New World Scion’s Fall Upends Succession at $23 Billion Dynasty

Even by the standards of big-money Hong Kong, K11 Musea, a glittering marvel dubbed the “Silicon Valley of Culture,” stands apart for its lavishness.

It took Adrian Cheng, scion of one of the city’s richest families, 10 years and $2.6 billion to bring to life his vision for the ornate art-and-luxury-retail galleria on harbour-front property passed down from his grandfather to his father and finally to him.

Now, a mere half-decade later, Cheng’s daring dream for his family’s New World Development Co - and for himself - has come crashing down.

Looking to invest in overseas properties? Explore projects available for sale around the world

Advertisement

Advertisement

To the shock of upper-crust Hong Kong, Cheng, 44, has abruptly stepped aside as the third-generation leader of New World, a pillar of one of Asia’s great business dynasties. For now, he’s been replaced by the company’s chief operating officer – someone who isn’t a member of the multibillionaire Cheng family. Shares of New World soared as much as 17% on Friday following the announcement.

K11 Musea, a glittering marvel dubbed the “Silicon Valley of Culture (Photo: Lam Yik/Bloomberg)

New World insiders are stunned. Close colleagues had caught wind of something. But Hong Kong’s real estate families, which have long ranked among the city’s richest and most influential power-players, rarely hand over to outsiders.

