CDL sales value nearly doubles y-o-y to $611.1 mil in 3QFY2024

City Developments Limited (CDL) sold 321 units with a total sales value of $611.1 million In 3QFY2024 ended Sept 30, nearly double the 183 units sold with a total sales value of $325.0 million in the same quarter last year.

According to a Nov 22 announcement, sales were mainly driven by the launch of the 276-unit freehold Kassia in July, a JV project located off Upper Changi Road North. To date, 179 units (65%) have been sold.

For 9M2024, the group and its joint venture (JV) associates sold 905 units with a total sales value of $1.8 billion, up from 691 units with sales value of $1.4 billion this time last year.

Read also: REDAS celebrates 65th anniversary, honours Chia Ngiang Hong with Lifetime Achievement Award

Advertisement

Advertisement

To date, Tembusu Grand, the 638-unit JV project at Katong, has sold 581 units (91%) [Photo: Samuel Isaac Chua/EdgeProp Singapore]

To date, Tembusu Grand, the 638-unit JV project at Katong, has sold 581 units (91%), while The Myst at Upper Bukit Timah Road has sold 297 of its 408 units (73%).

“With a moderation in interest rates, market activities have resumed, and residential sales have picked up after the seasonal lull in September, which coincided with the Hungry Ghost Festival,” says CDL.

As at Sept 30, the committed occupancy for CDL’s Singapore office portfolio was 97.4%, surpassing the islandwide office occupancy rate of 89.0%. “This is primarily attributed to the increase in occupancy at South Beach,” says CDL.

Republic Plaza, the Group’s flagship Grade A office building, achieved a committed occupancy of 98.3%, higher than the previous quarter of 97.0%. City House and King’s Centre office assets had committed occupancies of 98.6% and 100%, respectively. According to CDL, all three office assets achieved “healthy” rental reversion without providing further details.

City Square Mall, which is undergoing an asset enhancement initiative (AEI), maintained a 99.7% committed occupancy for non-affected AEI spaces during the same period (Photo: Samuel Isaac Chua/EdgeProp Singapore)

The group’s Singapore retail portfolio registered a committed occupancy of 98.5% as at Sept 30, surpassing the islandwide retail occupancy of 93.5%.

City Square Mall, which is undergoing an asset enhancement initiative (AEI), maintained a 99.7% committed occupancy for non-affected AEI spaces during the same period.

Read also: CDL sells 20% of Union Square Residences at an average price of $3,200 psf

Advertisement

Advertisement

The second phase of the AEI is on track for completion by 1H2025, with a pre-commitment rate exceeding 70% for areas affected by AEI, says CDL.

The group’s other retail assets, Palais Renaissance and Quayside Isle, recorded committed occupancies of 98.8% and 100% respectively.

“Robust leasing demand in 1H2024 has sustained the group’s retail asset performance over the first nine months, resulting in healthy operating metrics, improved shopper traffic and higher retail sales,” says CDL.

Despite challenges in China’s real estate sector, top-tier cities like Shanghai, Suzhou and Shenzhen remain promising due to their role in economic growth and innovation (Photo: CDL)

Yardhouse marks its first co-living scheme project in the UK and is its fifth PRS project in the UK since 2019 (Photo: CDL)

Since the start of November, new home sales have registered exceptional performance, with around 2,000 units sold (excluding Executive Condominiums) across five launches, including Union Square Residences (Credit: CDL)

Republic Plaza, the Group’s flagship Grade A office building, achieved a committed occupancy of 98.3%, higher than the previous quarter of 97.0% (Photo: Samuel Isaac Chua/EdgeProp Singapore)

The robust sales performance in November surpassed the 1,889 units (excluding Executive Condominiums) sold in 1H2024. The strong take-up rates generated the highest monthly new home sales since March 2013, signalling improved market sentiment.

This positive trend is also boosting interest in existing inventory. In November alone, over 50 units of Tembusu Grand were sold, bringing the project to 91% sold to date.

