should be limited.Regional opportunities and risks

The diverse and complex Asia Pacific macroeconomic environment presents a variety of opportunities for real estate investors with a range of risk-return profiles.Multi-family – At a nascent stage, except in Japan

The living sectors across Asia are undergoing a significant transformation driven by demographic shifts and policy support. For example, as household sizes shrink in most major Asia Pacific markets due to delayed marriages and low fertility rates, there is a growing preference for renting over owning. In the near term, LaSalle Investment maintains a positive rental growth outlook for most multi-family rental markets in Asia Pacific, recognising their ability to pass through inflation due to typically short lease terms. Japan’s multi-family sector leads as a well-established market characterised by stable net operating income (NOI), deep institutional ownership and healthy liquidity, keeping it attractive to core investors. Despite high entry prices, recent wage growth momentum creates opportunities for investors to pursue value-add strategies, such as retrofitting older buildings and improving amenities. The multi-family sector in the rest of the region is still in its infancy in terms of professionally managed multi-family rental units, implying the potential for institutionalisation. The Australian government plans to reduce net migration by next year while maintaining migration pathways for the long run. Achieving high returns in Australia may be difficult due to normalising rental demand and high interest rates. However, the living sectors remain attractive to investors with long or flexible investment horizons. Similar to Australia, young adults in South Korea opt to rent due to lifestyle preferences and high housing prices. In addition, tenants are shifting from Jeonse (a large lump-sum payment deposited for the duration of a two-year rental contract) to monthly rent contracts. The trend is expected to continue. Investment opportunities could emerge in areas where there is a concentration of young population. Since the multi-family rental sector in South Korea is still in its infancy, exit liquidity has not yet been proven. It would, therefore, take time to fully unlock value in this emerging sector. Despite favourable policy toward the sector in China, the near-term outlook remains uncertain. For example, in Shanghai, the government’s commitment to social security housing and tax reductions for landlords and operators have spurred investments but have also led to oversupply in selected submarkets. Non-core districts are more vulnerable to supply risk than core districts. Additionally, ongoing concerns over job security and income reductions could continue to weigh on tenant affordability.Office – Cyclical changes vs potential structural shifts

