Rental growth in 3Q2024 'short-lived'; upside capped by increased competition for tenants

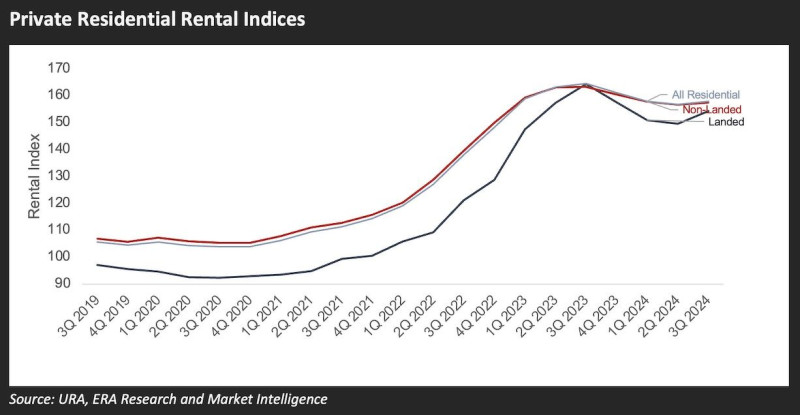

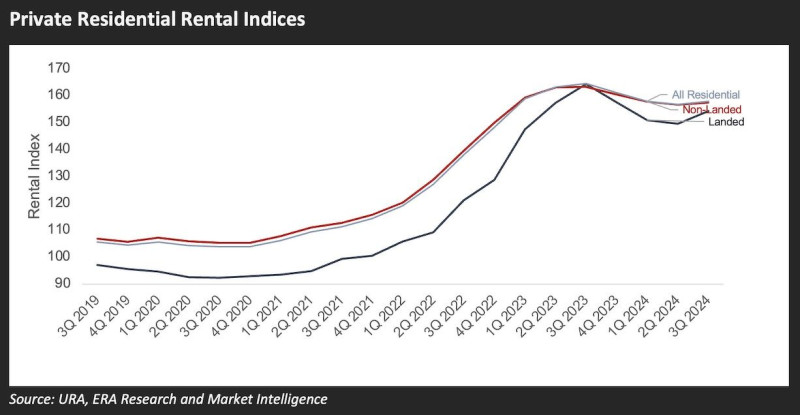

Private residential rents rose by 0.8% q-o-q in 3Q2024, following three consecutive quarters of decline. However, this uptick may be short-lived, according to ERA's 3Q2024 report released on Nov 13

The modest recovery in 3Q2024 may be due to tenants' preference for private homes, seeking greater value in properties with in-house amenities, says Wong Shanting, vice president of ERA research and market intelligence. The shift is due to the narrowing gap between the rents of private condos relative to HDB flats over the past three quarters.

