Retail property prices rise 1.7% q-o-q in 3Q2024

Prices of retail space in Singapore posted a 1.7% q-o-q increase in 3Q2024, reversing the 1.2% q-o-q decline seen in 2Q2024. Meanwhile, overall retail rents marginally increased by 0.3% q-o-q in 3Q2024 after recording a flat performance in the previous quarter. The latest price and rental statistics were announced by URA on Oct 25.

Retail rents in the Central Region rose by 0.3% q-o-q, making gains compared to the flat performance in 2Q2024. According to research by CBRE, demand for prime retail spaces remains robust, and island-wide prime retail rents increased by 0.7% q-o-q last quarter, extending the 1.1% q-o-q gains that were made in 2Q2024.

“Retail take-ups in Orchard are improving as tourist traffic and spending recovery,” says Wong Xian Yang, head of research, Singapore and Southeast Asia, at Cushman & Wakefield.

Read also: Freehold strata retail unit at Lucky Plaza for sale at $32 mil

Advertisement

Advertisement

He adds that the prime shopping belt saw a handful of notable store openings last quarter, including several foreign athleisure brands, drawn by the global shift towards more casual, versatile fashion and the rise of hybrid work.

American brand Columbia opened its second outlet in Singapore at Paragon. Chinese brand Anta Sports launched its ninth store at Plaza Singapura after its debut at VivoCity last year, and French brand Salomon is set to open its seventh outlet at Ngee Ann City, following its debut at Raffles City earlier this year.

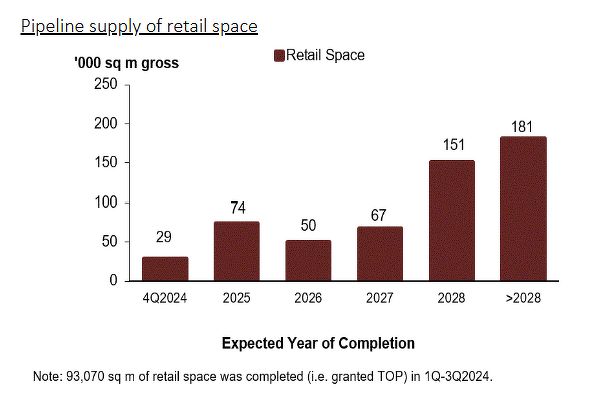

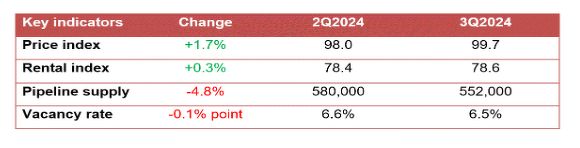

Table: URA

“While the retail market has largely benefitted from a bump in international visitor arrivals so far this year, the return of tourists has not been able to overcome the prevailing challenges of high operating costs in the retail space,” cautions Leonard Tay, head of research at Knight Frank Singapore.

“Anecdotally, CBRE Research notes that while F&B operators continue to drive demand, there has been a spate of closures in the fine dining scene recently, with casualties such as Bam! Restaurant,” says Tricia Song, head of research, Singapore and Southeast Asia, at CBRE.

She adds that beauty and health brands, such as Jungsaemmool and Kilian Paris, continue to increase their retail footprint, while other retailers, such as Sephora and 45R, have refreshed their concepts or revamped existing outlets to stay relevant to consumers.

