In Apac’s living sector, Singapore’s co-living gain investor interest: CBRE

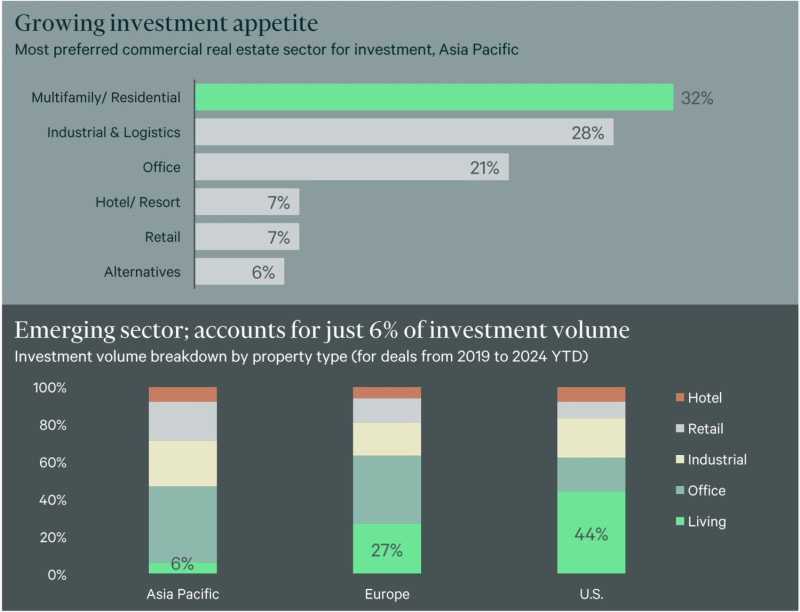

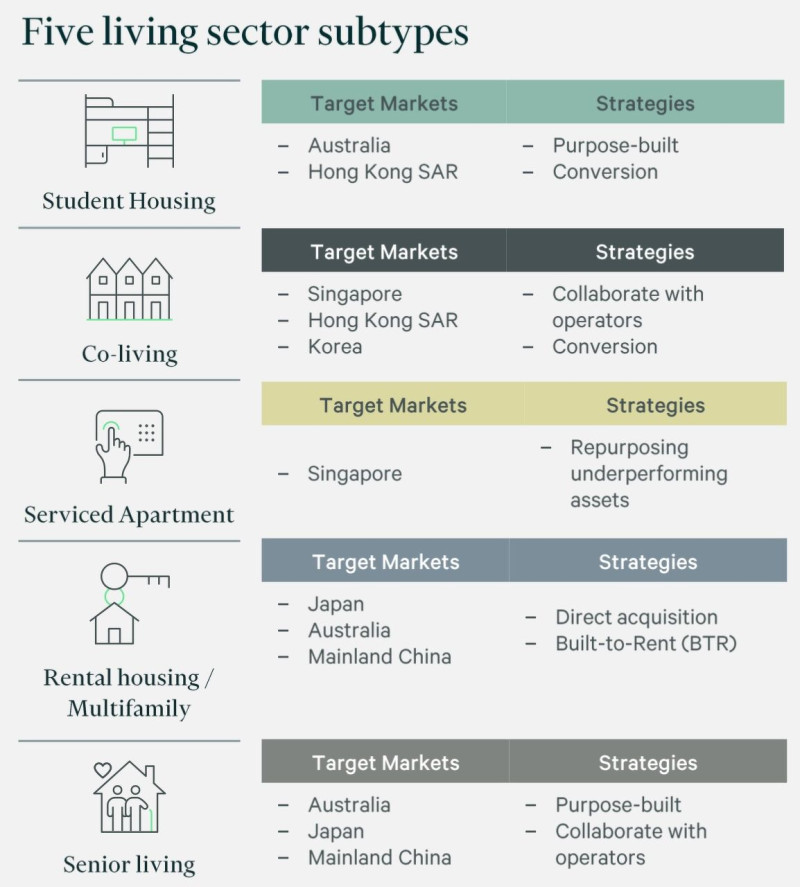

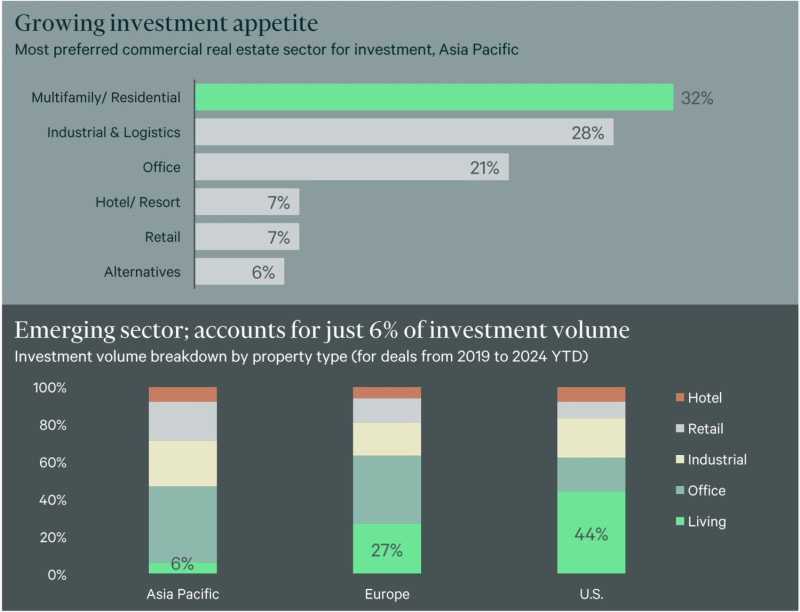

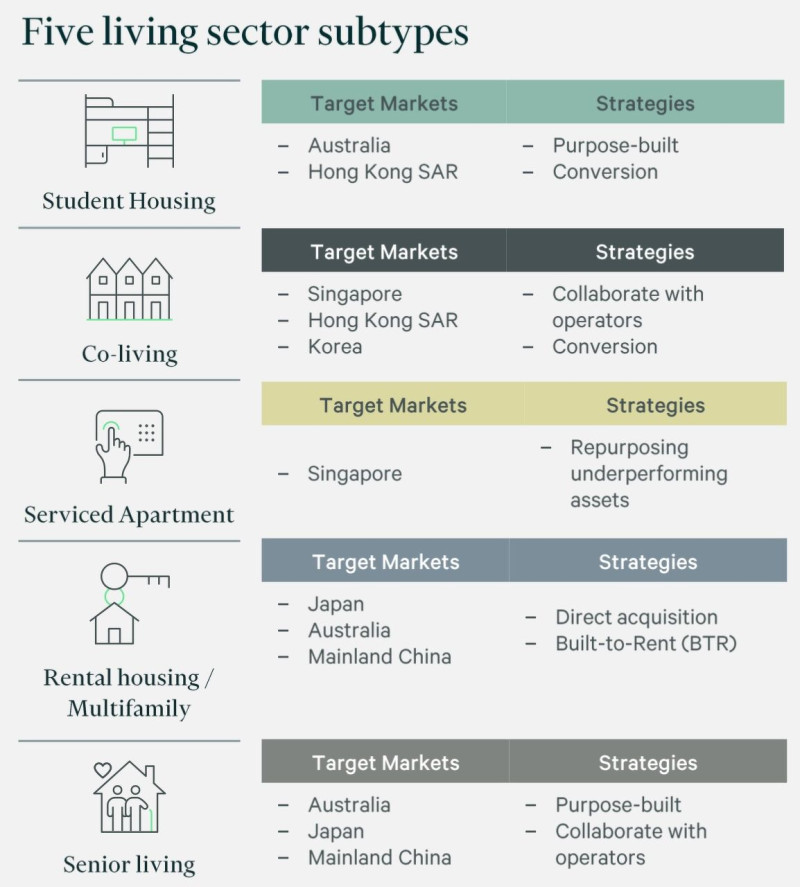

Despite a slowdown in global economic growth and elevated interest rates, fundamentals in the living sector have remained robust. It has, in turn, spurred investor interest in multifamily/rental housing and other types of living assets, such as student housing, co-living, serviced apartments and senior living.

"With strong market fundamentals and resilient demand, the living sector offers institutional investors and private equity fund managers the opportunity to diversify their portfolio," says Greg Hyland, head of capital markets, Asia Pacific, for CBRE.

In Hong Kong SAR, Singapore, and South Korea, the living sector is attracting increasing attention, particularly for more niche co-living and student housing subtypes, according to CBRE's latest research report on the living sector, published on Sept 16.

Read also: Kenwa Corp wins SLA tender for co-living properties on Hindoo Road, with top bid of $52,000

Advertisement

Advertisement

CBRE attributes the increased interest to an influx of foreigners and expatriates, an increasing preference for renting over buying, and rising rents.