On hotels, CDL expects y-o-y growth across its hotel portfolio, especially in key markets like Singapore, London and New York. “The recent acquisition of the Hilton Paris Opera hotel is expected to strengthen the segment's overall performance. Additionally, China’s recent fiscal stimulus packages aimed at economic revival may boost discretionary spending, positively impacting travel demand from Chinese travellers — an important feeder market for many of the group’s hotels.”

On Oct 30, the UK announced a 6.7% hike in the national living wage, effective April 2025, with higher rates for younger workers. While this will increase operating costs in the UK, CDL says it will “continue to enhance its efficiencies to manage these costs”.

In March, CDL partnered with CapitaLand Development, Frasers Property TQ5, Mitsui Fudosan (Asia) and Mitsubishi Estate and submitted two joint bids for the master developer site at Jurong Lake District (JLD).

However, in September, the URA announced that it would not award the tender, following a two-stage evaluation process comprising both concept design and price assessment.

“While the consortium may not have the opportunity to realise its vision for the site, it has gained valuable insights from the process,” says CDL.

Shares in CDL closed 2 cents higher, or 0.4% up, at $5.14 on Nov 22.

China ‘challenging’

CDL also provided updates on its residential projects in Australia and China, as well as investment properties in the UK, Thailand and China. The office leasing market in China, in particular, remains “challenging”, says CDL. As of Sept 30, the group’s office portfolio in China is 68% occupied. Despite challenges in China’s real estate sector, top-tier cities like Shanghai, Suzhou and Shenzhen remain promising due to their role in economic growth and innovation,” says CDL. “The Chinese government’s stimulus package, which includes easing mortgage rates and promoting sustainable urbanisation, creates an investor-friendly environment.” Read also: CDL jointly acquires mixed-use development site in Shanghai for RMB8.94 bil with Chinese partner Lianfa Group Advertisement Advertisement For 9M2024, the group’s wholly-owned subsidiary, CDL China Limited, and its JV associates sold 123 residential, office and retail units, with a total sales value of RMB743.5 million ($136.0 million). The group announced on Nov 1 its joint acquisition of a 27,994 sqm mixed-use development site in Shanghai for RMB8.94 billion with its partner Lianfa Group, following a government land tender. Through its wholly-owned subsidiary, Chenghong (Shanghai) Investment, the group holds a 51% controlling stake in the JV acquisition, which amounts to RMB4.56 billion. “The group’s acquisition in central Shanghai reflects its confidence in China’s long-term growth prospects, with a focus on placemaking opportunities in Tier 1 and 2 cities. Given the prime location and rarity of villa products in central Shanghai, the group is confident in the demand for residential units in this project. In addition, the boutique hotel and ancillary retail spaces to be developed in this prime site are expected to become valuable core assets,” says CDL.

Living sector

In the living sector, CDL’s 665-unit project in Leeds, The Junction, achieved about 60% committed occupancy in 3QFY2024. CDL says it is “accelerating its leasing and marketing efforts”. Meanwhile, the group’s purpose-built student accommodation portfolio counts six properties in the UK, with around 2,400 beds, and achieved an occupancy rate of 90% for the current academic year 2024/2025. In September, CDL completed its investment in a 183-unit PRS asset in Yokohama, Japan, achieving over 90% committed occupancy within a month. In 3QFY2024, the portfolio maintained a “robust” average occupancy rate of 95% and generated “stable income”, supported by strong leasing momentum from foreign and domestic tenants in Japan’s rental housing market.

