Government releases four residential sites under 2H2024 GLS programme

In a joint press release issued on Oct 17, the Urban Redevelopment Authority (URA) and Housing Development Board (HDB) announced that the government has released four sites for sale under the 2H2024 Government Land Sales (GLS) Programme.

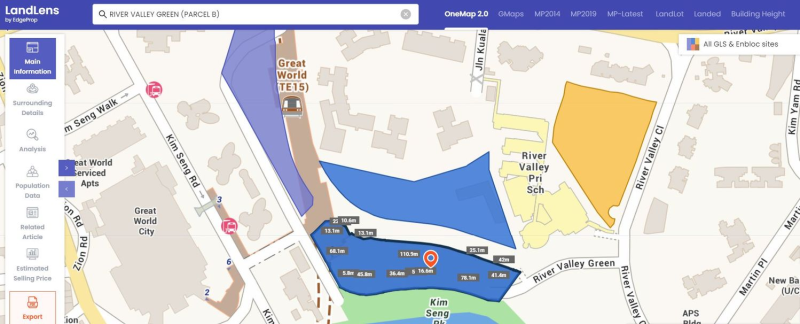

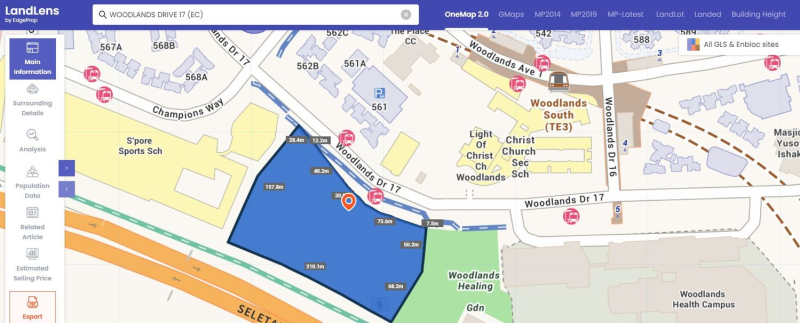

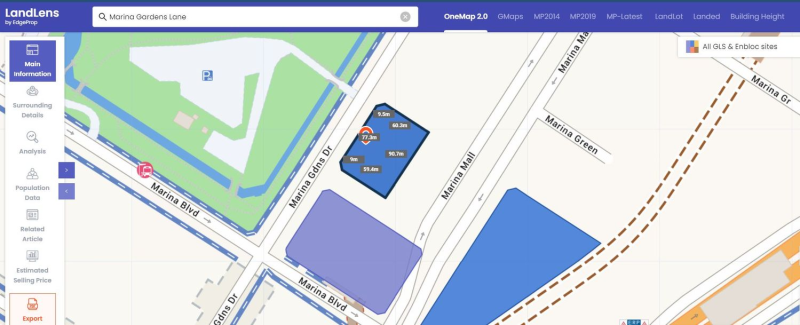

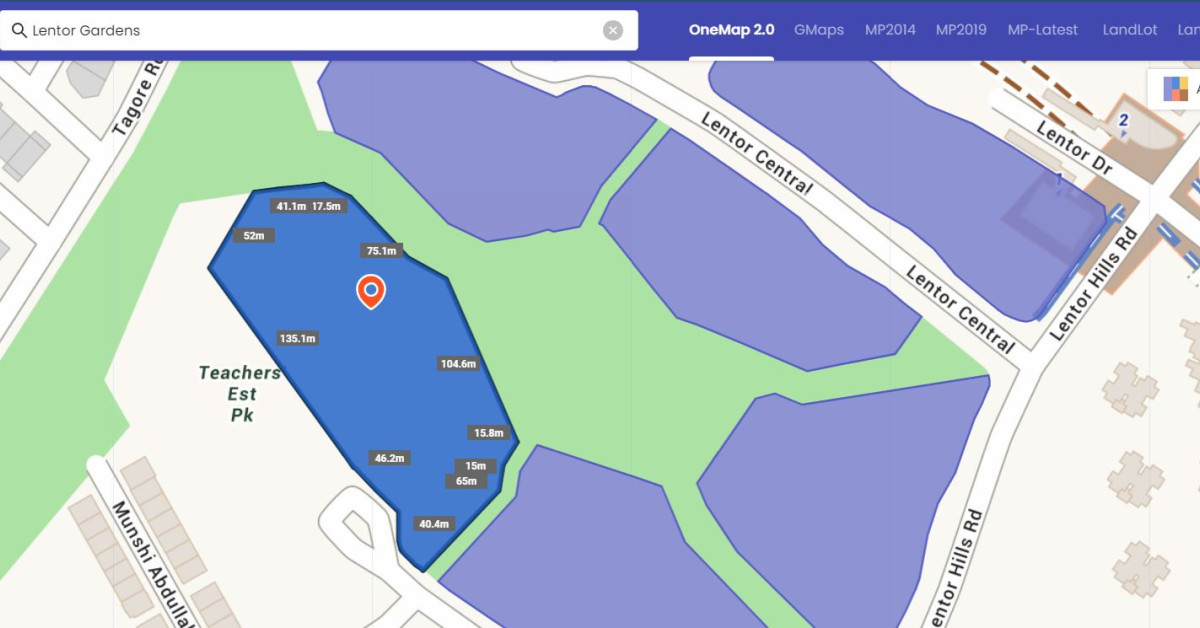

Two sites, Lentor Gardens and River Valley Green (Parcel B), have been launched for sale under the Confirmed List. The remaining two sites, Marina Gardens Lane and Woodlands Drive 17, are available for application under the Reserve List.

The Woodlands Drive site is for the development of an executive condominium (EC), while the Lentor Gardens site is zoned for residential development. The remaining two sites at River Valley Green (Parcel B) and Marina Gardens Lane are zoned residential with commercial at the first storey.

Advertisement

Advertisement

The 222,161 sq ft Lentor Gardens site is the seventh plot to be launched in the developing Lentor Hills Estate. The residential site could yield approximately 500 units and will be a mix of low-rise residential blocks and residential blocks of up to 16 storeys.

Projects in Lentor Hills include the 605-unit Lentor Modern, 474-unit Hillock Green, 267-unit Lentoria, 598-unit Lentor Hills Residences, and most recently the 533-unit Lentor Mansion, as well as a yet-to-be-unveiled project by CSC Land, Hong Leong Holdings’ Intrepid Investments and GuocoLand. The tender for a site at Lentor Gardens on the Reserve List has yet to be triggered.