Source: CBRE Research

Source: CBRE Research

Since LHN purchased its first property in 2020, the Coliwoo brand has grown to lead the Singapore market with 2,401 keys managed as of June 2024 (Photo: Samuel Isaac Chua/EdgeProp Singapore)

Still nascent stage

Unlike in the US and Europe, where the living sector accounts for 44% and 27% of total commercial real estate investments since 2019, it accounts for just 6% in Asia Pacific over the same period. Therefore, Asia Pacific's living sector is still at a nascent stage when compared to Europe and the US, where the living sector is at a more mature stage of development. It also suggests "plenty of room for further growth", says CBRE. Japan, Australia and mainland China are Asia Pacific's largest investment volumes in the living sector. Japan's multifamily sector is the most mature market in the region, with institutional capital, REITs, and foreign players having established a presence. Australia and mainland China, the second and third biggest living sector investment markets, have seen more interest in rental housing or Build-to-Rent (BTR) facilities. In Hong Kong SAR, a popular entry strategy for investors to gain access to its rental housing market in recent years has been to acquire hotels. While opportunities for hotel conversions may have declined as Hong Kong's tourism industry gradually recovers, investors continue to explore ways to enter the sector and tap into growing rental demand from international students and expatriate working professionals. Read also: TS Group-TAP JV submits top bid of $102,888/mth for Henderson Rd senior co-living site Advertisement Advertisement

Non-resident population make up 30%

In Singapore, some 30% of its 5.9 million population are non-residents. Historically, rental housing demand has been driven by expatriates, mainly working professionals with S or Employment Passes. Following a two-year decline due to pandemic-related lockdowns and travel restrictions, the expatriate population recovered to 383,900 in 2023, approaching the pre-pandemic 2019 level of 393,700. While many still rent private or public apartments, more are turning to co-living options following a 50% rental growth from 2021-2023 and for flexibility and community elements, says CBRE. The foreign student population has been recovering slowly since the pandemic. According to the Ministry of Education and Immigration and Checkpoint Authority data, the number of foreign student pass holders in Singapore fell 13%, from 68,200 in April 2020 to 59,100 in April 2021. By January 2022, this number had risen to 63,600 and grew 25% to 79,300 by January 2023. Over 80% of the resident population live in HDB flats, with home ownership among the highest in the world at 90%. Singaporeans typically live at home until they marry and become eligible to purchase a subsidised public housing flat. Attitudes have recently shifted in favour of renting, fuelled by higher rates of singlehood and changing lifestyle preferences. Some couples are opting for short-term rentals due to lower upfront costs and the long waiting period for public housing. Read also: LHN’s Coliwoo to launch two new co-living properties in River Valley Advertisement Advertisement

