Singapore among most transparent real estate markets in the world: JLL

Singapore has joined the top ranks of real estate markets in terms of transparency, according to a report by JLL. The city-state is placed in the “Highly Transparent” group of markets under the latest Global Real Estate Transparency Index (GRETI), which evaluates real estate markets worldwide based on market data and information gathered through a survey.

JLL and LaSalle publish the report every two years. This year’s edition assessed market transparency in 89 countries and territories and 151 cities worldwide.

This is the first time Singapore has been categorised under the Highly Transparent group, the highest tier under GRETI and comprises markets that achieve the lowest scoring band according to the index framework.

Read also: Hong Kong Lifts Veil on Land Sales, Yet Trails China, Singapore

Advertisement

Advertisement

Singapore’s entry into the top tier was bolstered by its focus on sustainability, with the country introducing mandatory climate-related reporting requirements for listed companies that will take effect in 2025.

In addition, the city-state’s ranking was also supported by its efforts to improve technology and digital services. This includes launching the country’s Real Estate Industry Transformation Map (ITM) 2025, which outlines plans to digitalise property transaction processes, promote technology adoption by property agencies and enhance skills.

Source: JLL, LaSalle

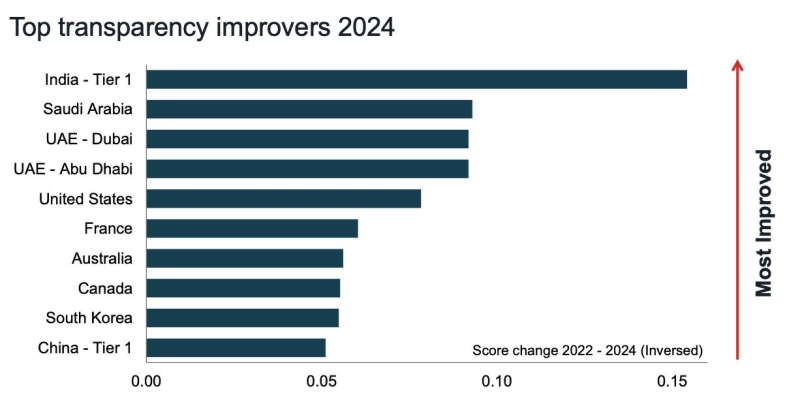

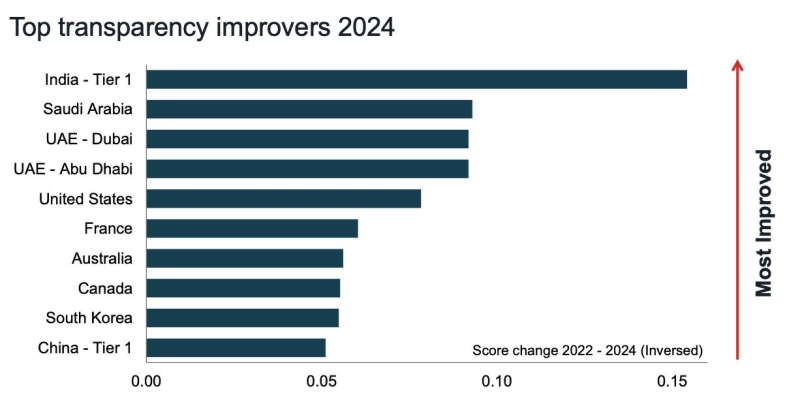

South Korea was also among the top improvers, supported by a growing REIT market, more benchmarks from regulatory boards, and new sustainability reporting regulations. China saw a similar boost, aided by a new unified land registry system and mandatory ESG disclosures for large listed companies.

Advertisement

Advertisement

These sweeping changes across the region are enabling Apac countries to gain some ground on their Western counterparts. Nonetheless, Europe remains the most transparent region, propelled by progress in sustainability standards. The UK maintained its position at the top of this year’s GRETI rankings, while France, the Netherlands, Ireland, Sweden, Germany and Belgium also made the Highly Transparent group. Together, the countries account for over half of the cohort.

North America also remains at the forefront, anchored by leading cities in the US and Canada. These countries have shown strong improvement on various transparency fronts, including beneficial ownership legislation, climate disclosure requirements and building emissions regulation.

