Shophouse transactions lower in 3Q2024, but uncaveated deals show demand: Huttons Asia

SINGAPORE (EDGEPROP) - Interest in the shophouse market remained robust in 3Q2024 despite a decline in caveated transactions, according to Huttons Asia’s latest quarterly shophouse market report published on Nov 12.

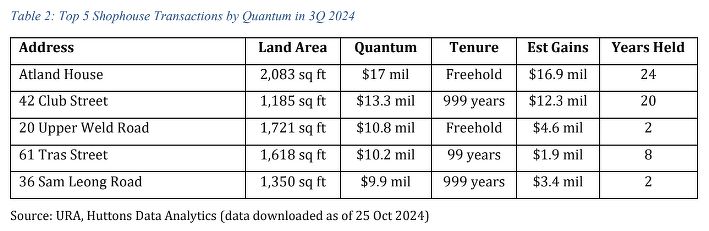

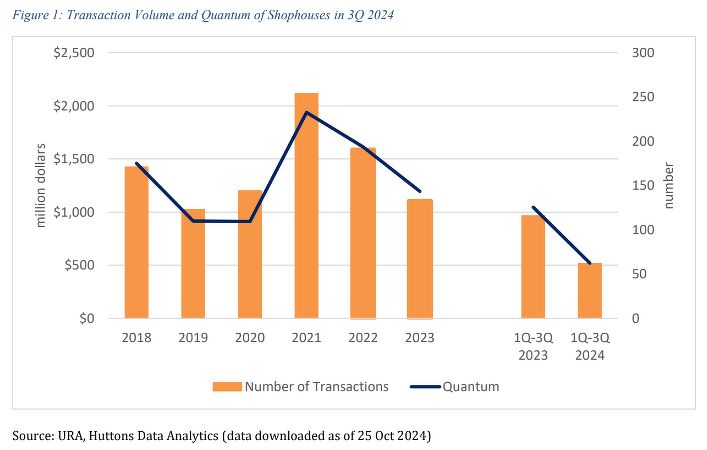

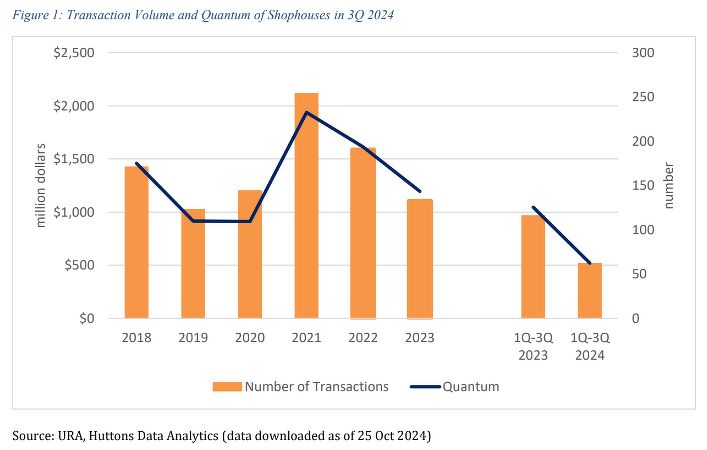

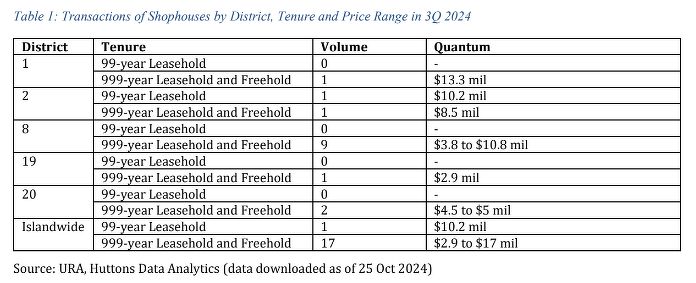

Eighteen caveats were lodged for shophouse transactions in 3Q2024, lower than the 21 caveated deals in 2Q2024. The total transacted quantum of the caveated shophouses was $138.9 million in 3Q2024, 28.8% lower than the previous quarter’s $195.1 million. On a y-o-y basis, this is half of 3Q2023’s transacted quantum of $278.6 million.

For the first nine months of 2024, caveats show that 62 shophouses were sold, which is 46.1% lower y-o-y than the caveated shophouse transactions during the same period last year. The total value of transactions for the first three quarters of 2024 is $519 million, 48.5% lower than the same period in 2023.

Read also: Indon tycoon Bachtiar Karim's family office Invictus Developments buys lyf Ginza Tokyo for $93 mil

Advertisement

Advertisement

For the first nine months of 2024, caveats show that 62 shophouses were sold, which is 46.1% lower y-o-y than the caveated shophouse transactions during the same period last year. The total value of transactions for the first three quarters of 2024 is $519 million, 48.5% lower than the same period in 2023.

