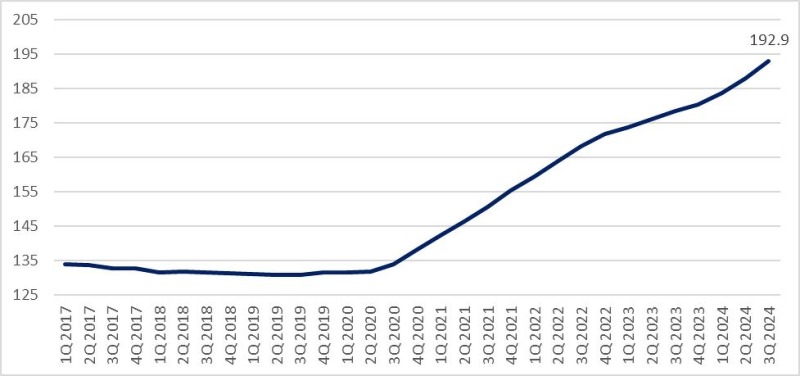

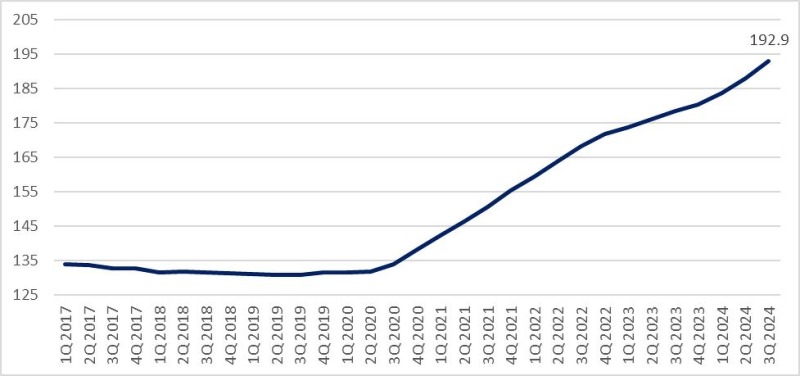

HDB resale prices rise for 18th consecutive quarter, up 2.7% q-o-q in 3Q2024

HDB resale prices rose 2.7% q-o-q in 3Q2024 for the 18th straight quarter, according to the latest market data published by HDB on Oct 25.

According to Christine Sun, chief researcher & strategist at OrangeTee Group, the 2.7% q-o-q price growth in 3Q2024 marks the fastest growth rate that the public housing market has seen since 2Q2022, when prices rose by 2.8% q-o-q.

The 2.7% price increase also outpaces the price growth recorded in 2Q2024, which saw HDB resale prices climb by 2.3% q-o-q.

Read also: New housing areas in Sembawang North, Woodlands North Coast to offer 14,000 new homes

Advertisement

Advertisement

HDB Resale Price Index. (Source: HDB, Huttons Data Analytics)

Over the first nine months of this year, HDB resale prices jumped by 6.9%, which is higher than the 3.8% increase seen during the same period in 2023, notes Mohan Sandrasegeran, head of research & data analytics at SRI.

Resale flats in Geylang saw the largest gains, recording a q-o-q average price increase of 8.6%, followed by Central Area (8.1%) and Jurong East (7.7%), according to Lee Sze Teck, senior director of data analytics at Huttons Asia. Overall, 19 out of 26 HDB towns saw price gains of 0.6% or more.

The steeper increase in HDB resale prices so far this year can likely be attributed to supply tightness as the number of new flats meeting their minimum occupancy period (MOP) dropped from 53,902 units in the two-year period between 2021 and 2022 to 27,501 units from 2023 to 2024, says Sun.

