3Q2024 investment sales climb 22.7% q-o-q on the back of ‘mega deals’; Savills

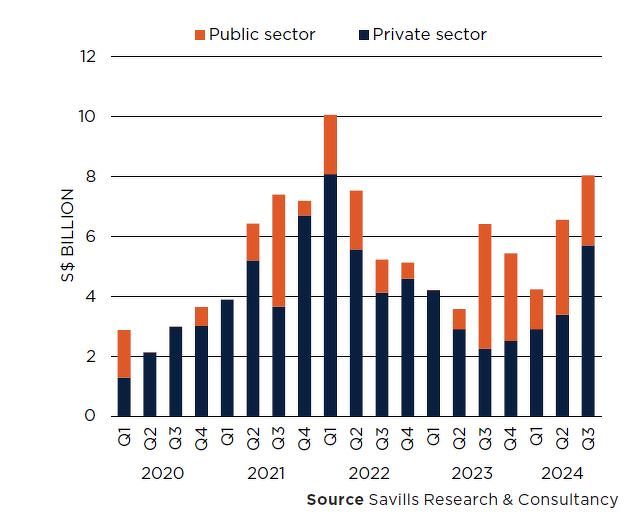

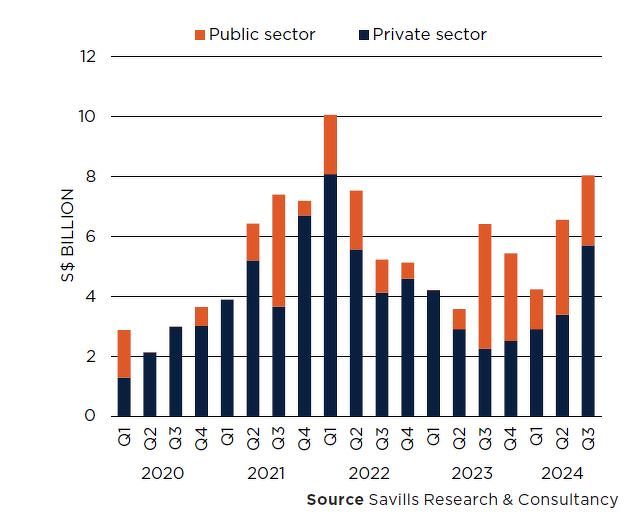

Real estate investment sales in Singapore recorded a 22.7% q-o-q increase to about $8.05 billion in 3Q2024, driven by a handful of high-value private investment sales, according to a market report by Savills Singapore.

The first three quarters of this year recorded total investment deals worth $18.85 billion, reflecting a 32.6% y-o-y increase over the $14.21 million that transacted over the same period last year.

Given the expected absence of more big-ticket deals in the last quarter of this year, and the government’s rejection of the Jurong Lake District master plan bid last month, Savills expects that the local real estate investment market could reap between $22 billion to $23 billion for the full year.

Read also: Parkway Hospitals pays $31.33 mil or a record $4,562 psf for sixth floor office at Tong Building

Advertisement

Advertisement

Investment sales transaction values from 1Q2020 to 3Q2024

In 3Q2024, the largest private investment transaction was CapitaLand Investment’s divestment of its 50% stake in ION Orchard to CapitaLand Integrated Commercial Trust (CICT) for $1.85 billion, which is $5,928 psf on the net lettable area.

The second-highest private market deal last quarter was the $1.6 billion acquisition of a portfolio of industrial assets by joint venture partners Warburg Pincus and Lendlease. The properties were sold by Soilbuild Business Space REIT and span 4.5 million sq ft across developments such as West Park Bizcentral, 2PS1, Solaris@Kallang 164, Solaris@one-north, Qualcomm Building, Eightrium@Changi Business Park, and Tuas Connection.

CICT’s acquisition of a 50% stake in ION Orchard and the industrial portfolio acquisition by Warburg Pincus and Lendlease account for 70.9% of the real estate investment value for 3Q2024.

Top land sales in the public sector for 3Q2024

Five successful government land sale (GLS) sites were awarded in August for a total of $2.34 billion. They include four condo plots at Zion Road Parcel B, Margaret Drive, Canberra Crescent, and De Souza Ave. The last site was an Executive Condo site at Jalan Loyang Besar.

Alan Cheong, executive director at Savills, observes that the winning bids for the condo sites were “generally falling below market expectations” and saw muted interest from developers.

Only the EC site at Jalan Loyang Besar was relatively more competitive and set a new EC land price record when a Qingjian-led consortium of developers submitted a top bid of $729 psf per plot ratio ($557 million) for the site.

The priciest private residential GLS site awarded last quarter was the sale of the 99,953 sq ft site at Zion Road (Parcel B), which was awarded to Allgreen Properties after it put in the top bid of $730.09 million.

