Hong Kong luxe project sales buoyed by mainland Chinese buyers post-policy easing, says DBS

Following the Hong Kong government's announcement on February 28, 2024, to abolish the Special Stamp Duty (SSD), Buyers' Stamp Duty (BSD), and New Residential Stamp Duty (NRSD) for residential properties, developers seized the opportunity to offer more new residential projects for sale and expedite inventory sales to tap pent-up demand.

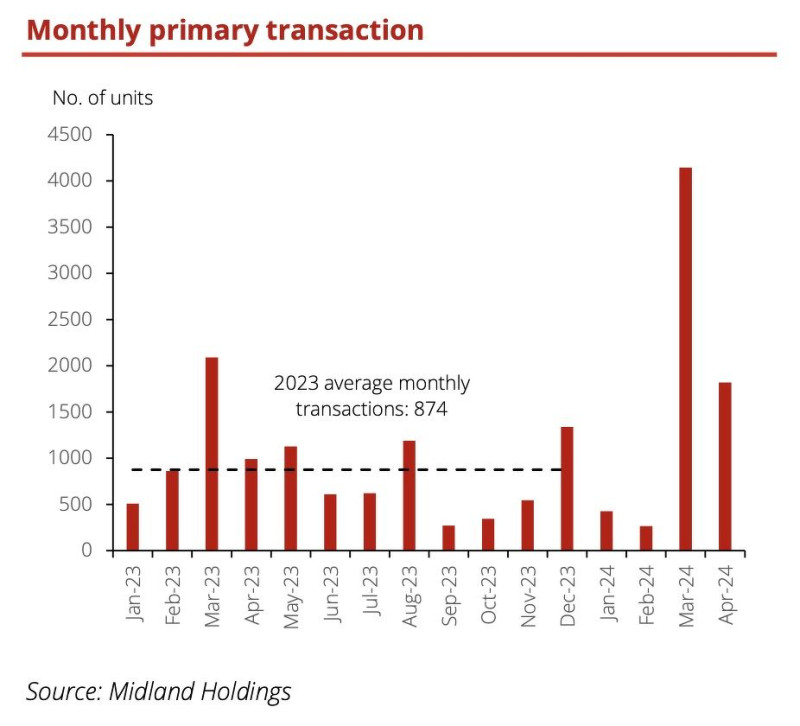

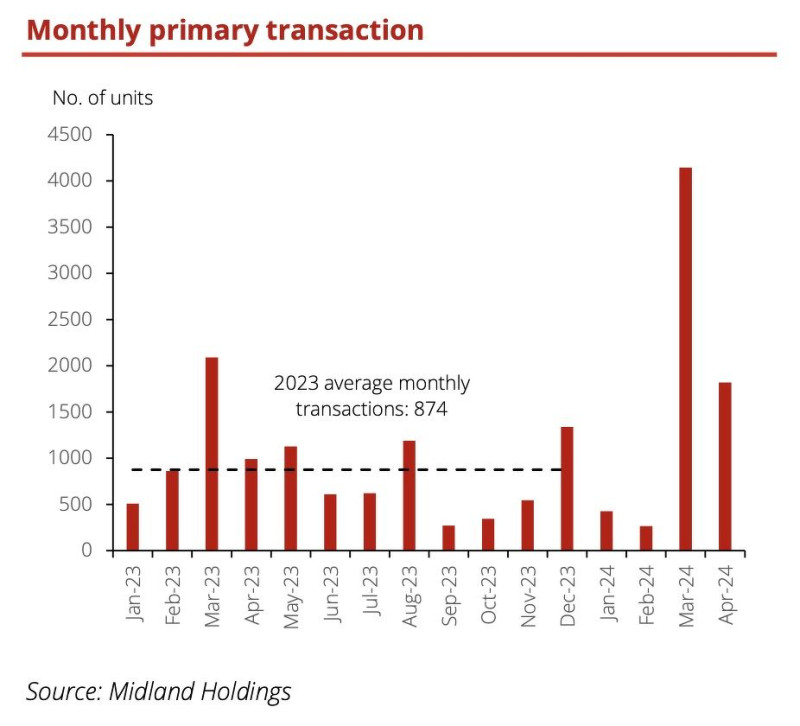

With the return of mainland Chinese buyers and property investors on the one hand and the increase in purchases by local end-users, the response to project launches in Hong Kong has been enthusiastic. About 6,000 primary units were sold in March and April, compared to fewer than 900 units in 2023. The mainland Chinese drove a "meaningful portion" of the purchases, says DBS Group Research in a report on May 13.

