Emerald of Katong hits 99% sales at launch, averaging $2,621 psf

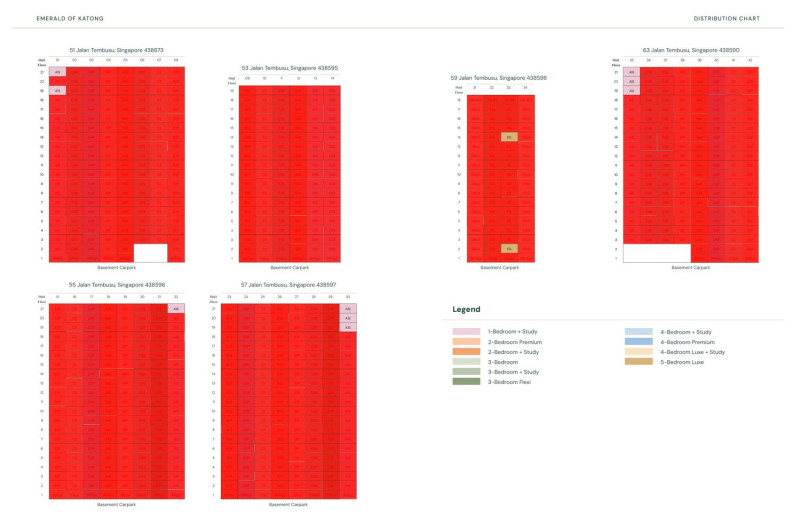

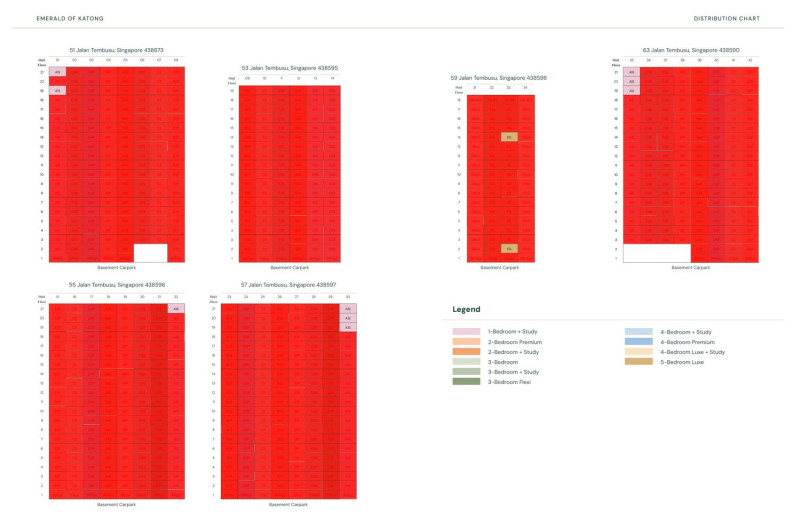

Emerald of Katong recorded strong sales over its launch weekend, with developer Sim Lian Group selling 835 of 846 units (98.7%) in two days. Its VIP sales on Nov 15 saw 401 units (47%) taken up, followed by another 434 units on Nov 16. The average price of units sold across the weekend was $2,621 psf. Sim Lian declined to comment on its sales.

“It probably holds the record for the most number of units sold in a day, besting J'Gateway's 738 units in June 2013," says Mark Yip, CEO of Huttons Asia.

Only 11 units remain available at Emerald of Katong—nine one-bedroom and two five-bedroom units. All two-, three-, and four-bedroom unit types have been sold out. "Buyers favoured the larger units with either a study or flex layout," notes Yip. "They were likely purchasing for owner-occupation, needing the study or flexible layout to suit their lifestyle needs."

Get the latest details on available units and prices for Emerald Of Katong

Advertisement

Advertisement

Emerald of Katong sales chart as of 9.30pm, Nov 16 (Sources: Real estate agents)

Top selling project of 2024

Lee Liat Yeang, the real estate senior partner of Dentons Rodyk & Davidson LLP, the developer's lawyers, regards Emerald of Katong as the top-selling project of 2024 in terms of both the number of units and the percentage sold during its launch weekend.

The sales performance of the 99-year leasehold project at Jalan Tembusu in District 15 is particularly notable, as its launch coincided with two other projects on the same weekend.

The 552-unit Nava Grove, a 99-year leasehold development by MCL Land and Sinarmas Land, reportedly sold 353 units on Nov 16, representing 64% of its total units. On the same day, Novo Place, a 504-unit executive condominium (EC) at Plantation Close in Tengah, by joint developers Hoi Hup Realty and Sunway Developments, is said to have achieved a 56% sales rate.

These three projects conclude an unprecedented six new residential projects (including the EC project) launched over the past fortnight. "We were initially concerned that launching six projects within 14 days might result in some of them being overshadowed by others," says Ismail Gafoor, CEO of PropNex.

"However, with 3,551 units on offer, homebuyers had the opportunity to visit all the developments before choosing their preferred one," adds Gafoor. "In fact, having so many options in a short span seemed to help buyers make decisions more quickly. The interest might not have been as intense if the launches had been spread over two months."

