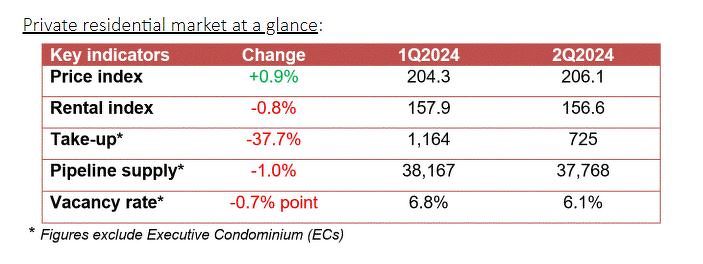

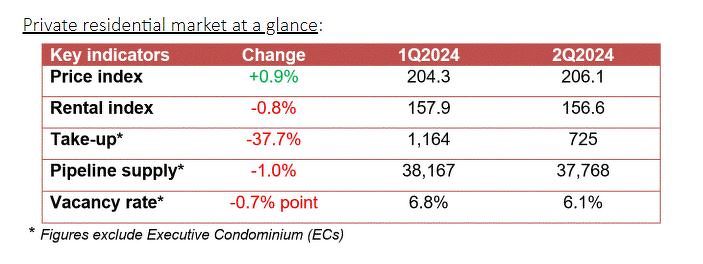

Private home prices continue to slow in 2Q2024 with 0.9% q-o-q increase

In 2Q2024, the price of private residential homes rose 0.9% q-o-q, showing further moderation after the 1.4% increase in the first three months of the year.

Landed properties saw the highest rate of price growth with a 1.9% increase q-o-q. However, it still falls short of the 2.6% price hike the previous quarter.

Meanwhile, non-landed property prices islandwide rose at an average rate of 0.6% over the same quarter.

Read also: City Developments announces new launches, lower interest cover in 1QFY2024 update

Advertisement

Advertisement

The sluggish growth was underpinned by a 0.3% q-o-q fall in prices for non-landed homes sold in the Core Central Region (CCR), partially reversing the 3.4% increase seed in 1Q2024.

However, non-landed homes in the Rest of Central Region (RCR) saw a price increase of 1.6% q-o-q, accelerating from the 0.3% bump registered last quarter.

Prices in the Outside Central Region (OCR) maintained a 0.2% q-o-q growth – the same as in 1Q2024.

(Source: URA)

Dropping private home rents

Rents for private homes dropped by 0.8% quarter-on-quarter in 2Q2024, continuing their descent following the 1.6% decrease in 1Q2024.

The landed property market saw a contraction of 0.9%, slowing from the 4.2% q-o-q drop in 1Q2024. The non-landed market recorded a similar rate of contraction, slipping 0.8% q-o-q, slowing from its 1.6% q-o-q dip in 1Q2024.

Further breaking down numbers in the non-landed market, rents in the RCR and OCR saw the most significant contraction of 1.4% and 1.9% q-o-q, respectively. They show a moderation from 1Q2024 when the RCR dropped 1.9% q-o-q while the OCR decreased 1.4% q-o-q.

Rents in the CCR slipped only 0.1% q-o-q in 2Q2024 compared to the 1.6% decline at the start of the year.

Read also: Landed home sales volume up 21.3% q-o-q in 1Q2024: Huttons Asia

Advertisement

Advertisement

Slower launches, developers’ sales

Only 634 new private homes (excluding executive condos or ECs) were launched for sale in 2Q2024, a 51.3% drop from the 1,304 units the previous quarter. “The steep decline in sales can be attributed to the record-low number of homes being launched,” says Christine Sun, chief researcher and strategist at OrangeTee Group. Of the 634 units launched, 259 were in the CCR, 249 were in the RCR, and the remaining 126 were in the OCR. “The reduction likely reflects a strategic move by developers to space out project launches, aiming to boost market impact and sales,” says Mohan Sandrasegeran, head of research and data analytics at SRI. He adds that 2H2024 is expected to see more new project launches, potentially reinvigorating the market. Developers sold 725 residential units (excluding ECs) in 2Q2024, a 37.7% q-o-q drop relative to the 1,164 units sold the previous quarter. Read also: Commercial office prices dip 5.9% in 4Q2023, amid asset repricing pressure Advertisement Advertisement No new ECs were launched last quarter, although 146 EC units were sold. In 1Q2024, developers launched 512 EC units for sale and sold 449 units.Secondary market and new supply

The resale market saw an increase in activity last quarter, with 3,802 transactions, a 41.4% increase from 2,689 transactions in 1Q2024. Resale transactions accounted for a larger share (77.4%) of all sales in 2Q2024, relative to 63.6% in 1Q2024. According to SRI’s Sandrasegeran, it is the highest volume of private resale transactions since 2Q2022. There are 42,481 private homes in the pipeline, including 4,713 EC units. Of these, 22,099 units remain unsold, an increase from 1Q2024’s 21,562 units. In 2Q2024, 3,339 private residential units (including ECs) were completed. These include the 640-unit Clavon, the 319-unit Hyll on Holland, and the 219-unit Midtown Bay. Based on developers’ expected completion dates, URA expects 7,675 units (including ECs) to be completed in 2H2024, bringing the total new private home supply to 11,300 units. A further 26,801 units (including ECs) are expected to be completed between 2025 and 2027, with an additional 23,100 units by 2028. Outlook Based on current economic conditions, such as Singapore’s steady economy and favourable employment prospects, OrangeTee’s Sun expects private home prices to maintain their stable growth trajectory for the remainder of the year. Considering the persistently high interest rate environment, she forecasts private new home prices to increase by 4.5 to 5.5% for the full year, with new home sales between 5,000 and 6,200 units. Lee Sze Teck, senior director of data analytics at Huttons Asia, expects new private home prices to rise 4% by the end of 2024, with developers selling 5,500 new homes by year-end.