Home prices have shown signs of stabilisation since March. Local buyers are still price-sensitive, especially amid expectations of delayed interest rate cuts.

Read also: Hong Kong average room rates surpass pre-Covid period in 2019: CBRE

Advertisement

Advertisement

Moreover, with rising new home supply on the one hand and sizeable unsold inventory on the other, developers are compelled to maintain a flexible pricing strategy to move sales further.

"With the return of affluent mainland Chinese buyers, luxury developments should exhibit more resilience and fare better than mass market projects, which could see price declines of 5% in 2024 if rate cuts fail to materialise," says the report.

According to the DBS analysts, Hong Kong-listed property developers are trading at a 60% discount to the current NAV (net asset value). Prolonged interest rate upcycle remains the key investment risk, amongst others.

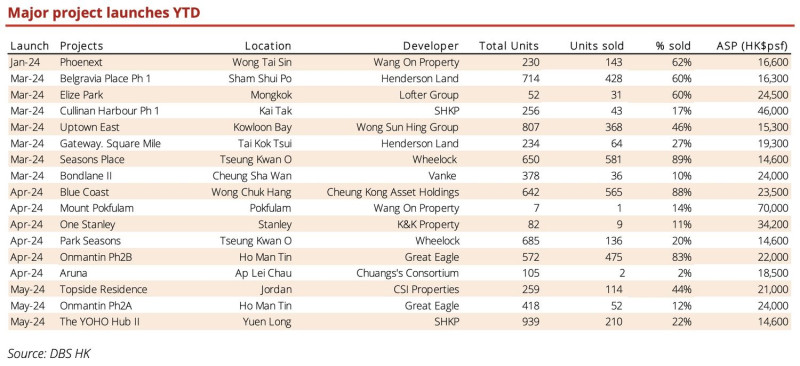

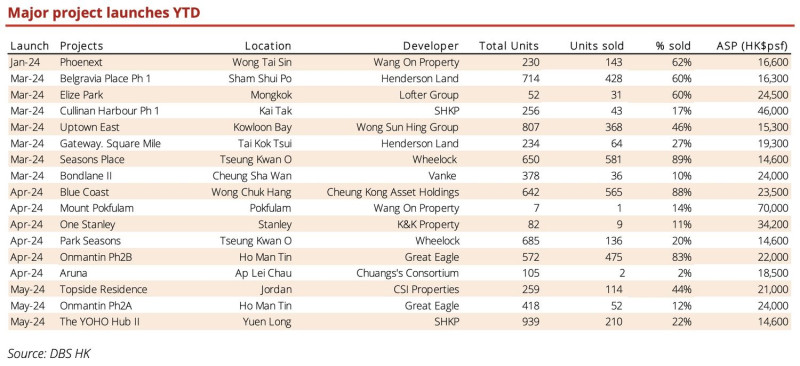

In April, CK Asset Holdings launched Blue Coast (The Southside Package 3B) in Wong Chuk Hang for pre-sale. According to DBS, the market response was overwhelmingly positive at prices more than 20% lower than the average selling price of the neighbouring La Montagne that was sold in August 2023.

CK Asset Holdings has sold 565 units, or 88% of the total, for over HK$10.4 billion (about S$1.77 billion), making it the best-selling residential project in Hong Kong. Located atop Wong Chuk Hang MTR station, six minutes from Admiralty station by subway, the 1,200-unit The Southside Package 3 is developed in two phases.

"With the return of affluent mainland Chinese buyers, luxury developments should exhibit more resilience and fare better than mass market projects, which could see price declines of 5% in 2024 if rate cuts fail to materialise," says the report.

According to the DBS analysts, Hong Kong-listed property developers are trading at a 60% discount to the current NAV (net asset value). Prolonged interest rate upcycle remains the key investment risk, amongst others.

In April, CK Asset Holdings launched Blue Coast (The Southside Package 3B) in Wong Chuk Hang for pre-sale. According to DBS, the market response was overwhelmingly positive at prices more than 20% lower than the average selling price of the neighbouring La Montagne that was sold in August 2023.

CK Asset Holdings has sold 565 units, or 88% of the total, for over HK$10.4 billion (about S$1.77 billion), making it the best-selling residential project in Hong Kong. Located atop Wong Chuk Hang MTR station, six minutes from Admiralty station by subway, the 1,200-unit The Southside Package 3 is developed in two phases.

