Private residential resale prices hold steady in 3Q2024

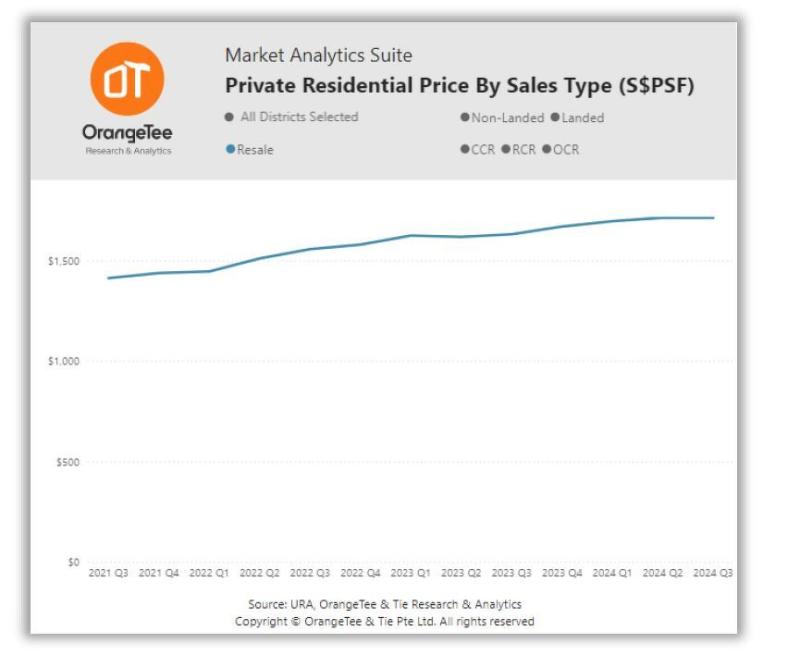

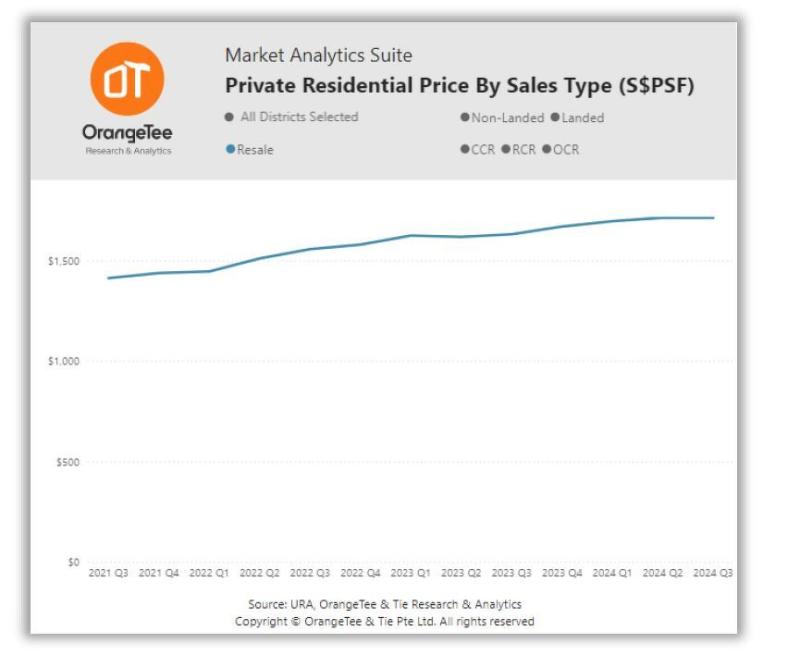

Private resale home prices held steady in 3Q2024 despite the prevailing high-interest rate environment, according to a report by OrangeTee Research & Analytics.

URA records show that the average resale prices for landed and non-landed private residential homes, excluding executive condos (ECs), remained unchanged at $1,713 psf from 2Q2024 to 3Q2024.

