Fed rate cut to bolster investment sales, especially for industrial and living sector assets: Knight Frank

The long-awaited interest rate cut by the US Federal Reserve is revitalising the real estate capital market, with investment activity already displaying early signs of a resurgence, as detailed in a report by Knight Frank Singapore.

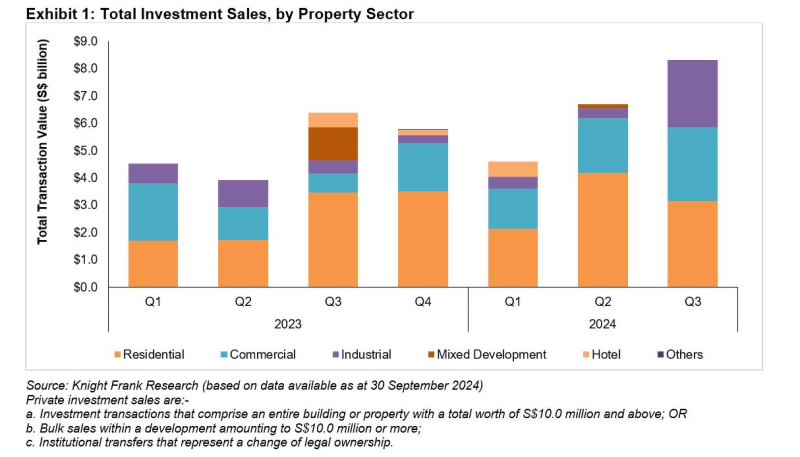

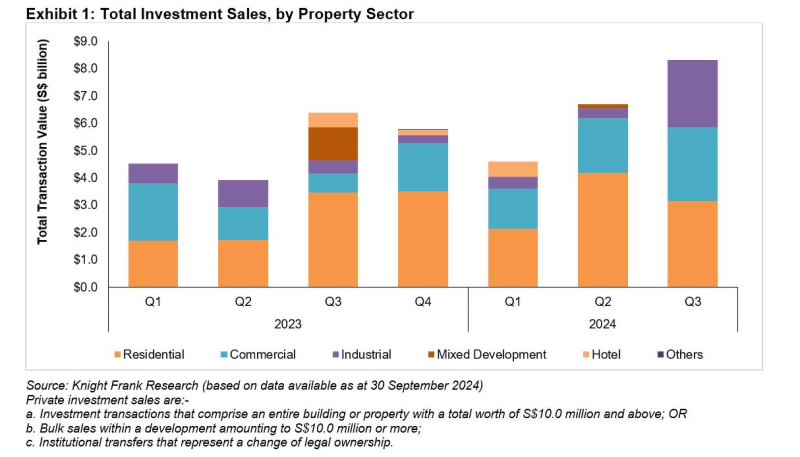

Data compiled by the consultancy indicate that a total of $8.3 billion worth of real estate investment deals were transacted in 3Q2024. This points to a 24.8% surge q-o-q, which Knight Frank attributes to a rise in investor activity in anticipation of the rate cut. On Sept 18, the Fed reduced interest rates by half a percentage point to a targeted range of 4.75% to 5%, marking its first cut in over four years.

The bulk of investment deals in 3Q2024 were private sales totalling $6 billion, with public sales making up the remaining $2.3 billion. By property sector, the industrial segment saw the biggest spike in activity in 3Q2024, with industrial investment sales shooting up 427% q-o-q to hit $2.5 billion in value.

Read also: 2Q2024 investment sales up 52.6% q-o-q, bolstered by government land sales: Savills

Advertisement

Advertisement

The spike follows the $1.6 billion sale of a portfolio of seven Singapore industrial properties to a joint venture by global private equity firm Warburg Pincus and Australian-listed Lendlease Group. The partners purchased the portfolio in August from Soilbuild Business Space REIT, which is controlled by Blackstone and Lim Chap Huat, executive chairman of Soilbuild Group.

Other notable industrial transactions in 3Q2024 include the purchase of a 51% stake in an industrial site at 20 Tuas South Avenue 14 by ESR-Logos REIT for $444.6 million and Ho Bee Land’s sale of a 49% stake in Elementum, a biomedical sciences development at 1 North Buona Vista Link, to a sovereign wealth fund for $272 million. Both deals took place in August.

