Four-bedder at Ardmore Park sold for $2.65 mil profit

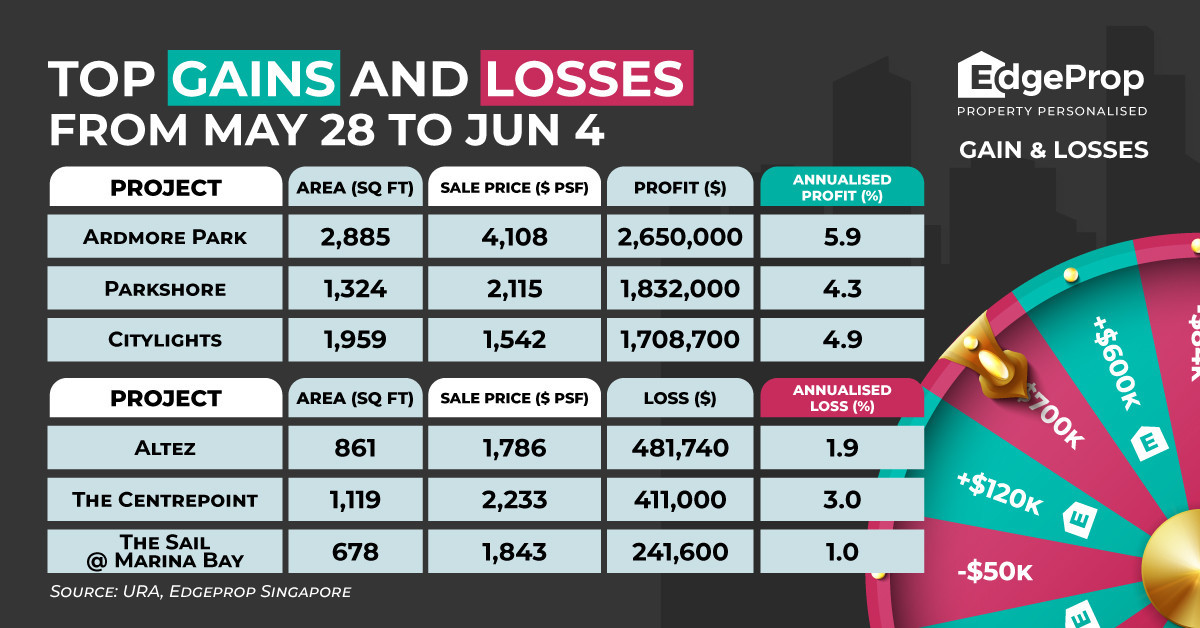

The sale of a four-bedroom unit at Ardmore Park was the most profitable condo resale transaction during the week of May 28 to June 4. The 2,885 sq ft unit on the 22nd floor changed hands for $11.85 million ($4,108 psf) on May 29. The seller bought the unit in January 2020 for $9.2 million ($3,189 psf). This means they made a profit of $2.65 million after owning the unit for just under 4½ years, which works out to a capital gain of 29% for the seller.

The 2,885 sq ft unit at Ardmore Park changed hands for $11.85 million ($4,108 psf) on May 29 (Picture: Samuel Isaac Chua/The Edge Singapore)

Ardmore Park is a 330-unit, freehold condo located in the upscale Ardmore Park area in prime District 10. The condo was completed in 2001 and has three 30-storey towers. Typical units at the condo are 2,885 sq ft, four-bedroom apartments, but it also has six 8,740 sq ft, duplex penthouses.

The development has seen a high proportion of profitable resale transactions in recent years. Data compiled on EdgeProp Research shows that since January 2020, 29 out of 32 resale deals logged at the condo have occurred above purchase price, based on caveats lodged. Of these 29 transactions, 20 have resulted in gross gains of at least $2 million.

Read also: Four-bedder at Marina Bay Suites sold at $2.1 mil loss

Advertisement

The most profitable resale transaction ever recorded at Ardmore Park was the sale of a duplex penthouse measuring 8,740 sq ft for about $27.65 million ($3,163 psf) in April 2020. The seller had held the unit since January 1998, when they purchased it for $16 million ($1,831 psf). As such, they raked in a profit of $11.65 million on the sale.

The second most profitable condo resale transaction during the week in review was the sale of a three-bedroom, 1,324 sq ft apartment at Parkshore. The third-floor unit fetched $2.8 million ($2,115 psf) on June 4. The seller, who bought the unit in July 1999 for $968,000 ($731 psf), walked away with a profit of $1.83 million (189%) after a holding period of 25 years.

This is the second most profitable unit to change hands at Parkshore to date. The record belongs to a four-bedroom, 2,325 sq ft unit that sold for $4.2 million ($1,806 psf) in December 2020. It had previously changed hands for $1.24 million ($533 psf) in December 2005, which means the seller netted a profit of $2.96 million.

A 1,324 sq ft unit at Parkshore fetched $2.8 million ($2,115 psf) on June 4, netting a profit of $1.83 million (Picture: Albert Chua/The Edge Singapore)

Parkshore is a freehold condo on Tanjong Rhu Road in District 15 that was completed in 1995. It is part of a private residential enclave along the Kallang Basin, which includes the 510-unit Pebble Bay and the 737-unit Costa Rhu. Parkshore comprises a single 15-storey tower housing 152 units. Apartments consist of two-bedders from 990 sq ft to 1,044 sq ft, three-bedders from 1,324 sq ft to 1,722 sq ft, and four-bedroom units of 2,325 sq ft.

The condo is a five-minute walk to the Tanjong Rhu MRT Station on the Thomson-East Coast Line, which will open on June 23.

Meanwhile, the most unprofitable condo resale transaction during the week in review was the sale of a one-bedroom loft at Altez. The 861 sq ft unit on the 30th floor changed hands for $1.54 million ($1,786 psf) on May 29. It was purchased by the seller from the developer for $2.02 million ($2,345 psf) in March 2010. As a result, they made a loss of about $482,000 (24%) on the sale.

Read also: Three-bedder at Pebble Bay sold for $2.2 mil profit

Advertisement

The sale of an 861 sq ft loft at Altez for $1.54 million ($1,786 psf) on May 29 made a loss of about $482,000 (Picture: Google Maps)

Located on Enggor Street in District 2’s Tanjong Pagar area, Altez is a 280-unit condo that was completed in 2014. The 99-year leasehold development consists of a 62-storey tower that includes a retail podium. Residences comprise one- and two-bedroom units of 527 sq ft to 1,013 sq ft, one- to three-bedroom lofts of 753 sq ft to 1,658 sq ft, and penthouses of 2,486 sq ft to 4,424 sq ft.

Besides the unit sold on May 29, there have been two other resale transactions at Altez so far this year, both of which occurred below their purchase prices. On April 3, a 1,184 sq ft unit fetched $2.25 million ($1,900 psf). The seller acquired the unit in January 2021 for $2.4 million, making a loss of $150,000. On April 12, a 764 sq ft unit changed hands for $1.68 million ($2,198 psf ). The seller, who bought the unit in April 2014 for $1.97 million ($2,576 psf), netted a loss of about $288,000.

Check out the latest listings for Ardmore Park, Parkshore, Altez properties