Realtor Marcus Luah makes upgrading possible and safe, one YouTube video at a time

Property agent Marcus Luah has built a reputation for guiding condo buyers through insightful advice and thorough planning in more than 16 years of experience in the real estate industry.

The PropNex agency vice president, who works with his own new/existing clients despite heading a team of more than 5,000 agents, has carved this particular niche, whether buying their first brand new property or even a second property investment.

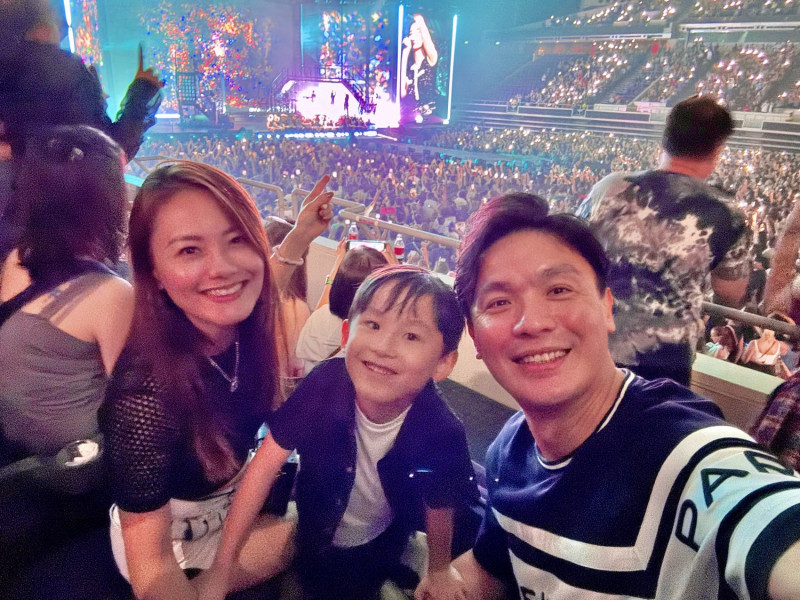

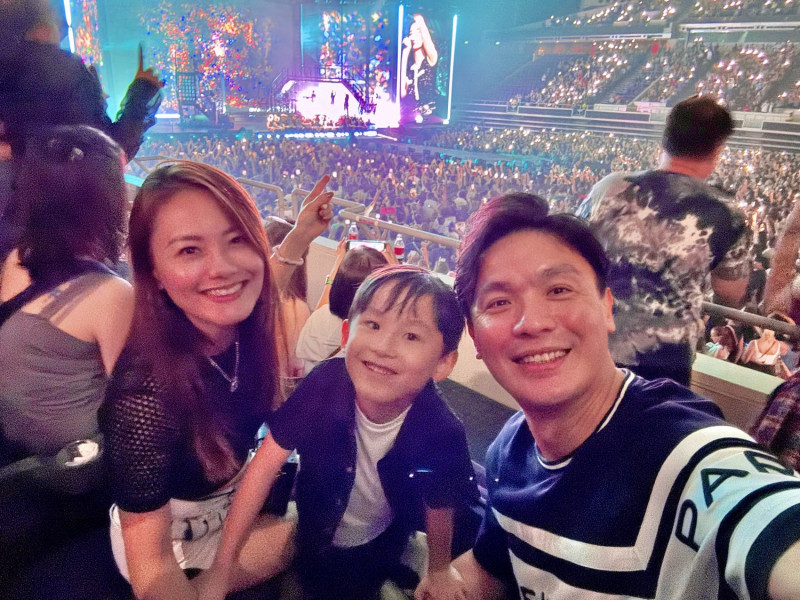

Marcus has successfully carved a niche in helping property investors achieve their real estate investment dreams (Photo: Marcus Luah)

With a unique approach that balances emotions with practicality, Marcus helps clients avoid emotional pitfalls by focusing on data-driven insights. These include whether the price premium for features like higher floors or preferred facings is justifiable or if a particular layout aligns with the region's exit strategy, ensuring long-term investment viability.

Read also: PropNex soars, capturing greater market share amid challenging real estate climate

Advertisement

Advertisement

An example of this approach includes comparing price trends within and outside the region to identify fair pricing and determine a safe entry price. This strategy of ensuring a solid exit strategy provides clients with confidence in their investment decisions and clarity on potential returns.

