MCL-Sinarmas to capture market share with Nava Grove priced from $2,224 psf

Robust new home sales since September have galvanised Singapore developers to roll out new projects in the last quarter of the year. Three new projects are being readied for preview on the first weekend of November: City Developments’ (CDL) 366-unit Union Square Residences in the Core Central Region (CCR); MCL Land and Sinarmas Land’s 552-unit Nava Grove at Pine Grove, in District 21, Rest of Central Region (RCR); and Hoi Hup Realty and Sunway Developments’ 504-unit executive condo Novo Place at Plantation Close in Tengah, in the Outside Central Region (OCR).

“The launches are leading to a flurry of activity in the last quarter,” says Ken Low, managing partner of SRI. “It’s like the year just started this quarter.”

Two other projects are also slated to preview in November — Kingsford Development’s 916-unit Chuan Park at Lorong Chuan and Sim Lian Group’s 846-unit Emerald of Katong in the east. If they take off, there will be five new projects in the November launch pipeline, yielding 3,184 units in total.

Get the latest details on available units and prices for Nava Grove

Advertisement

Advertisement

“There is a surge of new project launches as developers want to take advantage of the small window before the start of the year-end school holidays in mid-November when most people will be travelling,” says Ismail Gafoor, CEO of PropNex.

For Sinarmas Land — Indonesia’s largest property developer by land bank and market capitalisation — Nava Grove is its first residential project in Singapore. The Singapore-listed company is the property arm of Sinar Mas Group, a conglomerate with interests in agribusiness, healthcare, mining, property and paper. It was founded by the late Eka Tjipta Widjaja, who passed away in 2019 at 98.

His sons, Franky Oesman Widjaja and Mukhtar Widjaja, are the executive chairman and CEO of Singapore-listed Sinarmas Land, respectively. Mukhtar’s daughter, Margaretha Natalia Widjaja, is an executive director and vice chairman of Sinarmas Land. According to Forbes, the Widjajas are among Indonesia’s wealthiest, with a net worth of over US$10.8 billion as of June 2023.

The botanical gardens of Nava Park township development in BSD City in the southwest of Central Jakarta (Photo: Nava Park Instagram)

Lee: The project [Nava Grove] will attract an influx of younger and more affluent families to the area. It will also rejuvenate the entire neighbourhood and set new price benchmarks, thereby increasing existing property values (Photo: Samuel Isaac Chua/EdgeProp Singapore)

Before assuming his current role in 2018, COO of MCL Land Lee Tong Voon, spent several years in Jakarta, where he oversaw the development of Nava Park. “It is a beautiful township that is sold-out and well-loved by local Indonesians,” says Lee in an interview with EdgeProp Singapore.

Established in Singapore in 1963, MCL Land’s recent residential project launches include the 638-unit Tembusu Grand in the east, the 639-unit Copen Grand executive condo in Tengah (which was fully sold within a month of its launch in November 2022), and the fully sold 407-unit Piccadilly Grand. All three projects are developed jointly with CDL.

MCL’s recently completed projects include the 638-unit, freehold Leedon Green, a joint venture project with Singapore-listed Chinese developer Yanlord Land Group. It was entirely sold and completed last year. Two other projects by MCL Land are the 309-unit Margaret Ville at Margaret Drive and the 1,399-unit Parc Esta at Sims Avenue. They were completed in 2021 and 2022 respectively.

An upcoming project, expected to be launched next year, is a new 500-unit private residential development at Clementi Avenue 1. MCL Land and joint venture partner CSC Land Group beat five others to win the site with a bid of $633.45 million ($1,250 psf ppr) last November.