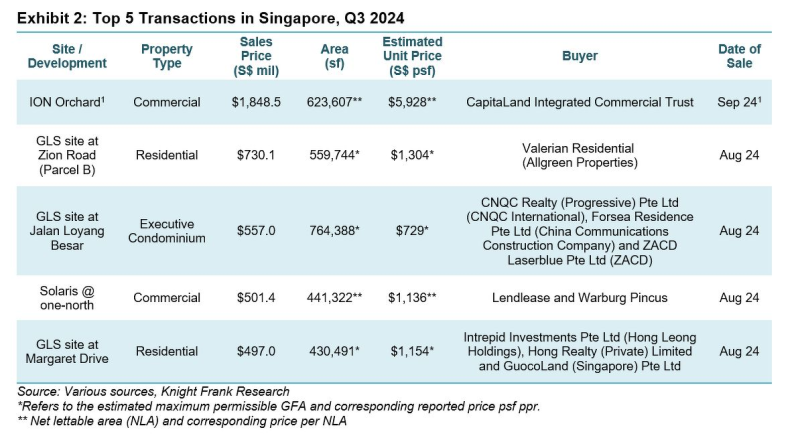

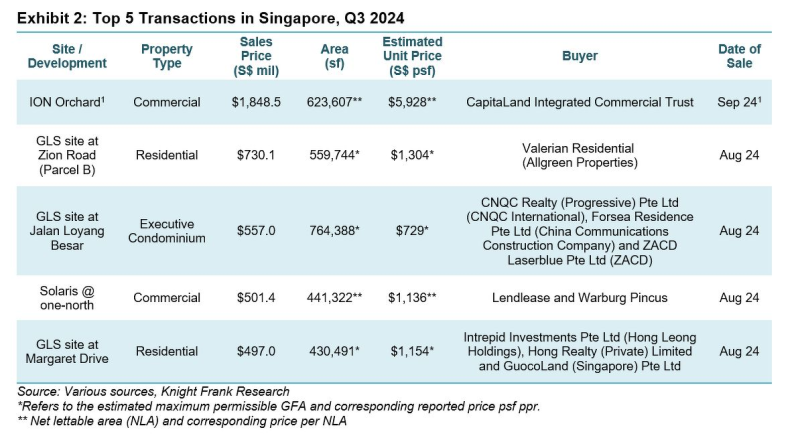

Residential investment deals made up $3.2 billion of total sales in 3Q2024, falling 24.7% q-o-q. Over two-thirds, or $2.3 billion, comprised government land sales (GLS). They include Zion Road (Parcel B), which was awarded to Allgreen Properties for $730.09 million ($1,304 psf per plot ratio or ppr) and an executive condominium site on Jalan Loyang Besar that sold for $557 million ($729 psf ppr) to a consortium of developers consisting of Qingjian Realty, China Communications Construction Co. and ZACD Group. Both sites were awarded in August.

Another GLS site on Margaret Drive was also sold in August. The site went to a consortium made up of GuocoLand, Hong Leong Holdings’ Intrepid Investments and Hong Leong Group’s Hong Realty, who submitted a top bid of $497 million or $1,154 psf ppr.

A number of good class bungalow (GCBs) deals also took place last quarter, contributing to residential investment sales. For instance, in July, a GCB at Tanglin Hill was sold for $93.9 million. On Belmont Road, two GCBs were also sold in July for $73.7 million and $57.7 million respectively, says Knight Frank.

The spike follows the $1.6 billion sale of a portfolio of seven Singapore industrial properties to a joint venture by global private equity firm Warburg Pincus and Australian-listed Lendlease Group. The partners purchased the portfolio in August from Soilbuild Business Space REIT, which is controlled by Blackstone and Lim Chap Huat, executive chairman of Soilbuild Group.

Other notable industrial transactions in 3Q2024 include the purchase of a 51% stake in an industrial site at 20 Tuas South Avenue 14 by ESR-Logos REIT for $444.6 million and Ho Bee Land’s sale of a 49% stake in Elementum, a biomedical sciences development at 1 North Buona Vista Link, to a sovereign wealth fund for $272 million. Both deals took place in August.

Residential investment deals made up $3.2 billion of total sales in 3Q2024, falling 24.7% q-o-q. Over two-thirds, or $2.3 billion, comprised government land sales (GLS). They include Zion Road (Parcel B), which was awarded to Allgreen Properties for $730.09 million ($1,304 psf per plot ratio or ppr) and an executive condominium site on Jalan Loyang Besar that sold for $557 million ($729 psf ppr) to a consortium of developers consisting of Qingjian Realty, China Communications Construction Co. and ZACD Group. Both sites were awarded in August.

