Government ramps up private housing supply; offers three EC sites on Confirmed List

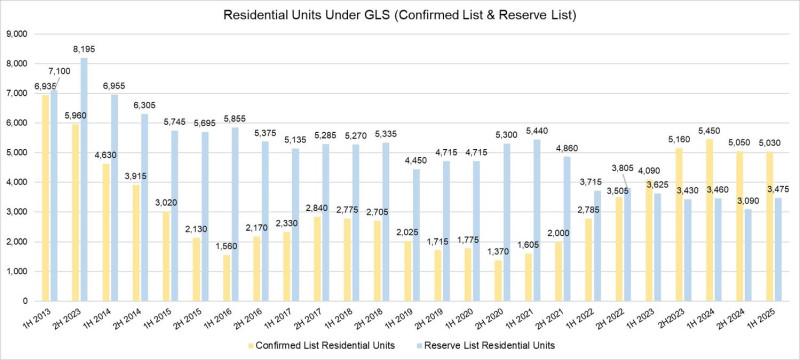

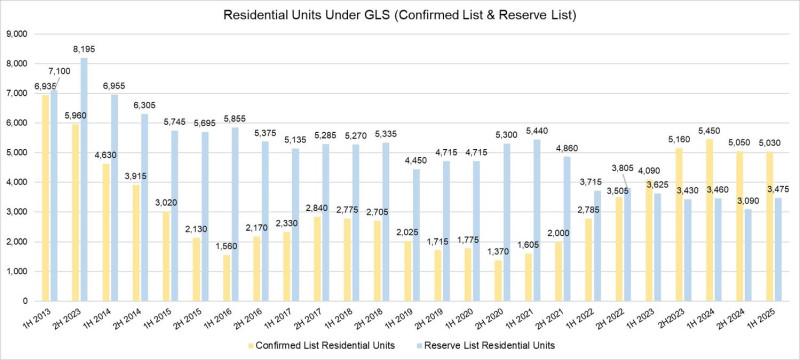

To ensure that there is adequate supply to meet housing demand and to maintain market stability, the government has sustained the supply of private residential units by offering 8,505 units in the upcoming Confirmed List and Reserved List of the 1H2025 GLS Government Land Sales (GLS) programme 1H2025.

Ten plots will be offered under the Confirmed List, comprising nine residential sites, three of which are executive condo (EC) plots. The tenth plot is a residential cum commercial site. The 10 sites can yield an estimated 5,030 residential units, including the 980 EC units.

In terms of residential units for sale, it’s in line with the 5,050 units offered in the Confirmed List of 2H2024. However, it’s almost 60% higher than the average supply on the Confirmed List in each GLS programme from 2021 to 2023.

Read also: URA launches tenders for two GLS sites at Media Circle

Advertisement

Advertisement

The Reserve List includes four private residential sites, one commercial site, three White sites and one hotel site, which can potentially yield an additional 3,475 private residential units and 199,900 sqm (2.15 million sq ft) gross floor area (GFA) of commercial space.

The 3,475 residential units on the Reserve List of 1H2025 are higher than the 3,090 units in 2H2024. Including the Reserve List, the overall private housing supply of 8,505 units in 1H2025 is on a par with the 8,140 units in 2H2024.

Source: PropNex Research

Following the progressive ramp-up of private housing supply in the GLS programmes over the last three years, the inventory of private residential units available for sale has increased steadily from 16,100 units at the end of 2021 to around 21,000 units as of end-2024.

The ramp-up of supply from the GLS programmes has contributed to the stabilisation of the private residential market, as reflected by the moderation in property price momentum. Based on the URA private residential property price index, price growth has moderated to 6.8% in 2023 from 10.6% in 2021 and 8.6% in 2022.

Private residential prices are expected to see more modest gains in 2024, with the cumulative price increase over the first three quarters of the year at around 1.6%.

