Fresh launches supercharge November new private home sales to 2,557 units, up 247% m-o-m

Developers sold 2,557 new private homes excluding executive condos (ECs) in November, according to URA data published on Dec 16. The figure represents a 247% surge from the 738 new private homes sold in October and a 226% jump compared to units sold in November 2023.

“The surge marked the highest monthly developer sales since March 2013, when 2,793 units (excluding ECs) were sold,” says Christine Sun, chief researcher and strategist at OrangeTee Group. Mohan Sandrasegeran, head of research and data analytics at Singapore Realtors Inc (SRI), adds that this is the first time new home sales have exceeded the 2,000-unit threshold in a single month since March 2013.

The November developer sales figure comes off the back of an “unprecedented” number of project launches during the month, says Lee Sze Teck, senior director of data analytics at Huttons Asia. Five private residential projects were launched in November, comprising the 916-unit Chuan Park, the 846-unit Emerald of Katong, the 552-unit Nava Grove, the 367-unit The Collective at One Sophia, and the 366-unit Union Square Residences.

Get the latest details on available units and prices for Nava Grove

Advertisement

Advertisement

In total, developers launched 2,871 new homes excluding ECs in November – a 438% spike compared to the month before, and 19% higher than a year ago.

In addition, the 504-unit Novo Place EC also commenced sales in November. Including ECs, new home sales jumped by 277% m-o-m and 226% y-o-y to 2,891 units in November.

As of November, developers have sold an estimated 6,344 units, which is marginally higher than the 6,317 units sold in the first months of 2023. This comes off the back of 6,627 units launched for sale by developers in the first 11 months of 2024. In comparison, developers launched 7,515 units across the same period last year.

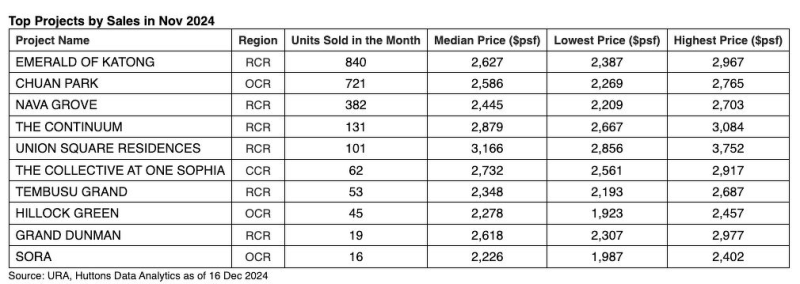

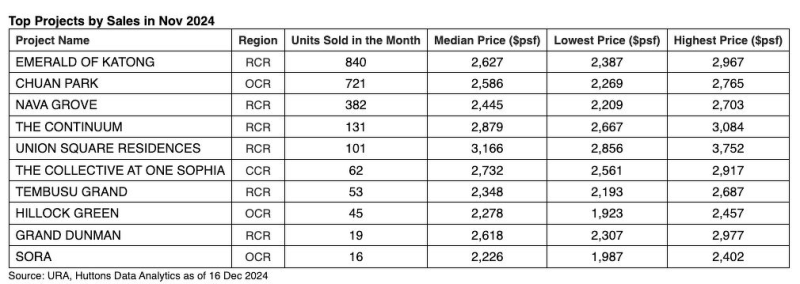

Top-selling projects Emerald of Katong was the best-selling project in November. The 846-unit development by Sim Lian Group on Jalan Tembusu in the Rest of Central Region (RCR) moved 840 units, or 99% during the month with a median price of $2,627 psf. This makes the 99-year leasehold development the bestselling project by units and percentage in 2024, says Lee. “Buyers were drawn to the project's excellent design and offerings, particularly those wishing to live near the East Coast. The improved affordability of mortgages likely further incentivized buyers to invest in this city-fringe project, as lower interest rates have made mortgages more accessible,” observes OrangeTee’s Sun. Kingsford Group’s 916-unit Chuan Park sold 721 (79%) units with a median price of $2,586 psf, making it the second best-selling project by number of units in November. The 99-year leasehold condo is located on Lorong Chua, adjacent to Lorong Chuan MRT Station, in the Outside Central Region (OCR).

Read also: Grange 1866 sets new high of $3,393 psf

Advertisement

Advertisement

Nava Grove, situated at Pine Grove in District 21, was the third best-selling project by units sold. The 99-year leasehold, RCR development by MCL Land and Sinarmas Land sold 382 units (69%) in November with a median price of $2,445 psf.

