Good Class Bungalow sales in 4Q2024 signal strong momentum in 2025

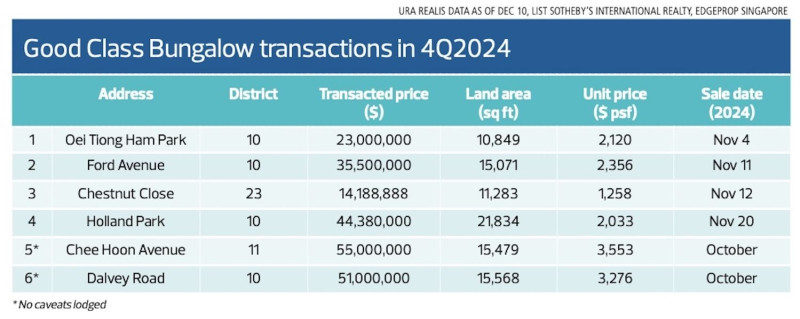

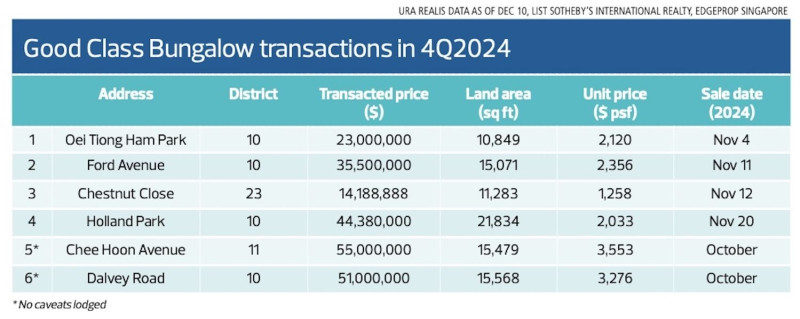

Good Class Bungalow (GCB) transactions have picked up in the second half of 2024. However, some deal completions and caveats have only started to surface over the past two months.

The catalyst, says Steve Tay, co-founder of the eponymous boutique real estate agency Steve Tay Real Estate (STRE), was the series of interest rate cuts by the US Federal Reserve — 50 basis points (bps) in September, another 25 bps in November and expectation is that there will be another 25 bps cut later this month.

“Greater clarity in the direction of the interest rate trajectory has rekindled confidence among buyers in the GCB market,” says Tay. “It has enhanced not only affordability but also the long-term investment value of GCBs as an asset class.”

Read also: Bungalow deals gain momentum; semi-detached price psf hits new record

Advertisement

Advertisement

Significant wealth has been generated in the cryptocurrency and the traditional financial markets over the past six months, says Tay. He highlights the price movement of Bitcoin, which dropped to a six-month low of US$49,159.94 ($65,924) on Aug 5 before soaring to a high of US$103,617.37 on Dec 5. As of Dec 10, it was trading at US$97,680.75.

The latest caveat lodged was for the freehold GCB at Holland Park, designed by the late William Lim in the mid-century modern architecture style that changed hands for $44.38 million (Photo: Samuel Isaac Chua/EdgeProp Singapore)

The Holland Park house, completed in 1963, has a built-up area of 4,650 sq ft and sits on a sprawling freehold site of 21,834 sq ft (Photo: Samuel Isaac Chua/EdgeProp Singapore)

The two eldest children now live in the UK, while the youngest — artist-photographer Tan Ngiap Heng — stayed in Singapore to care for his ageing parents. After their passing, he was entrusted with selling the property.

The Holland Park house has a built-up area of 4,650 sq ft and sits on a sprawling freehold site of 21,834 sq ft. Originally part of an estate developed by Fraser & Neave, many of the surrounding bungalow owners later subdivided their plots for sale. The Tan family’s property is one of the few that has remained intact.

Read also: Creating a niche in luxury Good Class Bungalows sold at record-breaking prices

Advertisement

Advertisement

Managing director and founder of Newsman Realty, KH Tan, the exclusive marketing agent for the Holland Park GCB, declined to comment on the deal.