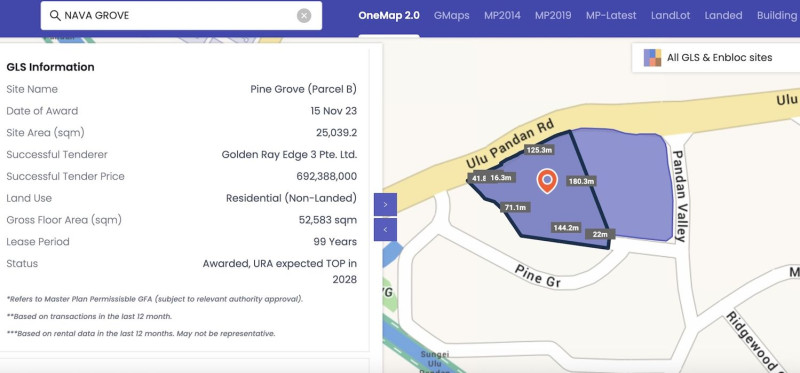

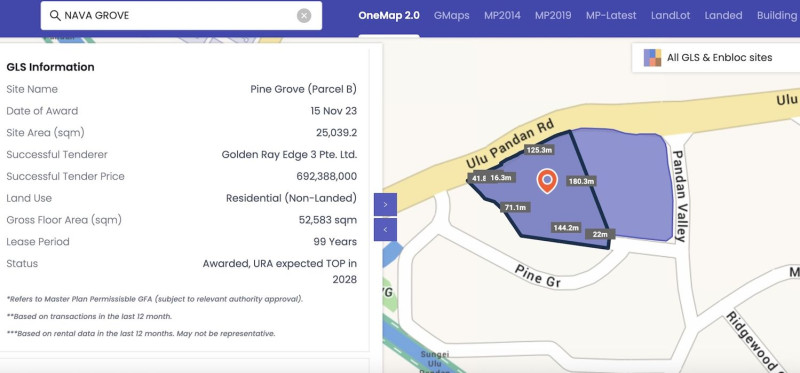

Nava Grove sits on a 269,522 sq ft, 99-year leasehold site at Pine Grove (Parcel B) that MCL and Sinarmas acquired in a land tender in November 2023 for $692.388 million or $1,223 psf per plot ratio (Source: EdgeProp Landlens)

Artist's impression of the three 24-storey towers of Nava Grove and the pavilions fronting Ulu Pandan Road and the Clementi Forest (Picture: MCL Land & Sinarmas Land)

Showflat of a 786 sq ft, two-bedroom plus study priced from $1.888 million (Photo: Samuel Isaac Chua/EdgeProp Singapore)

All the units at Nava Grove feature large-format floor tiles and bathrooms with full-slab tiled walls. The kitchens are equipped with Smeg appliances and sintered stone countertops. The two-bedroom and studio unit of the dual-key apartments will include an “invisible hob” integrated into the kitchen countertop.

The four- and five-bedroom premium units come with additional finishes and provisions, such as a Wells water purifier and dispenser, a wine chiller, and a steam oven in the dry kitchen. The wet kitchen will be equipped with a dishwasher and a ceiling-mounted Steigen clothes rack integrated with LED lighting. The master bedroom will also offer extra wardrobe space.

For the first 18 months following completion — targeted for 2028 — the developer will provide a shuttle service for residents of Nava Grove to Buona Vista MRT Interchange (serving the Circle and East-West lines) and Holland Village MRT Station (Circle Line). The condo will have two side gates, offering residents direct access to bus stops along Ulu Pandan Road. An overhead bridge will also connect residents to Clementi Forest across the road.

Source: EdgeProp Buddy

The 1,722 sq ft five-bedroom premium unit with a private lift is priced from $3.988 million (Photo: Samuel Isaac Chua/EdgeProp Singapore)

Living area of the 1,464 sq ft four-bedroom dual-key unit priced from $3.468 million (Photo: Samuel Isaac Chua/EdgeProp Singapore)

Audrey Goh, MCL Land’s general manager of sales & marketing, expects most buyers at Nava Grove to come from the surrounding area. ‘It may not necessarily be residents from neighbouring private residential estates, but rather HDB upgraders from Clementi and Jurong who want to live closer to town,’ she says. Goh also anticipates some potential buyers will be empty-nesters downsizing from landed properties.

Nava Grove is expected to preview on Nov 2, with its sales launch scheduled for Nov 16. MCL’s Lee believes the project will attract an influx of “younger and more affluent families” to the area. “It will also rejuvenate the entire neighbourhood and set new price benchmarks, thereby increasing existing property values,” he says.

Audrey Goh, general manager of sales & marketing and Lee Tong Voon, COO of MCL Land (Photo: Samuel Isaac Chua/EdgeProp Singapore)

