Government offers one-time property tax rebate to owner-occupiers

The government will provide a one-off property tax rebate of 20% for owner-occupied HDB flats, and a one-off rebate of 15% for owner-occupied private residential properties in 2025. However, owner-occupiers of private residential properties will have their rebate capped at $1,000.

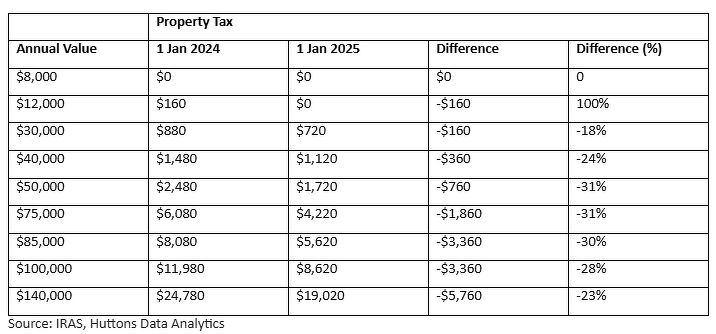

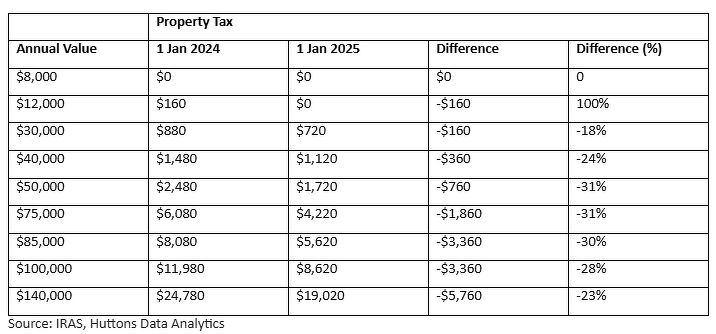

Property tax is calculated based on a property’s annual value, which is the estimated rent a property can fetch a year if rented out.

The property tax rebate was unveiled by the government on Nov 29 as it prepares to raise all annual value bands of owner-occupier’s residential property tax rates on Jan 1 next year as part of Budget 2024.

Read also: Property Unpacked: How do the recent changes to property tax impact you?

Advertisement

Advertisement

As a result of both changes, the government says that all owner-occupiers of HDB flats and over 90% of private residential properties would see lower property taxes next year. The government says this supports its aim of mitigating cost-of-living concerns among Singaporeans.

According to Lee Sze Teck, senior director of data analytics at Huttons Asia, the annual value of private properties is expected to end this year flat on the back of low to marginal growth in private residential rents this year.

On the other hand, he says that HDB rents could increase by 4% for the whole year, nudging up the annual value of HDB flats.

“This once-off property tax rebate may potentially help HDB owners to cushion any impact from an increase in annual value, if any. For example, if a HDB flat has an annual value of $30,000, the property tax payable is $720 in 2025. Assuming there is no change in AV, the owner will only need to pay $576, a savings of $144,” says Lee.

He adds that some private residential owners may also stand to benefit from the one-off rebate.

For example, if the annual value of their property is $85,000, the property tax payable in 2025 is $5,760. Lee calculates that with a 15% property tax rebate, capped at $1,000, the owner of this private property will pay $4,896 in property taxes, saving $864.

“Property tax rebates have been offered before and does not reduce the appeal of investing in residential properties in Singapore. The appeal of investing in residential properties in Singapore lies in the potential for capital appreciation which far outweighs the increase in property tax,” says Lee.

Read also: Budget 2024: Revised property taxes to benefit owner-occupied properties with lower annual values

Advertisement

Advertisement

“This once-off property tax rebate may potentially help HDB owners to cushion any impact from an increase in annual value, if any. For example, if a HDB flat has an annual value of $30,000, the property tax payable is $720 in 2025. Assuming there is no change in AV, the owner will only need to pay $576, a savings of $144,” says Lee.

He adds that some private residential owners may also stand to benefit from the one-off rebate.

For example, if the annual value of their property is $85,000, the property tax payable in 2025 is $5,760. Lee calculates that with a 15% property tax rebate, capped at $1,000, the owner of this private property will pay $4,896 in property taxes, saving $864.

“Property tax rebates have been offered before and does not reduce the appeal of investing in residential properties in Singapore. The appeal of investing in residential properties in Singapore lies in the potential for capital appreciation which far outweighs the increase in property tax,” says Lee.

Read also: Budget 2024: Revised property taxes to benefit owner-occupied properties with lower annual values

Advertisement

Advertisement

“This once-off property tax rebate may potentially help HDB owners to cushion any impact from an increase in annual value, if any. For example, if a HDB flat has an annual value of $30,000, the property tax payable is $720 in 2025. Assuming there is no change in AV, the owner will only need to pay $576, a savings of $144,” says Lee.

He adds that some private residential owners may also stand to benefit from the one-off rebate.

For example, if the annual value of their property is $85,000, the property tax payable in 2025 is $5,760. Lee calculates that with a 15% property tax rebate, capped at $1,000, the owner of this private property will pay $4,896 in property taxes, saving $864.

“Property tax rebates have been offered before and does not reduce the appeal of investing in residential properties in Singapore. The appeal of investing in residential properties in Singapore lies in the potential for capital appreciation which far outweighs the increase in property tax,” says Lee.

Read also: Budget 2024: Revised property taxes to benefit owner-occupied properties with lower annual values

Advertisement

Advertisement

“This once-off property tax rebate may potentially help HDB owners to cushion any impact from an increase in annual value, if any. For example, if a HDB flat has an annual value of $30,000, the property tax payable is $720 in 2025. Assuming there is no change in AV, the owner will only need to pay $576, a savings of $144,” says Lee.

He adds that some private residential owners may also stand to benefit from the one-off rebate.

For example, if the annual value of their property is $85,000, the property tax payable in 2025 is $5,760. Lee calculates that with a 15% property tax rebate, capped at $1,000, the owner of this private property will pay $4,896 in property taxes, saving $864.

“Property tax rebates have been offered before and does not reduce the appeal of investing in residential properties in Singapore. The appeal of investing in residential properties in Singapore lies in the potential for capital appreciation which far outweighs the increase in property tax,” says Lee.

Read also: Budget 2024: Revised property taxes to benefit owner-occupied properties with lower annual values

Advertisement

Advertisement