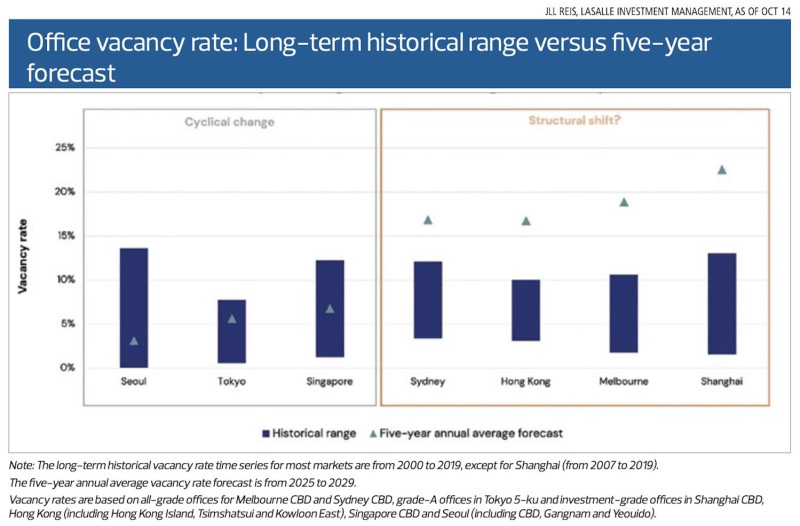

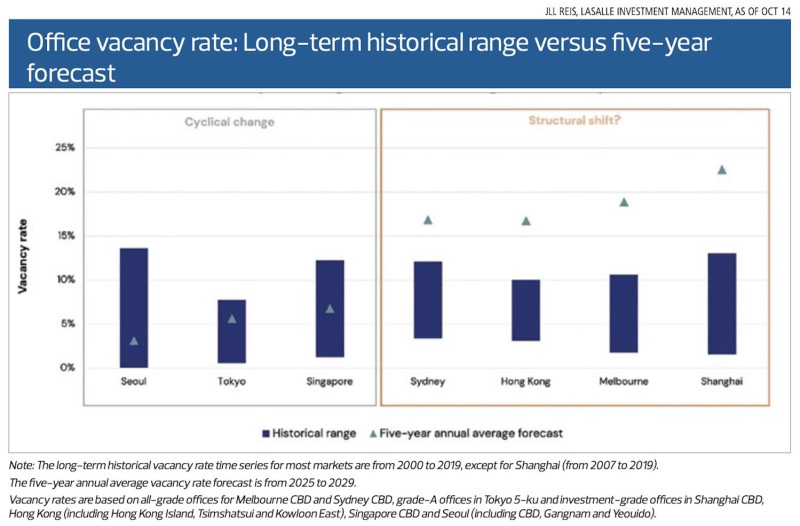

The office landscape in Asia Pacific is more complex than ever. Office markets in Seoul, Singapore and Japan are undergoing a somewhat typical cycle, while Greater China and Australia demonstrate signs of potential structural changes. Seoul stands out as the healthiest office market in the region, with low single-digit vacancy rates. Strong demand is mainly driven by domestic conglomerates supported by technology and export-oriented industries. The potential economic deceleration due to uncertainty in exports, particularly semiconductor exports, suggests no or limited rental growth potential in the Seoul office sector next year. For higher-return strategies, asset-level leasing plans and disciplined investment horizons are critical. Net effective rent has grown over 50% since 2019 and more pipeline projects will be coming to the market after 2028. Office market fundamentals in Japan remain relatively sanguine by global standards, but there are potential risks associated with rising interest rates and high supply pipelines in selected locations. Most Japanese companies are encountering challenges in attracting talent. In response, the government has introduced a series of labour market reforms to enhance worker mobility and re-skilling. In Singapore, both occupier fundamentals and capital values are peaking. In the next 12–18 months, the market is likely to experience limited expansionary demand and higher new supply. However, for investors with flexible investment horizons or seeking to preserve wealth over the long term, freehold offices in prime locations, which are scarce, remain an attractive proposition despite cooling fundamentals.

In China, Hong Kong, and Australia, where there are indications of potential structural changes, it is unlikely that market fundamentals will return to their historical norms in the near term.

Weak business conditions and the downsizing of foreign companies in China and Hong Kong have significantly reduced office demand, casting uncertainty over whether demand will return to pre-pandemic levels. Despite easing financial conditions, low liquidity and weak fundamentals should continue to impact capital values. It is too early to enter these office markets despite discounted prices.

In Australia, the potential increase in return-to-office mandates next year may improve office utilisation. However, it is unlikely to materially improve the supply-demand imbalance over the next three to five years.

Moreover, starting next July, government tenants will have a higher minimum energy rating requirement under the National Australian Built Environment Rating System (NABERS) for new office leases. It is likely to further concentrate demand for prime-grade offices at the expense of secondary-grade offices.

Australia’s office capital values are expected to remain under downward pressure in the coming years due to weak office market fundamentals and a prolonged period of high interest rates. As a result, it may be premature to invest in the Australian office market unless prices are adjusted to reflect these risks.

In Singapore, both occupier fundamentals and capital values are peaking. In the next 12–18 months, the market is likely to experience limited expansionary demand and higher new supply. However, for investors with flexible investment horizons or seeking to preserve wealth over the long term, freehold offices in prime locations, which are scarce, remain an attractive proposition despite cooling fundamentals.

In China, Hong Kong, and Australia, where there are indications of potential structural changes, it is unlikely that market fundamentals will return to their historical norms in the near term.

Weak business conditions and the downsizing of foreign companies in China and Hong Kong have significantly reduced office demand, casting uncertainty over whether demand will return to pre-pandemic levels. Despite easing financial conditions, low liquidity and weak fundamentals should continue to impact capital values. It is too early to enter these office markets despite discounted prices.

In Australia, the potential increase in return-to-office mandates next year may improve office utilisation. However, it is unlikely to materially improve the supply-demand imbalance over the next three to five years.

Moreover, starting next July, government tenants will have a higher minimum energy rating requirement under the National Australian Built Environment Rating System (NABERS) for new office leases. It is likely to further concentrate demand for prime-grade offices at the expense of secondary-grade offices.

Australia’s office capital values are expected to remain under downward pressure in the coming years due to weak office market fundamentals and a prolonged period of high interest rates. As a result, it may be premature to invest in the Australian office market unless prices are adjusted to reflect these risks.