Check out the latest listings for Nava Grove properties

Ask Buddy

Upcoming new launch projects

Total number of units in Nava Grove

Condo sale transactions in District 21

Tenure of Pinetree Hill

Price trend chart for Pinetree Hill

Upcoming new launch projects

Total number of units in Nava Grove

Condo sale transactions in District 21

Tenure of Pinetree Hill

Price trend chart for Pinetree Hill

Ask Buddy

Upcoming new launch projects

Total number of units in Nava Grove

Condo sale transactions in District 21

Tenure of Pinetree Hill

Price trend chart for Pinetree Hill

Upcoming new launch projects

Total number of units in Nava Grove

Condo sale transactions in District 21

Tenure of Pinetree Hill

Price trend chart for Pinetree Hill

Indonesian connection

When Sinarmas Land decided to venture into property development in Singapore for the first time, they chose MCL Land as a partner. MCL Land is a subsidiary of Hongkong Land and a member of Hong Kong’s Jardine Matheson Group. “We are excited to work with MCL Land to deliver our vision of quality and sophistication and set new benchmarks of living in Singapore,” said Margaretha. Before Nava Grove in Singapore, Hongkong Land and Sinarmas Land were joint venture partners in a township development in Bumi Serpong Damai (BSD City), Indonesia’s first integrated smart city in the southwest of Central Jakarta. Named Nava Park, the 68-ha township was launched in 2014 and includes a mix of landed houses, apartment towers, commercial buildings, recreational facilities, and a 2.4-ha country club. Read also: EdgeProp debuts intelligent assistant 'Buddy,' partners with 11 developers to provide insights on 9 new projects Advertisement Advertisement “Riding on the success of the Nava Park collaboration in Indonesia, we will continue to curate opulent living where life connects, flows and flourishes,” said John Simpkins, CEO of MCL Land.

‘Exclusivity and accessibility’

Nava Grove sits on a 269,522 sq ft, 99-year leasehold site at Pine Grove (Parcel B) that MCL and Sinarmas acquired in a land tender in November 2023 for $692.388 million or $1,223 psf per plot ratio (psf ppr). Read also: Pine Grove to launch fifth collective sale attempt at $1.78 bil valuation Advertisement Advertisement The 50:50 joint venture partners were drawn to the site’s location within a private residential enclave surrounded by two nature reserves — Clementi Forest and Dover Forest. “The site is also right on the edge of prime District 10,” MCL’s Lee points out. “It strikes a good balance between exclusivity and accessibility to the city.” Nava Grove is on an upward-sloping terrain, perched 11m above street level on one end and at the other end, 18.4m above. The three 24-storey towers are further elevated by 12.6m above ground, making the second-floor apartments equivalent in height to the eighth floor of a typical street-level apartment block. The towers, designed by project architect P&T Consultants, have a north-south orientation, maximising cross ventilation. Their site footprint is just 20%, frees up 80% of the site for landscaping and condo facilities. STX Landscape Architects has designed three organic-shaped pools, including the largest, 50m in length. There are also lawns, lush landscaped gardens, a tennis court and multi-purpose courts. In addition to the clubhouse and gym, amenities include a wellness zone with pavilions hugging the hillside, which is ideal for reading, working, studying, or relaxing. The developers are conserving six heritage trees on the site, including a pair that will grace the main entrance.

‘Competitively priced’

Nava Grove is a luxury project with a good spread of unit types, ranging from two- to five-bedrooms. Two bedrooms start from 624 sq ft, with prices from $1.388 million ($2,224 psf). Three bedrooms begin at 947 sq ft and are priced from $2.1888 million ($2,310 psf). Four-bedroom units start from 1,335 sq ft, with prices upwards of $2.988 million ($2,238 psf). There is also a stack of four-bedroom dual-key units of 1,464 sq ft, priced from $3,468 million ($2,369 psf). Four-bedroom premium units with private lifts are 1,550 sq ft in size and priced from $3.588 million ($2,315 psf). Five-bedroom premium units with private lifts are 1,722 sq ft each, priced from $3.988 million ($2,316 psf). “We will deliver a premium product, but we will price the project competitively, within the affordability range of our target audience,” says MCL’s Lee.

The last 10 transactions at Pinetree

‘Paring down of units at Pinetree Hill’

Next door is the 520-unit Pinetree Hill at Pine Grove (Parcel A). The site was purchased in June 2022 by joint developers UOL Group and Singapore Land (SingLand) Group for $671.5 million ($1,318 psf ppr). The first phase of 400 units at Pinetree Hill was launched in mid-July 2023. As of August, 63% had been sold at an average price of about $2,430 psf. In September, the remaining 120 units of Pinetree Hill were launched as Phase 2. They featured primarily higher-floor units. Based on caveats lodged, 122 units have been sold since September at an average price of $2,506 psf. Gafoor of PropNex attributes the higher psf price to the large number of two-bedroom units on higher floors taken up. Of the 71 units sold in September, 44 were under 800 sq ft. To date, Pinetree Hill is 71% sold. “The paring down of units at Pinetree Hill bodes well for Nava Grove,” says Gafoor. “As the projects are next to each other, they share similar locational attributes.” According to SRI’s Low, Pinetree Hill is likely to be the best-selling project in the RCR this year, with 202 units taken up since January. In terms of land rate, Nava Grove’s $1,223 psf ppr is 7.2% lower than Pinetree Hill’s $1,318 psf ppr.