Read also: Singapore ranks 23 of 30 cities in prime residential price growth for 1H2024; Savills

Advertisement

Advertisement

Top private investment sales for 3Q2024

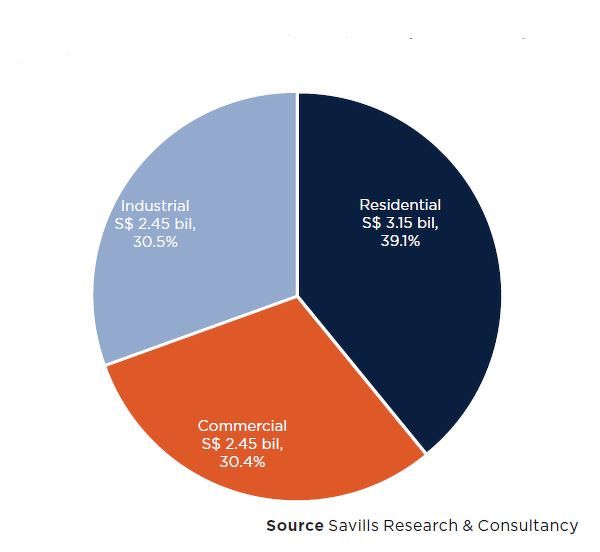

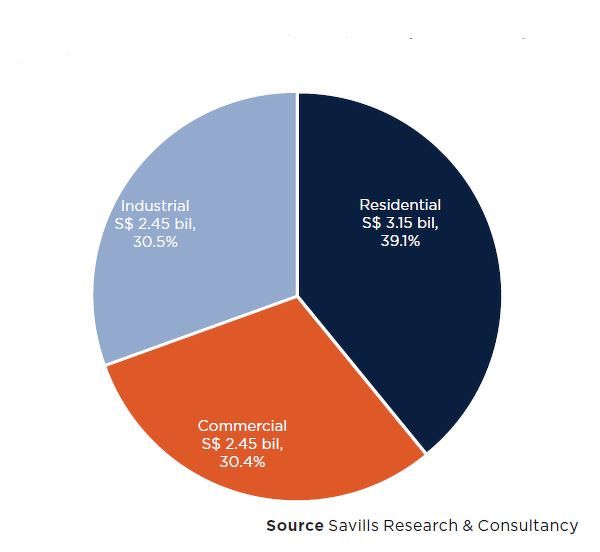

Overall, the Savills report notes that investment sales in the residential segment dropped to $3.15 billion in 3Q2024, which is a quarterly decline of 22% compared to the $4.04 billion recorded in 2Q2024.

On the other hand, there were nine Good Class Bungalow (GCB) deals that closed last quarter, making it the highest quarterly transaction volume since 4Q2021. According to the Savills report, the most expensive GCB sold in 3Q2024 was a 15,150 sq ft bungalow on Tanglin Hill that fetched $93.0 million, reflecting a land rate of $6,197 psf.

Investment sales in the commercial sector reached $2.45 billion across nine transactions in 3Q2024, a 51.7% q-o-q jump in value from 2Q2024. Cheong notes that investment activity for commercial assets has been picking up since the second quarter of this year.

The largest deal was the sale of two office floors at Tong Building by luxury watch retailer Hourglass, who purchased the strata units for $68.5 million ($4,987 psf). “Buyers have shown greater enthusiasm for freehold office projects, such as Solitaire On Cecil, 108 Robinson Road, and 6 Raffles Quay in Singapore’s CBD, as well as Tong Building on Orchard Road,” says Cheong.

Other major transactions include the sale of Sceneca Square, the single-storey retail podium of Sceneca Residence at Tanah Merah Kechil Link, to 8M Real Estate for $64 million and Sheng Siong’s acquisition of nine retail units – eight freehold strata units at Siglap V in Bedok and one HDB retail unit in Toa Payoh Central – for $50.2 million.

“Although interest rates have fallen, there is still a large spread between net yields and total borrowing costs. We may see one or two mega deals conclude in the coming quarters, but it is our opinion that investment sales would generally be driven by the return of ultra-high net worth individuals,” says Cheong

Read also: Last three floors at Solitaire on Cecil sold at $4,130 to $4,200 psf

Advertisement

Advertisement

Other major transactions include the sale of Sceneca Square, the single-storey retail podium of Sceneca Residence at Tanah Merah Kechil Link, to 8M Real Estate for $64 million and Sheng Siong’s acquisition of nine retail units – eight freehold strata units at Siglap V in Bedok and one HDB retail unit in Toa Payoh Central – for $50.2 million.

“Although interest rates have fallen, there is still a large spread between net yields and total borrowing costs. We may see one or two mega deals conclude in the coming quarters, but it is our opinion that investment sales would generally be driven by the return of ultra-high net worth individuals,” says Cheong

Read also: Last three floors at Solitaire on Cecil sold at $4,130 to $4,200 psf

Advertisement

Advertisement

Other major transactions include the sale of Sceneca Square, the single-storey retail podium of Sceneca Residence at Tanah Merah Kechil Link, to 8M Real Estate for $64 million and Sheng Siong’s acquisition of nine retail units – eight freehold strata units at Siglap V in Bedok and one HDB retail unit in Toa Payoh Central – for $50.2 million.

“Although interest rates have fallen, there is still a large spread between net yields and total borrowing costs. We may see one or two mega deals conclude in the coming quarters, but it is our opinion that investment sales would generally be driven by the return of ultra-high net worth individuals,” says Cheong

Read also: Last three floors at Solitaire on Cecil sold at $4,130 to $4,200 psf

Advertisement

Advertisement

Other major transactions include the sale of Sceneca Square, the single-storey retail podium of Sceneca Residence at Tanah Merah Kechil Link, to 8M Real Estate for $64 million and Sheng Siong’s acquisition of nine retail units – eight freehold strata units at Siglap V in Bedok and one HDB retail unit in Toa Payoh Central – for $50.2 million.

“Although interest rates have fallen, there is still a large spread between net yields and total borrowing costs. We may see one or two mega deals conclude in the coming quarters, but it is our opinion that investment sales would generally be driven by the return of ultra-high net worth individuals,” says Cheong

Read also: Last three floors at Solitaire on Cecil sold at $4,130 to $4,200 psf

Advertisement

Advertisement