The Ford Avenue GCB was transacted at $35.5 million ($2,356 psf), based on a caveat lodged in November (Photo: Samuel Isaac Chua/EdgeProp Singapore)

Another GCB that changed hands in November is located at Ford Avenue. This double-storey bungalow, built by a developer in 1988, features a built-up area of 8,000 sq ft. It includes five ensuite bedrooms, a spacious living and dining area, a private library, a swimming pool and a covered car porch that can accommodate two cars. The property sits on a freehold site measuring 15,071 sq ft.

The Ford Avenue GCB was transacted at $35.5 million ($2,356 psf), based on a caveat lodged in November. Realstar Premier Group is said to have brokered the deal.

At Oei Tiong Ham Park, a GCB on a freehold site of 10,849 sq ft changed hands last month for $23 million ($2,120 psf). Although the house was built in 1992, the exterior remains in good condition.

At Oei Tiong Ham Park, a GCB on a freehold site of 10,849 sq ft changed hands last month for $23 million ($2,120 psf) [Photo: Samuel Isaac Chua/EdgeProp Singapore]

According to property records, the GCB at Chee Hoon Avenue was sold for $55 million ($3,553 psf) with the deal completed in October (Photo: Samuel Isaac Chua/EdgeProp Singapore)

The house boasts a spacious living and dining area, wet and dry kitchens, an entertainment room, a wine cellar with a 3,000-bottle capacity and a landscaped garden with an 18m by 5m in-ground swimming pool.

According to property records, the GCB at Chee Hoon Avenue was sold for $55 million ($3,553 psf). However, no caveat was lodged for the transaction, which was completed in October. Documents indicate that the buyer is Alan Wei Zhaolun, the founder and CEO of A-Speed Infotech and Aperia Cloud Services, which became Nvidia’s first qualified Nvidia Cloud Partner in Southeast Asia.

The GCB at Dalvey Road, which sits on a freehold site of 15,568 sq ft, was transacted for $51 million ($3,276 psf) in July, with the deal completed in October (Photo: Samuel Isaac Chua/EdgeProp Singapore)

The GCB in Dalvey Estate changed hands in February at $57 million, although a caveat hasn't been lodged (Photo: Samuel Isaac Chua/EdgeProp Singapore)

Another GCB where the deal was inked in February, but the transaction surfaced only recently is at Dalvey Estate, off Bukit Timah Road. The property, designed by Aamer Taher Architects, is named “The Long House — Dalvey Estate,” as it was inspired by the Iban Longhouse in Sarawak. Completed in 2009, it boasts a built-up area of 12,000 sq ft and sits on a freehold site of 19,048 sq ft.

Property documents show that the GCB at Dalvey Estate was purchased by Singapore citizen Anthony Tjajadi. He is the founding partner of Trihill Capital, a Singapore-based multi-asset investment fund specialising in global public equity and Southeast Asian venture capital. Tjajadi paid $57 million ($2,992 psf) for the property.

The seller of the GCB was Teo Kok Woon, the largest shareholder of TSH Corp, a company that operates a chain of whisky and cocktail bars. Teo serves as TSH’s non-independent and non-executive director, according to the company’s FY2023 annual report. In addition, Teo, a hotelier with 29 years of industry experience, is also the chairman of Cockpit International and group executive director of Goodearth Realty, his family’s hotel and property investment business.

The GCB at Joan Road in Caldecott Hill Estate that is said to have change hands in September for $47 million ($1,594 psf), although a caveat has yet to be lodged (Photo: Albert Chua/EdgeProp Singapore)

On Fifth Avenue, off Bukit Timah Road, a GCB on a freehold site spanning 19,811 sq ft was sold for $47 million ($2,374 psf) in September (Photo: Samuel Isaac Chua/EdgeProp Singapore)

STRE’s Tay says GCB buyers today comprise a diverse mix of younger Singaporean entrepreneurs who have excelled in their respective fields, including F&B, tech, commodities and finance. Some could have also received seed capital from their parents to fund their GCB purchase.

