Private home prices down 0.7% q-o-q in 3Q2024 after four quarters of growth

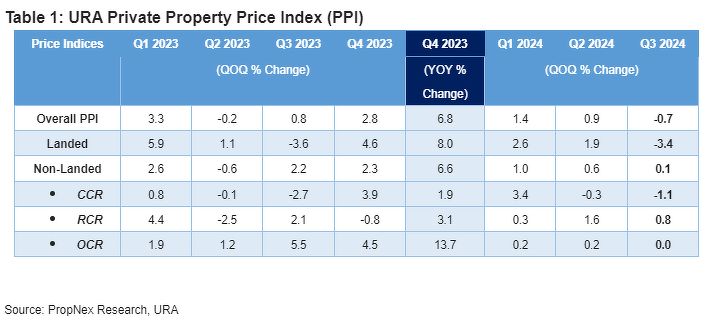

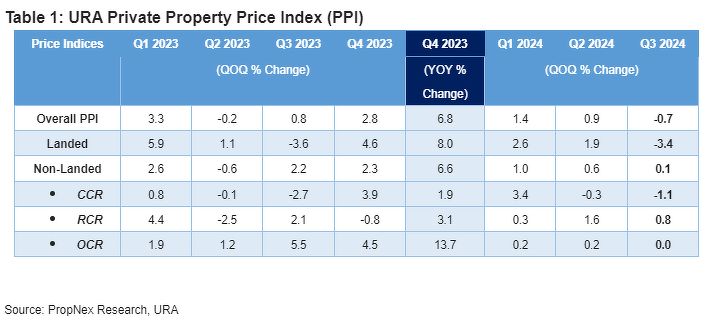

SINGAPORE (EDGEPROP) - In 3Q2024, the URA private residential price index dropped 0.7% q-o-q, a reversal from 2Q2024's 0.9% q-o-q gain. It marks the first decline in private property prices since 2Q2023 when prices eased by 0.2%.

Price correction in 3Q2024 was led by landed properties, which posted a 3.4% q-o-q fall after a 1.9% q-o-q rise the previous quarter. Price growth in the non-landed segment showed further moderation to a meagre 0.1% q-o-q increase in 3Q2024, down from 0.6% q-o-q growth in 2Q2024, says Tricia Song, CBRE head of research for Southeast Asia.

Among non-landed market segments, the Rest of Central Region (RCR) recorded price growth of 0.8% q-o-q, followed by the suburban or Outside Central Region (OCR) market where prices were unchanged. Meanwhile, the prime or Core Central Region (CCR) underperformed, recording a 1.1% decline.

Read also: Developer sales rebounds in September, rising 90.1% m-o-m

Advertisement

Advertisement

The CCR saw a lower volume of high-value transactions ($10 million and above), which Mohan Sandrasegeran, SRI head of research and data analytics, sees as "a stabilising property market".

More non-landed homes were sold at a loss in the CCR over the quarter, leading to the 1.1% price decline q-o-q, observes Lee Sze Teck, senior director of data analytics at Huttons Asia.

Aggregate price growth for the first nine months of 2024 amounted to 1.6%, a significant slowdown from the 3.9% increase in 2023 and an 8.2% leap in 2022.

However, CBRE expects a rebound in 4Q2024 on the back of better sentiment amid lower interest rates and a more optimistic economic outlook. Song expects prices to rise by 3% by the end of 2024. "Prices are unlikely to correct significantly due to resilient household balance sheets and low unsold inventory," she comments.

Among non-landed market segments, the Rest of Central Region (RCR) recorded price growth of 0.8% q-o-q, followed by the suburban or Outside Central Region (OCR) market where prices were unchanged. Meanwhile, the prime or Core Central Region (CCR) underperformed, recording a 1.1% decline.

Read also: Developer sales rebounds in September, rising 90.1% m-o-m

Advertisement

Advertisement

The CCR saw a lower volume of high-value transactions ($10 million and above), which Mohan Sandrasegeran, SRI head of research and data analytics, sees as "a stabilising property market".

More non-landed homes were sold at a loss in the CCR over the quarter, leading to the 1.1% price decline q-o-q, observes Lee Sze Teck, senior director of data analytics at Huttons Asia.

Aggregate price growth for the first nine months of 2024 amounted to 1.6%, a significant slowdown from the 3.9% increase in 2023 and an 8.2% leap in 2022.

However, CBRE expects a rebound in 4Q2024 on the back of better sentiment amid lower interest rates and a more optimistic economic outlook. Song expects prices to rise by 3% by the end of 2024. "Prices are unlikely to correct significantly due to resilient household balance sheets and low unsold inventory," she comments.

The most expensive non-landed units sold in 3Q2024 were recorded at 32 Gilstead, with three units sold for more than $14.4 million each. All three were purchased by permanent residents (PRs).