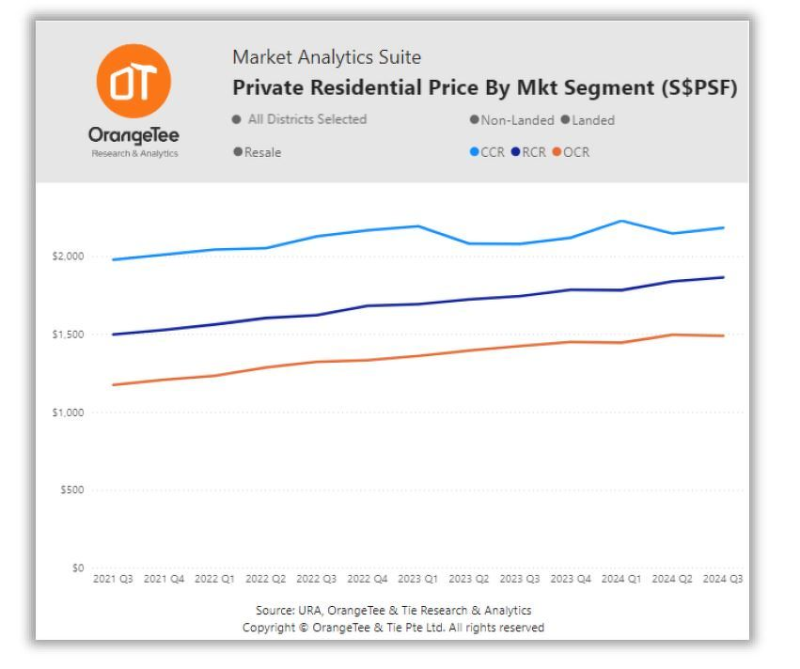

However, average resale prices within the Core Central Region (CCR), Rest of Central Region (RCR) and Outside of Central Region (OCR) saw some fluctuation.

