Average land betterment charges up 2.8% for landed, down 5.4% for non-landed housing

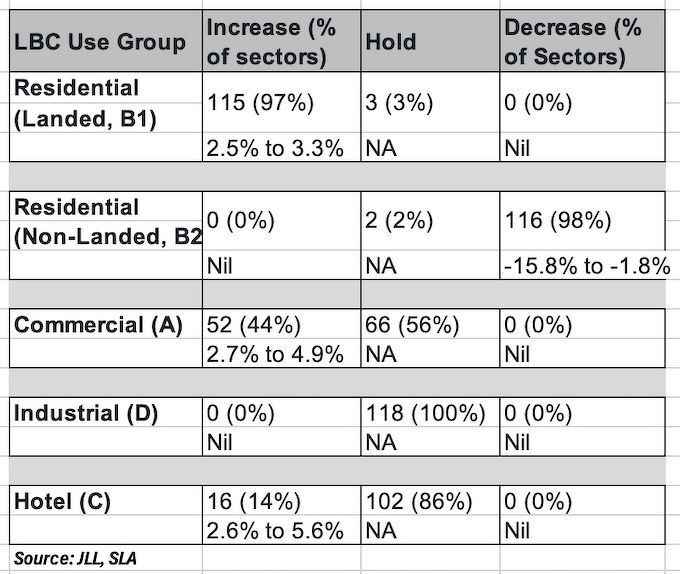

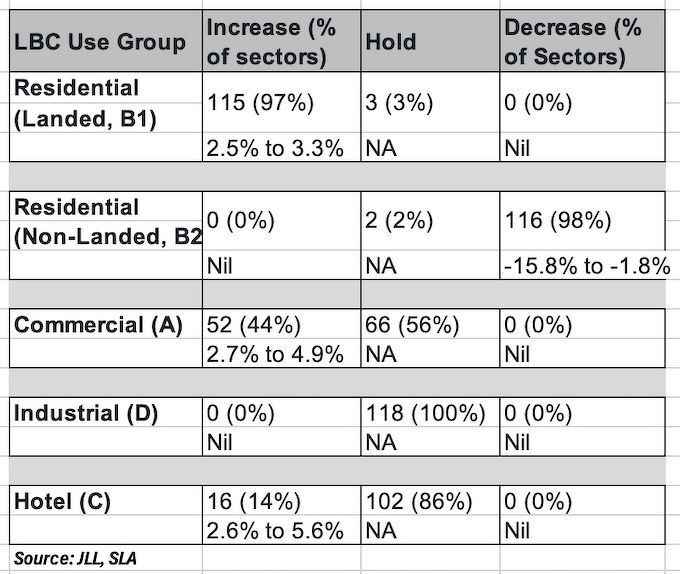

The Singapore Land Authority released the latest Land Betterment Charge (LBC) rates for the period 1 Sep 2024 to 28 Feb 2025. Most use groups saw LBC rates increase, including commercial, residential (landed), and hotel and hospital use groups. Conversely, the LBC rates for the residential (non-landed) use group declined.

For the non-landed residential use group, the average LBC rates decreased by 5.4%, a reversal from the 0.1% increase in March.

Chua Yang Liang, head of research and consultancy for Southeast Asia, JLL, attributes the decline to the "overhanging property cooling measures, a high interest rate environment, and rising global geopolitical risks have resulted in a loss in investor and developer appetite in this market".

Read also: Average 3% to 11% drop in Land Betterment Charge for residential, non-landed use

Advertisement

Advertisement

Overall, Chua estimated an average decline of 13% in land values across the island, weighed down mainly by recent government land sales sites in Sectors 108, 112 and 115 (Holland Rd/ Dunearn Rd/ Sixth Ave, West Coast Road/Jurong East, Sembawang/ Mandai/ Woodlands).

Chua remarks that the fact that LBC for the non-residential sector declined an average of 5.4% overall was no surprise.

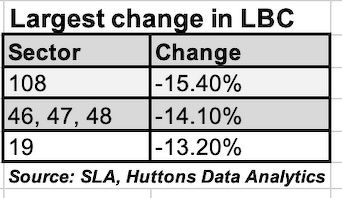

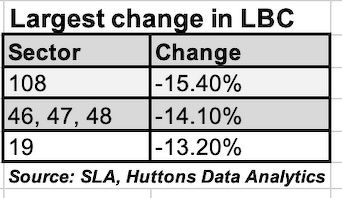

Over 90% or 116 of 118 sectors registered a decline in LBC rates ranging from 2% to 16%. Sector 108 (Commonwealth/Queen Astrid/Watten) saw the biggest decline of 15.4%. Lee Sze Teck, senior director of data analytics at Huttons Asia, attributes the decline in LBC rates to the relatively subdued land sales market in the past six months to the high interest rates, construction costs, and modest take-up at new condo launches.