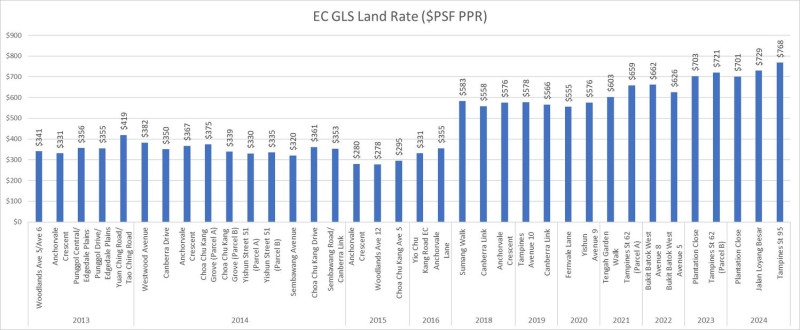

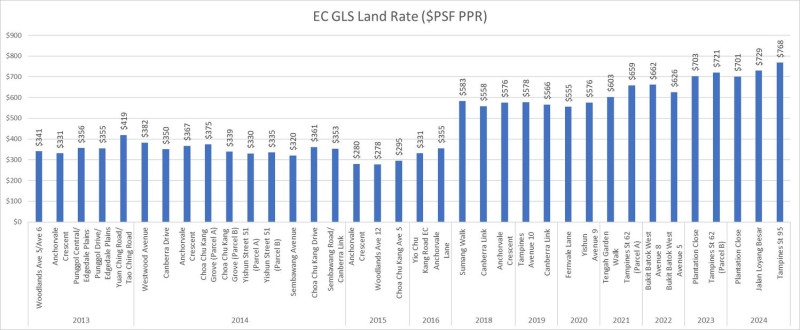

In view of the stiff competition for EC sites among developers and rising EC land prices, the government has ramped up the supply of EC sites, with three plots potentially yielding 980 units in the Confirmed List of 1H2025. This is a shift from previous GLS programmes since 2019, with only one EC site offered in each of the half-yearly land sales programmes, notes PropNex.

Read also: First private residential site in Bayshore launched for sale

Advertisement

Advertisement

Source: PropNex Research

The last time three EC plots were launched for sale in a single GLS programme was in 2H2014 when EC sites in Sembawang Road/Canberra Link, Anchorvale Crescent, and Woodlands Avenue 12 were launched for tender. In 1H2014, four EC sites (two in Yishun, one each in Sembawang and Choa Chu Kang) were launched for sale via the GLS.

The increase in the EC land supply in 1H2025 could “go some way to soothe the competition among developers in land tenders and help to moderate EC land cost and prices accordingly”, says Ismail Gafoor, CEO of PropNex.

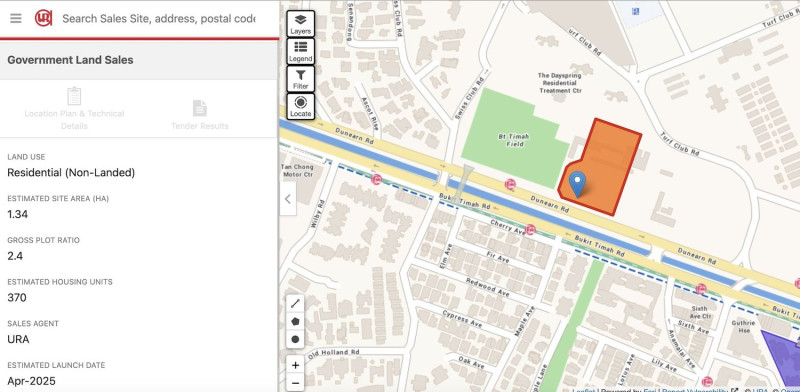

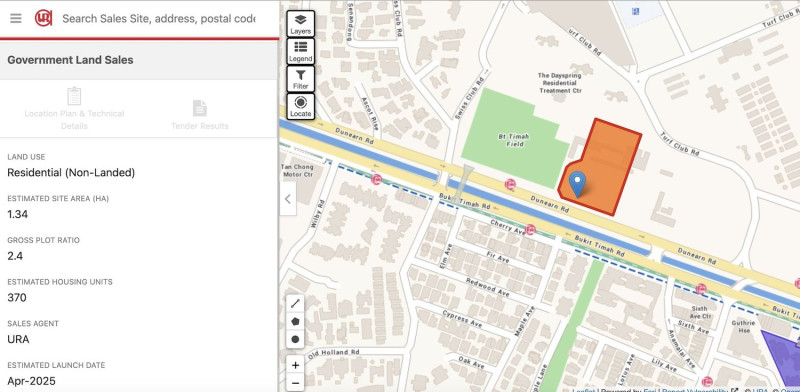

Seven new plots will be introduced in the 1H2025 GLS programme. They include a plot at Lakeside Drive near the Jurong Lake Gardens in Jurong Lake District, Dunearn Road in the new housing precinct in Bukit Timah Turf City, and Telok Blangah Road on the former Keppel Golf Course site.

The Dunearn Road GLS site is in the new housing precinct of Bukit Timah Turf City (Source: URA)