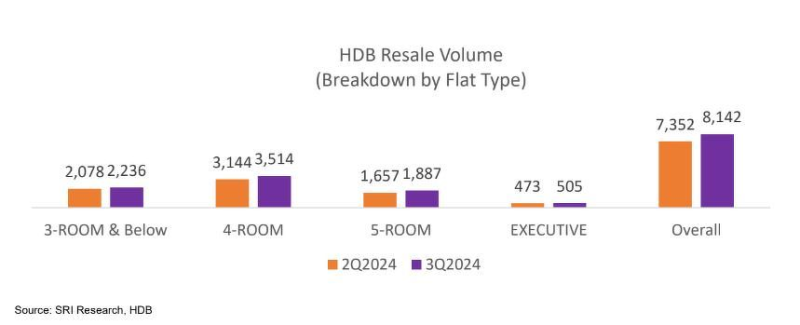

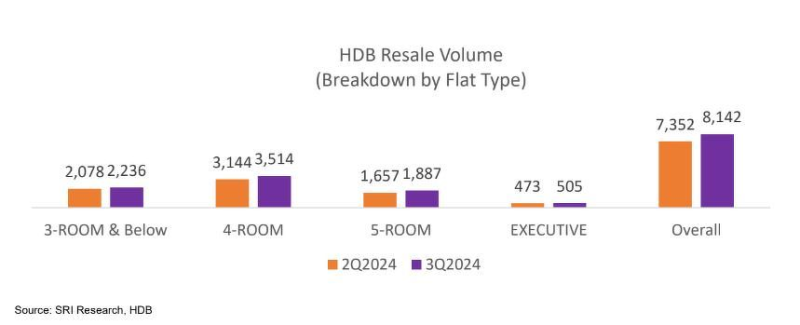

Meanwhile, resale transaction volumes rose 10.7% q-o-q and 21.6% y-o-y from 7,352 deals in 2Q2024 to 8,142 deals last quarter.

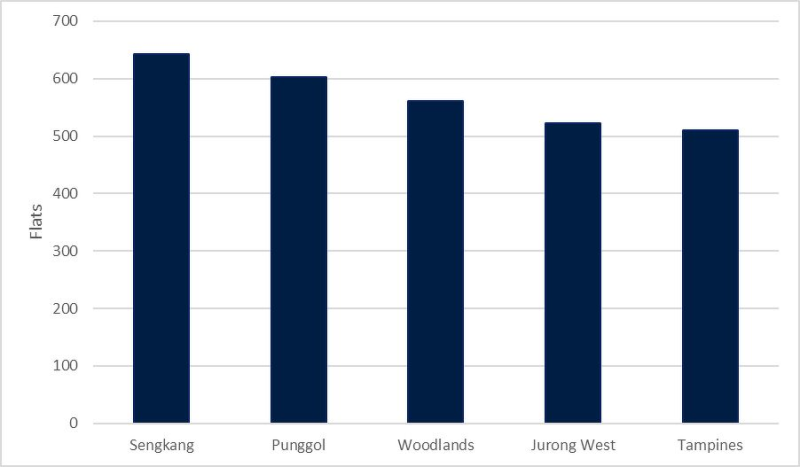

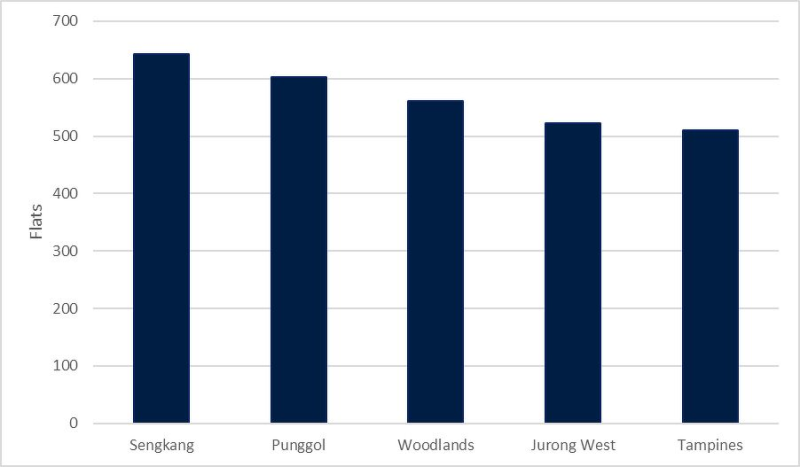

Sengkang, Punggol, Woodlands, Jurong West and Tampines saw the highest HDB resale transactions for 3Q2024, says Lee. They accounted for 34.9% of the quarter’s total transaction volume.

Top Five most popular HDB Towns among buyers in 3Q 2024 (Source: HDB, Huttons Data Analytics)

SRI’s Sandrasegeran noted that there was a spike in the number of five-room flats being sold last quarter, climbing 13.9% compared to 2Q2024. Similarly, the number of four-room flats sold in 3Q2024 jumped by 11.8% compared to the preceding quarter. Sandrasegeran reckons this trend indicates a growing demand for larger flat sizes among buyers.