Read also: OrangeTee to offer its agents access to JustCo co-working spaces

Advertisement

Advertisement

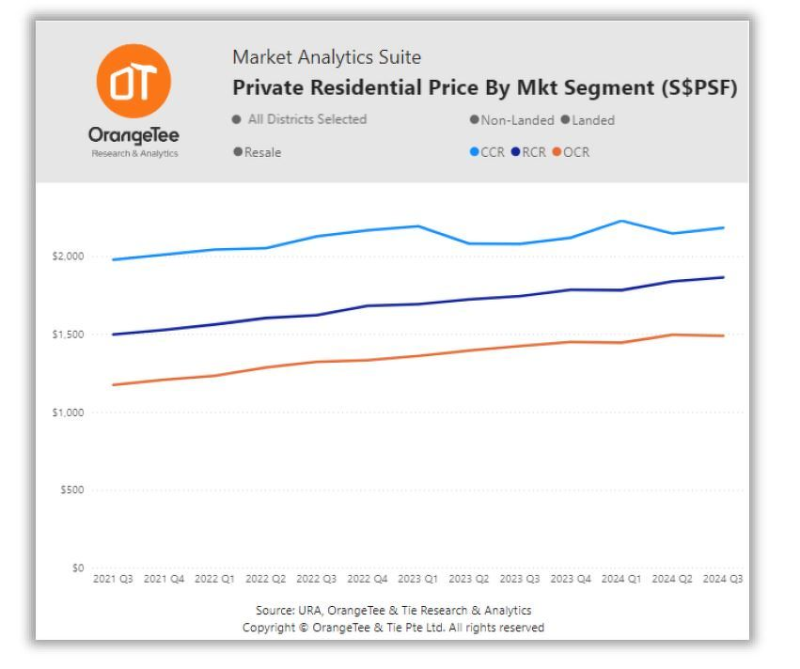

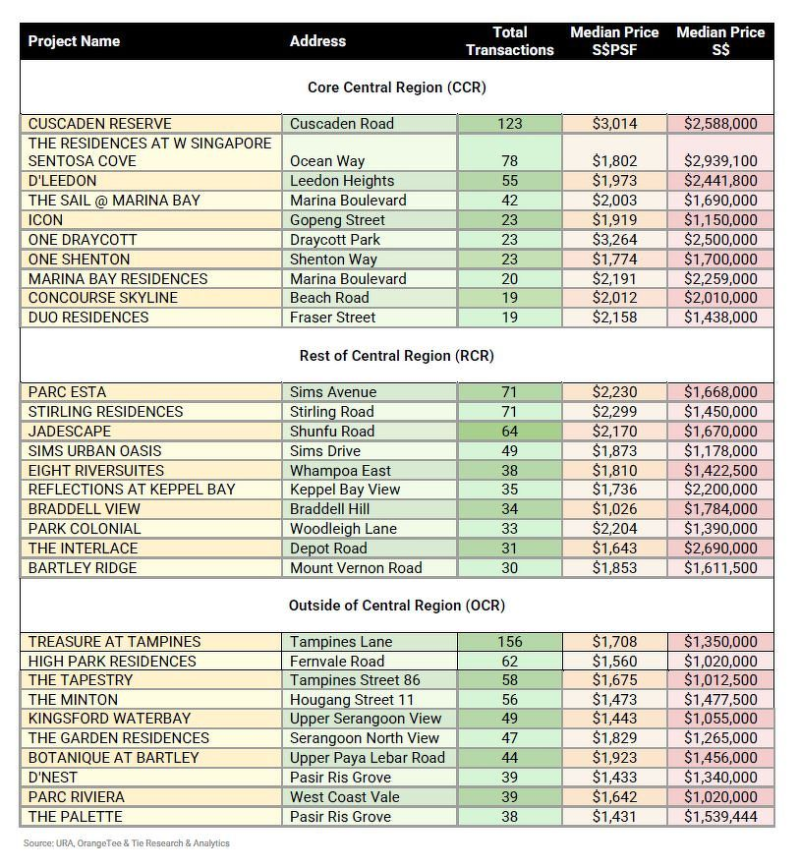

Average resale prices in the CCR recorded a 1.6% increase from $2,145 psf in 2Q2024 to $2,181 psf in 3Q2024. This partially reverses the 3.6% q-o-q price drop recorded from 1Q2024 to 2Q2024.

Prices in the RCR also increased, growing 1.4% from $1,837 psf to $1,863 psf during the same period. This is a moderation from the 3.1% q-o-q price growth seen the previous quarter.

Conversely, the average price of private residential resale homes in the OCR dropped by 0.4% from $1,495 psf to $1,489 psf in 3Q2024, marking a turnabout from the 3.5% growth in resale prices seen in 2Q2024.

However, average resale prices within the Core Central Region (CCR), Rest of Central Region (RCR) and Outside of Central Region (OCR) saw some fluctuation.

Read also: OrangeTee to offer its agents access to JustCo co-working spaces

Advertisement

Advertisement

Average resale prices in the CCR recorded a 1.6% increase from $2,145 psf in 2Q2024 to $2,181 psf in 3Q2024. This partially reverses the 3.6% q-o-q price drop recorded from 1Q2024 to 2Q2024.

Prices in the RCR also increased, growing 1.4% from $1,837 psf to $1,863 psf during the same period. This is a moderation from the 3.1% q-o-q price growth seen the previous quarter.

Conversely, the average price of private residential resale homes in the OCR dropped by 0.4% from $1,495 psf to $1,489 psf in 3Q2024, marking a turnabout from the 3.5% growth in resale prices seen in 2Q2024.

The report notes that “the robust demand for resale homes could be attributed to a substantial increase in housing supply”. Close to 30,000 private homes were completed over the past two years. As the available supply expands, it “broadens the spectrum of housing options for prospective purchasers”.

Furthermore, buyers may look towards the secondary market for lower-cost private housing as new private home prices continue to remain high.

Norwood Grand, a recently launched condo in the OCR, has sold 293 units at an average price of $2,086 psf since its launch in October. This marks a 39.5% premium over the average price of $1,495 psf in the region. Likewise, recently launched RCR project Meyer Blue sold 122 units at an average price of $3,252 psf the same month — 74.5% higher than the average price of resale units in the RCR.

The report notes that “the robust demand for resale homes could be attributed to a substantial increase in housing supply”. Close to 30,000 private homes were completed over the past two years. As the available supply expands, it “broadens the spectrum of housing options for prospective purchasers”.

Furthermore, buyers may look towards the secondary market for lower-cost private housing as new private home prices continue to remain high.

Norwood Grand, a recently launched condo in the OCR, has sold 293 units at an average price of $2,086 psf since its launch in October. This marks a 39.5% premium over the average price of $1,495 psf in the region. Likewise, recently launched RCR project Meyer Blue sold 122 units at an average price of $3,252 psf the same month — 74.5% higher than the average price of resale units in the RCR.

