Jurong Lake District master developer site not awarded; $640 psf ppr bid deemed 'too low'

URA announced on September 13 that the 6.5 ha master developer site at Jurong Lake District (JLD) has not been awarded. Launched for sale on June 22, 2023, the site was envisioned to be "the catalyst to kickstart the next phase of development in JLD".

The tender for the JLD site closed on March 26, 2024, with a sole bid from a consortium of developers that submitted two concept proposals. The consortium comprised five developers -- CapitaLand Group, City Developments Ltd (CDL), Frasers Property, Mitsubishi Estate Co. and Mitsui Fudosan Co. Ltd. CapitaLand, CDL and Frasers Property took a 25% stake each, while Mitsubishi Estate and Mitsui Fudosan assumed a 12.5% stake each.

"After evaluating both concept proposals, one of the proposals was thereafter shortlisted," says URA. "However, the tender has not been awarded as the shortlisted concept, at the tendered price of $6,888.90 psm of GFA [gross floor area], was assessed to be too low." The price of $6,888.90 psm of GFA translates to $640 psf per plot ratio (ppr).

Get the latest details on available units and prices for Sora

Advertisement

Advertisement

The master developer site at JLD will now be placed on the Reserve List under the concept and price revenue tender approach, subject to a minimum price acceptable to the government.

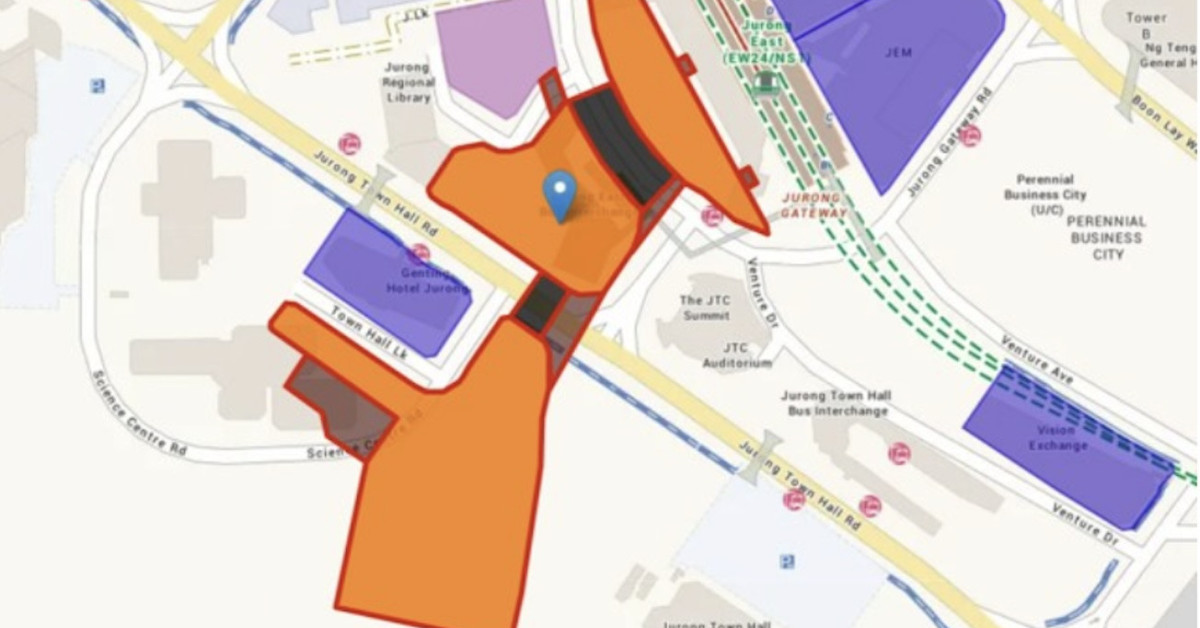

The JLD master developer site is made up of three sites next to the Jurong East MRT Interchange station and the upcoming J'den by CapitaLand Development, one of the joint bidders of the site (Photo: Samuel Isaac Chua/EdgeProp Singapore)

The 440-unit Sora is 24% sold since its launch in July, with prices averaging $2,161 psf (Photo: Samuel Isaac Chua/EdgeProp Singapore)

The 306-unit The LakeGarden Residences entered the market in August last year and is 57% sold, with prices averaging $2,155 psf this year (Photo: Samuel Isaac Chua/EdgeProp Singapore)

Ask Buddy

What is the buyer profile for The Lakegarden Residences?