The most expensive non-landed units sold in 3Q2024 were recorded at 32 Gilstead, with three units sold for more than $14.4 million each. All three were purchased by permanent residents (PRs).

A higher proportion of HDB upgraders also entered the private resale market, notes SRI's Sandrasegeran. The number of buyers with HDB addresses increased 20.1% y-o-y in 3Q2024. "The resilience of the private resale market is a positive signal of underlying demand, particularly among buyers looking for completed homes in well-established areas," he adds.

A total of 10,351 private resale homes changed hands in the first nine months of 2024, 21.8% higher than the 8,498 units over the same period last year.

A higher proportion of HDB upgraders also entered the private resale market, notes SRI's Sandrasegeran. The number of buyers with HDB addresses increased 20.1% y-o-y in 3Q2024. "The resilience of the private resale market is a positive signal of underlying demand, particularly among buyers looking for completed homes in well-established areas," he adds.

A total of 10,351 private resale homes changed hands in the first nine months of 2024, 21.8% higher than the 8,498 units over the same period last year.

Among non-landed market segments, the Rest of Central Region (RCR) recorded price growth of 0.8% q-o-q, followed by the suburban or Outside Central Region (OCR) market where prices were unchanged. Meanwhile, the prime or Core Central Region (CCR) underperformed, recording a 1.1% decline.

Read also: Developer sales rebounds in September, rising 90.1% m-o-m

Advertisement

Advertisement

The CCR saw a lower volume of high-value transactions ($10 million and above), which Mohan Sandrasegeran, SRI head of research and data analytics, sees as "a stabilising property market".

More non-landed homes were sold at a loss in the CCR over the quarter, leading to the 1.1% price decline q-o-q, observes Lee Sze Teck, senior director of data analytics at Huttons Asia.

Aggregate price growth for the first nine months of 2024 amounted to 1.6%, a significant slowdown from the 3.9% increase in 2023 and an 8.2% leap in 2022.

However, CBRE expects a rebound in 4Q2024 on the back of better sentiment amid lower interest rates and a more optimistic economic outlook. Song expects prices to rise by 3% by the end of 2024. "Prices are unlikely to correct significantly due to resilient household balance sheets and low unsold inventory," she comments.

Among non-landed market segments, the Rest of Central Region (RCR) recorded price growth of 0.8% q-o-q, followed by the suburban or Outside Central Region (OCR) market where prices were unchanged. Meanwhile, the prime or Core Central Region (CCR) underperformed, recording a 1.1% decline.

Read also: Developer sales rebounds in September, rising 90.1% m-o-m

Advertisement

Advertisement

The CCR saw a lower volume of high-value transactions ($10 million and above), which Mohan Sandrasegeran, SRI head of research and data analytics, sees as "a stabilising property market".

More non-landed homes were sold at a loss in the CCR over the quarter, leading to the 1.1% price decline q-o-q, observes Lee Sze Teck, senior director of data analytics at Huttons Asia.

Aggregate price growth for the first nine months of 2024 amounted to 1.6%, a significant slowdown from the 3.9% increase in 2023 and an 8.2% leap in 2022.

However, CBRE expects a rebound in 4Q2024 on the back of better sentiment amid lower interest rates and a more optimistic economic outlook. Song expects prices to rise by 3% by the end of 2024. "Prices are unlikely to correct significantly due to resilient household balance sheets and low unsold inventory," she comments.