Hotels

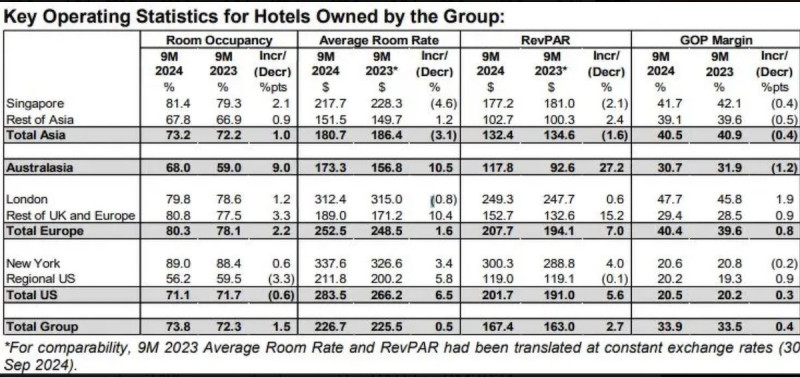

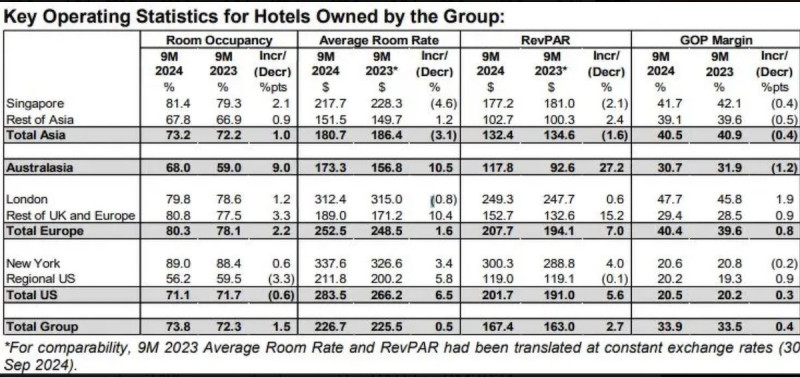

For 9M2024, the group’s hotels achieved a 2.7% increase in global growth in revenue per available room (RevPAR), reaching $167.40, mainly due to higher occupancy and average room rate (ARR) from Australasia. Rest of Asia, Europe and New York markets also continued their y-o-y growth trajectory, says CDL. CDL’s Singapore hotels experienced a 2.1% y-o-y decline in RevPAR for 9M2024, mainly due to lower ARR. “While major events like the Taylor Swift concerts and the Formula 1 Singapore Grand Prix boosted occupancy, they could not mitigate the shortfall in ARR.” In contrast, for the Rest of Asia, the RevPAR increased 2.4% y-o-y, primarily driven by the strong performance of Taipei. The group’s Southeast Asia hotels also recorded improved results compared to last year. Gross operating profit margin for Asia hotels was 40.5%. In the UK, Millennium Hotel London Knightsbridge (222 rooms) will undergo a major renovation of GBP17 million ($29 million). The renovation is currently at the design and planning stage. Site work will begin in 1H2025. Upon completion in 4Q2025, it will be reflagged as M Social Knightsbridge, marking the Group’s first M Social property in the UK. The hotel will continue to operate during the AEI period. The 318-room Copthorne Orchid Hotel Penang is currently undergoing a major renovation of RM96 million ($29 million) and will be rebranded as M Social Resort Penang. The hotel is scheduled to soft open in phases from 1Q2025, with full completion and re-opening expected in mid-2025. Millennium Downtown New York (569 rooms) commenced a US$46 million ($60 million) renovation in 3Q2024 and will be reflagged as M Social Downtown New York upon completion in 2Q2025. In California, M Social Hotel Sunnyvale (263 rooms) is undergoing foundation work. Developed at a cost of US$118 million, the hotel is expected to be fully open in 2H2026.

Capital position

As at Sept 30, net gearing ratio (factoring in fair value on investment properties) stands at 70%, following several acquisitions during the year, including the Hilton Paris Opéra hotel, and four Japan PRS properties. CDL’s interest cover stands at 2.1 times and its debt expiry profile remains “healthy”. “The group maintains strong cash reserves of $2.0 billion and a robust liquidity position, supported by $3.9 billion in cash and available undrawn committed bank facilities. The group maintained a substantial level of natural hedge for its overseas investments and continues to adopt a proactive and disciplined approach to capital management.” CDL says there is a “notable uptick” in residential sales in Singapore since 3QFY2024, driven by a more favourable interest rate environment and pent-up demand, “particularly for highly sought-after locations”. Since the start of November, new home sales have registered exceptional performance, with around 2,000 units sold (excluding Executive Condominiums) across five launches, including Union Square Residences.