For the non-landed residential use group, the average LBC rates decreased by 5.4%, a reversal from the 0.1% increase in March.

Chua Yang Liang, head of research and consultancy for Southeast Asia, JLL, attributes the decline to the "overhanging property cooling measures, a high interest rate environment, and rising global geopolitical risks have resulted in a loss in investor and developer appetite in this market".

Read also: Average 3% to 11% drop in Land Betterment Charge for residential, non-landed use

Advertisement

Advertisement

Overall, Chua estimated an average decline of 13% in land values across the island, weighed down mainly by recent government land sales sites in Sectors 108, 112 and 115 (Holland Rd/ Dunearn Rd/ Sixth Ave, West Coast Road/Jurong East, Sembawang/ Mandai/ Woodlands).

Chua remarks that the fact that LBC for the non-residential sector declined an average of 5.4% overall was no surprise.

Over 90% or 116 of 118 sectors registered a decline in LBC rates ranging from 2% to 16%. Sector 108 (Commonwealth/Queen Astrid/Watten) saw the biggest decline of 15.4%. Lee Sze Teck, senior director of data analytics at Huttons Asia, attributes the decline in LBC rates to the relatively subdued land sales market in the past six months to the high interest rates, construction costs, and modest take-up at new condo launches.

The ramp-up in government land sales (GLS) saw more sites sold between March and August, with land bids "within expectations after factoring in the different operating environment", he says,

The expected lower US interest rates could lead to borrowing rates in Singapore trending downwards, notes Huttons Lee. It may push buyers waiting on the sidelines to enter the market and, in turn, push up demand and prices.

"If the sales take-up at new project launches improves, developers may need to replenish their land bank earlier," says Lee. "Nevertheless, developers are expected to remain cautious in bidding for land. Thus, LBC rates for non-landed residential properties are estimated to remain stable," Lee remarks.

Read also: Land betterment charge rates marginally increased for residential properties

Advertisement

Advertisement

The lower LBC rates for the non-landed residential use group is not expected to lead to an increase in en bloc sales.

LBC rates increased by 2.8% on average for the landed residential use group compared to the 7.8% hike during the last review in March. Over 97% or 115 out of 118 geographical sectors saw an increase in LBC rates of about 3%, with the remaining three sectors seeing no change.

Lee attributes the increase to a pick-up in landed transactions and high quantum deals in the Good Class Bungalow (GCB) market.

The largest GCB deal by quantum during the reviewed period was an uncompleted GCB in Tanglin Hill that was sold for $93.3 million.

LBC rates for the commercial group edged up by 1.5% on average, as compared to the 3.8% increase in March. About 44% or 52 out of the 118 sectors saw an increase in LBC rates ranging from 3% to 5%, with no change in the remaining 66 sectors.

Lee notes that there was slightly more interest in the segment, with some of the assets linked to the money laundering case concluded during this period.

Advertisement

Advertisement

Some of the high quantum deals included the sale of Paragon REIT's The Rail Mall along Upper Bukit Timah Road, a 999-year leasehold three-storey shophouse at 182 Telok Ayer Street, and strata-titled units at the freehold Grade A commercial development Solitaire on Cecil in the CBD.

JLL's Chua expects the expected US interest rate cut to "lift the fog of uncertainty clouding the investment markets in and around Asia".

Several commercial buildings were also sold in recent months, notably, the sale of 30 Prinsep Street by Income Insurance ($142 million), the sale of Mapletree Anson by Mapletree Pan Asia Commercial Trust ($775 million) and the sale of 20 Harbour Drive by Mapletree Investments ($160 million).

"We are not surprised by the average 1.5% increase provided by the chief valuer," remarks JLL's Chua.

The ramp-up in government land sales (GLS) saw more sites sold between March and August, with land bids "within expectations after factoring in the different operating environment", he says,

The expected lower US interest rates could lead to borrowing rates in Singapore trending downwards, notes Huttons Lee. It may push buyers waiting on the sidelines to enter the market and, in turn, push up demand and prices.

"If the sales take-up at new project launches improves, developers may need to replenish their land bank earlier," says Lee. "Nevertheless, developers are expected to remain cautious in bidding for land. Thus, LBC rates for non-landed residential properties are estimated to remain stable," Lee remarks.

