Developers find hope in strata-titled food factories as investor appetite grows

Singaporeans love eating out or ordering takeout via delivery service apps. According to a recent survey, only 22% of Singaporean households cook at home. Rakuten Insight found that 24% of Singaporeans dine out or buy outside meals daily, while 48% do so several times a week.

The demand for outside meals has spurred demand for food factories in Singapore. "Due to labour shortage and high rents in commercial spaces, most F&B outlets cannot afford to allocate too much space for kitchens," says Lim Yew Soon, managing director of EL Development. "To save on kitchen space and reduce the number of kitchen staff, they outsource the bulk of the cooking process to food factories."

Sensing the demand early on, EL Development launched its first strata-titled, multi-user food factory project — Jurong Food Hub — in the western region in November 2008. The six-storey, 128-unit, ramp-up food factory is near Jurong Fishery Port Road. EL Development purchased the 23-year leasehold site (with effect from 2008) via a JTC industrial government land sale (IGLS) tender in 2007. The project was completed in 2010.

Despite the short lease, all the units at Jurong Food Hub were entirely sold by early 2011. The latest resale transaction was in June 2022, when a 2,648 sq ft unit on the sixth floor changed hands for $600,000 ($227 psf) based on a caveat lodged.

Artist’s impression of the 114-unit, freehold Food Vision @ Mandai by EL Development and Sim Lian Group, which is 40% sold and scheduled to be completed next year

Artist’s impression of the 125-unit, 60-year leasehold Food Ascent at Tuas South, which is 73% sold to date (Source: Soilbuild Group)

Artist’s impression of Smart Food @ Mandai, where a VIP preview was held in January, and 30% of the 84 freehold units have been sold (Picture: Smartisan Realty)

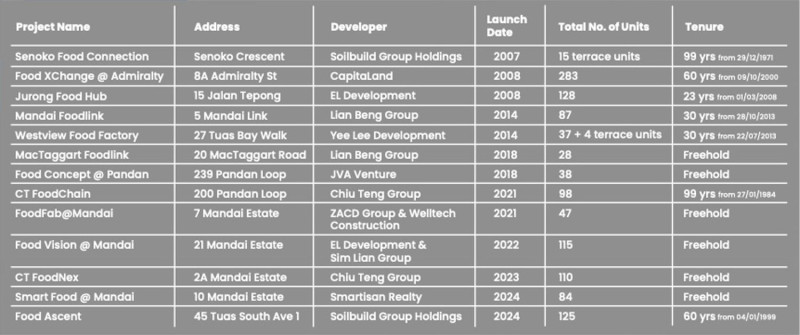

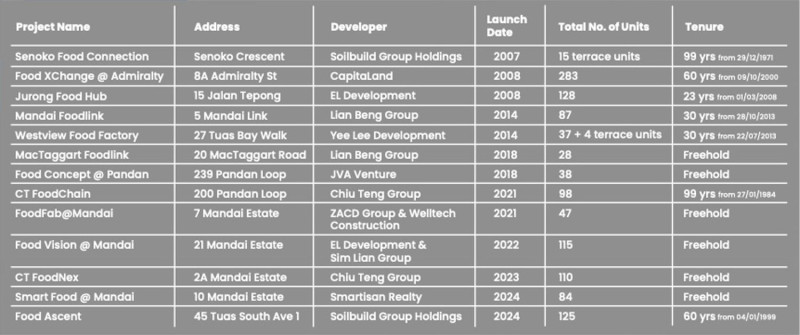

Sources: Developers, EdgeProp Singapore

While most buyers of CT FoodNex were single-unit buyers, several were multiple-unit purchasers who bought two or three units, including one who bought an entire floor of 12 units, commented Jerome Ng, director of business development at Chiu Teng Group, following the launch last year. About 90% of the buyers were Singaporeans, and the remaining 10% were foreigners.

In April 2023, Smartisan Realty purchased two adjoining freehold industrial sites at 10 and 12 Mandai Estate for $100 million. It marked the developer's maiden foray into the strata-titled, multi-user factory space.

The new development — Smart Food @ Mandai — is a 10-storey, freehold, ramp-up factory building with 84 strata-titled factory units for sale. In January, the developer held a VIP preview for Smart Food @ Mandai, and about 30% of the units were sold.

Many of the buyers are end-users who intend to use the space as a central kitchen or a cold room, says Roy Ang, head of marketing at Smartisan Realty.

According to Smartisan's Ang, the long-term potential of Mandai Estate's location is its proximity to the Sungei Kadut Eco-District. A master-planned rejuvenation initiative, the precinct will feature new developments, such as the Agri-Food Innovation Park and Kranji Green, which will cater to food technology companies.

In May, the last site at the former BHL Factories, 2C Mandai Estate, was sold to a joint venture between Unitedland Development and Ding Zhou Group. The 50,630 sq ft, freehold site fetched $74 million. Provisional approval from URA has been obtained for the redevelopment of the site into a new strata-titled food factory project. The new project is expected to be launched next year.