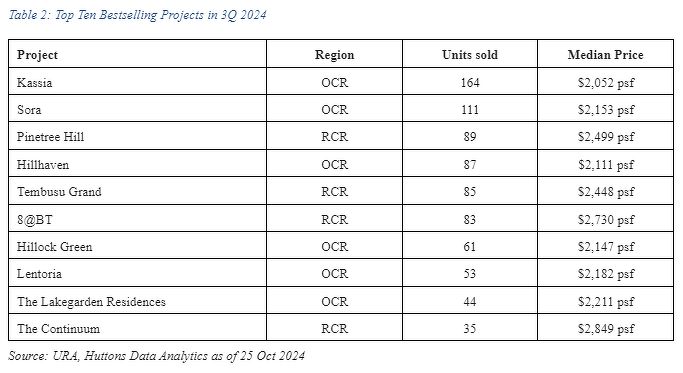

Affordability drove sales in OCR

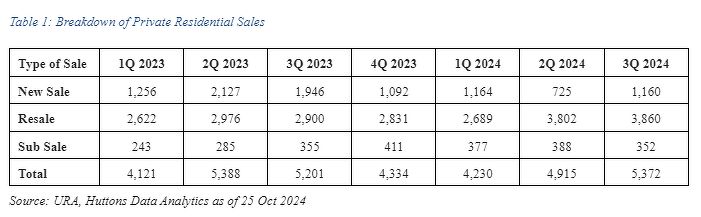

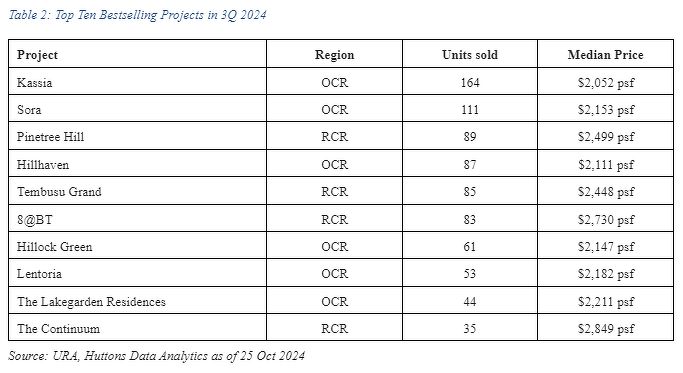

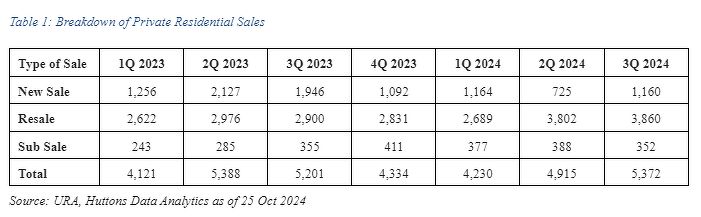

Private home transaction volume went up by 9.3% q-o-q in 3Q2024 to 5,372 units, compared to 4,915 units in the previous quarter. It is the first time in 12 months that transaction volume is above 5,000 units, remarks Lee of Huttons. Sales growth was primarily driven by increased demand for new homes last quarter, says Christine Sun, chief researcher and strategist at OrangeTee Group, notes. Developers launched 1,284 units in 3Q2024, more than double of that in 2Q2024. New home sales surged by 60% q-o-q to 1,160 units in 3Q2024 from 725 units in 2Q2024. Read also: Private home prices drop 1.1% q-o-q in 3Q2024: URA flash estimates Advertisement Advertisement The bulk of the transactions came from the Outside Central Region (OCR), which saw transaction volumes rising from 414 units in 2Q2024 to 715 units in 3Q2024. Similarly, in the secondary market, most transactions were in the Outside Central Region (OCR), accounting for 54.7% (2,113 units) of the total resale volume (3,860 units) in the 3Q2024. "Consumers may be opting for lower-value private homes for better affordability, which led to most new transactions (excluding ECs) taking place in the OCR," Sun says. "As most of such suburban properties were sold at lower prices than other market segments, the high sales volume dragged down the overall price index for the entire market." The three major private projects launched in 3Q2024 were the 440-unit Sora in Jurong Lake District, the freehold 276-unit Kassia on Flora Drive, and the 158-unit 8@BT along Bukit Timah Link. "These projects saw robust sales on their launch weekend, particularly Kassia and 8@BT, which saw a more than 50% take-up rate," notes Lee of Huttons. "This indicates strengthening buyers' sentiments in the market." The most expensive non-landed units sold in 3Q2024 were recorded at 32 Gilstead, with three units sold for more than $14.4 million each. All three were purchased by permanent residents (PRs).

The most expensive non-landed units sold in 3Q2024 were recorded at 32 Gilstead, with three units sold for more than $14.4 million each. All three were purchased by permanent residents (PRs).

HDB upgraders led private resale growth

Private resale market sales grew at a slower pace in 3Q2024, up 1.5% q-o-q to 3,860 units from 3,802 units the previous quarter. Huttons attributes the slower growth to competition from developer sales. "Some buyers switched to a new launch due to the narrowing price gap between some new launches and resale properties while others waited for lower interest rates before buying," Lee adds. Read also: S‘pore will ‘act decisively’ on more housing curbs if needed: MND Advertisement Advertisement A higher proportion of HDB upgraders also entered the private resale market, notes SRI's Sandrasegeran. The number of buyers with HDB addresses increased 20.1% y-o-y in 3Q2024. "The resilience of the private resale market is a positive signal of underlying demand, particularly among buyers looking for completed homes in well-established areas," he adds.

A total of 10,351 private resale homes changed hands in the first nine months of 2024, 21.8% higher than the 8,498 units over the same period last year.

A higher proportion of HDB upgraders also entered the private resale market, notes SRI's Sandrasegeran. The number of buyers with HDB addresses increased 20.1% y-o-y in 3Q2024. "The resilience of the private resale market is a positive signal of underlying demand, particularly among buyers looking for completed homes in well-established areas," he adds.

A total of 10,351 private resale homes changed hands in the first nine months of 2024, 21.8% higher than the 8,498 units over the same period last year.