Office rents and prices recover 3.1% q-o-q in 2Q2024 as pipeline supply drop

Overall office prices in Singapore show signs of recovery with a 3.1% q-o-q increase, reversing the 1.2% decline in 1Q2024. Similarly, rents were up 3.1% q-o-q, reversing the 1.7% fall in 1Q2024. Marketwide occupancy rates dipped 1.2% q-o-q from 90.4% in 1Q2024 to 89.2% in 2Q2024.

Catherine He, head of research, Colliers Singapore, believes the price increase could be attributed to several high-value deals in the last three months. One such deal was the sale of the 12,465 sq ft strata floor on the ninth floor at the freehold office development Solitaire on Cecil. It fetched $51.48 million, or $4,130 ps.

Several floors at Suntec City also changed hands. The most expensive transaction by psf price was the sale of a 3,078 sq ft unit in Suntec Tower 1 for $11.5 million, or $3,736 psf, on June 20.

Read also: Office fit-out costs in Singapore rise to $188 psf, highest in Southeast Asia

Advertisement

Advertisement

Colliers' He also points to the sale of 30 Prinsep Street for $147 million, or about $3,000 psf, and Wilmer Place at 50 Armenian Street for $26.5 million, or $3,464 psf.

According to He, these transactions demonstrate the demand for office assets in Singapore by private investors who seem relatively unaffected by the persistently high interest rate environment.

IOI Central Boulevard Towers, a multi-billion-dollar commercial development with 1.26 million sq ft of Grade-A office space (Photo: Samuel Isaac Chua/EdgeProp Singapore)

CBD Grade-A rents climbed to $11.50 psf per month in 2Q2024, 25% shy of the historical peak of $15.27 psf per month recorded in 2Q2008 (Photo: Albert Chua/EdgeProp Singapore)

Flight to quality continues

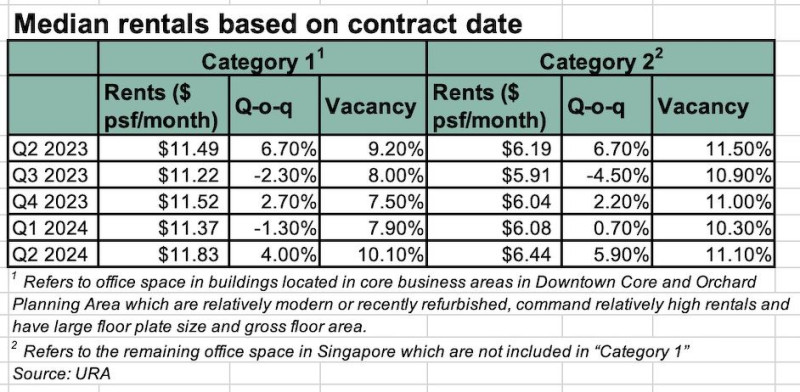

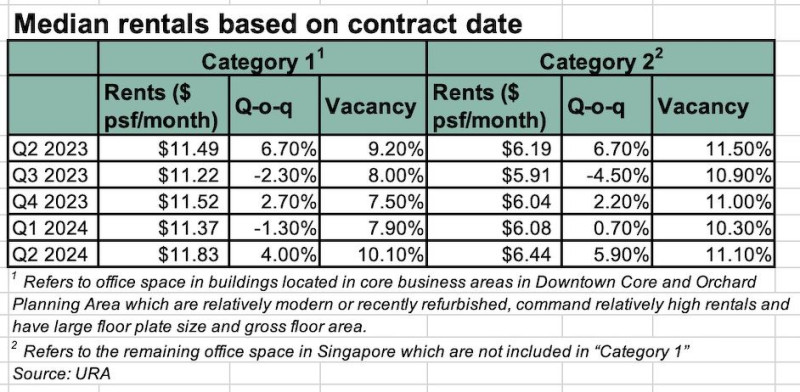

Grade A office rents grew by 4% q-o-q in 2Q2024, rebounding from the 1.3% dip in 1Q2024 despite a 2.2% rise in vacancy rates to 10.1%. Wong Xian Yang, head of research at Cushman & Wakefield (C&W), attributes this to the continued flight to quality since the start of the year as more companies take up smaller but higher-quality spaces. As large occupiers face capital expenditure constraints due to macroeconomic conditions, they opt to renew their leases rather than relocate, says Wong. It has allowed landlords to push for higher rents. Wong posits that if the flight to quality trend continues in the face of growing investment interest in Southeast Asia from wealth management and tech firms, office demand may pick up in 2H2024. Meanwhile, office rents outside the CBD saw a higher q-o-q recovery with a 5.9% rent increase. Vacancy rates rose 0.8% q-o-q, to 11.1% in 2Q2024, from 10.3% in 1Q2024. Read also: Central Region office rents dip 1.7% in 1Q2024, reversing nine straight quarters of growth Advertisement Advertisement

Injection of stock

The quarter also saw a net supply increase of about 936,000 sq ft of new office space, or 1.1% of the total supply. According to Tricia Song, head of research at CBRE, the influx is attributed mainly to IOI Central Boulevard Towers, a multi-billion-dollar commercial development with 1.26 million sq ft of Grade-A office space. Supply over the next 12 to 18 months remained significant, with Keppel South Central (0.6 million sq ft) and the redeveloped Shaw Tower (0.4 million sq ft) on track for completion in 2025, says Chua Yang Liang, JLL head of research and consultancy for Southeast Asia. Adding the uncommitted spaces at IOI Central Boulevard Towers, there could still be over 1.5 million sq ft of new quality office space competing for occupiers, he adds. The office market is also grappling with the need to backfill the spaces that some larger floorplate occupiers plan to relinquish as part of their corporate restructuring, according to Chua. These include Meta's space at South Beach Tower, expiring in September this year, as well as BNP Paribas's space at Ocean Financial Centre, when their lease expires at the end of this year. This recent rebound in rent is also in line with JLL research data, which showed that gross effective rent for CBD Grade-A office space is still expanding, although it decelerated from 1.4% q-o-q in 1Q2024 to 0.7% q-o-q in 2Q24. This slower rental growth comes shortly after office rents exited two-quarters of rental contraction in 1Q2024.