The food factory of BreadTalk IHQ in Tai Seng, which is now owned by Lian Beng Group (Photo: Samuel Isaac Chua/EdgeProp Singapore)

Food Vision @ Mandai

In 2022, EL Development and Sim Lian Group decided to jointly redevelop their adjacent ageing freehold industrial buildings in Mandai Estate in the northern region. The new, 10-storey, freehold, ramp-up food factory — Food Vision @ Mandai — has 115 strata-titled units for sale. Since its launch in late 2022, about 40% of the units at Food Vision @ Mandai have been sold. Based on caveats lodged, units of around 1,722 sq ft each were sold at an average of $1,434 psf. The project is targeted for completion next year. According to EL Development's Lim, most of the buyers were end-users looking for a central kitchen or food-processing space. More investors have been eyeing food factories, switching from residential properties since the property cooling measures of April 2023, when additional buyer’s stamp duty for foreigners and corporate entities were increased. Another developer who is also a first-mover in the food factory space is Soilbuild Group Holdings. Its first multi-user food factory was Senoko Food Connection at Senoko Crescent, off Admiralty Road West in Sembawang. Completed in 2006, Senoko Food Connection has 15 strata terraced factory units with a 99-year lease from 1971. All the units were snapped up within a few months of its launch in early 2007. The latest transaction was the resale of a 21,022 sq ft, strata terraced unit that fetched $3.04 million ($145 psf) in February 2023.

Food Ascent in Tuas

Last year, Soilbuild acquired Tuas Vista, an old industrial building in the western region. Soilbuild is redeveloping the property into a new eight-storey, multi-user, ramp-up factory building named Food Ascent. It will have 125 strata-titled units with a 60-year lease from 1999. According to Soilbuild, 73% of the units at Food Ascent have been taken up since its launch in February. Based on caveats lodged, units sold have ranged from $1.072 million ($498 psf) for a 2,153 sq ft unit on the eighth floor to $2.067 million ($750 psf) for a 2,766 sq ft unit on the first level. "There is strong interest as Food Ascent is strategically located between the Tuas Mega Port and Tuas Second Link, which serves as a seamless gateway for international exports and imports," says Lim Han Qin, director of Soilbuild Group Holdings. He adds that the property is also close to the Tuas Viaduct, which connects to the Ayer Rajah, Pan Island, and Kranji expressways. Lim also believes there is a growing demand for such strata-titled food factories, which are limited in supply. At Food Ascent, the buyers are a good mix of business owners and investors.

Mandai Estate

Lian Beng Group was one of the first developers to launch a strata-titled, multi-user food factory in the Mandai industrial estate in the northern region. The project — Mandai Foodlink — is an 87-unit, 11-storey building at Mandai Link. The site was purchased through a IGLS tender and has a 30-year lease from 2013. The project was launched in November 2014, completed in 2017, and fully sold by 2018. Other developers have jumped on the bandwagon. It has led to a flurry of new strata-titled, multi-user, food factory developments launched in Mandai in recent years. In 2021, Hong Kong-listed ZACD Group and Welltech Construction jointly launched the 47-unit FoodFab@Mandai in Mandai Estate. The 8-storey, freehold, strata-titled food factory is substantially sold at prices ranging from $2.095 million ($1,125 psf) for a 1,862 sq ft unit on the ninth floor to $4.976 million ($1,700 psf) for a 2,928 s ft unit on the second floor. The highest psf price achieved was $2,077 psf in September 2022, when a 2,142 sq ft unit on the first level fetched $4.45 million. In July 2022, Chiu Teng Group purchased the former BHL Factories site at 2A and 2B Mandai Estate for $130 million. The 80,288 sq ft, freehold site is being redeveloped into CT FoodNex — a 10-storey, freehold, ramp-up food factory with 110 units. Launched in May 2023, CT FoodNex's units, which range from 1,700 to 2,928 sq ft, were priced from $2.5 million. Within the first week of launch, 61 units (56%) were taken up at an average price of $1,545 psf. To date, close to 80% have been sold.Strata Industrial Food Factories

Tai Seng area

Tai Seng Business Hub is another industrial area that has become a sought-after food factory location. In 2021, a Lian Beng Group-led consortium purchased BreadTalk IHQ on Tai Seng Street for $118 million. BreadTalk IHQ is within walking distance of Tai Seng MRT Station on the Circle Line, as well as F&B, banking and lifestyle amenities. In 2022, Lian Beng acquired a unit of Food Empire Holdings, which holds the freehold, 11-storey industrial building at 31 Harrison Road in the Tai Seng area. The property sits just behind the Lian Beng Building, the company's headquarters. Shaun Poh, head of capital markets at Cushman & Wakefield, who brokered the deal, says that a long-term plan would be to amalgamate Food Empire Building with LIan Beng’s own headquarters and redevelop the combined site into a multi-user food factory. Last November, the freehold Noel Building on Playfair Road was enbloc for $81.18 million. The buyer was Apex Asia Development, founded by chairman Li Jun, the former managing director of Qingjian Realty. Apex Asia intends to redevelop the building into a new strata-titled food factory for sale. Swee Shou Fern, head of investment advisory at Edmund Tie, who brokered the deal, says the Noel Building is within 400m of Tai Seng MRT Station. "The outlook for food factories is positive due to the growth and transformation driven by rising consumerism in Asia," observes Soilbuild's Lim. "With many global food manufacturing brands and startups choosing Singapore as their testing ground for new products, we believe there is sufficient demand to meet the new supply."