Sun believes the strong sales performance among the new launches was fuelled by pent-up demand and improved buyer sentiment following interest rate cuts in September. “Consequently, many buyers were eager to take advantage of attractive deals as several prominent projects were launched simultaneously,” she continues.

Huttons’ Lee adds that buying momentum has been gathering pace since the last quarter when project launches such as the 158-unit 8@BT and the 348-unit Norwood Grand saw a robust response. Demand was also funnelled to the wider market, as buyers who missed out on their choice unit in a particular project were prompted to quickly commit to a unit in other new or existing projects.

EdgeProp Singapore reported last month that Emerald of Katong’s launch has created a ripple effect on neighbouring projects in District 15, with developments such as Tembusu Grand and The Continuum seeing an uptick in take-up.

Read also: Emerald of Katong boosts District 15 new home sales: The Continuum emerges as top beneficiary

Kingsford Group’s 916-unit Chuan Park sold 721 (79%) units with a median price of $2,586 psf, making it the second best-selling project by number of units in November. The 99-year leasehold condo is located on Lorong Chua, adjacent to Lorong Chuan MRT Station, in the Outside Central Region (OCR).

Read also: Grange 1866 sets new high of $3,393 psf

Advertisement

Advertisement

Nava Grove, situated at Pine Grove in District 21, was the third best-selling project by units sold. The 99-year leasehold, RCR development by MCL Land and Sinarmas Land sold 382 units (69%) in November with a median price of $2,445 psf.

Sun believes the strong sales performance among the new launches was fuelled by pent-up demand and improved buyer sentiment following interest rate cuts in September. “Consequently, many buyers were eager to take advantage of attractive deals as several prominent projects were launched simultaneously,” she continues.

Huttons’ Lee adds that buying momentum has been gathering pace since the last quarter when project launches such as the 158-unit 8@BT and the 348-unit Norwood Grand saw a robust response. Demand was also funnelled to the wider market, as buyers who missed out on their choice unit in a particular project were prompted to quickly commit to a unit in other new or existing projects.

EdgeProp Singapore reported last month that Emerald of Katong’s launch has created a ripple effect on neighbouring projects in District 15, with developments such as Tembusu Grand and The Continuum seeing an uptick in take-up.

Read also: Emerald of Katong boosts District 15 new home sales: The Continuum emerges as top beneficiary

Ask Buddy

Condo sale transactions in District 1

Show me condo listings in District 21

Past Condo rental transactions

Most unprofitable condo transactions in past 1 year

Condo projects with most profitable transactions

Condo sale transactions in District 1

Show me condo listings in District 21

Past Condo rental transactions

Most unprofitable condo transactions in past 1 year

Condo projects with most profitable transactions

Ask Buddy

Condo sale transactions in District 1

Show me condo listings in District 21

Past Condo rental transactions

Most unprofitable condo transactions in past 1 year

Condo projects with most profitable transactions

Condo sale transactions in District 1

Show me condo listings in District 21

Past Condo rental transactions

Most unprofitable condo transactions in past 1 year

Condo projects with most profitable transactions

Top-selling projects Emerald of Katong was the best-selling project in November. The 846-unit development by Sim Lian Group on Jalan Tembusu in the Rest of Central Region (RCR) moved 840 units, or 99% during the month with a median price of $2,627 psf. This makes the 99-year leasehold development the bestselling project by units and percentage in 2024, says Lee. “Buyers were drawn to the project's excellent design and offerings, particularly those wishing to live near the East Coast. The improved affordability of mortgages likely further incentivized buyers to invest in this city-fringe project, as lower interest rates have made mortgages more accessible,” observes OrangeTee’s Sun.

Kingsford Group’s 916-unit Chuan Park sold 721 (79%) units with a median price of $2,586 psf, making it the second best-selling project by number of units in November. The 99-year leasehold condo is located on Lorong Chua, adjacent to Lorong Chuan MRT Station, in the Outside Central Region (OCR).

Read also: Grange 1866 sets new high of $3,393 psf

Advertisement

Advertisement

Nava Grove, situated at Pine Grove in District 21, was the third best-selling project by units sold. The 99-year leasehold, RCR development by MCL Land and Sinarmas Land sold 382 units (69%) in November with a median price of $2,445 psf.

Sun believes the strong sales performance among the new launches was fuelled by pent-up demand and improved buyer sentiment following interest rate cuts in September. “Consequently, many buyers were eager to take advantage of attractive deals as several prominent projects were launched simultaneously,” she continues.