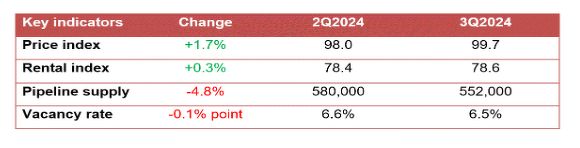

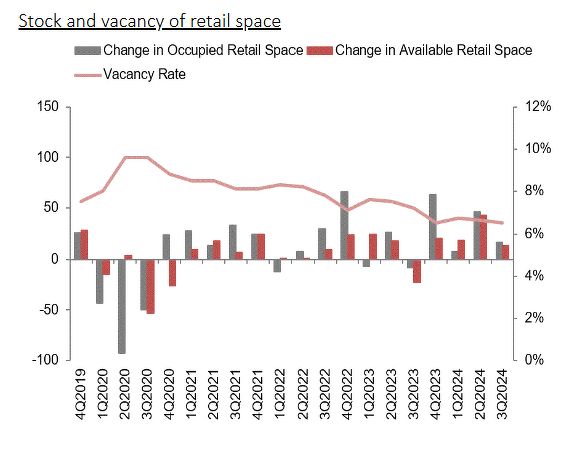

Graph: URA

The best performing region was the Outside Central Region (OCR) which saw a positive net absorption of about 65,000 sq ft, extending the strong positive net absorption of 237,000 sq ft in 2Q2024. The vacancy rate in the OCR fell to 4% in 3Q2024 compared to 4.6% in the previous quarter.

The strong take-up rate comes on the back of the full pre-commitment of recently renovated retail space at Tampines 1, which added about 9,000 sq ft of new retail space to the market when renovations were completed in September. The mall has attained 100% occupancy with 68 new-to-mall concepts.

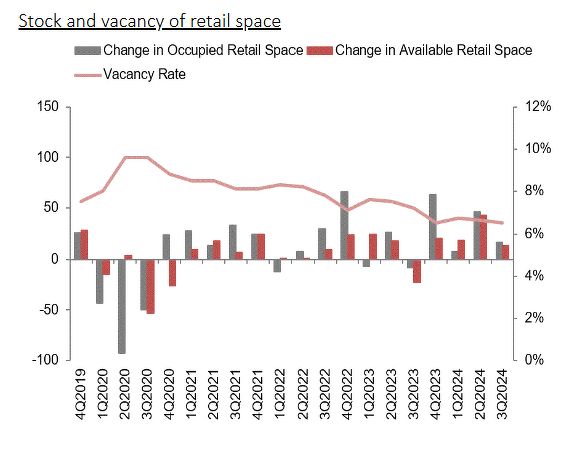

Graph: URA

Meanwhile, Tay opines that the “substantial” number of new overseas brands making their way into the Singapore retail market is creating pressure for local F&B brands. “Many homegrown F&B operators are forced to innovate or consolidate in order to keep business operations at sustainable levels, in what is a very Darwinian retail environment,” he says.

Read also: Two-tiered retail market in 2Q2024, with Central Region rents staying flat

Advertisement

Advertisement

Singapore’s retail property market is showing signs that rental growth has started to taper and flatline as the high-cost environment seems to be taking a toll on retailers. “Not all is well in the retail space despite visitor arrivals progressively normalising to pre-pandemic numbers,” cautions Tay.

Positive take-up rate extends to fourth consecutive quarter

Meanwhile, niche retailers like gaming and collectible shops have been gradually increasing their space requirements. The latest data provided by URA also indicates that there was a positive net absorption in the island-wide private retail market for the fourth consecutive quarter. Read also: Resale flat prices rise 2.5% in 3Q2024: HDB Flash Estimates Advertisement Advertisement Net demand for retail space stood at about 129,000 sq ft, extending the positive net absorption of about 388,000 sq ft in Q2 2024, based on data tabulated by CBRE. As a result, island-wide private retail vacancy rates fell from 6.6% in 2Q2024 to 6.4% in 3Q2024. The Downtown core area was the only submarket to record a negative net absorption of retail space last quarter, and vacancy rates inched up marginally from 7.4% in 2Q2024 to 7.5% last quarter.

Increased turnover among retail brands

“Singapore's retail property market remains resilient, underpinned by limited supply, steady consumer spending, tourism growth, and a tight labour market. However, retailers face pressures from rising labour and rent costs, leading to increased turnover and consolidation,” says Wong. He adds that the retail landscape in Singapore must be continuously rejuvenated with new or expanding retailers to quickly backfill some vacant spaces.