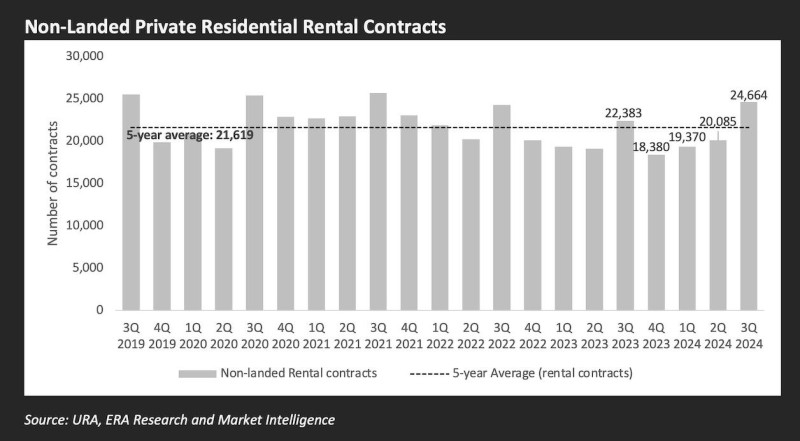

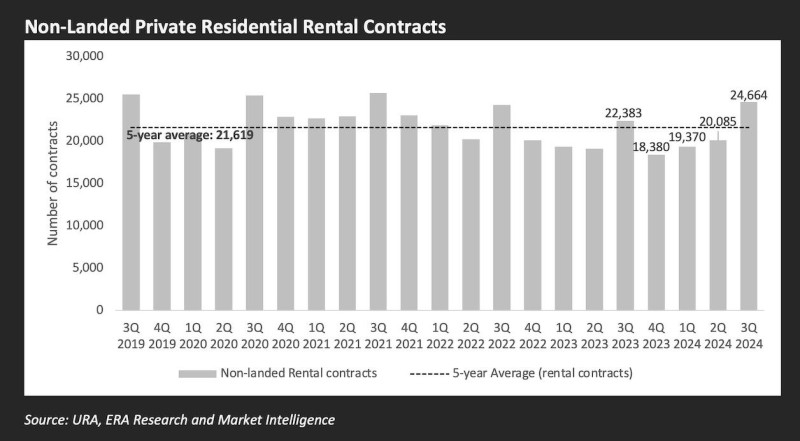

Rental contract volumes rose significantly in 3Q2024, reflecting an increase in tenant activity. URA data reveals that contracts for non-landed private homes surged by 22.8% q-o-q and by 10.2% y-o-y, while landed property rental contracts saw a 45.9% q-o-q increase in 3Q2024.

Read also: Penthouse at Parc Palais sold for $2.9 mil profit

Advertisement

Advertisement

Rents in the Outside Central Region (OCR) rose 2.2% q-o-q, while rents in the Rest of the Central Region (RCR) were up 1.7% q-o-q. Meanwhile, rents in the Core Central Region (CCR) declined 1.6% q-o-q last quarter.

Savills Research found that overall rents of one- to three-bedroom units in the CCR fell by 1.5% q-o-q in 3Q2024. However, they rose 1% in the RCR and 0.3% in the OCR over the quarter. The average increase for one- to three-bedroom units was 0.1% q-o-q, according to Savills Research in its Nov 14 report.

Rental contract volumes rose significantly in 3Q2024, reflecting an increase in tenant activity. URA data reveals that contracts for non-landed private homes surged by 22.8% q-o-q and by 10.2% y-o-y, while landed property rental contracts saw a 45.9% q-o-q increase in 3Q2024.

Read also: Penthouse at Parc Palais sold for $2.9 mil profit

Advertisement

Advertisement

Rents in the Outside Central Region (OCR) rose 2.2% q-o-q, while rents in the Rest of the Central Region (RCR) were up 1.7% q-o-q. Meanwhile, rents in the Core Central Region (CCR) declined 1.6% q-o-q last quarter.

Savills Research found that overall rents of one- to three-bedroom units in the CCR fell by 1.5% q-o-q in 3Q2024. However, they rose 1% in the RCR and 0.3% in the OCR over the quarter. The average increase for one- to three-bedroom units was 0.1% q-o-q, according to Savills Research in its Nov 14 report.

"The market for three-bedroom apartments continues to see stable demand as they appeal to expatriates with families, particularly in well-connected and sought-after locations," says George Tan, managing director of Livethere Residential, Savills Singapore. "However, global economic uncertainty and lower rental budget may put some pressure on the positive but competitive leasing activity, thereby keeping the rental growth in check."

The rise in rental demand in 3Q2024 coincided with high vacancy rates in the CCR, which rose to 11.2%. ERA's Wong attributes the high vacancy to the completion of significant developments in the CCR, such as the 296-unit One Holland Village Residences and the 376-unit The Avenir at River Valley Close, bringing the total to about 1,000 units.

The RCR saw around 1,400 new units added from projects like the 774-unit One Pearl Bank and the 429-unit The Reef at King's Dock. The vacancy rate in the RCR stood at 8.1% in 3Q2024. Meanwhile, OCR vacancy held steady at 4.9%.