Huttons’ Lee adds that buying momentum has been gathering pace since the last quarter when project launches such as the 158-unit 8@BT and the 348-unit Norwood Grand saw a robust response. Demand was also funnelled to the wider market, as buyers who missed out on their choice unit in a particular project were prompted to quickly commit to a unit in other new or existing projects.

EdgeProp Singapore reported last month that Emerald of Katong’s launch has created a ripple effect on neighbouring projects in District 15, with developments such as Tembusu Grand and The Continuum seeing an uptick in take-up.

Read also: Emerald of Katong boosts District 15 new home sales: The Continuum emerges as top beneficiary

Kingsford Group’s 916-unit Chuan Park sold 721 (79%) units with a median price of $2,586 psf, making it the second best-selling project by number of units in November. The 99-year leasehold condo is located on Lorong Chua, adjacent to Lorong Chuan MRT Station, in the Outside Central Region (OCR).

Read also: Grange 1866 sets new high of $3,393 psf

Advertisement

Advertisement

Nava Grove, situated at Pine Grove in District 21, was the third best-selling project by units sold. The 99-year leasehold, RCR development by MCL Land and Sinarmas Land sold 382 units (69%) in November with a median price of $2,445 psf.

Sun believes the strong sales performance among the new launches was fuelled by pent-up demand and improved buyer sentiment following interest rate cuts in September. “Consequently, many buyers were eager to take advantage of attractive deals as several prominent projects were launched simultaneously,” she continues.

Huttons’ Lee adds that buying momentum has been gathering pace since the last quarter when project launches such as the 158-unit 8@BT and the 348-unit Norwood Grand saw a robust response. Demand was also funnelled to the wider market, as buyers who missed out on their choice unit in a particular project were prompted to quickly commit to a unit in other new or existing projects.

EdgeProp Singapore reported last month that Emerald of Katong’s launch has created a ripple effect on neighbouring projects in District 15, with developments such as Tembusu Grand and The Continuum seeing an uptick in take-up.

Read also: Emerald of Katong boosts District 15 new home sales: The Continuum emerges as top beneficiary

New launches to bolster momentum in 2025

Looking ahead, a more muted December is anticipated due to the school holidays and the festive season. Huttons' Lee believes the lack of launches planned for December will result in new private home sales falling to around 200 to 250 units. This will bring full-year developer sales to about 6,500 units, which is slightly more than in 2023. In terms of prices, Lee predicts full-year price growth to come in at about 5%, moderating from 6.8% growth registered in 2023. Read also: Unit at Island View sold for $3.5 mil profit Advertisement Advertisement Going into the new year, SRI's Sandrasegeran expects new home sales to regain momentum in January 2025 with the launch of the 777-unit The Orie by City Developments on Lorong 1 Toa Payoh. "[The area] has not seen a new property launch since Gem Residences in 2016, and this extended gap is likely to generate pent-up demand, continuing buyer enthusiasm for this well-established estate which is closely situated to Braddell MRT station," he says. Other launches expected in 1Q2025 include the 113-unit Bagnall Haus, the 186-unit Aurea and the 760-unit Aurelle of Tampines EC. OrangeTee's Sun believes that the recent surge in sales is a temporary phenomenon. "Throughout 2024, new home demand has been subdued, primarily due to the lack of significant private project launches, " she points out. Developer sales during the first three quarters of 2024 amounted to 3,049 units, which is the lowest Q1 to Q3 figures recorded since 2004, the year when data from URA first became available. Lee says he is "cautiously optimistic" of a better performance in the new sale market in 2025. "Some of the unsatiated demand in 2024 may flow over to the launches in 1Q2025," he says. Lee is projecting new private home sales to rebound to between 7,000 and 8,000 units in 2025, while prices are estimated to grow between 4% and 7%. Check out the latest listings for Emerald Of Katong, Nava Grove, Chuan Park, Union Square Residences, Condominium properties Ask Buddy

Condo sale transactions in District 1

Show me condo listings in District 21

Past Condo rental transactions

Most unprofitable condo transactions in past 1 year

Condo projects with most profitable transactions

Condo sale transactions in District 1

Show me condo listings in District 21

Past Condo rental transactions

Most unprofitable condo transactions in past 1 year

Condo projects with most profitable transactions

Ask Buddy

Condo sale transactions in District 1

Show me condo listings in District 21

Past Condo rental transactions

Most unprofitable condo transactions in past 1 year

Condo projects with most profitable transactions

Condo sale transactions in District 1

Show me condo listings in District 21

Past Condo rental transactions

Most unprofitable condo transactions in past 1 year

Condo projects with most profitable transactions