Logistics – Not a clear outperformer

Performance across logistics markets in Asia Pacific has become more varied. Markets such as Australia, Singapore, and parts of Japan, including Greater Fukuoka, continue to show relatively balanced supply-demand dynamics. While these markets still offer investment opportunities, high logistics prices and a slowing outlook for rental growth are reducing return expectations. In China and Hong Kong, high supply and plummeting demand have led to a substantial supply-demand imbalance and a sharp decline in rents, which are expected to continue for an extended period. Despite the correction in asset prices, investors might consider avoiding these markets in the short to medium term, unless they have a high risk appetite or long or flexible investment horizons. Supply-demand dynamics vary significantly across logistics sub-sectors and submarkets. For example, in Greater Seoul, an oversupply of cold storage facilities has caused them to underperform compared to dry warehouses. However, with improving borrowing costs in South Korea and a conservative underwriting approach, discounted entry prices have created selective opportunities for leased or pre-leased dry warehouses. In contrast, Greater Tokyo is expected to see an increasing supply of dry warehouses in certain submarkets in the near term. However, there remains a shortage of modern cold storage facilities, presenting opportunities in strategic locations. These include areas near suppliers, consumers, expressways and ageing facilities (to meet demand for upgrades), as well as port areas, which are critical for handling imported food demand. These nuances suggest that market, submarket and sub-sector selection remain important but may be insufficient to generate the returns that investors were accustomed to a few years ago. In the current market environment of high land and construction costs, in-house leasing and execution capabilities are crucial for achieving strong performance in logistics value-add and development strategies in the region. Additionally, labour shortages present a significant challenge for development projects in Japan, making it essential to secure reliable general contractors.Retail – Distinctive consumption patterns

The retail sector in Asia Pacific is dynamic and diverse, comprising various sub-sectors and markets with unique consumption patterns. To achieve strong performance, retail assets must be well-managed, with tenant mixes and market positioning carefully adapted to evolving consumer habits. This approach increases operational demands but is essential for success. Some assets are evolving into lively social hubs, offering a variety of experiences, such as live performances and libraries, while catering to local preferences through events like seasonal festivals and embracing omnichannel strategies. As performance varies widely across markets and sub-sectors, a granular, asset-level approach to investment is essential. Recent trends in China highlight a significant reduction in luxury spending, a growing preference for discount retailers, delays in big-ticket purchases such as automobiles and an increase in household savings. This cautious consumer behaviour is expected to persist, dampening occupier demand and putting pressure on asset valuations. In the near term, real consumer spending in Singapore is projected to remain relatively stable, while declines are expected in the Australian and Hong Kong markets. The retail sector in Japan is characterised by distinctive dynamics, notably a strong preference for in-store shopping compared to other Asia Pacific markets and tourist consumption supported by a relatively weak yen. Consumer spending has recovered to pre-pandemic levels in value terms. However, due to inflationary pressures, consumers remain cost-conscious and are likely to continue prioritising non-discretionary and service-oriented spending in the near term. This trend could present selective opportunities in the Japanese retail market, particularly for core or value-added investments in non-discretionary and service-oriented assets, with some potential in tourism-driven properties as well.Hotel – Momentum mostly priced in, except in Japan

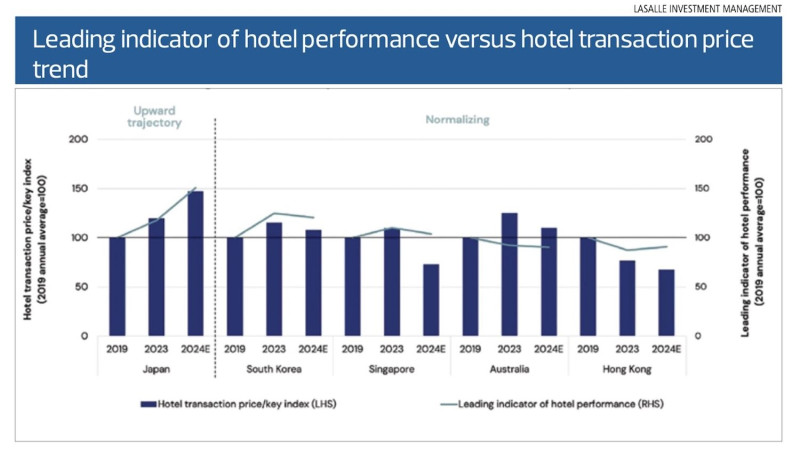

Outside Japan, Asia Pacific’s hotel sector offers only a limited set of attractive investment opportunities on a risk-adjusted basis. Hotel markets in Australia, Singapore, and South Korea are gradually normalizing in demand due to slowing domestic consumption and the continued absence of inbound Chinese tourists. The hotel sector outlooks for China and Japan, the two largest markets in the region, reflect contrasting dynamics. China’s hotel sector, heavily reliant on domestic demand, continues to face challenges from an oversupply of hotels and declining per capita tourism spending. These risks are not adequately offset by declining transaction prices.