Read also: Land betterment charge rates marginally increased for residential properties

Advertisement

Advertisement

The lower LBC rates for the non-landed residential use group is not expected to lead to an increase in en bloc sales.

LBC rates increased by 2.8% on average for the landed residential use group compared to the 7.8% hike during the last review in March. Over 97% or 115 out of 118 geographical sectors saw an increase in LBC rates of about 3%, with the remaining three sectors seeing no change.

Lee attributes the increase to a pick-up in landed transactions and high quantum deals in the Good Class Bungalow (GCB) market.

The largest GCB deal by quantum during the reviewed period was an uncompleted GCB in Tanglin Hill that was sold for $93.3 million.

LBC rates for the commercial group edged up by 1.5% on average, as compared to the 3.8% increase in March. About 44% or 52 out of the 118 sectors saw an increase in LBC rates ranging from 3% to 5%, with no change in the remaining 66 sectors.

Lee notes that there was slightly more interest in the segment, with some of the assets linked to the money laundering case concluded during this period.

Advertisement

Advertisement

Some of the high quantum deals included the sale of Paragon REIT's The Rail Mall along Upper Bukit Timah Road, a 999-year leasehold three-storey shophouse at 182 Telok Ayer Street, and strata-titled units at the freehold Grade A commercial development Solitaire on Cecil in the CBD.

JLL's Chua expects the expected US interest rate cut to "lift the fog of uncertainty clouding the investment markets in and around Asia".

Several commercial buildings were also sold in recent months, notably, the sale of 30 Prinsep Street by Income Insurance ($142 million), the sale of Mapletree Anson by Mapletree Pan Asia Commercial Trust ($775 million) and the sale of 20 Harbour Drive by Mapletree Investments ($160 million).

"We are not surprised by the average 1.5% increase provided by the chief valuer," remarks JLL's Chua.

For the non-landed residential use group, the average LBC rates decreased by 5.4%, a reversal from the 0.1% increase in March.

Chua Yang Liang, head of research and consultancy for Southeast Asia, JLL, attributes the decline to the "overhanging property cooling measures, a high interest rate environment, and rising global geopolitical risks have resulted in a loss in investor and developer appetite in this market".

Read also: Average 3% to 11% drop in Land Betterment Charge for residential, non-landed use

Advertisement

Advertisement

Overall, Chua estimated an average decline of 13% in land values across the island, weighed down mainly by recent government land sales sites in Sectors 108, 112 and 115 (Holland Rd/ Dunearn Rd/ Sixth Ave, West Coast Road/Jurong East, Sembawang/ Mandai/ Woodlands).

Chua remarks that the fact that LBC for the non-residential sector declined an average of 5.4% overall was no surprise.

Over 90% or 116 of 118 sectors registered a decline in LBC rates ranging from 2% to 16%. Sector 108 (Commonwealth/Queen Astrid/Watten) saw the biggest decline of 15.4%. Lee Sze Teck, senior director of data analytics at Huttons Asia, attributes the decline in LBC rates to the relatively subdued land sales market in the past six months to the high interest rates, construction costs, and modest take-up at new condo launches.

For the non-landed residential use group, the average LBC rates decreased by 5.4%, a reversal from the 0.1% increase in March.

Chua Yang Liang, head of research and consultancy for Southeast Asia, JLL, attributes the decline to the "overhanging property cooling measures, a high interest rate environment, and rising global geopolitical risks have resulted in a loss in investor and developer appetite in this market".

Read also: Average 3% to 11% drop in Land Betterment Charge for residential, non-landed use

Advertisement

Advertisement

Overall, Chua estimated an average decline of 13% in land values across the island, weighed down mainly by recent government land sales sites in Sectors 108, 112 and 115 (Holland Rd/ Dunearn Rd/ Sixth Ave, West Coast Road/Jurong East, Sembawang/ Mandai/ Woodlands).

Chua remarks that the fact that LBC for the non-residential sector declined an average of 5.4% overall was no surprise.

Over 90% or 116 of 118 sectors registered a decline in LBC rates ranging from 2% to 16%. Sector 108 (Commonwealth/Queen Astrid/Watten) saw the biggest decline of 15.4%. Lee Sze Teck, senior director of data analytics at Huttons Asia, attributes the decline in LBC rates to the relatively subdued land sales market in the past six months to the high interest rates, construction costs, and modest take-up at new condo launches.

The ramp-up in government land sales (GLS) saw more sites sold between March and August, with land bids "within expectations after factoring in the different operating environment", he says,

The expected lower US interest rates could lead to borrowing rates in Singapore trending downwards, notes Huttons Lee. It may push buyers waiting on the sidelines to enter the market and, in turn, push up demand and prices.

