Private home prices drop 1.1% q-o-q in 3Q2024: URA flash estimates

SINGAPORE (EDGEPROP) - Private home prices declined by 1.1% q-o-q in 3Q2024, according to flash estimates released by URA on Oct 1. This is a reversal from the 0.9% q-o-q increase logged the previous quarter.

It marks the first q-o-q drop in private residential property prices since 2Q2023, breaking a streak of four consecutive quarters of growth, says Tricia Song, head of research for Southeast Asia at CBRE. “This is the first time prices have corrected by more than 1% since Q3 2016 which recorded a 1.5% q-o-q fall,” she adds.

A limited number of launches, coupled with the Hungry Ghost Festival and September school holidays contributed to the slump, according to Mohan Sandrasegeran, head of research and data analytics at SRI.

Read also: URA launches tender for Faber Walk GLS residential site

Advertisement

Advertisement

On a cumulative basis, private residential prices have grown 1.1% in the first nine months of the year, a significant moderation from the 3.9% and 8.2% gain over the same period in 2023 and 2022, respectively.

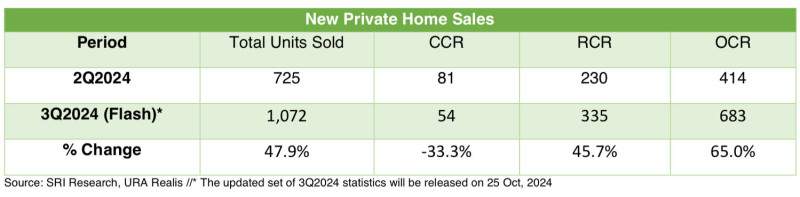

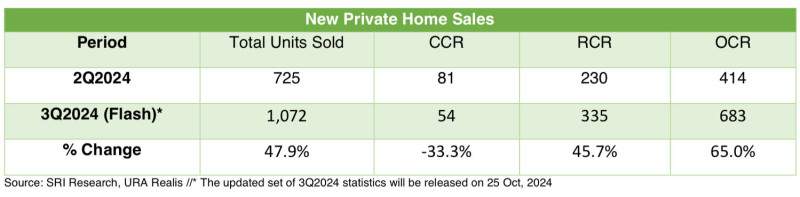

Song notes that the slide in prices come in tandem with developer sales that remain relatively subsdued as weak economic conditions, buyer fatique and increasing resistant to high price points impacted sentiment. A total of 1,054 new private homes excluding executive condominiums were sold in 3Q2024. “While up 45.4% q-o-q from Q2 2024’s low base of 725, this is about half of the five-year quarterly average of 2,214 units,” she points out.

Wong Xian Yang, head of research for Singapore & Southeast Asia at Cushman & Wakefield, adds that performance of new launches have moderated as buyers have become increasingly selective. “Between January to August 2024, only two out of eight major projects (25%) managed to sell more than 50% of their units during their month of launch,” he observes. In comparison, over the same period last year, six out of 14 (43%) major new launches moved more than half their stock within their launch month.

Overall, sales volume fell by about 11% q-o-q in 3Q2024. For the first three quarters of 2024, sales transaction volume dropped by 8.1% from the level over the same period in the previous year.

Across segments, the landed market saw the biggest decline in prices during 3Q2024. Landed property prices fell 3.8% q-o-q, contracting from the 1.9% growth registered in 2Q2024. On the other hand, non-landed private property prices fell by 0.3% q-o-q, reversing from the 0.6% growth the previous quarter.

Among the sub-markets in the non-landed property segment, prices dipped the most in the Core Central Region (CCR). CCR condo prices dropped by 1.5% q-o-q, continuing the 0.3% q-o-q decrease in the previous quarter. In the Outside Central Region (OCR) prices fell 0.1%, compared to an increase of 0.2% q-o-q in the previous quarter.

Read also: Private housing prices further moderates to 1.1% q-o-q growth in 2Q2024; URA flash estimates

Advertisement

Advertisement

In contrast, prices of non-landed properties in the Rest of Central Region (RCR) increased marginally by 0.2% q-o-q – easing from the 1.6% increase in the previous quarter.