In contrast, Japan’s hotel market is on a growth trajectory, driven primarily by domestic demand and, to a lesser extent, by inbound tourism. This growth has pushed hotel transaction prices in Japan to record highs this year. However, performance across segments is expected to vary, influenced by operational challenges such as labour shortages and rising labour costs.

The hotel sector outlooks for China and Japan, the two largest markets in the region, reflect contrasting dynamics. China’s hotel sector, heavily reliant on domestic demand, continues to face challenges from an oversupply of hotels and declining per capita tourism spending. These risks are not adequately offset by declining transaction prices.

In contrast, Japan’s hotel market is on a growth trajectory, driven primarily by domestic demand and, to a lesser extent, by inbound tourism. This growth has pushed hotel transaction prices in Japan to record highs this year. However, performance across segments is expected to vary, influenced by operational challenges such as labour shortages and rising labour costs.

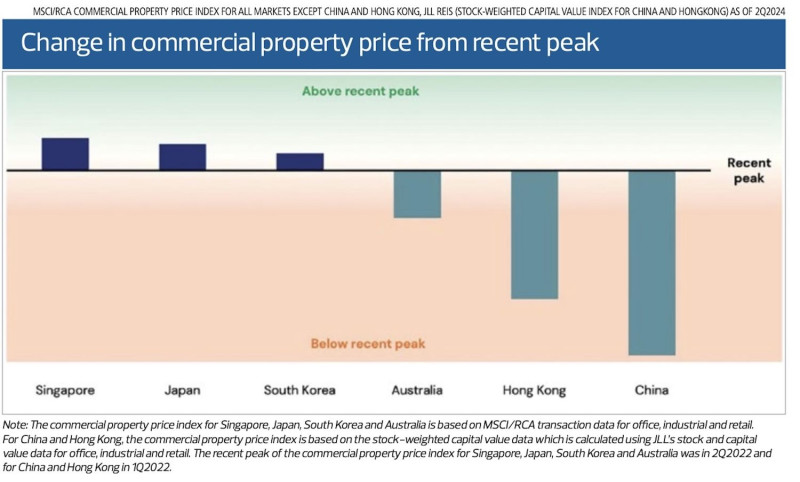

Capital market conundrums

Commercial real estate (CRE) liquidity in Asia Pacific has shown resilience compared to other global markets but remains constrained to varying degrees, with Japan as a notable exception. Capital raising for real estate in Asia Pacific hit its lowest level in over a decade early this year, reflecting heightened investor caution. Among the region’s major markets, China is the least liquid, experiencing significant price declines. Australia has also seen price reductions, particularly in office assets, though to a lesser extent. In contrast, CRE prices in Japan, Singapore, and South Korea have shown relative resilience despite varying levels of liquidity. This resilience has posed challenges for some investors, particularly in markets and sectors with uncertainty over net operating income (NOI) growth. The disparity between buyer and seller expectations continues to weigh on liquidity across the region. In Japan, the long-anticipated return of inflation, if sustained, may create opportunities for cash flow growth but could also affect cap rates. Nevertheless, Japan is expected to maintain the region’s most accommodative interest rates despite potential near-term increases. Monetary easing policies in Hong Kong, Singapore, and South Korea could provide some relief to capital market liquidity, though this may come with downside risks to NOI. Meanwhile, the expectation of prolonged high interest rates in Australia will likely pressure some property owners to address funding gaps.

Looking ahead

Investors in Asia-Pacific real estate face the challenge of navigating new investments and managing existing portfolios in a complex environment marked by signs of structural change and a cycle that differs significantly from historical norms. The current economic climate, coupled with the anticipated effects of Trump 2.0 policies, is expected to create substantial challenges for China’s economy and real estate markets in the coming years, with Hong Kong also likely to be affected, albeit to a lesser extent. Beyond China and Hong Kong, the broader impact of the election results on the region is less certain, given the strong trade ties between many Asia-Pacific economies and China. However, specific real estate markets or sectors, such as logistics in Fukuoka, may benefit from supply chain rebalancing. Japan remains one of the most liquid markets in the region and offers inflation-driven growth prospects. However, investors should carefully assess the potential effects of further interest rate hikes and capital market volatility. Flexibility and preparedness for unexpected outcomes are essential when evaluating prospective investment opportunities in this evolving landscape. This article was extracted from LaSalle Investment Management’s Insight, Strategy and Analysis Outlook 2025 report publishsed on Dec 12, 2024