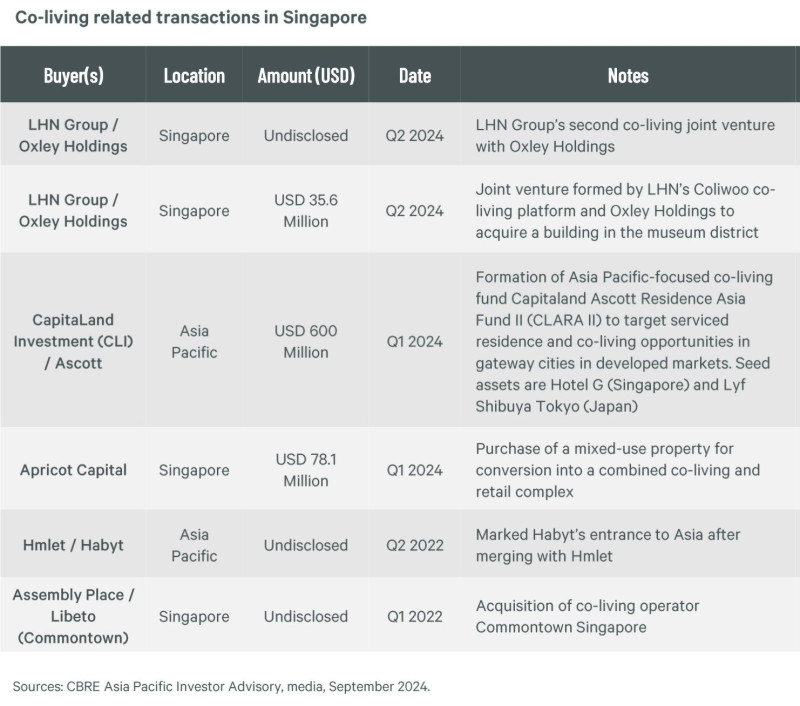

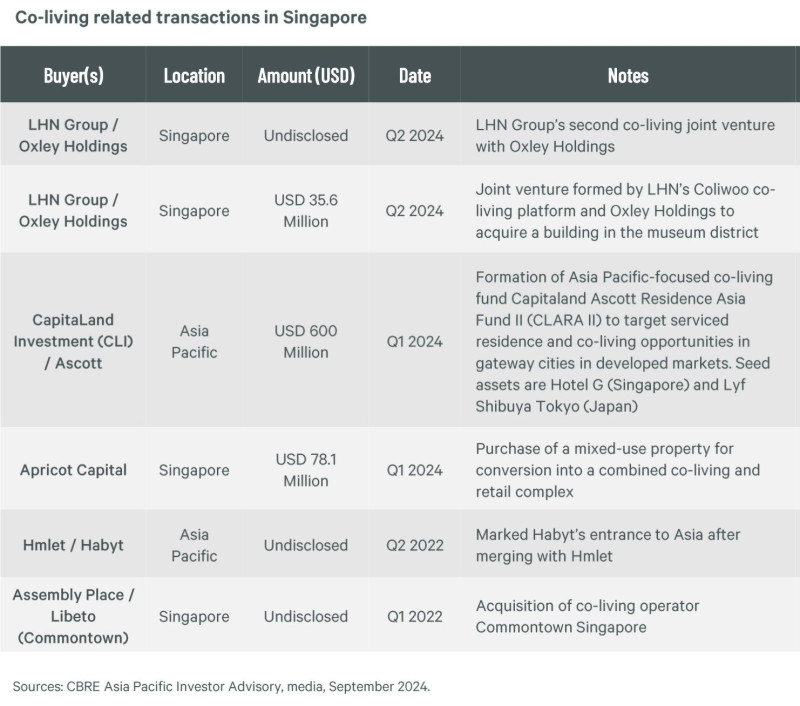

M&A

The maturing co-living sector in Singapore is attracting more investor interest, says CBRE. M&A is a common strategy key players employ to expand their market share. In 2022, local player The Assembly Place acquired the property assets of Libeto, another Singapore-based co-living start-up. The same year, another homegrown brand, Hmlet, was acquired by European co-living company Habyt and rebranded Habyt in July 2023. Traditional developers and hospitality players are joining the fray. CapitaLand's hospitality division, Ascott, launched its co-living brand Lyf in its Funan redevelopment in 2019 and expanded its Singapore portfolio to four assets by July 2024. Its latest asset is the conversion of the former Hotel G to Lyf Bugis. Since Singapore-listed property group LHN purchased its first property in 2020, the Coliwoo brand has grown to lead the Singapore market with 2,401 keys managed as of June 2024. LHN's strategy has been to acquire older commercial buildings and shophouses and repurpose them into co-living or serviced apartments. Private equity capital is partnering with local operators. Pincus-backed Weave Living recently partnered with BlackRock to purchase the 154-room serviced apartment complex, Citadines Mount Sophia. It follows the opening of Weave Living's maiden Singapore property, the 65-room Weave Suites Midtown, in March 2023. It was a repositioning of the former Clover Hotel, which occupied a row of shophouses.

Government initiatives

Singapore has no legal and regulatory framework governing co-living property, with prevailing minimum stay durations largely tied to land zoning. The government is also supportive of more institutional investment in the living sector. Recognising the rising demand for flexible accommodation and limited new supply, the authorities have introduced a range of initiatives in recent years. The Singapore Land Authority (SLA)'s ongoing tender of state properties for rent has included sites for repurposing into co-living spaces or serviced apartments. Launched under a 50-50 price and quality tender, seven such sites have been released or awarded. Given the unique nature of the sites, which are often heritage sites with historical significance, these tenders have attracted robust interest from existing co-working operators. Another government initiative is the introduction of long-stay serviced apartments (SA2) sites under the URA's government land sales programme. These hybrid sites combine SA2 units, which require a minimum stay of three months (the minimum stay for private residential property), with conventional housing. However, developers' response has been lukewarm, likely due to their untested nature and the higher initial capital expenditure required to integrate a serviced apartment component.