Most unprofitable landed transactions in past 1 year

Recently launched projects

Compare price trend of New sale condo vs Resale condo

Condo transactions with the highest profits in the past year

What is the buyer profile for The Lakegarden Residences?

Most unprofitable landed transactions in past 1 year

Recently launched projects

Compare price trend of New sale condo vs Resale condo

Condo transactions with the highest profits in the past year

Ask Buddy

What is the buyer profile for The Lakegarden Residences?

Most unprofitable landed transactions in past 1 year

Recently launched projects

Compare price trend of New sale condo vs Resale condo

Condo transactions with the highest profits in the past year

What is the buyer profile for The Lakegarden Residences?

Most unprofitable landed transactions in past 1 year

Recently launched projects

Compare price trend of New sale condo vs Resale condo

Condo transactions with the highest profits in the past year

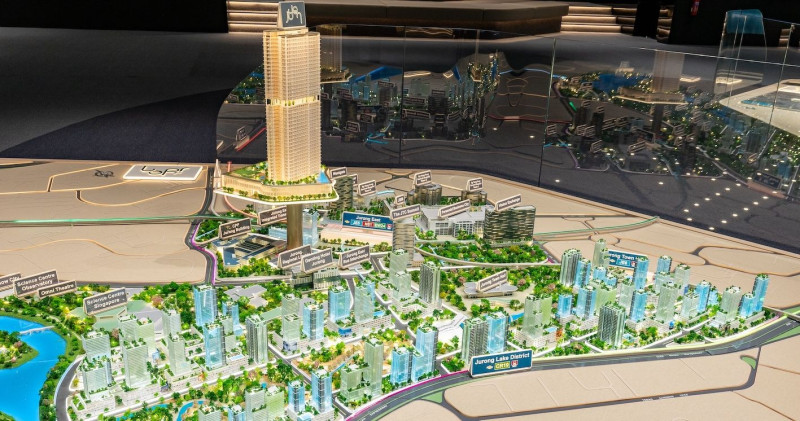

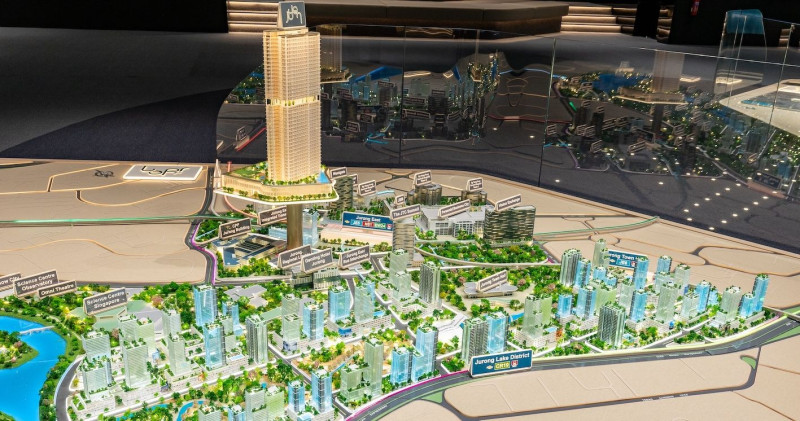

‘Not surprised’

The white site at Jurong Lake District can yield over 1.6 million sq ft of office space, 1,760 private residential units and 807,300 sq ft GFA of complementary uses such as retail, hotel or community use. While the site is supposed to be developed progressively over the next five to 10 years to cater to market demand, the successful tenderer was required to build at least 70,000 sqm (753,480 sq ft) GFA of office space and 600 private housing units as part of the first phase of the development. "We are not surprised that the URA has decided not to award the JLD master developer site," says Wong Siew Ying, PropNex head of research and content. According to Wong, there were two other white sites sold in Jurong East: Boon Lay Way (Westgate), awarded for $1,012 psf ppr in May 2011; and Jurong Gateway Road (JEM), awarded for nearly $650 psf ppr in June 2010. "Going by the recent residential land tenders elsewhere, and other white sites sold in the area, the tendered price of $640 psf ppr would come off as low," she adds.