Source: JLL, LaSalle

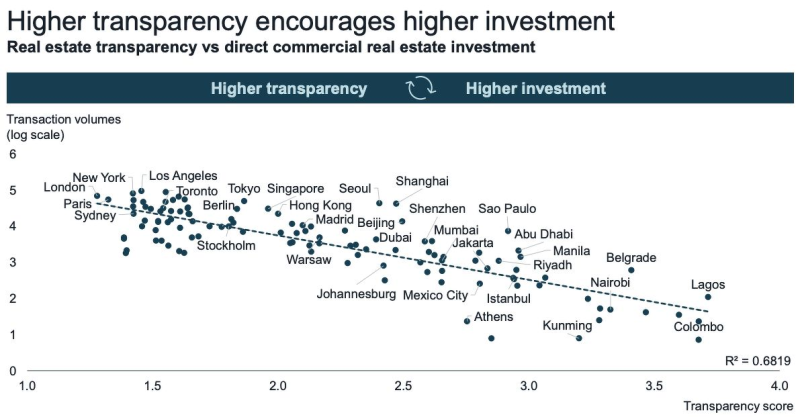

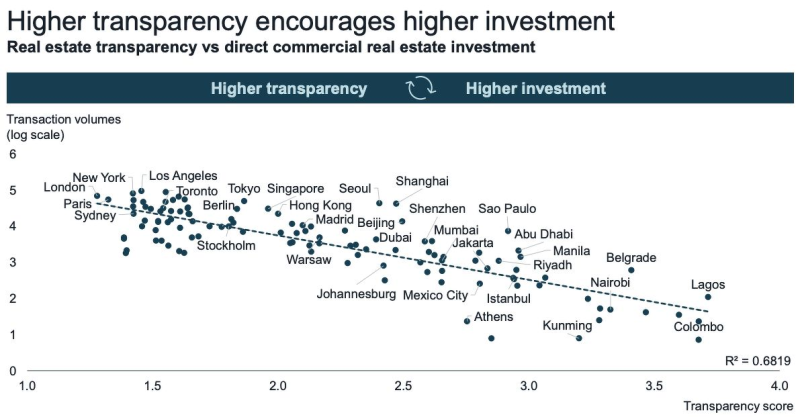

The Highly Transparent group's position ahead of the rest of the world is also reflected in investment activity. Over the last two years, over US$1.2 trillion ($1.6 trillion) in direct real estate investment poured into the Highly Transparent markets, representing 80% of the global total.

The group is expected to continue to benefit in the current environment as transparency becomes more critical than ever amid times of uncertainty. “The focus on transparency for investors has never been greater in global real estate markets as external challenges such as geopolitical tensions and election cycles draw increased attention in the near term,” says Richard Bloxam, CEO of capital markets at JLL.

He adds that interest rate tightening in the past two years — the most rapid cycle in decades — has led to a prolonged period of uncertainty and price discovery in the real estate capital markets.

Advertisement

Advertisement

With a cut in interest rates on the horizon, Highly Transparent markets are best-positioned to leverage on a new investment cycle, notes Brian Klinksiek, global head of research and strategy for LaSalle Investment Management. “Countries with transparent pricing and fundamentals, especially across the diverse range of speciality sectors and sub-sectors, will likely lead the real estate liquidity recovery.”

Europe leads, Apac catching up

Singapore is the fourth Asia Pacific (Apac) market in the Highly Transparent group, joining Australia, New Zealand and Japan. It is only the second Asian country to make the tier, following Japan’s inclusion in 2022. According to JLL’s report, Apac has shown the biggest improvement in regional average transparency in the last two years, backed by a growing emphasis on ESG disclosures, new construction standards and deeper data availability. India was the top improver globally, charting the biggest progress in its GRETI score this year compared to the last edition in 2022. JLL attributes the boost to greater data coverage and quality, a more proactive financial regulator and streamlined building regulations, among other factors.

Transparency driving progress

Despite improvements across the various regions, JLL notes that the Highly Transparent markets continue to be in a league of their own. The top set of countries registered the strongest gains in transparency, bolstered by cutting-edge technology integration, enhanced sustainability regulations and reporting, granular data availability and digital service provision.