For the first three quarters of 2024, CCR, RCR and OCR price were up 1.5%, 2.1% and 0.3% respectively, lower than the 1.9%, 3.1% and 13.7% full-year growth recorded for the regions in 2023. The steep moderation of OCR price growth could be a sign of increasing buyer resistance for OCR home prices which have seen substantial price growth over the last few years, highlights Cushman & Wakefield’s Wong.

Overall, sales volume fell by about 11% q-o-q in 3Q2024. For the first three quarters of 2024, sales transaction volume dropped by 8.1% from the level over the same period in the previous year.

Across segments, the landed market saw the biggest decline in prices during 3Q2024. Landed property prices fell 3.8% q-o-q, contracting from the 1.9% growth registered in 2Q2024. On the other hand, non-landed private property prices fell by 0.3% q-o-q, reversing from the 0.6% growth the previous quarter.

Among the sub-markets in the non-landed property segment, prices dipped the most in the Core Central Region (CCR). CCR condo prices dropped by 1.5% q-o-q, continuing the 0.3% q-o-q decrease in the previous quarter. In the Outside Central Region (OCR) prices fell 0.1%, compared to an increase of 0.2% q-o-q in the previous quarter.

Read also: Private housing prices further moderates to 1.1% q-o-q growth in 2Q2024; URA flash estimates

Advertisement

Advertisement

In contrast, prices of non-landed properties in the Rest of Central Region (RCR) increased marginally by 0.2% q-o-q – easing from the 1.6% increase in the previous quarter.

For the first three quarters of 2024, CCR, RCR and OCR price were up 1.5%, 2.1% and 0.3% respectively, lower than the 1.9%, 3.1% and 13.7% full-year growth recorded for the regions in 2023. The steep moderation of OCR price growth could be a sign of increasing buyer resistance for OCR home prices which have seen substantial price growth over the last few years, highlights Cushman & Wakefield’s Wong.

CBRE’s Song views that while the interest rate cuts and new launches could catalyse a recovery in 4Q2024, a more significant rebound in new developer sales is likely to occur only in 2025, when more clarity is reached on the global economic condition. She expects between 5,000 to 5,500 new homes to be sold in 2024.

Mark Yip, CEO of Huttons, is projecting a similar range of around 5,000 new homes that will be sold by developers this year. “This will be the lowest sales since the Global Financial Crisis in 2008 where only 4,264 units were sold,” he remarks. He anticipates private residential prices will increase between 0% to 2% in 2024.

Read also: Private home prices up 1.5% q-o-q in 1Q2024, transactions down 20%: URA flash

Advertisement

Advertisement

CBRE’s Song views that while the interest rate cuts and new launches could catalyse a recovery in 4Q2024, a more significant rebound in new developer sales is likely to occur only in 2025, when more clarity is reached on the global economic condition. She expects between 5,000 to 5,500 new homes to be sold in 2024.

Mark Yip, CEO of Huttons, is projecting a similar range of around 5,000 new homes that will be sold by developers this year. “This will be the lowest sales since the Global Financial Crisis in 2008 where only 4,264 units were sold,” he remarks. He anticipates private residential prices will increase between 0% to 2% in 2024.

Read also: Private home prices up 1.5% q-o-q in 1Q2024, transactions down 20%: URA flash

Advertisement

Advertisement

Overall, sales volume fell by about 11% q-o-q in 3Q2024. For the first three quarters of 2024, sales transaction volume dropped by 8.1% from the level over the same period in the previous year.

Across segments, the landed market saw the biggest decline in prices during 3Q2024. Landed property prices fell 3.8% q-o-q, contracting from the 1.9% growth registered in 2Q2024. On the other hand, non-landed private property prices fell by 0.3% q-o-q, reversing from the 0.6% growth the previous quarter.