Pricing in uncertainty, risks

Developers could have submitted a cautious bid in view of the high financing cost, the large size of the development, the cautious market sentiment, and potential risks that may come with being committed to a 10-15 year project, comments Wong. "There may also be other costs related to master-planning the development, including the implementation of district-level urban solutions such as a district cooling system and district pneumatic waste conveyancing system." Read also: URA launches tender for Faber Walk GLS residential site Advertisement Advertisement Risks include a long gestation period to recoup the huge outlay, according to Mark Yip, CEO of Huttons Asia. "The pandemic has affected the demand for office space, and the market is still going through a period of adjustment," he adds. "It is unclear whether there is sufficient demand for the 1.57 million sq ft of office space in the next 10 years." If the high-speed rail (HSR) between Singapore and Kuala Lumpur is confirmed, it may help with accelerating the development of JLD, says Yip. "Faced with high costs and huge uncertainty in developing a 6.5 ha site, these risks will have to be priced in, thus leading to a land price of $640 psf ppr."

‘Medium-term relief’

After considering many factors, including the soft office market, relatively volatile interest rate expectations between March and now, construction cost uncertainties, and developers' low-risk appetites, "pushing through the decentralised vision regardless of land pricing may not be the best idea for now", remarks Tricia Song, CBRE head of research for Southeast Asia. Not awarding the site at JLD will provide "a medium-term relief" to the islandwide office supply, as some 0.7 million sq ft of potential JLD phase one office stock will be pushed back beyond 2030, adds Song. However, the impending supply is not going to go away entirely "as the government remains committed to JLD". The master developer site comprises three sites right at the heart of the JLD. It is near the Singapore Science Centre, Genting Hotel Jurong, JEM, Westgate, and the IMM mall. New homes in JLD are expected to see healthy interest from buyers, says PropNex. For instance, J'den sold about 88% of its 368 units on launch day when it hit the market in November 2023. The project is about 93% sold, with prices averaging around $2,561 psf in 2024, based on caveats lodged. Two other projects were launched in the Yuan Ching Road neighbourhood of JLD. According to caveats lodged, the 440-unit project was launched in July and is 24% sold at an average price of $2,161 psf. The 306-unit The LakeGarden Residences entered the market in August last year and is 57% sold. The latest average price based on caveats lodged is $2,155 psf. Read also: Tender for EC site at Tampines St 95 launched Advertisement Advertisement "Buyers who want to stay in JLD can consider existing projects like J’den, Sora, and The Lakegarden Residences," says Huttons' Yip. Check out the latest listings for J'den, Sora, The Lakegarden Residences properties Ask Buddy

What is the buyer profile for The Lakegarden Residences?

Most unprofitable landed transactions in past 1 year

Recently launched projects

Compare price trend of New sale condo vs Resale condo

Condo transactions with the highest profits in the past year

What is the buyer profile for The Lakegarden Residences?

Most unprofitable landed transactions in past 1 year

Recently launched projects

Compare price trend of New sale condo vs Resale condo

Condo transactions with the highest profits in the past year

Ask Buddy

What is the buyer profile for The Lakegarden Residences?

Most unprofitable landed transactions in past 1 year

Recently launched projects

Compare price trend of New sale condo vs Resale condo

Condo transactions with the highest profits in the past year

What is the buyer profile for The Lakegarden Residences?

Most unprofitable landed transactions in past 1 year

Recently launched projects

Compare price trend of New sale condo vs Resale condo

Condo transactions with the highest profits in the past year