Singapore may need more ‘aggressive’ property cooling measures: Barclays

Singapore authorities may need to add more “aggressive” real estate curbs down the road if they fail to tackle a homebuying frenzy by early next year, Barclays warned.

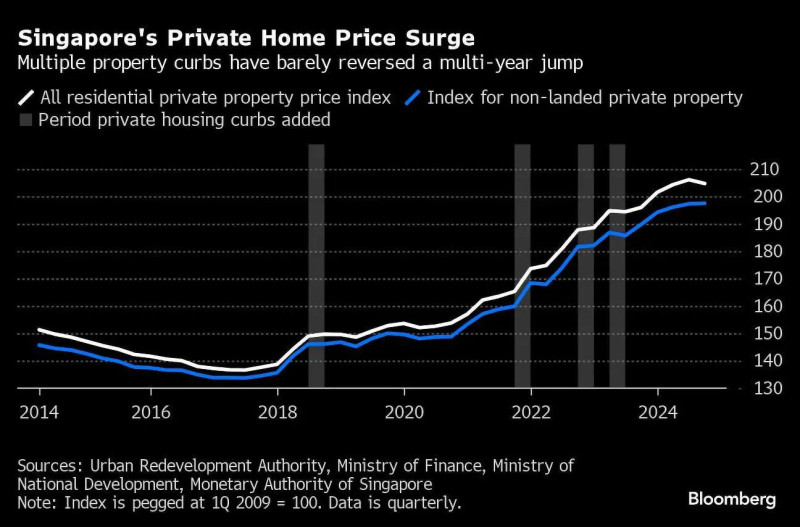

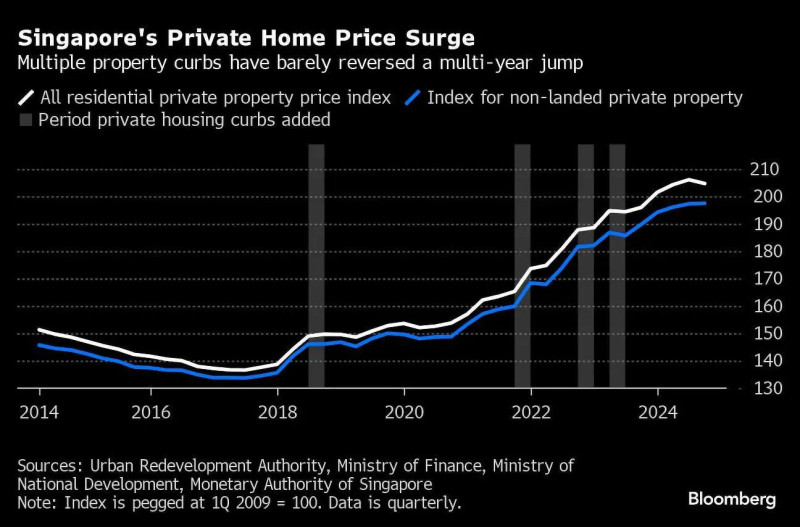

A recent resurgence in the private market driven by a blockbuster November has “raised the likelihood of a revival in property prices”, and a repeat of 2017-2019 when buyers shrugged off cooling measures, analysts Brian Tan and Audrey Ong wrote in a note Monday. “A lack of response may well be interpreted as confirmation that policymakers are only half-heartedly trying to contain property prices.”

More than 2,400 new private homes were sold last month, according to preliminary data from the Urban Redevelopment Authority, putting sales on pace for their best month in more than a decade.

Read also: Measures to check HDB resale market running ‘out of line with economic fundamentals’

Advertisement

Advertisement

Singapore’s central bank said last week that the easing of domestic lending rates has boosted sentiment in the private property market. The government “will remain vigilant to market developments”, it said in an annual financial stability review.

Authorities have acted three times in just under three years to cool the private market, most recently by doubling stamp duty for most foreigners to 60% in 2023, one of the highest rates globally.

A 2025 property tax rebate announced recently for homes occupied by their owners could also inadvertently compound property investor sentiment despite being a targeted measure to help tackle cost of living concerns, Barclays said.

“Real estate investors are nonetheless likely to retroactively interpret the announcement as a signal that the government is easing on the brakes,” its analysts wrote. “Some market players may choose to see what they want to see in order to muster as many arguments as they can to further fuel the frenzy if investor sentiment improves.”

More than 2,400 new private homes were sold last month, according to preliminary data from the Urban Redevelopment Authority, putting sales on pace for their best month in more than a decade.

Read also: Measures to check HDB resale market running ‘out of line with economic fundamentals’

Advertisement

Advertisement

Singapore’s central bank said last week that the easing of domestic lending rates has boosted sentiment in the private property market. The government “will remain vigilant to market developments”, it said in an annual financial stability review.

Authorities have acted three times in just under three years to cool the private market, most recently by doubling stamp duty for most foreigners to 60% in 2023, one of the highest rates globally.

A 2025 property tax rebate announced recently for homes occupied by their owners could also inadvertently compound property investor sentiment despite being a targeted measure to help tackle cost of living concerns, Barclays said.

“Real estate investors are nonetheless likely to retroactively interpret the announcement as a signal that the government is easing on the brakes,” its analysts wrote. “Some market players may choose to see what they want to see in order to muster as many arguments as they can to further fuel the frenzy if investor sentiment improves.”

More than 2,400 new private homes were sold last month, according to preliminary data from the Urban Redevelopment Authority, putting sales on pace for their best month in more than a decade.

Read also: Measures to check HDB resale market running ‘out of line with economic fundamentals’

Advertisement

Advertisement

Singapore’s central bank said last week that the easing of domestic lending rates has boosted sentiment in the private property market. The government “will remain vigilant to market developments”, it said in an annual financial stability review.

Authorities have acted three times in just under three years to cool the private market, most recently by doubling stamp duty for most foreigners to 60% in 2023, one of the highest rates globally.

A 2025 property tax rebate announced recently for homes occupied by their owners could also inadvertently compound property investor sentiment despite being a targeted measure to help tackle cost of living concerns, Barclays said.

“Real estate investors are nonetheless likely to retroactively interpret the announcement as a signal that the government is easing on the brakes,” its analysts wrote. “Some market players may choose to see what they want to see in order to muster as many arguments as they can to further fuel the frenzy if investor sentiment improves.”

More than 2,400 new private homes were sold last month, according to preliminary data from the Urban Redevelopment Authority, putting sales on pace for their best month in more than a decade.

Read also: Measures to check HDB resale market running ‘out of line with economic fundamentals’

Advertisement

Advertisement

Singapore’s central bank said last week that the easing of domestic lending rates has boosted sentiment in the private property market. The government “will remain vigilant to market developments”, it said in an annual financial stability review.

Authorities have acted three times in just under three years to cool the private market, most recently by doubling stamp duty for most foreigners to 60% in 2023, one of the highest rates globally.

A 2025 property tax rebate announced recently for homes occupied by their owners could also inadvertently compound property investor sentiment despite being a targeted measure to help tackle cost of living concerns, Barclays said.

“Real estate investors are nonetheless likely to retroactively interpret the announcement as a signal that the government is easing on the brakes,” its analysts wrote. “Some market players may choose to see what they want to see in order to muster as many arguments as they can to further fuel the frenzy if investor sentiment improves.”