Another GLS site on Margaret Drive was also sold in August. The site went to a consortium made up of GuocoLand, Hong Leong Holdings’ Intrepid Investments and Hong Leong Group’s Hong Realty, who submitted a top bid of $497 million or $1,154 psf ppr.

A number of good class bungalow (GCBs) deals also took place last quarter, contributing to residential investment sales. For instance, in July, a GCB at Tanglin Hill was sold for $93.9 million. On Belmont Road, two GCBs were also sold in July for $73.7 million and $57.7 million respectively, says Knight Frank.

The spike follows the $1.6 billion sale of a portfolio of seven Singapore industrial properties to a joint venture by global private equity firm Warburg Pincus and Australian-listed Lendlease Group. The partners purchased the portfolio in August from Soilbuild Business Space REIT, which is controlled by Blackstone and Lim Chap Huat, executive chairman of Soilbuild Group.

Other notable industrial transactions in 3Q2024 include the purchase of a 51% stake in an industrial site at 20 Tuas South Avenue 14 by ESR-Logos REIT for $444.6 million and Ho Bee Land’s sale of a 49% stake in Elementum, a biomedical sciences development at 1 North Buona Vista Link, to a sovereign wealth fund for $272 million. Both deals took place in August.

Residential investment deals made up $3.2 billion of total sales in 3Q2024, falling 24.7% q-o-q. Over two-thirds, or $2.3 billion, comprised government land sales (GLS). They include Zion Road (Parcel B), which was awarded to Allgreen Properties for $730.09 million ($1,304 psf per plot ratio or ppr) and an executive condominium site on Jalan Loyang Besar that sold for $557 million ($729 psf ppr) to a consortium of developers consisting of Qingjian Realty, China Communications Construction Co. and ZACD Group. Both sites were awarded in August.

Another GLS site on Margaret Drive was also sold in August. The site went to a consortium made up of GuocoLand, Hong Leong Holdings’ Intrepid Investments and Hong Leong Group’s Hong Realty, who submitted a top bid of $497 million or $1,154 psf ppr.

A number of good class bungalow (GCBs) deals also took place last quarter, contributing to residential investment sales. For instance, in July, a GCB at Tanglin Hill was sold for $93.9 million. On Belmont Road, two GCBs were also sold in July for $73.7 million and $57.7 million respectively, says Knight Frank.

The spike follows the $1.6 billion sale of a portfolio of seven Singapore industrial properties to a joint venture by global private equity firm Warburg Pincus and Australian-listed Lendlease Group. The partners purchased the portfolio in August from Soilbuild Business Space REIT, which is controlled by Blackstone and Lim Chap Huat, executive chairman of Soilbuild Group.

Other notable industrial transactions in 3Q2024 include the purchase of a 51% stake in an industrial site at 20 Tuas South Avenue 14 by ESR-Logos REIT for $444.6 million and Ho Bee Land’s sale of a 49% stake in Elementum, a biomedical sciences development at 1 North Buona Vista Link, to a sovereign wealth fund for $272 million. Both deals took place in August.

Residential investment deals made up $3.2 billion of total sales in 3Q2024, falling 24.7% q-o-q. Over two-thirds, or $2.3 billion, comprised government land sales (GLS). They include Zion Road (Parcel B), which was awarded to Allgreen Properties for $730.09 million ($1,304 psf per plot ratio or ppr) and an executive condominium site on Jalan Loyang Besar that sold for $557 million ($729 psf ppr) to a consortium of developers consisting of Qingjian Realty, China Communications Construction Co. and ZACD Group. Both sites were awarded in August.

Another GLS site on Margaret Drive was also sold in August. The site went to a consortium made up of GuocoLand, Hong Leong Holdings’ Intrepid Investments and Hong Leong Group’s Hong Realty, who submitted a top bid of $497 million or $1,154 psf ppr.

A number of good class bungalow (GCBs) deals also took place last quarter, contributing to residential investment sales. For instance, in July, a GCB at Tanglin Hill was sold for $93.9 million. On Belmont Road, two GCBs were also sold in July for $73.7 million and $57.7 million respectively, says Knight Frank.