Tay notes that recent GCB buyers also include naturalised citizens, particularly those acquiring larger plots in prime districts at higher price points above $50 million. Over the past year, these buyers have included nationals from Indonesia, China and India.

When these 13 transactions are aggregated, the total transaction value will amount to over $700 million, exceeding the $587.35 million from the 21 deals with lodged caveats, notes Han. Combining both sets of transactions brings the total GCB investment value for 2024 to more than $1.2 billion, which exceeds the $1.186 billion recorded for 44 GCB deals in 2022, based on data from List Sotheby’s.

Of the 13 GCB deals transacted without caveats in 2024, eight were said to be completed in the second half of the year. According to Han, it is a clear indication that transaction momentum picked up in the latter half of 2024. She reckons that the higher number of deals could be attributed to some sellers adopting more realistic pricing strategies.

STRE’s Tay believes the outlook for the GCB market in 2025 will be “even more positive”, particularly in terms of transaction volume. “The buyers in the GCB segment are savvy and experienced,” he says. “Demand remains strong, and buyers are prepared to commit to prices they consider reasonable.”

When these 13 transactions are aggregated, the total transaction value will amount to over $700 million, exceeding the $587.35 million from the 21 deals with lodged caveats, notes Han. Combining both sets of transactions brings the total GCB investment value for 2024 to more than $1.2 billion, which exceeds the $1.186 billion recorded for 44 GCB deals in 2022, based on data from List Sotheby’s.

Of the 13 GCB deals transacted without caveats in 2024, eight were said to be completed in the second half of the year. According to Han, it is a clear indication that transaction momentum picked up in the latter half of 2024. She reckons that the higher number of deals could be attributed to some sellers adopting more realistic pricing strategies.

STRE’s Tay believes the outlook for the GCB market in 2025 will be “even more positive”, particularly in terms of transaction volume. “The buyers in the GCB segment are savvy and experienced,” he says. “Demand remains strong, and buyers are prepared to commit to prices they consider reasonable.”

Flow of wealth

This wealth has increasingly flowed into the GCB market, as evidenced by caveats lodged in November. The latest recorded transaction was a freehold GCB at Holland Park, sold for $44.38 million ($2,033 psf) in November. The buyer is reportedly a trustee who purchased the property in trust. The GCB at Holland Park was designed in the mid-century modern architectural style by the late William Lim, co-founder of DP Architects (formerly Design Partnership), who also designed buildings such as Tanglin Shopping Centre (1972), People’s Park Complex (1973) and Golden Mile Complex (1974). The architecture of the house has remained unchanged since it was built in 1963 as the private residence of forensic pathologist Dr Tan Kheng Khoo (Dr. KK Tan) and his wife, Gunn Chit Siew. The couple lived in the house for over 60 years, raising their three children there.

New GCBs above $3,500 psf

Several deals were completed recently without caveats lodged, but their transactions have since surfaced. One notable example is a newly completed GCB at Chee Hoon Avenue. The developer of the GCB is Singaporean businessman Yang Tse Pin, owner of Jian Yu Construction and a one-third stakeholder in Chuan Investments, part of the joint venture behind the mixed-use project TMW Maxwell. Yang’s diverse business portfolio includes operating and managing foreign workers’ dormitories, student accommodation and facilities management. Read also: Property Unpacked: What makes a bungalow a GCB? Advertisement Advertisement The GCB at Chee Hoon Avenue sits on a regular freehold plot of 15,479 sq ft. The newly built double-storey bungalow features six bedrooms, an attic and a basement, with a total built-up area of 26,000 sq ft. Gary Lim, co-founder and director of Tellus Architects, was the project architect, while Evelina Hu, founder and director of The Plush, crafted the interiors.