In April, CK Asset Holdings launched Blue Coast (The Southside Package 3B) and has sold 88% of the units (Photo: DBS Hong Kong)

Superstructure works are underway, and project completion is scheduled for 2025. CK Asset Holdings secured the development rights for the site via a railway project tender in August 2018. The land premium was HK$12.97 billion. Including construction cost and interest costs, DBS analysts estimate an all-in development cost of HK$27,500 psf (S$4,675 psf) on a saleable area basis.

Read also: Hong Kong budget 2024-25: finance chief Paul Chan scraps all property curbs in radical bid to boost ailing market

Advertisement

Advertisement

Wheelock & Co offered Seasons Place (Lohas Park Package 12) in Tseung Wan O for sale in March and has sold over 580 units, representing 89% of the total of 650 units.

Given the strong response, Wheelock followed up with the release of Park Seasons (Lohas Park Package 12B), which has sold 717 units. The 1,985-unit Lohas Park Package 12 is being developed in three phases and is scheduled for completion in 2025. Pre-sale consent for Package 12C was also obtained in January 2024.

Great Eagle Holdings' launch of Onmantin was also greeted with enthusiastic response. Since late April, over 520 units have been sold for over HK$6.4 billion. Onmantin sits atop Ho Man Tin MTR Station, an interchange for the Tuen Ma Line and Kwun Tong Line Extension. Scheduled for completion in 2025, Onmantin has 990 units across five residential towers.

Great Eagle Holdings' launch of Onmantin in late April saw over 520 units sold (Photo: DBS Hong Kong)

Sun Hung Kai Properties recently launched the YOHO Hub II for sale, and all 210 were snapped up on the first day. YOHO Hub II is adjacent to Yuen Long Station.

Cullinan Harbour, located at the front end of the Kai Tak runway, has panoramic views of Victoria Harbour. The residential project by Sun Hung Kai has two phases and a total of 439 residential units. The developer has sold 43 luxury apartments in Phase 1 for HK$2.8 billion (S$476 million) or HK$46,000 psf (S$7,820 psf). Pre-sale consent for Cullinan Harbour Phase 2 is pending approval.

Sun Hung Kai also sold 31 newly refurbished luxury apartments at Dynasty Court in Mid-levels for over HK$1.7 billion (S$289 million). These units have been retained for rental for three decades.

Read also: Office floors at Hong Kong’s One Island East sold for HK$5.4 bil

Advertisement

Advertisement

The launch of residential projects near railway stations has all been well received, says the DBS report. The analysts attribute it to strong connectivity and attractive pricing.

About 428 units, or 60% of Henderson Land's Belgravia Place Phase 1 have been taken up (Photo: DBS Hong Kong)

Henderson Land has been offloading residential projects for sale since the government scrapped the property curbs at the end of February. Two new developments, Belgravia Place Phase 1 in Sham Shui Po and Gateway Square Mile in Tai Kok Tsui, have been offered for sale since then. About 428 units, or 60% of the total in Belgravia Place Phase 1 has been taken up. Belgravia Place has 1,035 units and is being developed in two phases. It is scheduled for completion in 2025.

Henderson Land's inventory sales have improved remarkably, according to the report. The developer sold 145 units at The Holborn in Quarry Bay and about 134 units at Baker Circle Greenwich in Hung Hom since property cooling measures were lifted in late February.

The Holborn is virtually sold out, while Baker Circle Greenwich is 96% sold. The analysts at DBS estimated that Henderson Land generated about HK$8 billion (S$1.36 billion) in proceeds from property sales since the relaxation of the policy.

Since March, Wong Sun Hing Group, an unlisted real estate player, has sold over 360 units at Uptown East in Kowloon Bay for over HK$15,000 psf (S$2,550 psf). It represented 46% of a total of 807 units.

Since March, Wong Sun Hing Group, an unlisted real estate player, has sold over 360 units at Uptown East in Kowloon Bay for over HK$15,000 psf (S$2,550 psf) or 46% of the 897 units (Photo: DBS Hong Kong)

Developed by K&K Holdings, One Stanley was also recently offered for sale. Nine units were sold via tender for HK$811 million (S$137.9 million) or over HK$34,000 psf (S$5,780 psf). One Stanley contains 82 units comprising 32 luxurious houses and 50 low-rise apartments.

Meanwhile, Wang On Properties sold one house at Mount Pokfulam for HK$334 million (S$57.29 million) or HK$70,000 psf (S$11,900 psf)

Since March, Hong Kong-listed Chinese developer Poly Property and Chinese Resources Land, the property development arm of Chinese Resources Group, sold 133 units at Pano Harbour in Kai Tak for HK$4.06 billion. It brought units sold to 236 or 41% of 582 units.