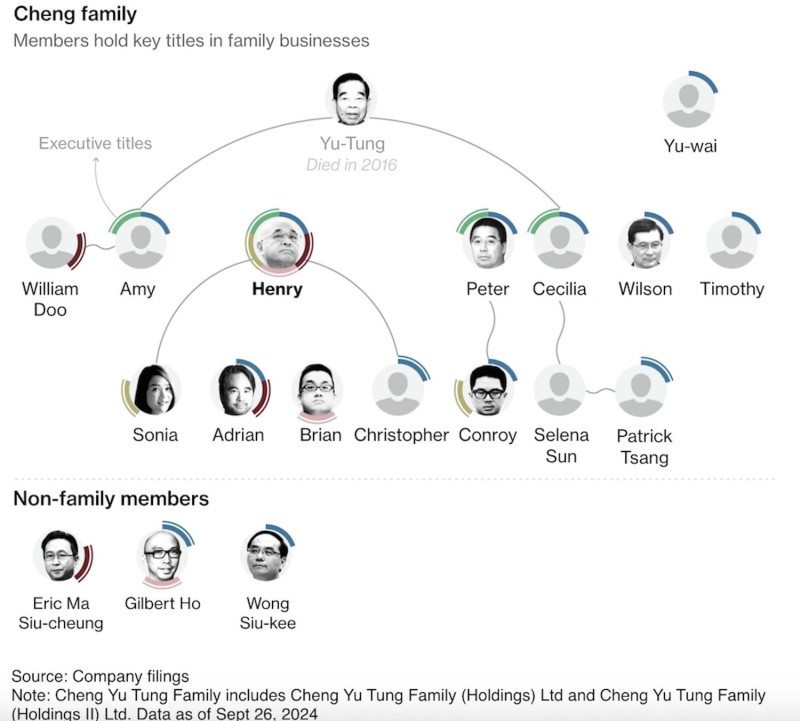

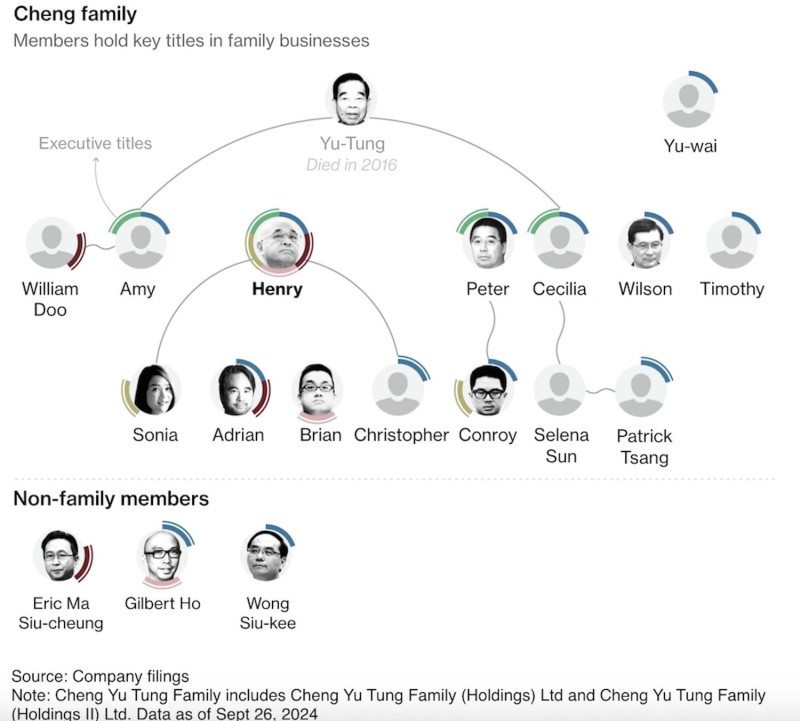

Behind the scenes, Cheng’s 77-year-old father, Henry Cheng, has stepped into the fray and reassumed a hands-on role at the family’s sprawling empire, including New World, according to people familiar with the matter. After elevating his eldest son only to watch him lose billions, the family patriarch has assigned key parts of the business group to his daughter Sonia, 43; second son Brian, 41; and third son Christopher, 35.

The unfolding drama underscores how Hong Kong’s weakening real estate market is rippling through the city’s economy and all the way up to its billionaires. As the market began to soften – home prices have fallen roughly 25% from their peak in 2021 – members of the Cheng family had grown increasingly concerned about their young CEO’s stewardship of their business. They are intent on disproving the ancient Chinese proverb, “Wealth doesn’t pass three generations.”

In his time atop New World, Adrian Cheng, a Harvard-educated “it” boy of the Hong Kong art scene, struggled to prove himself in business the way his late grandfather and, eventually, his father did. His grandfather, New World founder Cheng Yu-Tung, a former gold shop apprentice, went on to become one of richest people in Hong Kong. He handed his business to his eldest son Henry, who initially drove New World deep into debt, much the way his own eldest son would decades later. Cheng Yu-Tung stepped back in to fix things. Side by side, father and son pulled it off: Today the Cheng family is worth $22.6 billion, making them one of the richest families in Asia, according to the Bloomberg Billionaires Index.

Credit: Bloomberg

But New World has gotten into trouble since Adrian Cheng was elevated to chief executive officer in 2020, four years after his grandfather died. During his tenure, New World has sunk deeper into debt than any other major Hong Kong property developer, with net debt to equity at over 80% as of the end of 2023, according to Bloomberg Intelligence. It also has posted its first annual net loss – the equivalent of $2.5 billion — in 20 years.

Read also: New World promotes Eric Ma to CEO, replacing Adrian Cheng after reporting HK$19.7 billion loss

Advertisement

Advertisement

“Third-generation successors of large family empires are typically under tremendous pressure,” said Marlen Dieleman, professor of family business at IMD Business School in Singapore. “In particular, if they face economic headwinds, high expectations from family members and significant visibility in the business community.”

As New World’s fortunes turned, along with the rest of the Hong Kong property market, members of the Cheng family began to express concern that Adrian Cheng — Henry’s eldest son — was spending too much time on cultural pursuits, including those involving K11 Musea, according to people familiar with the matter. In a television interview last year, Henry Cheng said he was still looking for a successor, even though by that time Adrian had been CEO for several years.

Representatives for Chow Tai Fook Enterprises Ltd, the private investment vehicle of Henry Cheng's family, as well as for Adrian Cheng and New World, didn’t respond to requests for comment.