High Street Centre gets 80% nod for lower price of $678 mil, but buyer’s deposit delayed

High Street Centre's marketing agent, Cushman & Wakefield (C&W), sent a letter dated August 7 to the strata-titled owners of the mixed-use development, announcing that the 80% mandate needed to proceed with the collective sale at a lower price of $678 million has been secured.

The letter sent by C&W was also on behalf of the lawyer representing the owners, Legal Solutions LLP, and the High Street Centre Collective Sale Committee.

The offer price of $678 million, received at the close of the tender on June 24, is about 9.4% lower than the reserve price of $748 million.

Read also: Roxy Square up for collective sale at $1.25 billion

Advertisement

Advertisement

According to C&W, at least 80.27% of the owners by share value and 88.38% of the owners by strata area have fully signed the supplemental joint agreement to proceed with the sale of the High Street Centre at the lowered price.

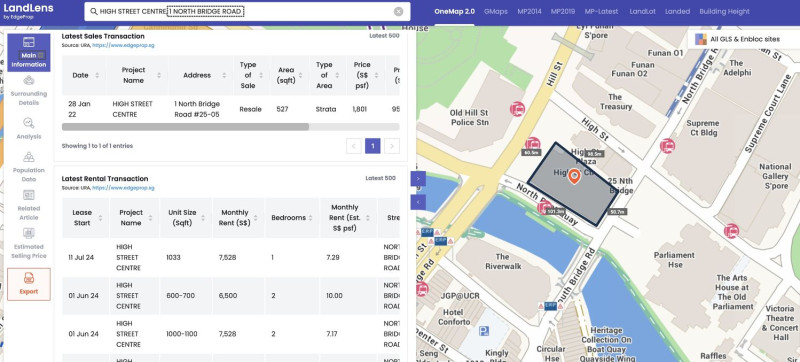

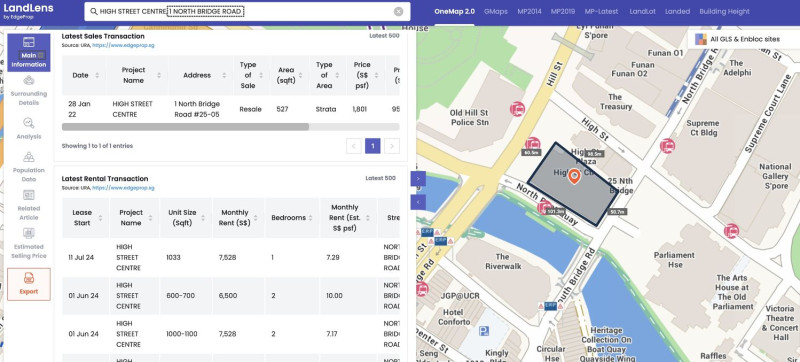

Latest apartment transactions at High Street Centre (Source: EdgeProp Landlens)

Buyer unknown

C&W did not disclose the buyer's identity. An initial deposit of 1%, or $6.78 million, was due on July 31. The payment was delayed because the buyer was subjected to "heightened regulatory vigilance on fund movements," C&W stated in the letter. "As a gesture of sincerity, the purchasers have made a second token payment of a further $100,000, taking the total deposit amount to $200,000," noted C&W. "We also understand that once the purchasers' bankers manage to satisfy regulatory measures, the monies will be remitted, and all requisite payments will be up to date." Consequently, the timeline "will now have to be pushed back by some four to five weeks to accommodate the time needed by the purchasers to remit their funds from the United States of America", according to C&W. The marketing agent added that the 1% payment of $6.58 million ($6.78 million less $200,000) will be paid on or before September 5. Once the 1% deposit is received, the collective sale committee must file at the Strata Titles Board for approval by October 2. The buyer is likely to be new to the market, which is unusual for a collective sale site given its complexity and many moving parts, say sources. Read also: First-level food court and shop at People’s Park Centre for sale at $27 mil Advertisement Advertisement If the deal goes through at $678 million, High Street Centre will be the largest collective sale deal this year. The biggest collective sale deal concluded this year was Delfi Orchard, sold to Singapore-listed property giant City Developments Ltd (CDL) in May. Before the purchase, CDL already owned 84% or 126 of the 150 strata commercial and residential units at Delfi Orchard.