However, average resale prices within the Core Central Region (CCR), Rest of Central Region (RCR) and Outside of Central Region (OCR) saw some fluctuation.

Read also: OrangeTee to offer its agents access to JustCo co-working spaces

Advertisement

Advertisement

Average resale prices in the CCR recorded a 1.6% increase from $2,145 psf in 2Q2024 to $2,181 psf in 3Q2024. This partially reverses the 3.6% q-o-q price drop recorded from 1Q2024 to 2Q2024.

Prices in the RCR also increased, growing 1.4% from $1,837 psf to $1,863 psf during the same period. This is a moderation from the 3.1% q-o-q price growth seen the previous quarter.

Conversely, the average price of private residential resale homes in the OCR dropped by 0.4% from $1,495 psf to $1,489 psf in 3Q2024, marking a turnabout from the 3.5% growth in resale prices seen in 2Q2024.

However, average resale prices within the Core Central Region (CCR), Rest of Central Region (RCR) and Outside of Central Region (OCR) saw some fluctuation.

Read also: OrangeTee to offer its agents access to JustCo co-working spaces

Advertisement

Advertisement

Average resale prices in the CCR recorded a 1.6% increase from $2,145 psf in 2Q2024 to $2,181 psf in 3Q2024. This partially reverses the 3.6% q-o-q price drop recorded from 1Q2024 to 2Q2024.

Prices in the RCR also increased, growing 1.4% from $1,837 psf to $1,863 psf during the same period. This is a moderation from the 3.1% q-o-q price growth seen the previous quarter.

Conversely, the average price of private residential resale homes in the OCR dropped by 0.4% from $1,495 psf to $1,489 psf in 3Q2024, marking a turnabout from the 3.5% growth in resale prices seen in 2Q2024.