"The market for three-bedroom apartments continues to see stable demand as they appeal to expatriates with families, particularly in well-connected and sought-after locations," says George Tan, managing director of Livethere Residential, Savills Singapore. "However, global economic uncertainty and lower rental budget may put some pressure on the positive but competitive leasing activity, thereby keeping the rental growth in check."

The rise in rental demand in 3Q2024 coincided with high vacancy rates in the CCR, which rose to 11.2%. ERA's Wong attributes the high vacancy to the completion of significant developments in the CCR, such as the 296-unit One Holland Village Residences and the 376-unit The Avenir at River Valley Close, bringing the total to about 1,000 units.

The RCR saw around 1,400 new units added from projects like the 774-unit One Pearl Bank and the 429-unit The Reef at King's Dock. The vacancy rate in the RCR stood at 8.1% in 3Q2024. Meanwhile, OCR vacancy held steady at 4.9%.

Looking ahead, ERA anticipates that both the RCR and OCR will see increased completions in 4Q2024. With most units intended for owner-occupation, this will result in a marginal uptick in rents in these regions. New completions in the CCR are expected to drive up competition for tenants among landlords, thus placing downward pressure on rental rates.

Read also: Is it a Good Deal?: $1.03 million for a four-room HDB flat in District 10

Advertisement

Advertisement

"We believe that the overhang in supply arising from the 19,376 units that were completed in 2023 have been cleared out of the system," comments Alan Cheong, executive director of research & consultancy at Savills Singapore. "The completion numbers in 2Q2024 were also low, at 1,882 units, further helping to ease the indigestion from the 2023 supply. For 2024, about 9,100 units could be completed, and this rapid climbdown in new supply is probably the main reason for the turnaround in rents."

Although rents have turned the corner, Savills believes that several factors will cap the upside, chief among them being the expected 3,000 or more new unit completions per quarter. "This will increase the competition level for potential tenants," reckons Cheong. "Inflationary pressures are also driving up conservancy charges, giving landlords another reason not to give in to lowball rental offers."

ERA forecasts that private rental rates will ease by 1.3% y-o-y, with total rental contracts expected to range between 80,000 and 90,000 by the end of 2024.

Looking ahead, ERA anticipates that both the RCR and OCR will see increased completions in 4Q2024. With most units intended for owner-occupation, this will result in a marginal uptick in rents in these regions. New completions in the CCR are expected to drive up competition for tenants among landlords, thus placing downward pressure on rental rates.

Read also: Is it a Good Deal?: $1.03 million for a four-room HDB flat in District 10

Advertisement

Advertisement

"We believe that the overhang in supply arising from the 19,376 units that were completed in 2023 have been cleared out of the system," comments Alan Cheong, executive director of research & consultancy at Savills Singapore. "The completion numbers in 2Q2024 were also low, at 1,882 units, further helping to ease the indigestion from the 2023 supply. For 2024, about 9,100 units could be completed, and this rapid climbdown in new supply is probably the main reason for the turnaround in rents."

Although rents have turned the corner, Savills believes that several factors will cap the upside, chief among them being the expected 3,000 or more new unit completions per quarter. "This will increase the competition level for potential tenants," reckons Cheong. "Inflationary pressures are also driving up conservancy charges, giving landlords another reason not to give in to lowball rental offers."

ERA forecasts that private rental rates will ease by 1.3% y-o-y, with total rental contracts expected to range between 80,000 and 90,000 by the end of 2024.