Dalvey deals above $50 million

Another GCB that changed hands in July, although the deal was only completed in October, is located on Dalvey Road, near Cluny Road and Nassim Road. Based on property records, the GCB, which sits on a freehold site of 15,568 sq ft, was transacted for $51 million ($3,276 psf). The buyer is Chrispianto Karim, a Singapore citizen and a family member of Indonesian palm oil tycoon Bachtiar Karim, who serves as the chairman of Musim Mas. Bachtiar Karim’s Singapore-based family office, Invictus Developments, is managed by his son, Chayadi. Invictus Developments holds several high-profile assets in Singapore, including the 143-room The Standard, Singapore; a row of nine shophouses along Desker Road and Rowell Road (collectively known as The Rochor Collection); the national monument House of Tan Yeok Nee on Penang Road; and the carparks of Bukit Timah Plaza and Bukit Timah Shopping Centre. The seller of the GCB on Dalvey Road was Tao Yaqiong, the wife of Zhu Su, co-founder of the collapsed crypto hedge fund Three Arrows Capital.

A diverse mix of buyers

Another GCB said to have changed hands, although no caveat has been lodged yet, is located on Joan Road in the Caldecott Hill Estate. This six-bedroom, double-storey bungalow was built in the 1960s as a family home and sits on a sprawling freehold site of 29,483 sq ft. The property on Joan Road was put up for sale two years ago with an asking price of $48 million. According to sources, it sold in September for $47 million ($1,594 psf). Meanwhile, on Fifth Avenue, off Bukit Timah Road, a GCB on a freehold site spanning 19,811 sq ft was sold for $47 million ($2,374 psf) in September. The buyer is reportedly a member of the second-generation Tan family behind Sunray Woodcraft Construction. The transaction is said to have been brokered by Realstar Premier.

Total deals surpass the high of 2022

In 2024 to date, based on caveats lodged, the total investment value of 21 GCB deals amounted to $587.35 million, a 35.8% surge from the $432.51 million recorded for 18 GCB deals in 2023, says Han Huan Mei, director of research at List Sotheby’s International Realty. However, the 2024 figure excludes some 13 deals completed this year without caveats lodged. These transactions include the two largest GCB deals of the year: a GCB under construction at Tanglin Hill that sold for $93.889 million ($6,197 psf) in March and another at Bin Tong Park that was sold for $84 million ($2,988 psf) in April. When these 13 transactions are aggregated, the total transaction value will amount to over $700 million, exceeding the $587.35 million from the 21 deals with lodged caveats, notes Han. Combining both sets of transactions brings the total GCB investment value for 2024 to more than $1.2 billion, which exceeds the $1.186 billion recorded for 44 GCB deals in 2022, based on data from List Sotheby’s.

Of the 13 GCB deals transacted without caveats in 2024, eight were said to be completed in the second half of the year. According to Han, it is a clear indication that transaction momentum picked up in the latter half of 2024. She reckons that the higher number of deals could be attributed to some sellers adopting more realistic pricing strategies.

STRE’s Tay believes the outlook for the GCB market in 2025 will be “even more positive”, particularly in terms of transaction volume. “The buyers in the GCB segment are savvy and experienced,” he says. “Demand remains strong, and buyers are prepared to commit to prices they consider reasonable.”

When these 13 transactions are aggregated, the total transaction value will amount to over $700 million, exceeding the $587.35 million from the 21 deals with lodged caveats, notes Han. Combining both sets of transactions brings the total GCB investment value for 2024 to more than $1.2 billion, which exceeds the $1.186 billion recorded for 44 GCB deals in 2022, based on data from List Sotheby’s.

Of the 13 GCB deals transacted without caveats in 2024, eight were said to be completed in the second half of the year. According to Han, it is a clear indication that transaction momentum picked up in the latter half of 2024. She reckons that the higher number of deals could be attributed to some sellers adopting more realistic pricing strategies.

STRE’s Tay believes the outlook for the GCB market in 2025 will be “even more positive”, particularly in terms of transaction volume. “The buyers in the GCB segment are savvy and experienced,” he says. “Demand remains strong, and buyers are prepared to commit to prices they consider reasonable.”