Among the sub-markets in the non-landed property segment, prices dipped the most in the Core Central Region (CCR). CCR condo prices dropped by 1.5% q-o-q, continuing the 0.3% q-o-q decrease in the previous quarter. In the Outside Central Region (OCR) prices fell 0.1%, compared to an increase of 0.2% q-o-q in the previous quarter.

Read also: Private housing prices further moderates to 1.1% q-o-q growth in 2Q2024; URA flash estimates

Advertisement

Advertisement

In contrast, prices of non-landed properties in the Rest of Central Region (RCR) increased marginally by 0.2% q-o-q – easing from the 1.6% increase in the previous quarter.

For the first three quarters of 2024, CCR, RCR and OCR price were up 1.5%, 2.1% and 0.3% respectively, lower than the 1.9%, 3.1% and 13.7% full-year growth recorded for the regions in 2023. The steep moderation of OCR price growth could be a sign of increasing buyer resistance for OCR home prices which have seen substantial price growth over the last few years, highlights Cushman & Wakefield’s Wong.

Overall, sales volume fell by about 11% q-o-q in 3Q2024. For the first three quarters of 2024, sales transaction volume dropped by 8.1% from the level over the same period in the previous year.

Across segments, the landed market saw the biggest decline in prices during 3Q2024. Landed property prices fell 3.8% q-o-q, contracting from the 1.9% growth registered in 2Q2024. On the other hand, non-landed private property prices fell by 0.3% q-o-q, reversing from the 0.6% growth the previous quarter.

Among the sub-markets in the non-landed property segment, prices dipped the most in the Core Central Region (CCR). CCR condo prices dropped by 1.5% q-o-q, continuing the 0.3% q-o-q decrease in the previous quarter. In the Outside Central Region (OCR) prices fell 0.1%, compared to an increase of 0.2% q-o-q in the previous quarter.

Read also: Private housing prices further moderates to 1.1% q-o-q growth in 2Q2024; URA flash estimates

Advertisement

Advertisement

In contrast, prices of non-landed properties in the Rest of Central Region (RCR) increased marginally by 0.2% q-o-q – easing from the 1.6% increase in the previous quarter.

For the first three quarters of 2024, CCR, RCR and OCR price were up 1.5%, 2.1% and 0.3% respectively, lower than the 1.9%, 3.1% and 13.7% full-year growth recorded for the regions in 2023. The steep moderation of OCR price growth could be a sign of increasing buyer resistance for OCR home prices which have seen substantial price growth over the last few years, highlights Cushman & Wakefield’s Wong.