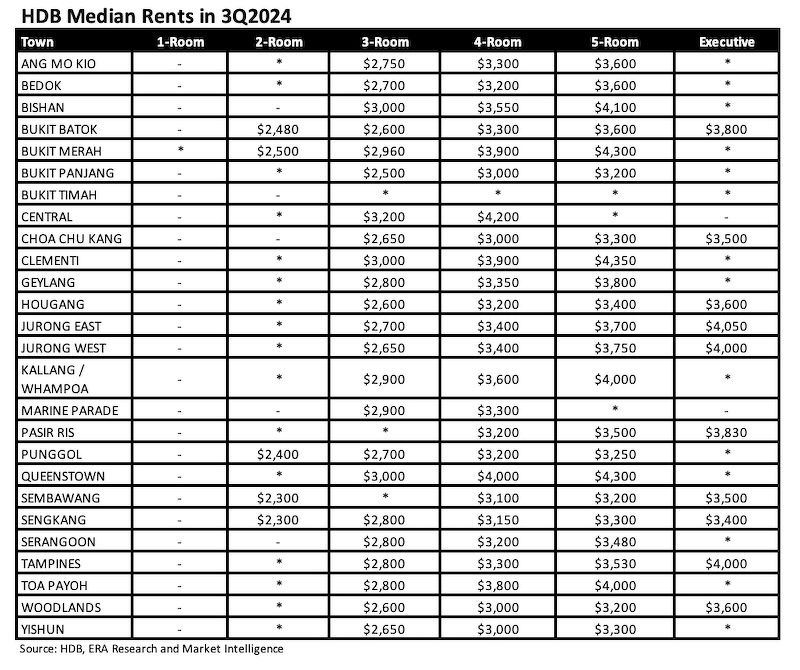

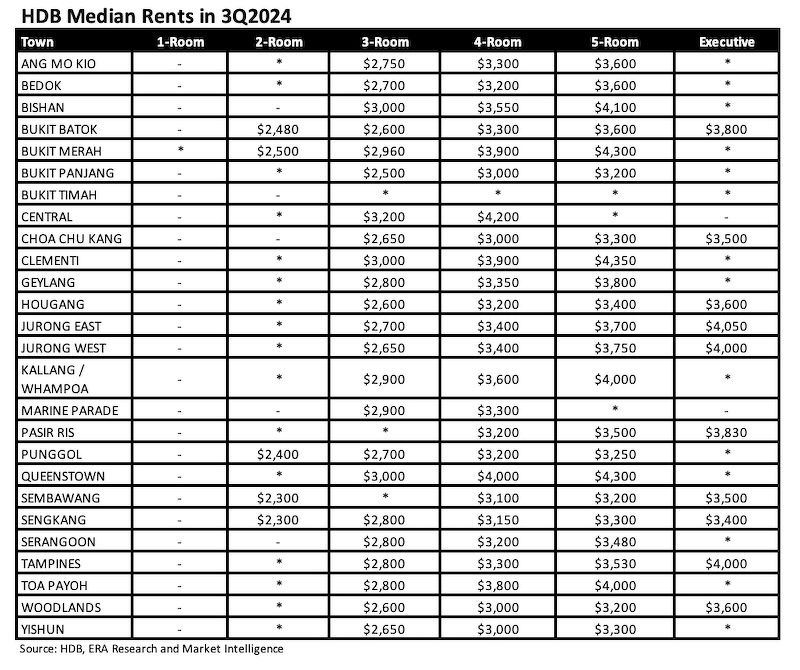

In the HDB segment, median rents increased across all flat types in 3Q2024, rising between 0.1% and 4.5% q-o-q. Among the HDB towns, Jurong West reported the fastest rental growth, with rents rising q-o-q across most flat types – from three-room to executive units.