"If the sales take-up at new project launches improves, developers may need to replenish their land bank earlier," says Lee. "Nevertheless, developers are expected to remain cautious in bidding for land. Thus, LBC rates for non-landed residential properties are estimated to remain stable," Lee remarks.

Read also: Land betterment charge rates marginally increased for residential properties

Advertisement

Advertisement

The lower LBC rates for the non-landed residential use group is not expected to lead to an increase in en bloc sales.

LBC rates increased by 2.8% on average for the landed residential use group compared to the 7.8% hike during the last review in March. Over 97% or 115 out of 118 geographical sectors saw an increase in LBC rates of about 3%, with the remaining three sectors seeing no change.

Lee attributes the increase to a pick-up in landed transactions and high quantum deals in the Good Class Bungalow (GCB) market.

The largest GCB deal by quantum during the reviewed period was an uncompleted GCB in Tanglin Hill that was sold for $93.3 million.

LBC rates for the commercial group edged up by 1.5% on average, as compared to the 3.8% increase in March. About 44% or 52 out of the 118 sectors saw an increase in LBC rates ranging from 3% to 5%, with no change in the remaining 66 sectors.

Lee notes that there was slightly more interest in the segment, with some of the assets linked to the money laundering case concluded during this period.

Advertisement

Advertisement

Some of the high quantum deals included the sale of Paragon REIT's The Rail Mall along Upper Bukit Timah Road, a 999-year leasehold three-storey shophouse at 182 Telok Ayer Street, and strata-titled units at the freehold Grade A commercial development Solitaire on Cecil in the CBD.

JLL's Chua expects the expected US interest rate cut to "lift the fog of uncertainty clouding the investment markets in and around Asia".

Several commercial buildings were also sold in recent months, notably, the sale of 30 Prinsep Street by Income Insurance ($142 million), the sale of Mapletree Anson by Mapletree Pan Asia Commercial Trust ($775 million) and the sale of 20 Harbour Drive by Mapletree Investments ($160 million).

"We are not surprised by the average 1.5% increase provided by the chief valuer," remarks JLL's Chua.

The ramp-up in government land sales (GLS) saw more sites sold between March and August, with land bids "within expectations after factoring in the different operating environment", he says,

The expected lower US interest rates could lead to borrowing rates in Singapore trending downwards, notes Huttons Lee. It may push buyers waiting on the sidelines to enter the market and, in turn, push up demand and prices.

"If the sales take-up at new project launches improves, developers may need to replenish their land bank earlier," says Lee. "Nevertheless, developers are expected to remain cautious in bidding for land. Thus, LBC rates for non-landed residential properties are estimated to remain stable," Lee remarks.

Read also: Land betterment charge rates marginally increased for residential properties

Advertisement

Advertisement

The lower LBC rates for the non-landed residential use group is not expected to lead to an increase in en bloc sales.

LBC rates increased by 2.8% on average for the landed residential use group compared to the 7.8% hike during the last review in March. Over 97% or 115 out of 118 geographical sectors saw an increase in LBC rates of about 3%, with the remaining three sectors seeing no change.

Lee attributes the increase to a pick-up in landed transactions and high quantum deals in the Good Class Bungalow (GCB) market.

The largest GCB deal by quantum during the reviewed period was an uncompleted GCB in Tanglin Hill that was sold for $93.3 million.

LBC rates for the commercial group edged up by 1.5% on average, as compared to the 3.8% increase in March. About 44% or 52 out of the 118 sectors saw an increase in LBC rates ranging from 3% to 5%, with no change in the remaining 66 sectors.

Lee notes that there was slightly more interest in the segment, with some of the assets linked to the money laundering case concluded during this period.

Advertisement

Advertisement

Some of the high quantum deals included the sale of Paragon REIT's The Rail Mall along Upper Bukit Timah Road, a 999-year leasehold three-storey shophouse at 182 Telok Ayer Street, and strata-titled units at the freehold Grade A commercial development Solitaire on Cecil in the CBD.

JLL's Chua expects the expected US interest rate cut to "lift the fog of uncertainty clouding the investment markets in and around Asia".

Several commercial buildings were also sold in recent months, notably, the sale of 30 Prinsep Street by Income Insurance ($142 million), the sale of Mapletree Anson by Mapletree Pan Asia Commercial Trust ($775 million) and the sale of 20 Harbour Drive by Mapletree Investments ($160 million).

"We are not surprised by the average 1.5% increase provided by the chief valuer," remarks JLL's Chua.