Read also: Indon tycoon Bachtiar Karim's family office Invictus Developments buys lyf Ginza Tokyo for $93 mil

Advertisement

Advertisement

Despite the decline in transaction figures, Huttons’ report notes that a number of shophouse deals in 3Q2024 were not caveated. “According to market sources, several shophouses along Amoy Street, Neil Road and Telok Ayer Street in Districts 1 and 2 were reportedly sold,” says Lee Sze Teck, senior director of data analytics at Huttons Asia. The estimated quantum for these shophouses exceeds $70 million, he adds.

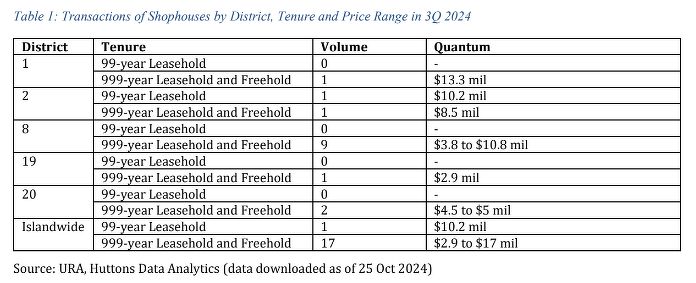

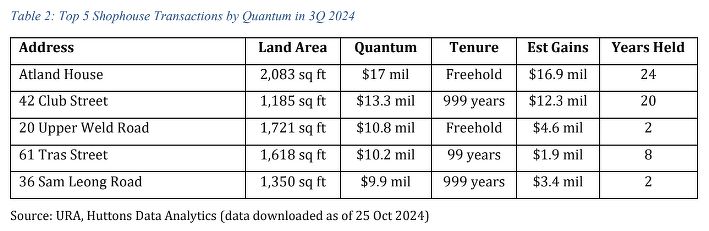

The deals are indicative of the demand for shophouses, which has picked up in the past few months, Lee says. “Investors are attracted to this market segment due to its scarcity and potential strong capital gains. With the interest rate cuts in the last couple of months, shophouses are getting popular as a wealth creation and preservation asset.” He also believes shophouse transaction volume and quantum may rise in 4Q2024.

Despite the decline in transaction figures, Huttons’ report notes that a number of shophouse deals in 3Q2024 were not caveated. “According to market sources, several shophouses along Amoy Street, Neil Road and Telok Ayer Street in Districts 1 and 2 were reportedly sold,” says Lee Sze Teck, senior director of data analytics at Huttons Asia. The estimated quantum for these shophouses exceeds $70 million, he adds.

The deals are indicative of the demand for shophouses, which has picked up in the past few months, Lee says. “Investors are attracted to this market segment due to its scarcity and potential strong capital gains. With the interest rate cuts in the last couple of months, shophouses are getting popular as a wealth creation and preservation asset.” He also believes shophouse transaction volume and quantum may rise in 4Q2024.

For the first nine months of 2024, caveats show that 62 shophouses were sold, which is 46.1% lower y-o-y than the caveated shophouse transactions during the same period last year. The total value of transactions for the first three quarters of 2024 is $519 million, 48.5% lower than the same period in 2023.

Read also: Indon tycoon Bachtiar Karim's family office Invictus Developments buys lyf Ginza Tokyo for $93 mil

Advertisement

Advertisement

For the first nine months of 2024, caveats show that 62 shophouses were sold, which is 46.1% lower y-o-y than the caveated shophouse transactions during the same period last year. The total value of transactions for the first three quarters of 2024 is $519 million, 48.5% lower than the same period in 2023.

Read also: Indon tycoon Bachtiar Karim's family office Invictus Developments buys lyf Ginza Tokyo for $93 mil

Advertisement

Advertisement

Despite the decline in transaction figures, Huttons’ report notes that a number of shophouse deals in 3Q2024 were not caveated. “According to market sources, several shophouses along Amoy Street, Neil Road and Telok Ayer Street in Districts 1 and 2 were reportedly sold,” says Lee Sze Teck, senior director of data analytics at Huttons Asia. The estimated quantum for these shophouses exceeds $70 million, he adds.

The deals are indicative of the demand for shophouses, which has picked up in the past few months, Lee says. “Investors are attracted to this market segment due to its scarcity and potential strong capital gains. With the interest rate cuts in the last couple of months, shophouses are getting popular as a wealth creation and preservation asset.” He also believes shophouse transaction volume and quantum may rise in 4Q2024.

Despite the decline in transaction figures, Huttons’ report notes that a number of shophouse deals in 3Q2024 were not caveated. “According to market sources, several shophouses along Amoy Street, Neil Road and Telok Ayer Street in Districts 1 and 2 were reportedly sold,” says Lee Sze Teck, senior director of data analytics at Huttons Asia. The estimated quantum for these shophouses exceeds $70 million, he adds.

The deals are indicative of the demand for shophouses, which has picked up in the past few months, Lee says. “Investors are attracted to this market segment due to its scarcity and potential strong capital gains. With the interest rate cuts in the last couple of months, shophouses are getting popular as a wealth creation and preservation asset.” He also believes shophouse transaction volume and quantum may rise in 4Q2024.