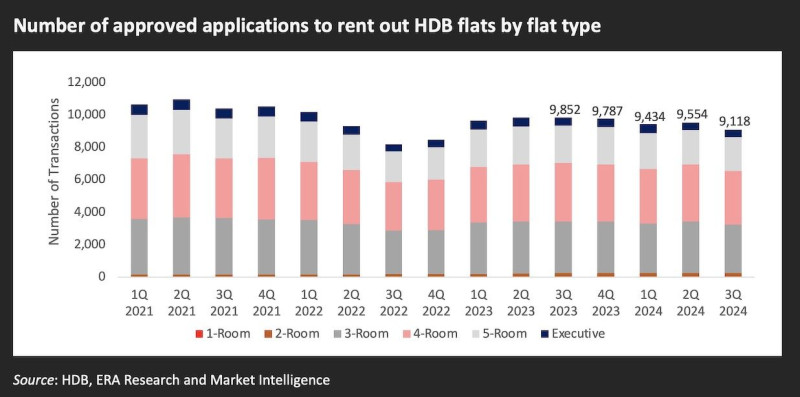

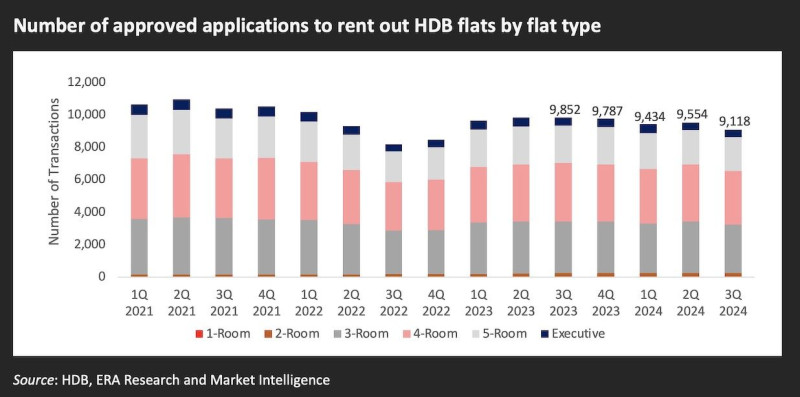

HDB rental rates are expected to increase due to the tight supply of HDB flats that have reached their five-year minimum occupation period (MOP). Around 12,000 flats will reach their MOP by the end of 2024, with only 7,000 to do so next year. Hence, ERA is projecting a 5% to 10% y-o-y rise in HDB rental rates across all flat types, based on HDB rental approvals estimated to reach 36,000 and 38,000 contracts by the end of 2024.

In the HDB segment, median rents increased across all flat types in 3Q2024, rising between 0.1% and 4.5% q-o-q. Among the HDB towns, Jurong West reported the fastest rental growth, with rents rising q-o-q across most flat types – from three-room to executive units.

HDB rental rates are expected to increase due to the tight supply of HDB flats that have reached their five-year minimum occupation period (MOP). Around 12,000 flats will reach their MOP by the end of 2024, with only 7,000 to do so next year. Hence, ERA is projecting a 5% to 10% y-o-y rise in HDB rental rates across all flat types, based on HDB rental approvals estimated to reach 36,000 and 38,000 contracts by the end of 2024.

Check out the latest listings for Rental, HDB, Condominium properties

Check out the latest listings for Rental, HDB, Condominium properties

Ask Buddy

Past Condo rental transactions

Compare price trend of Condo new sale vs EC new sale

Past HDB rental transactions

Compare price trend of HDB vs Condo vs Landed

Past HDB sale transactions

Past Condo rental transactions

Compare price trend of Condo new sale vs EC new sale

Past HDB rental transactions

Compare price trend of HDB vs Condo vs Landed

Past HDB sale transactions

Ask Buddy

Past Condo rental transactions

Compare price trend of Condo new sale vs EC new sale

Past HDB rental transactions

Compare price trend of HDB vs Condo vs Landed

Past HDB sale transactions

Past Condo rental transactions

Compare price trend of Condo new sale vs EC new sale

Past HDB rental transactions

Compare price trend of HDB vs Condo vs Landed

Past HDB sale transactions

Rental contract volumes rose significantly in 3Q2024, reflecting an increase in tenant activity. URA data reveals that contracts for non-landed private homes surged by 22.8% q-o-q and by 10.2% y-o-y, while landed property rental contracts saw a 45.9% q-o-q increase in 3Q2024.

Read also: Penthouse at Parc Palais sold for $2.9 mil profit

Advertisement

Advertisement

Rents in the Outside Central Region (OCR) rose 2.2% q-o-q, while rents in the Rest of the Central Region (RCR) were up 1.7% q-o-q. Meanwhile, rents in the Core Central Region (CCR) declined 1.6% q-o-q last quarter.