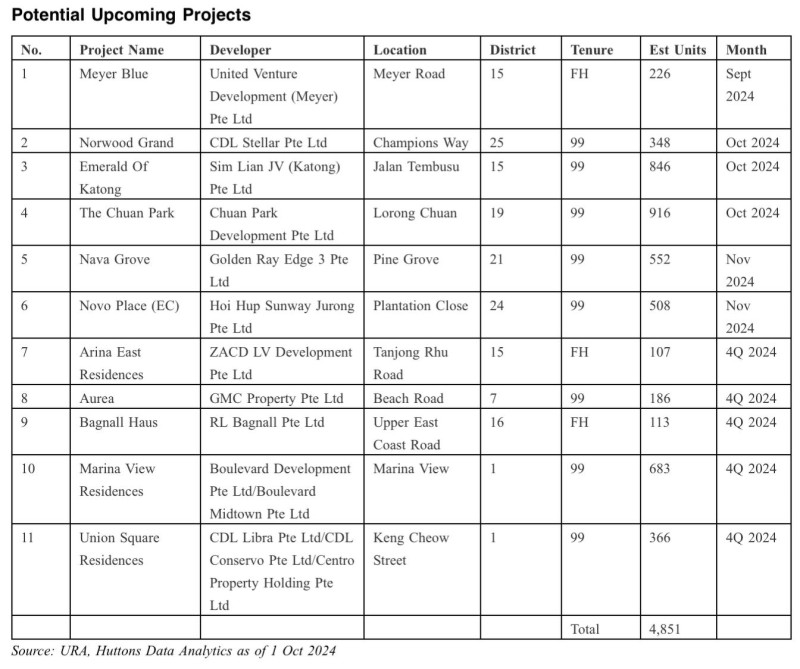

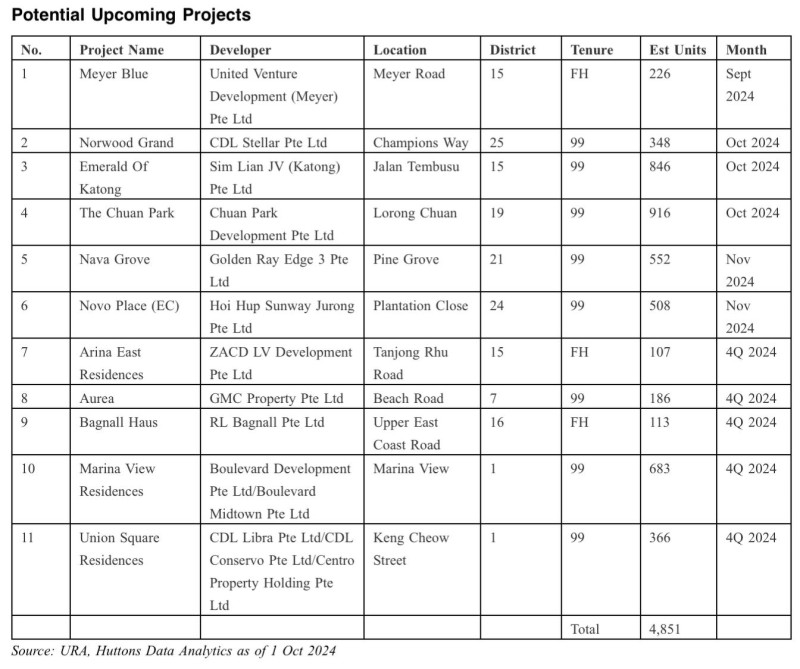

Interest rate cut, new launches to support prices

Looking ahead, the recent larger-than-expected interest rate cut by the US Federal should boost sentiment, notes SRI’s Sandrasegeran. “As economic conditions stabilise and financing options become more favorable, we anticipate renewed buyer confidence and an increase in transactions in the near future,” he adds. A number of project launches are expected in 4Q2024, including the 348-unit Norwood Grand, 226-unit Meyer Blue, the 552-unit Nava Grove, and the 504 units Novo Pace EC in Tengah. “With more project launches coming up in 4Q2024, we think private home prices could find some support, as new home sales tend to boost overall prices,” says Ismail Gafoor, CEO of PropNex Realty. CBRE’s Song views that while the interest rate cuts and new launches could catalyse a recovery in 4Q2024, a more significant rebound in new developer sales is likely to occur only in 2025, when more clarity is reached on the global economic condition. She expects between 5,000 to 5,500 new homes to be sold in 2024.

Mark Yip, CEO of Huttons, is projecting a similar range of around 5,000 new homes that will be sold by developers this year. “This will be the lowest sales since the Global Financial Crisis in 2008 where only 4,264 units were sold,” he remarks. He anticipates private residential prices will increase between 0% to 2% in 2024.

Read also: Private home prices up 1.5% q-o-q in 1Q2024, transactions down 20%: URA flash

Advertisement

Advertisement

CBRE’s Song views that while the interest rate cuts and new launches could catalyse a recovery in 4Q2024, a more significant rebound in new developer sales is likely to occur only in 2025, when more clarity is reached on the global economic condition. She expects between 5,000 to 5,500 new homes to be sold in 2024.

Mark Yip, CEO of Huttons, is projecting a similar range of around 5,000 new homes that will be sold by developers this year. “This will be the lowest sales since the Global Financial Crisis in 2008 where only 4,264 units were sold,” he remarks. He anticipates private residential prices will increase between 0% to 2% in 2024.

Read also: Private home prices up 1.5% q-o-q in 1Q2024, transactions down 20%: URA flash

Advertisement

Advertisement