According to Lee Sze Teck, senior director of data analytics at Huttons Asia, only 352 units (14.2%) of the 2,477 residential units launched in the area have remained unsold. “This shows buyers' receptiveness towards living in the Lentor private residential enclave and should ease concerns of a supply overhang in Lentor,” he adds.

Huttons expects one to three bidders for the site with a top bid of between $900 and $1,000 psf per plot ratio (ppr). The tender for the Lentor Gardens site closes April 3, 2025.

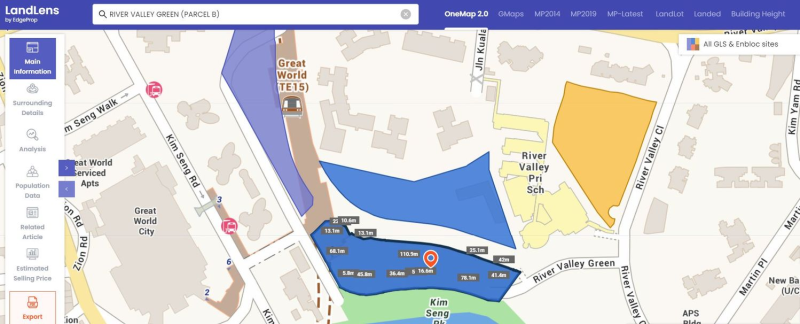

The River Valley Green (Parcel B) plot spans 126,325 sq ft and could accommodate about 475 residential units. (Image: EdgeProp LandLens)

Meanwhile, the River Valley Green (Parcel B) plot spans 126,325 sq ft and will have a maximum gross floor area (GFA) of 442,138 sq ft. The new development could accommodate about 475 residential units. According to the site’s land tender requirements, it will also have direct access to the nearby Great World MRT Station along the Thomson-East Coast Line (TEL).

Marcus Chu, CEO of ERA Singapore, notes that the site’s location is well-connected to major roads and expressways such as Central Expressway (CTE) and Ayer Rajah Expressway (AYE) by private transport while Great World MRT Station allows easy access to the Orchard Road shopping district one stop away.

Advertisement

Advertisement

Lee notes that the area already has a pipeline of incoming residential housing. Two other sites have been awarded in the area this year. In April, URA awarded a 164,439 sq ft site at Zion Road to a joint venture (JV) between City Developments Ltd (CDL) and Japanese real estate developer Mitsui Fudosan. In June, another residential GLS site in River Valley Green was awarded to Winchamp Investment, a subsidiary of Wing Tai Holdings.