Savills Research found that overall rents of one- to three-bedroom units in the CCR fell by 1.5% q-o-q in 3Q2024. However, they rose 1% in the RCR and 0.3% in the OCR over the quarter. The average increase for one- to three-bedroom units was 0.1% q-o-q, according to Savills Research in its Nov 14 report.

Rental contract volumes rose significantly in 3Q2024, reflecting an increase in tenant activity. URA data reveals that contracts for non-landed private homes surged by 22.8% q-o-q and by 10.2% y-o-y, while landed property rental contracts saw a 45.9% q-o-q increase in 3Q2024.

Read also: Penthouse at Parc Palais sold for $2.9 mil profit

Advertisement

Advertisement

Rents in the Outside Central Region (OCR) rose 2.2% q-o-q, while rents in the Rest of the Central Region (RCR) were up 1.7% q-o-q. Meanwhile, rents in the Core Central Region (CCR) declined 1.6% q-o-q last quarter.

Savills Research found that overall rents of one- to three-bedroom units in the CCR fell by 1.5% q-o-q in 3Q2024. However, they rose 1% in the RCR and 0.3% in the OCR over the quarter. The average increase for one- to three-bedroom units was 0.1% q-o-q, according to Savills Research in its Nov 14 report.

"The market for three-bedroom apartments continues to see stable demand as they appeal to expatriates with families, particularly in well-connected and sought-after locations," says George Tan, managing director of Livethere Residential, Savills Singapore. "However, global economic uncertainty and lower rental budget may put some pressure on the positive but competitive leasing activity, thereby keeping the rental growth in check."

The rise in rental demand in 3Q2024 coincided with high vacancy rates in the CCR, which rose to 11.2%. ERA's Wong attributes the high vacancy to the completion of significant developments in the CCR, such as the 296-unit One Holland Village Residences and the 376-unit The Avenir at River Valley Close, bringing the total to about 1,000 units.

The RCR saw around 1,400 new units added from projects like the 774-unit One Pearl Bank and the 429-unit The Reef at King's Dock. The vacancy rate in the RCR stood at 8.1% in 3Q2024. Meanwhile, OCR vacancy held steady at 4.9%.

"The market for three-bedroom apartments continues to see stable demand as they appeal to expatriates with families, particularly in well-connected and sought-after locations," says George Tan, managing director of Livethere Residential, Savills Singapore. "However, global economic uncertainty and lower rental budget may put some pressure on the positive but competitive leasing activity, thereby keeping the rental growth in check."

The rise in rental demand in 3Q2024 coincided with high vacancy rates in the CCR, which rose to 11.2%. ERA's Wong attributes the high vacancy to the completion of significant developments in the CCR, such as the 296-unit One Holland Village Residences and the 376-unit The Avenir at River Valley Close, bringing the total to about 1,000 units.

The RCR saw around 1,400 new units added from projects like the 774-unit One Pearl Bank and the 429-unit The Reef at King's Dock. The vacancy rate in the RCR stood at 8.1% in 3Q2024. Meanwhile, OCR vacancy held steady at 4.9%.

Looking ahead, ERA anticipates that both the RCR and OCR will see increased completions in 4Q2024. With most units intended for owner-occupation, this will result in a marginal uptick in rents in these regions. New completions in the CCR are expected to drive up competition for tenants among landlords, thus placing downward pressure on rental rates.

Read also: Is it a Good Deal?: $1.03 million for a four-room HDB flat in District 10

Advertisement

Advertisement

"We believe that the overhang in supply arising from the 19,376 units that were completed in 2023 have been cleared out of the system," comments Alan Cheong, executive director of research & consultancy at Savills Singapore. "The completion numbers in 2Q2024 were also low, at 1,882 units, further helping to ease the indigestion from the 2023 supply. For 2024, about 9,100 units could be completed, and this rapid climbdown in new supply is probably the main reason for the turnaround in rents."

