Wee Hur to divest PBSA portfolio for A$1.6 bil

Wee Hur Holdings has entered into a binding agreement to sell its portfolio of seven purpose-built student accommodation (PBSA) assets to Greystar, according to a Dec 16 release.

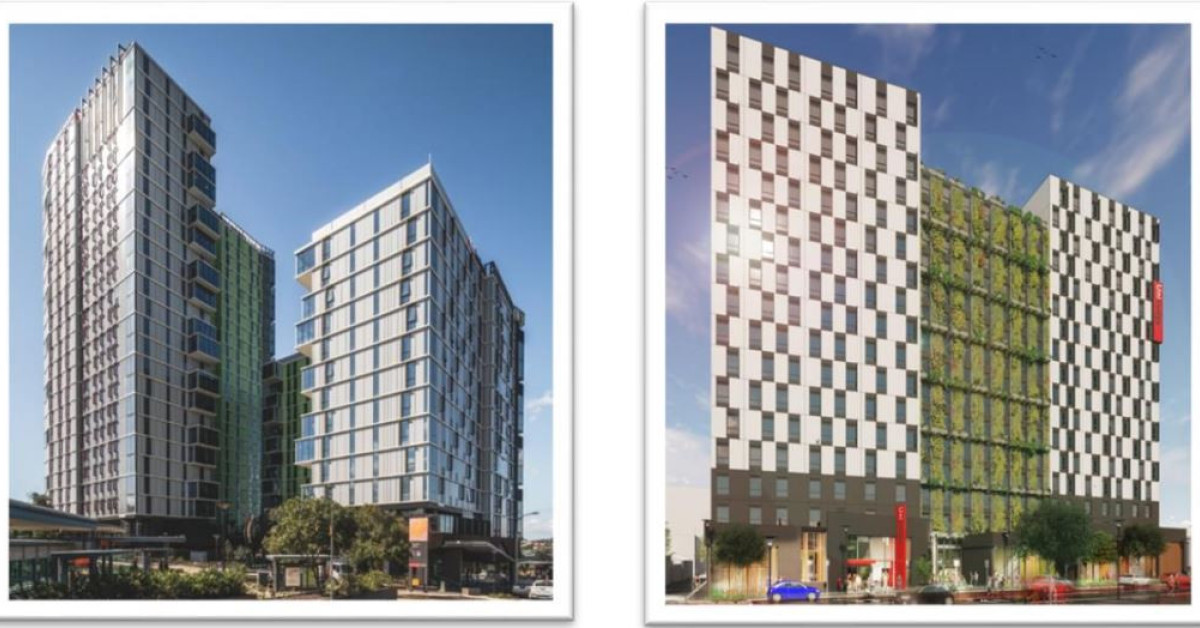

The group’s PBSA portfolio, which spans over 5,500 beds over several Australian cities, has a purchase consideration of A$1.6 billion ($1.4 billion).

Following the transaction, Wee Hur is set to retain a 13% stake through its subsidiary, Wee Hur (Australia).

Read also: Far East Orchard launches inaugural student accommodation fund with first close of GBP70 mil

Advertisement

Advertisement

According to the group, the net proceeds of approximately $320 million is expected to go towards Wee Hur’s strategic growth, support its reinvestment in core business, and expansion into new areas such as alternative investments.

The transaction is set to be completed within the next six months, subject to Greystar obtaining Foreign Investment Review Board (FIRB) approvals and Wee Hur obtaining consent from its shareholders.

The group says the transaction reflects Wee Hur’s “resilience in navigating complex market conditions”, including the challenges posed by Covid-19 and greenfield developments.

The transaction also supports Wee Hur’s long-term strategy and ongoing efforts to diversify its portfolio and position the group for sustainable growth across multiple sectors, adds Wee Hur.

Goh Wee Ping, CEO of Wee Hur Capital, says: “In 2021/2022, amidst global uncertainty, we acted decisively to secure liquidity and certainty through our successful recap with RECO. Two years later, as the PBSA market rebounded and our portfolio approached full stabilisation, we capitalised on yet another opportunity to unlock maximum value for our stakeholders through this landmark transaction.”