Lee estimates that both sites could be launched next year, yielding a total of 1,120 residential units. Furthermore, another nearby GLS site at River Valley Green (Parcel C) is set to be launched sometime in December 2024, according to URA. Should the River Valley Green (Parcel C) site be awarded, Lee predicts that the area could see almost 2,200 units for sale over the next few years.

Thus, developers are likely to be cautious in their bids given the expected supply of new private units entering the market in the area, says Lee. He estimates that the site could attract one to three bidders, with a top bid of $1,200 to $1,300 psf ppr.

The tender for the River Valley Green (Parcel B) closes on Feb 7, 2025.

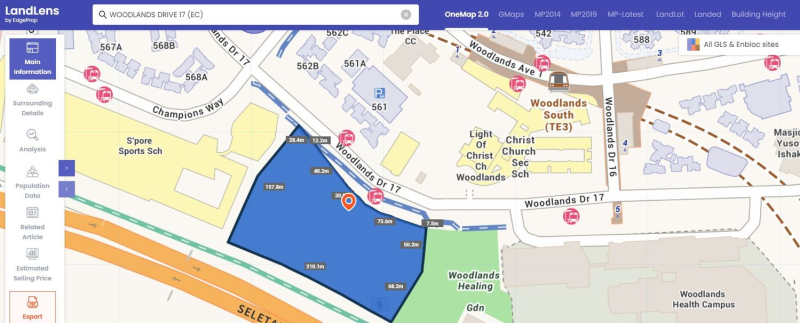

If the EC site at Woodlands Drive 17 is triggered for sale and awarded, the new development could yield 420 EC units. (Image: EdgeProp LandLens)

The EC site at Woodlands Drive spans 271,326 sq ft and has a maximum GFA of 461,255 sq ft. If the site is triggered for sale and awarded, the new development could yield 420 EC units. The site is close to Woodlands South MRT Station on the TEL, and the station is one stop from Woodlands Regional Centre and two stops to the upcoming RTS link to Johor Bahru.

It would also be the first EC site launched for sale in Woodlands South since 2013. The last EC site that was launched for sale has been developed into the 561-unit Bellewoods.

Lee estimates that 6,500 HDB flats in Woodlands were completed from 2016 to 2018, adding that this could contribute to the pool of potential buyers for a future EC development in the vicinity.

Advertisement

Advertisement

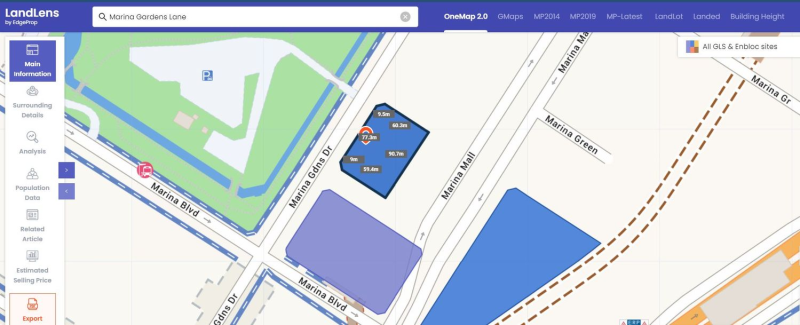

The Reserve List site located at Marina Gardens Lane is close to the upcoming Marina South MRT station on the TEL. (Image: EdgeProp LandLens)

The other Reserve List site is located at Marina Gardens Lane and spans 64,663 sq ft, with a maximum GFA of 362,119 sq ft. Zoned residential with commercial at first storey, the site is close to the upcoming Marina South MRT station on the TEL.

Lee opines that the site is unlikely to be triggered for sale due to the availability of other attractive sites on the 2H2024 Confirmed List such as Bayshore Road, Chencharu Close, Chuan Grove and Holland Link. The Marina Gardens Lane site is close to another GLS site at Marina Crescent, also on the Reserve List.

The Marina Crescent site was moved to the Reserve List earlier this year after the sole bid of $770.5 million ($984 psf ppr) submitted by GuocoLand, Intrepid Investments and TID was assessed to be too low by URA. The bid price reflected a nearly 30% haircut off the land rate of $1,402 psf ppr that a Kingsford Group-led consortium paid for a neighbouring plot in Marina Gardens Lane in July 2023.