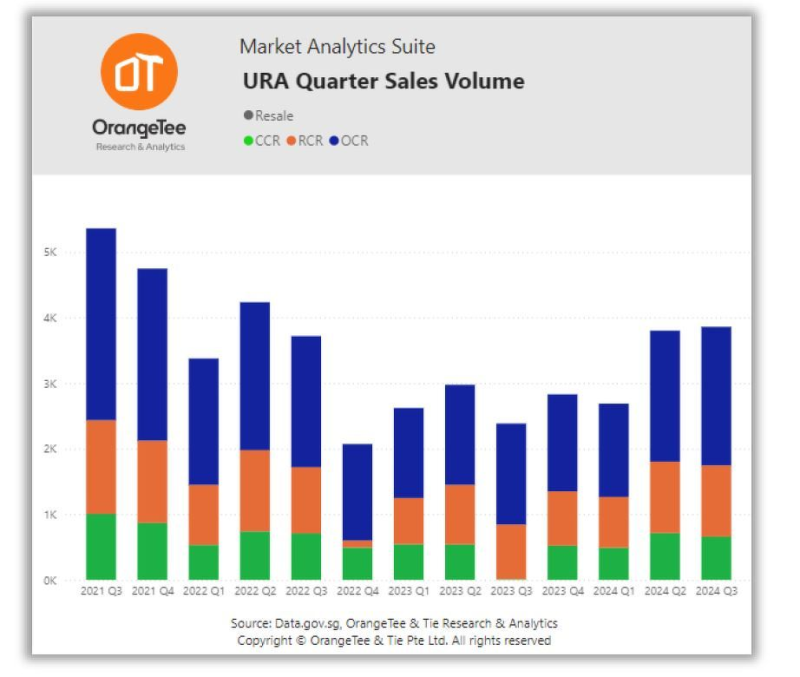

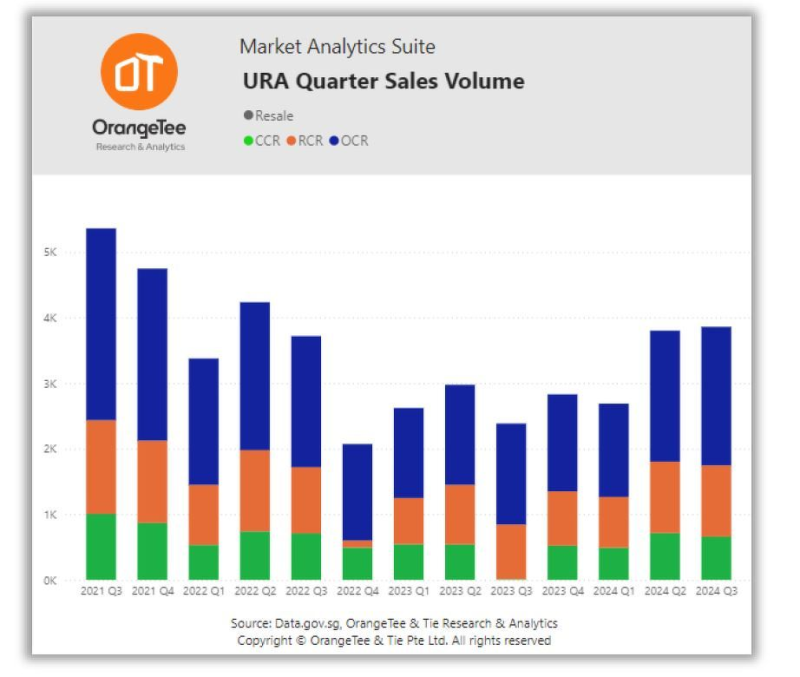

Robust demand for resale homes

In terms of volume, URA recorded 3,860 resale homes sold last quarter, marking a 1.5% q-o-q increase from the 3,802 units sold in 2Q2024. Resale transactions made up 71.9% of a total of 5,372 residential sales — including new sales, resale, and subscale — sold in 3Q2024. This marks a drop from the 77.4% in market share recorded in 2Q2024, which was the highest on record, according to OrangeTee. In the first nine months of this year, a total of 10,351 resale homes were sold, showing a 21.8% y-o-y increase from the 8,498 units transacted over the same period in 2023. Read also: Resale condo prices in the CCR climb 3.7% q-o-q in 1Q2024: OrangeTee & Tie Advertisement Advertisement The market share of resale homes saw a similar increase, growing from 57.8% of residential transactions in the first three quarters of 2023 to 71.3% of residential transactions over the same period this year. The report notes that “the robust demand for resale homes could be attributed to a substantial increase in housing supply”. Close to 30,000 private homes were completed over the past two years. As the available supply expands, it “broadens the spectrum of housing options for prospective purchasers”.

Furthermore, buyers may look towards the secondary market for lower-cost private housing as new private home prices continue to remain high.

Norwood Grand, a recently launched condo in the OCR, has sold 293 units at an average price of $2,086 psf since its launch in October. This marks a 39.5% premium over the average price of $1,495 psf in the region. Likewise, recently launched RCR project Meyer Blue sold 122 units at an average price of $3,252 psf the same month — 74.5% higher than the average price of resale units in the RCR.

The report notes that “the robust demand for resale homes could be attributed to a substantial increase in housing supply”. Close to 30,000 private homes were completed over the past two years. As the available supply expands, it “broadens the spectrum of housing options for prospective purchasers”.

Furthermore, buyers may look towards the secondary market for lower-cost private housing as new private home prices continue to remain high.

Norwood Grand, a recently launched condo in the OCR, has sold 293 units at an average price of $2,086 psf since its launch in October. This marks a 39.5% premium over the average price of $1,495 psf in the region. Likewise, recently launched RCR project Meyer Blue sold 122 units at an average price of $3,252 psf the same month — 74.5% higher than the average price of resale units in the RCR.

Interest rate cuts to spur sales

OrangeTee predicts that recent interest rate cuts by the US Federal Reserve may spur luxury home sales due to the reduced cost of borrowing. However, high-net-worth investors who are less sensitive to interest rate fluctuations are similarly less likely to base their property purchase decisions on mortgage rates. However, the report notes that buyers who may have adopted a more cautious approach due to high interest rates may be more inclined to enter the market now. Read also: OrangeTee & Tie unveils partnerships and strategic opportunities to elevate agent productivity Advertisement Advertisement OrangeTee expects resale prices to grow over the next few years due to the projected decrease in available stock. Approximately 5,300 private homes are expected to be completed in 2025, marking a significant increase from the 9,100 units that are expected to be completed this year. Therefore, OrangeTee’s forecasts positive prospects for resale homeowners barring major economic crises or unforeseen circumstances.