Kerry Properties has sold three units at Mont Verra at Beacon Hill (on the Kowloon side) for over HK$1.8 billion (S$306 million) since late February. It included a garden house which fetched HK$1 billion (S$170 million) or HK$86,300 psf (S$14,671 psf), a record high for a luxury development in Kowloon. It brings total sales to date to seven.

The joint venture between Logan Group and KWG Group Holdings sold 14 apartments at The Corniche in Ap Lei Chau for HK$817 million (S$139 million) or HK$27,800 psf (S$4,726 psf) since April.

According to DBS, over half of the transactions in selected developments are from mainland China. Investor demand has resurfaced, and local end-users have shaken off their wait-and-see attitude. As such, there has been a sharp rebound in primary market activities.

For the full year, DBS is projecting that 19,000 primary units will be sold in 2024, up 78% y-o-y.

The joint venture between Logan Group and KWG Group Holdings sold 14 apartments at The Corniche in Ap Lei Chau for HK$817 million (S$139 million) or HK$27,800 psf (S$4,726 psf) since April.

According to DBS, over half of the transactions in selected developments are from mainland China. Investor demand has resurfaced, and local end-users have shaken off their wait-and-see attitude. As such, there has been a sharp rebound in primary market activities.

For the full year, DBS is projecting that 19,000 primary units will be sold in 2024, up 78% y-o-y.

"With the return of affluent mainland Chinese buyers, luxury developments should exhibit more resilience and fare better than mass market projects, which could see price declines of 5% in 2024 if rate cuts fail to materialise," says the report.

According to the DBS analysts, Hong Kong-listed property developers are trading at a 60% discount to the current NAV (net asset value). Prolonged interest rate upcycle remains the key investment risk, amongst others.

In April, CK Asset Holdings launched Blue Coast (The Southside Package 3B) in Wong Chuk Hang for pre-sale. According to DBS, the market response was overwhelmingly positive at prices more than 20% lower than the average selling price of the neighbouring La Montagne that was sold in August 2023.

CK Asset Holdings has sold 565 units, or 88% of the total, for over HK$10.4 billion (about S$1.77 billion), making it the best-selling residential project in Hong Kong. Located atop Wong Chuk Hang MTR station, six minutes from Admiralty station by subway, the 1,200-unit The Southside Package 3 is developed in two phases.

"With the return of affluent mainland Chinese buyers, luxury developments should exhibit more resilience and fare better than mass market projects, which could see price declines of 5% in 2024 if rate cuts fail to materialise," says the report.

According to the DBS analysts, Hong Kong-listed property developers are trading at a 60% discount to the current NAV (net asset value). Prolonged interest rate upcycle remains the key investment risk, amongst others.

In April, CK Asset Holdings launched Blue Coast (The Southside Package 3B) in Wong Chuk Hang for pre-sale. According to DBS, the market response was overwhelmingly positive at prices more than 20% lower than the average selling price of the neighbouring La Montagne that was sold in August 2023.

CK Asset Holdings has sold 565 units, or 88% of the total, for over HK$10.4 billion (about S$1.77 billion), making it the best-selling residential project in Hong Kong. Located atop Wong Chuk Hang MTR station, six minutes from Admiralty station by subway, the 1,200-unit The Southside Package 3 is developed in two phases.

The joint venture between Logan Group and KWG Group Holdings sold 14 apartments at The Corniche in Ap Lei Chau for HK$817 million (S$139 million) or HK$27,800 psf (S$4,726 psf) since April.

According to DBS, over half of the transactions in selected developments are from mainland China. Investor demand has resurfaced, and local end-users have shaken off their wait-and-see attitude. As such, there has been a sharp rebound in primary market activities.

For the full year, DBS is projecting that 19,000 primary units will be sold in 2024, up 78% y-o-y.

The joint venture between Logan Group and KWG Group Holdings sold 14 apartments at The Corniche in Ap Lei Chau for HK$817 million (S$139 million) or HK$27,800 psf (S$4,726 psf) since April.

According to DBS, over half of the transactions in selected developments are from mainland China. Investor demand has resurfaced, and local end-users have shaken off their wait-and-see attitude. As such, there has been a sharp rebound in primary market activities.

For the full year, DBS is projecting that 19,000 primary units will be sold in 2024, up 78% y-o-y.