Marcus sees his clients’ real estate investments as benefiting themselves and also their future generations to come, which is the same mindset that he applies to his personal investments (Photo: Marcus Luah)

He is also deeply motivated by helping his clients avoid the regret he has heard many parents express. “I often hear parents say, ‘I could’ve bought that landed property or condo years ago for a fraction of the price today if only I had,’” he shares. This mindset shapes Marcus’ passion for helping others invest early rather than being the one left saying, "I wish I had."

By making informed property decisions, Marcus believes he has already witnessed clients secure a future for themselves and provide lasting financial stability for their families.

Marcus leverages on his YouTube channel, Keep It Real Estate, to educate the general public on property-related matters (Photo: Marcus Luah)

He began consistently producing videos on real estate every week in June 2023, ranging from new launch reviews and property news breakdowns to tips on upgrading to condos or landed properties with a quantum value between $2 and $5 million.

Over a year later, his channel has produced close to 100 videos and connected with a community of more than 100,000 followers across all his social media accounts as of November. Nowadays, he estimates that 80% of his clients come from the YouTube channel. These clients appreciate his channel as a casual and unfiltered resource, offering honest insights about buying, selling and upgrading through numbers and calculations. Though he speaks about serious matters, he keeps his sharing light-hearted and candid as he understands that buying a new property can be a stressful experience.

Marcus appreciates that these clients are typically well-informed and have done considerable research on YouTube. "They generally know what they want. They want to know my perspective on future exit plan for different units so they are reassured that I can sell it for them at their targeted price and have a peace of mind," he says. This is where Marcus meets up with them and shows data-driven insights and recommendations based on the client’s financial situation, needs and investment goals.

Almost 80% of Marcus’s clients come from his YouTube channel, which has exceeded 7,000 loyal subscribers (Photo: Marcus Luah)

Clients are easy to trust Marcus as he is transparent and genuine in sharing his own real estate investment journey (Photo: Marcus Luah)

Property as future retirement plan

Marcus’ balanced approach stems from his mindset that real estate is not just a means of wealth building but a key component of a long-term retirement plan. Inspired by the principles outlined in the best-selling book Rich Dad, Poor Dad, he believes that a real estate mortgage can be a form of good debt. “While your family is living in the property, you are also paying down your principal, which ultimately contributes to long-term wealth,” Marcus explains. By investing in property, he sees his clients securing a comfortable future for themselves and laying the foundation for generational wealth.

Unique connection with clients

Marcus’ personal goal is to provide honest and transparent advice. As a real estate investor who has upgraded from HDB to three new condos and then to landed properties, clients find him easy to relate to and are open to learning from his life experiences. Read also: Shophouse investment interest remained brisk in 3Q2024 despite fewer caveated deals: PropNex Advertisement Advertisement He channels this drive to producing casual but engaging videos on real estate matters on his YouTube channel, Keep It Real Estate, since the pandemic. These include reviews of new launches, personal stories of his real estate investment journey and educating the general public on property-related news. Through his channel, he aims to connect with like-minded individuals who see property as a defensive asset class and to contribute meaningful content to a community that has inspired him. “I was a very active user on the platform, learning about fitness and asset growth. Then I thought, if I’m investing my free time on YouTube for self-improvement, then surely others were too,” Marcus shares.

Balancing emotions with practicality

In the competitive and fast-moving Singapore real estate market, Marcus believes in taking a “defensive approach” by identifying hidden gems in the property market. He focuses on long-term gains for his clients while also managing their emotional expectations and possible challenges in upgrading. Instead of simply telling clients what to buy, Marcus empowers them to analyse the data themselves, ensuring that their journey with him is not just a transaction but a shared learning experience. Read also: Freehold bungalow in Caldecott Hill Estate GCB area for sale at $21.8 mil Advertisement Advertisement He recalls a client initially set on purchasing a freehold property in Orchard Road as their second property investment. On the surface, it seemed logical, he says. “However, after diving into the market data, I saw that the property’s appreciation had stagnated despite its prime location. Furthermore, while it is close to the MRT, it lacks the essential fundamentals of a good investment property. These are just one of the many critical factors to consider,” he says. He then advised his client to buy another new launch property with better appreciation value, which has since seen a more than 70% take-up rate. Today, the property is worth about 10% higher in 10 months since the purchase — a testament to Marcus’s market foresight.