Read also: Is it a Good Deal?: $1.5 million for a five-room HDB flat in Toa Payoh

Advertisement

Advertisement

“Buyers increasingly favoured these larger units, [and] their higher resale values likely played a significant role in pushing up overall market prices,” he says.

The latest market data also show that 311 flats changed hands for a million dollars or more. This brings the total number of flats that fetched a seven-figure price tag to 750 for the first nine months of 2024, says Eugene Lim, key executive officer of ERA.

While this figure is on track to double 2023’s tally of 469 million-dollar flats sold, Lim opines that this represents just 4.1% of all HDB resale transactions so far this year.

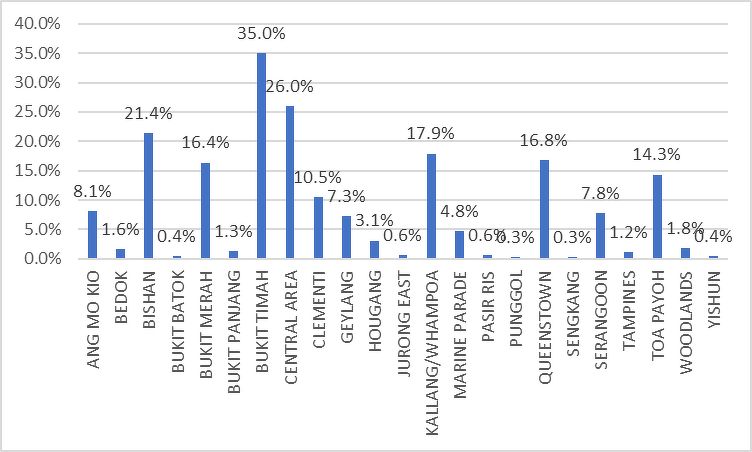

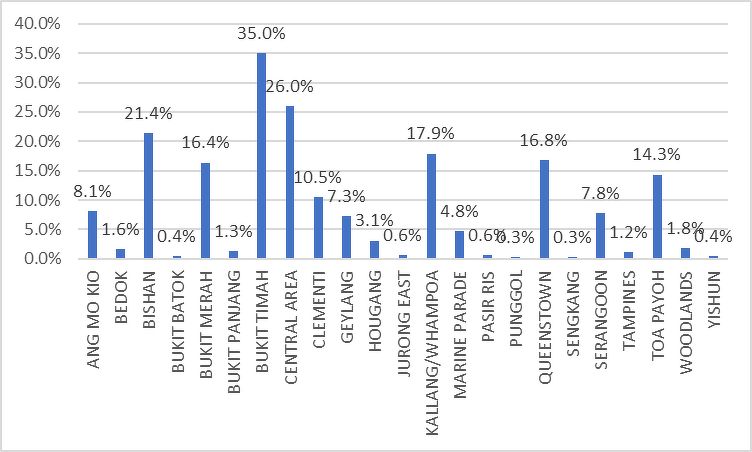

Around 90% of the million-dollar flats in 3Q 2024 are in the mature estates, observes Huttons’ Lee. The Kallang/Whampoa estate saw the highest number of million-dollar flat transactions at 55, followed by Bukit Merah at 45 and Queenstown at 37.

This pushes up the proportion of million-dollar flat transactions in towns like Bishan, Bukit Merah, Bukit Timah, Central Area, Kallang/Whampoa, Queenstown and Toa Payoh above the national average. Bukit Timah saw the highest proportion of million-dollar flat transactions at 35%, followed by Central Area (26%) and Bishan (21.4%).

The latest market data also show that 311 flats changed hands for a million dollars or more. This brings the total number of flats that fetched a seven-figure price tag to 750 for the first nine months of 2024, says Eugene Lim, key executive officer of ERA.

While this figure is on track to double 2023’s tally of 469 million-dollar flats sold, Lim opines that this represents just 4.1% of all HDB resale transactions so far this year.

Around 90% of the million-dollar flats in 3Q 2024 are in the mature estates, observes Huttons’ Lee. The Kallang/Whampoa estate saw the highest number of million-dollar flat transactions at 55, followed by Bukit Merah at 45 and Queenstown at 37.

This pushes up the proportion of million-dollar flat transactions in towns like Bishan, Bukit Merah, Bukit Timah, Central Area, Kallang/Whampoa, Queenstown and Toa Payoh above the national average. Bukit Timah saw the highest proportion of million-dollar flat transactions at 35%, followed by Central Area (26%) and Bishan (21.4%).