'Undervalued'

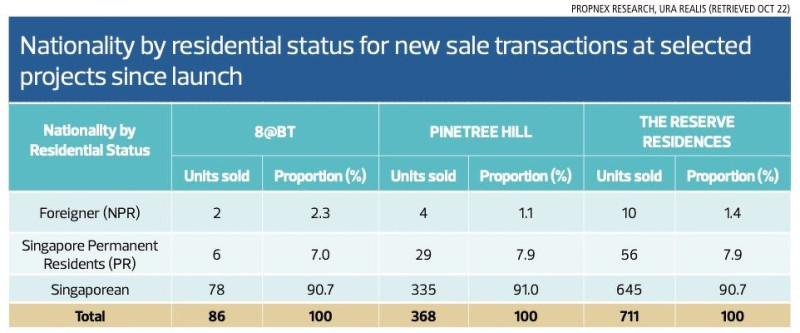

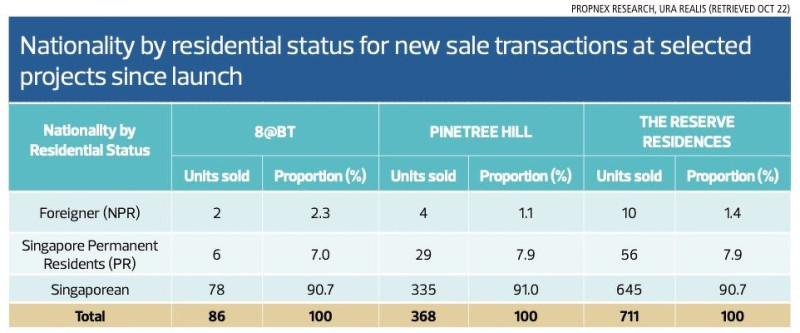

“Based on the indicative starting price of $2,224 psf, Nava Grove appears undervalued compared to other RCR projects,” notes Low of SRI. In the Upper Bukit Timah area of District 21, the 158-unit 8@BT at Bukit Timah Link was launched on Sept 20. Since then, 86 units (54%) have been sold at an average price of $2,731 psf, based on caveats lodged as of Oct 22. The 99-year leasehold residential project is just a two-minute walk to the Beauty World MRT Station. Across the road is the 732-unit The Reserve Residences, the 99-year leasehold residential component of the mixed-use development integrated with the Beauty World transport hub. Launched in May 2023, 670 units at The Reserve Residences were snapped up, earning it the best-selling project of 2023. Since the start of 2024, another 40 units have been sold at an average price of $2,571 psf, based on caveats lodged. Hence, the project is 98% taken-up. “While the Beauty World area is bustling with the upcoming integrated transport hub and ongoing transformation, the Pine Grove area offers a more idyllic and serene living environment,” says Gafoor. “The two areas have attributes that appeal to different lifestyles and preferences.” Amenities in the Pine Grove area include the nearby Clementi town, with schools such as Henry Park Primary School and Pei Tong Primary School located within a 1km range. Other nearby educational institutions include Singapore Polytechnic, the National University of Singapore, and the Singapore University of Social Sciences.

Potential buyers

Based on PropNex’s sales data of buyers at Pinetree Hill, 46% were those aged 30 to 39, with another 38% between 40 and 49 years, with those 50 and above making up 12%, and those 29 or below, accounting for 4%. About 48% of the buyers at Pinetree Hill have a private condo address, another 38% possess an HDB address, and 14% have a landed housing address. The top three districts the buyers hailed from were 19 (Hougang, Punggol and Serangoon Gardens), 22 (Boon Lay, Jurong and Tuas) and 21 (Upper Bukit Timah, Clementi Park and Ulu Pandan). Among these buyers, the two-bedders were the most popular (59.4%), followed by the three-bedders (35%). Four-bedders accounted for 4.3% of units purchased, with one-bedders just 1.3%. ”At Nava Grove, we expect a large proportion of upgraders who appreciate the views of Clementi Forest and Dover Forest,” says SRI’s Low. “It’s very close to District 10, just a four-minute drive to Henry Park Primary School and a six-minute drive to Pei Tong Primary. Holland Village is only four minutes away, and Dempsey Hill is just nine minutes away.”

Ask Buddy

Upcoming new launch projects

Total number of units in Nava Grove

Condo sale transactions in District 21

Tenure of Pinetree Hill

Price trend chart for Pinetree Hill

Upcoming new launch projects

Total number of units in Nava Grove

Condo sale transactions in District 21

Tenure of Pinetree Hill

Price trend chart for Pinetree Hill

Ask Buddy

Upcoming new launch projects

Total number of units in Nava Grove

Condo sale transactions in District 21

Tenure of Pinetree Hill

Price trend chart for Pinetree Hill

Upcoming new launch projects

Total number of units in Nava Grove

Condo sale transactions in District 21

Tenure of Pinetree Hill

Price trend chart for Pinetree Hill