New measures to cool public housing resale market; LTV limit cut for HDB loans

Late on August 19, The Ministry of National Development (MND) and Housing Development Board (HDB) jointly announced measures to cool the HDB resale market while providing more support for lower-to-middle-income first-time homebuyers.

With effect from midnight of August 20, the loan-to-value (LTV) limit for HDB housing loans will be lowered by 5% from 80% to 75%. It brings the LTV limit for HDB loans in line with loans granted by financial institutions, which remain at 75%.

The revised HDB LTV limit will apply to complete resale applications received by HDB on or after August 20 and Build-to-Order (BTO) applications for the October 2024 BTO exercise onwards.

Read also: Over a third of HDB owners feel priced out of private housing: PropNex poll

Advertisement

Advertisement

According to the release, first-time home buyers, especially lower-income households, will be less affected by the lower LTV limit as they receive significant housing grants.

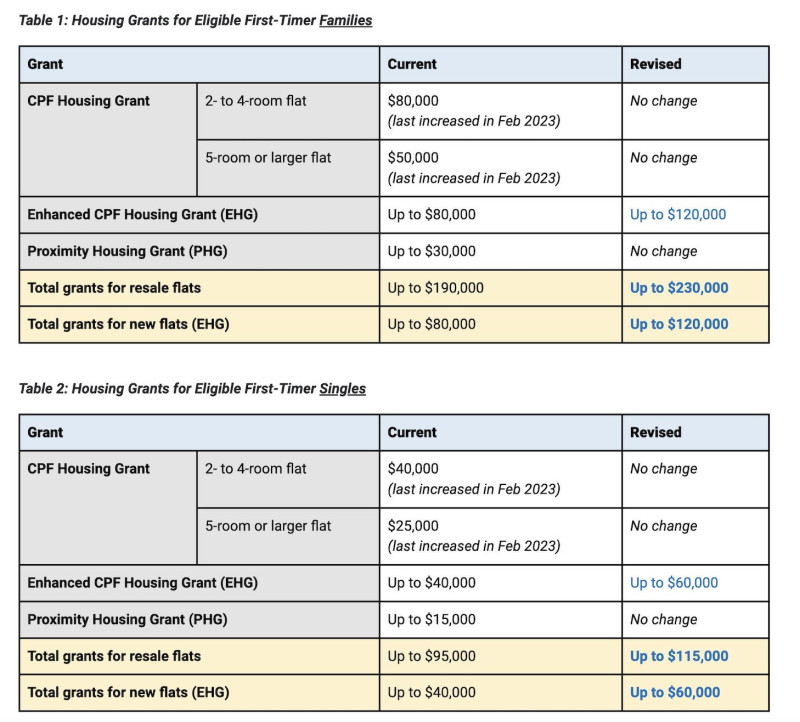

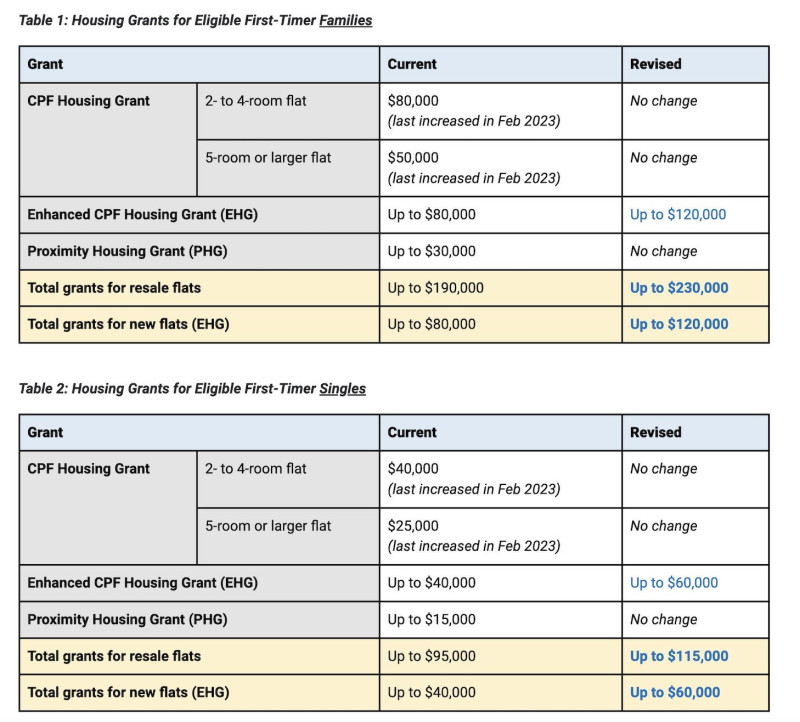

Prime Minister Lawrence Wong announced in the National Day Rally 2024 that the government will increase the Enhanced CPF Housing Grant (EHG) quantum for new and resale flats to support first-time home buyers. The EHG will be increased by:

Source: MND

Check out the latest listings for HDB properties

- Up to $40,000 for eligible first-timer families, from the current maximum grant amount of $80,000 to $120,000; and

- Up to $20,000 for eligible first-timer singles, from the current maximum grant amount of $40,000 to $60,000.