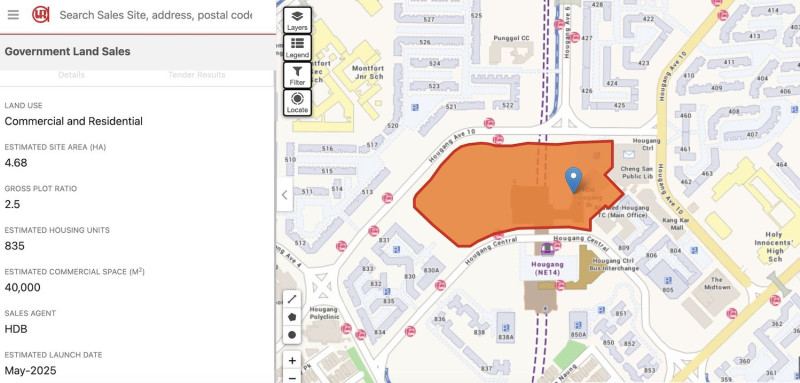

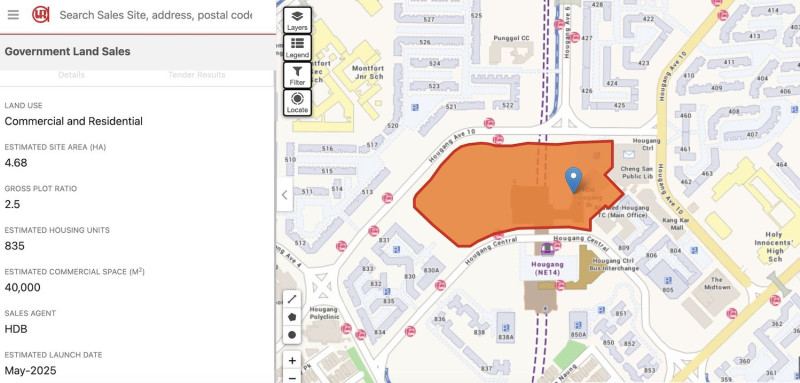

The site of the former Singapore Indian Fine Arts Society on Dorsett Road, off Rangoon Road, which can yield about 430 units, will also be launched for sale in 1H2025. A residential and commercial site at Hougang Central, which can yield a new mixed-use development with 835 residential units and over 400,000 sq ft of commercial space, is offered for sale. It will likely be integrated with the Hougang MRT Station on the Northeast Line.

Also on the Confirmed List is the residential plot in Upper Thomson Road (Parcel A), which saw no bids when its tender closed in June 2024. Previously, the plot was to offer a mix of residential units and long-stay serviced apartments. Of note, the URA has provided more flexibility this time; it said that serviced apartment/long-stay serviced apartment use would not be mandated for the site but can be allowed subject to approval from technical agencies, notes PropNex.

A residential and commercial site at Hougang Central, which can yield a new mixed-use development with 835 residential units and over 400,000 sq ft of commercial space, is offered for sale (Source: URA)

It was an unprecedented year for GLS tenders. For the first time, URA did not award the tender for three plots - Marina Gardens Crescent, the Jurong Lake District master developer site, and plots in Media Circle (for long-stay serviced apartment use). The URA rejected the bids offered because they were too low. These sites are now listed on the 1H2025 Reserve List.

Read also: ANALYSIS: What’s next for the Jurong Lake District GLS site?

Advertisement

Advertisement

In addition to sites in two new housing precincts, the majority of the sites are near MRT stations, which could appeal to developers and homebuyers alike, notes Gafoor. “In our view, the most attractive ones are the mixed-use site in Hougang Central (835 units) that will be connected to the Hougang MRT station, the Telok Blangah Road plot (740 units) and Dunearn Road (370 units) site in new housing precincts, and within minutes’ walk to the MRT station, as well as the Lakeside Drive site (575 units) which is right next to the Lakeside MRT station, Jurong Lake Gardens and the Jurong East commercial hub.”

Ask Buddy

Past Condo rental transactions

Past Condo sale transactions

Condo transactions with the highest profits in the past year

Upcoming new launch projects

Compare price trend of HDB vs Condo vs Landed

Past Condo rental transactions

Past Condo sale transactions

Condo transactions with the highest profits in the past year

Upcoming new launch projects

Compare price trend of HDB vs Condo vs Landed

Ask Buddy

Past Condo rental transactions

Past Condo sale transactions

Condo transactions with the highest profits in the past year

Upcoming new launch projects

Compare price trend of HDB vs Condo vs Landed

Past Condo rental transactions

Past Condo sale transactions

Condo transactions with the highest profits in the past year

Upcoming new launch projects

Compare price trend of HDB vs Condo vs Landed

Ask Buddy

Past Condo rental transactions

Past Condo sale transactions

Condo transactions with the highest profits in the past year

Upcoming new launch projects

Compare price trend of HDB vs Condo vs Landed

Past Condo rental transactions

Past Condo sale transactions

Condo transactions with the highest profits in the past year

Upcoming new launch projects

Compare price trend of HDB vs Condo vs Landed

Ask Buddy

Past Condo rental transactions

Past Condo sale transactions

Condo transactions with the highest profits in the past year

Upcoming new launch projects

Compare price trend of HDB vs Condo vs Landed

Past Condo rental transactions

Past Condo sale transactions

Condo transactions with the highest profits in the past year

Upcoming new launch projects

Compare price trend of HDB vs Condo vs Landed