It also helped that Kingsford Group moved forward the launch of the 916-unit, 99-year leasehold Chuan Park to Nov 10 from Nov 16, notes Gafoor. "Those whose first choice may have been Chuan Park but were unable to secure a unit there had the opportunity to consider Emerald of Katong instead," says Gafoor. "If the two projects had been launched on the same weekend, prospective buyers might have been torn between them. By bringing forward Chuan Park's launch, both projects benefited."

Read also: New private home sales surge 84% in October, a precursor to stirring sales in November

Advertisement

Advertisement

Chuan Park sold 696 units—representing 76% of its units—in a single day at an average price of $2,579 psf.

Holding prices steady

Another reason for the strong sales at Emerald of Katong was the developer's decision to hold prices steady throughout its launch day despite an overwhelming response. A total of 3,629 cheques were collected as expressions of interest, translating to the project being 4.3 times oversubscribed. "Sim Lian did not raise their selling prices from the initial price list," says Gafoor. "It reassured buyers and their agents that they still had an opportunity to secure a unit at the same price, even if their queue number was as high as 3,000.'

Based on caveats lodged, District 15 has always been among the top Districts to stay in Singapore, notes Huttons' Yip. "The East Coast lifestyle and the limited number of large projects attracted buyers to Emerald of Katong," he says.

"Compared with other new projects in the RCR [Rest of Central Region], which have a median price of $2,955 psf, Emerald of Katong's starting price from $2,423 psf is very attractively priced," says Marcus Chu, CEO of ERA Singapore.

Buyers who were unable to secure a unit at Emerald of Katong turned to other major condo projects in the vicinity, notably the three projects launched last year: the 1,008-unit, 99-year leasehold Grand Dunman; the 638-unit, 99-year leasehold Tembusu Grand; and the 816-unit, freehold The Continuum. "All three recorded good sales on Saturday," according to Huttons' Yip.

From Nov 11 to 16, The Continuum is reported to have registered 22 new sales, while Tembusu Grand saw 12 units sold, and Grand Dunman recorded five new sales.

Read also: Rental growth in 3Q2024 'short-lived'; upside capped by increased competition for tenants

Advertisement

Advertisement

Huttons' Yip attributes the strong sales momentum to "better economic growth and cuts in interest rates", which have attracted more buyers to the new homes market due to their improved borrowing capacity. He adds that lower returns from other investment assets may have encouraged more buyers to consider property as a preferred investment.

November sales likely to be highest since March 2013

Huttons estimates that developers' sales in November will reach up to 2,200 units, approaching the levels recorded in March 2013, when 2,793 units were sold.

On-the-ground observations indicate a growing number of prospective local and foreign buyers utilising trust structures to acquire homes for their children, notes Yip. "Investing in residential property may serve as a form of wealth planning and preservation," he says. This trend, he adds, reflects rising wealth among local buyers and an influx of overseas funds into Singapore.

Figures from the Monetary Authority of Singapore (MAS) show that the number of single-family offices grew to 1,650 as of August 2024, an increase of 250 from the end of 2023, according to Huttons. During the same period, the M1 money supply—which includes cash, demand deposits, and other liquid deposits—rose by $10.2 billion in the first nine months of 2024.

Check out the latest listings for Emerald Of Katong, Condominium properties

Ask Buddy

Compare price trend of New sale condo vs Resale condo

Compare price trend of HDB vs Condo vs Landed

Condo projects with most unprofitable transactions

Condo transactions with the highest profits in the past year

Most unprofitable condo transactions in past 1 year

Compare price trend of New sale condo vs Resale condo

Compare price trend of HDB vs Condo vs Landed

Condo projects with most unprofitable transactions

Condo transactions with the highest profits in the past year

Most unprofitable condo transactions in past 1 year

Ask Buddy

Compare price trend of New sale condo vs Resale condo

Compare price trend of HDB vs Condo vs Landed

Condo projects with most unprofitable transactions

Condo transactions with the highest profits in the past year

Most unprofitable condo transactions in past 1 year

Compare price trend of New sale condo vs Resale condo

Compare price trend of HDB vs Condo vs Landed

Condo projects with most unprofitable transactions

Condo transactions with the highest profits in the past year

Most unprofitable condo transactions in past 1 year

Ask Buddy

Compare price trend of New sale condo vs Resale condo

Compare price trend of HDB vs Condo vs Landed

Condo projects with most unprofitable transactions

Condo transactions with the highest profits in the past year

Most unprofitable condo transactions in past 1 year

Compare price trend of New sale condo vs Resale condo

Compare price trend of HDB vs Condo vs Landed

Condo projects with most unprofitable transactions

Condo transactions with the highest profits in the past year

Most unprofitable condo transactions in past 1 year

Ask Buddy

Compare price trend of New sale condo vs Resale condo

Compare price trend of HDB vs Condo vs Landed

Condo projects with most unprofitable transactions

Condo transactions with the highest profits in the past year

Most unprofitable condo transactions in past 1 year

Compare price trend of New sale condo vs Resale condo

Compare price trend of HDB vs Condo vs Landed

Condo projects with most unprofitable transactions

Condo transactions with the highest profits in the past year

Most unprofitable condo transactions in past 1 year