Although rents have turned the corner, Savills believes that several factors will cap the upside, chief among them being the expected 3,000 or more new unit completions per quarter. "This will increase the competition level for potential tenants," reckons Cheong. "Inflationary pressures are also driving up conservancy charges, giving landlords another reason not to give in to lowball rental offers."

ERA forecasts that private rental rates will ease by 1.3% y-o-y, with total rental contracts expected to range between 80,000 and 90,000 by the end of 2024.

Looking ahead, ERA anticipates that both the RCR and OCR will see increased completions in 4Q2024. With most units intended for owner-occupation, this will result in a marginal uptick in rents in these regions. New completions in the CCR are expected to drive up competition for tenants among landlords, thus placing downward pressure on rental rates.

Read also: Is it a Good Deal?: $1.03 million for a four-room HDB flat in District 10

Advertisement

Advertisement

"We believe that the overhang in supply arising from the 19,376 units that were completed in 2023 have been cleared out of the system," comments Alan Cheong, executive director of research & consultancy at Savills Singapore. "The completion numbers in 2Q2024 were also low, at 1,882 units, further helping to ease the indigestion from the 2023 supply. For 2024, about 9,100 units could be completed, and this rapid climbdown in new supply is probably the main reason for the turnaround in rents."

Although rents have turned the corner, Savills believes that several factors will cap the upside, chief among them being the expected 3,000 or more new unit completions per quarter. "This will increase the competition level for potential tenants," reckons Cheong. "Inflationary pressures are also driving up conservancy charges, giving landlords another reason not to give in to lowball rental offers."

ERA forecasts that private rental rates will ease by 1.3% y-o-y, with total rental contracts expected to range between 80,000 and 90,000 by the end of 2024.

In the HDB segment, median rents increased across all flat types in 3Q2024, rising between 0.1% and 4.5% q-o-q. Among the HDB towns, Jurong West reported the fastest rental growth, with rents rising q-o-q across most flat types – from three-room to executive units.

HDB rental rates are expected to increase due to the tight supply of HDB flats that have reached their five-year minimum occupation period (MOP). Around 12,000 flats will reach their MOP by the end of 2024, with only 7,000 to do so next year. Hence, ERA is projecting a 5% to 10% y-o-y rise in HDB rental rates across all flat types, based on HDB rental approvals estimated to reach 36,000 and 38,000 contracts by the end of 2024.

In the HDB segment, median rents increased across all flat types in 3Q2024, rising between 0.1% and 4.5% q-o-q. Among the HDB towns, Jurong West reported the fastest rental growth, with rents rising q-o-q across most flat types – from three-room to executive units.

HDB rental rates are expected to increase due to the tight supply of HDB flats that have reached their five-year minimum occupation period (MOP). Around 12,000 flats will reach their MOP by the end of 2024, with only 7,000 to do so next year. Hence, ERA is projecting a 5% to 10% y-o-y rise in HDB rental rates across all flat types, based on HDB rental approvals estimated to reach 36,000 and 38,000 contracts by the end of 2024.

Check out the latest listings for Rental, HDB, Condominium properties

Check out the latest listings for Rental, HDB, Condominium properties

Ask Buddy

Past Condo rental transactions

Compare price trend of Condo new sale vs EC new sale

Past HDB rental transactions

Compare price trend of HDB vs Condo vs Landed

Past HDB sale transactions

Past Condo rental transactions

Compare price trend of Condo new sale vs EC new sale

Past HDB rental transactions

Compare price trend of HDB vs Condo vs Landed

Past HDB sale transactions

Ask Buddy

Past Condo rental transactions

Compare price trend of Condo new sale vs EC new sale

Past HDB rental transactions

Compare price trend of HDB vs Condo vs Landed

Past HDB sale transactions

Past Condo rental transactions

Compare price trend of Condo new sale vs EC new sale

Past HDB rental transactions

Compare price trend of HDB vs Condo vs Landed

Past HDB sale transactions