Proportion of Million-Dollar Flats Against Total Transactions in 3Q 2024 (Source: HDB, Huttons Data Analytics)

OrangeTee’s Sun cautions prospective buyers to maintain a vigilant and discerning approach to making purchasing decisions as buyers could be paying a premium for flats that typically would not command such high prices.

Read also: 3Q2024 investment sales climb 22.7% q-o-q on the back of ‘mega deals’; Savills

Advertisement

Advertisement

With families typically travelling during the year-end festive season, ERA’s Lim expects that transaction volumes in the HDB resale market will likely slow in 4Q2024.

He anticipates overall HDB resale prices to grow by up to 10% over the whole of 2024. But Sun forecasts a more conservative price increase of between 7% and 8% for the full year.

HDB also announced that it will launch about 5,000 Build-To-Order (BTO) flats across Kallang/Whampoa, Queenstown, Woodlands and Yishun during its next BTO sales exercise in February 2025.

At the same time, HDB will also hold the largest Sale of Balance Flat (SBF) exercise to date, offering more than 5,500 units across various towns and estates. It adds that 40% of SBF flats re-offered for sale next February will be completed between 2025 and 2028, and that the new township-based HDB classification will not be applied to these SBF units.

Check out the latest listings for HDB properties

Ask Buddy

What is the HDB loan rate?

Past HDB rental transactions

Past HDB sale transactions

HDB loan vs Bank loan

Listings for HDB flats

What is the HDB loan rate?

Past HDB rental transactions

Past HDB sale transactions

HDB loan vs Bank loan

Listings for HDB flats

Ask Buddy

What is the HDB loan rate?

Past HDB rental transactions

Past HDB sale transactions

HDB loan vs Bank loan

Listings for HDB flats

What is the HDB loan rate?

Past HDB rental transactions

Past HDB sale transactions

HDB loan vs Bank loan

Listings for HDB flats

The latest market data also show that 311 flats changed hands for a million dollars or more. This brings the total number of flats that fetched a seven-figure price tag to 750 for the first nine months of 2024, says Eugene Lim, key executive officer of ERA.

While this figure is on track to double 2023’s tally of 469 million-dollar flats sold, Lim opines that this represents just 4.1% of all HDB resale transactions so far this year.

Around 90% of the million-dollar flats in 3Q 2024 are in the mature estates, observes Huttons’ Lee. The Kallang/Whampoa estate saw the highest number of million-dollar flat transactions at 55, followed by Bukit Merah at 45 and Queenstown at 37.

This pushes up the proportion of million-dollar flat transactions in towns like Bishan, Bukit Merah, Bukit Timah, Central Area, Kallang/Whampoa, Queenstown and Toa Payoh above the national average. Bukit Timah saw the highest proportion of million-dollar flat transactions at 35%, followed by Central Area (26%) and Bishan (21.4%).

The latest market data also show that 311 flats changed hands for a million dollars or more. This brings the total number of flats that fetched a seven-figure price tag to 750 for the first nine months of 2024, says Eugene Lim, key executive officer of ERA.

While this figure is on track to double 2023’s tally of 469 million-dollar flats sold, Lim opines that this represents just 4.1% of all HDB resale transactions so far this year.

Around 90% of the million-dollar flats in 3Q 2024 are in the mature estates, observes Huttons’ Lee. The Kallang/Whampoa estate saw the highest number of million-dollar flat transactions at 55, followed by Bukit Merah at 45 and Queenstown at 37.

This pushes up the proportion of million-dollar flat transactions in towns like Bishan, Bukit Merah, Bukit Timah, Central Area, Kallang/Whampoa, Queenstown and Toa Payoh above the national average. Bukit Timah saw the highest proportion of million-dollar flat transactions at 35%, followed by Central Area (26%) and Bishan (21.4%).

Ask Buddy

What is the HDB loan rate?

Past HDB rental transactions

Past HDB sale transactions

HDB loan vs Bank loan

Listings for HDB flats

What is the HDB loan rate?

Past HDB rental transactions

Past HDB sale transactions

HDB loan vs Bank loan

Listings for HDB flats

Ask Buddy

What is the HDB loan rate?

Past HDB rental transactions

Past HDB sale transactions

HDB loan vs Bank loan

Listings for HDB flats

What is the HDB loan rate?

Past HDB rental transactions

Past HDB sale transactions

HDB loan vs Bank loan

Listings for HDB flats