Impact of interest rate cuts on home loans: Is this a good time to refinance?

SINGAPORE (EDGEPROP) - On Aug 23, the US Federal Reserve chair Jerome Powell said “the time has come” to begin lowering interest rates. It has raised expectations of an interest rate cut at the next Federal Open Market Committee meeting in mid-September.

However, the magnitude of the first rate cut and the subsequent trajectory remains uncertain, says Jacquelyn Tan, UOB’s head of group personal financial services.

Singapore interest rate movements have historically aligned with US interest rates, says Clive Chng, associate director at Redbrick Mortgage Advisory. “When US interest rate increases or drops, Singapore interest rates and mortgage rates will follow suit.”

Read also: Mortgage repayments manageable despite higher rates, likely to increase next year: MAS

Advertisement

Advertisement

Interest rates in Singapore have already been sliding in recent months in anticipation of US interest rate cuts, notes Chua Hak Bin, regional co-head of macro-research at Maybank Investment Banking Group. “Mortgage rates will likely continue falling as the Fed eases monetary policy and cut interest rates.”

Mortgage rates, especially for fixed-rate mortgages, have dipped, with two-year fixed-rate mortgage packages available at nearly 3%.

The three-month Singapore Overnight Rate Average (Sora), the benchmark local banks use for floating mortgages, has already come down. At the start of January, Sora was 3.701%, and as of Aug 28, it stood at 3.572%, based on the Monetary Authority of Singapore rates.

Maybank’s Chua expects the three-month Sora rate to hit 3.4% by the end of the year. He projects a cumulative Fed rate cut of 50 basis points (bps) by the end of 2024. He estimates that the three-month Sora rate could drop further to 2.7% by the end of 2025.

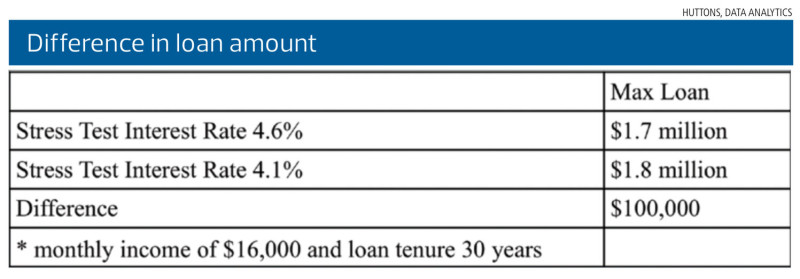

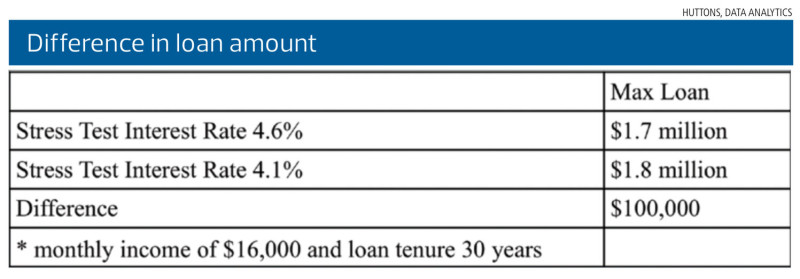

Capitalising on lower interest rate trend

Chua believes homeowners should capitalise on the lower interest rates to refinance their existing mortgages. However, he expects some “sticker shock” for some homeowners with a mortgage pegged to the Singapore Interbank Offered Rate (Sibor), which will be discontinued after Dec 31. This is because Sora tends to be higher than Sibor. “Homeowners should review and shop for more attractive mortgage deals if their financing rates have jumped because of the transition to a Sora benchmark,” says Chua. “Singaporean homeowners — both new and existing homeowners — should benefit from the lower financing rates.” Read also: Continued interest rate hikes raise spectre of distressed sales in auction market Advertisement Advertisement For instance, if a home buyer takes on a $1 million home loan at an interest rate of 3.6% over 30 years, the estimated mortgage instalment is $4,546 per month, says Lee Sze Teck, senior director of research and data analytics, Huttons Asia. If interest rates were down to 3.1% by the end of 2024, the monthly instalment would be $4,270, which translates to a monthly savings of $276. “For buyers with an outstanding mortgage loan, they should stay nimble and avoid locking themselves in a loan package, especially when the interest rate is expected to decline,” says Lee. “They may want to consider a variable rate package with a one-year lock-in.” A lower mortgage rate will also impact the loan amount a homebuyer can qualify for. Most banks use the Sora + 1% as the interest rate in a stress test. Buyers with a combined monthly income of $16,000 and loan tenure of 30 years can borrow up to $1.7 million. If the stress test interest rate is lowered by 50 bps, the loan quantum will increase by $100,000 to $1.8 million (See table).