Prime retail rents islandwide up 0.9% in 2Q2024: Knight Frank

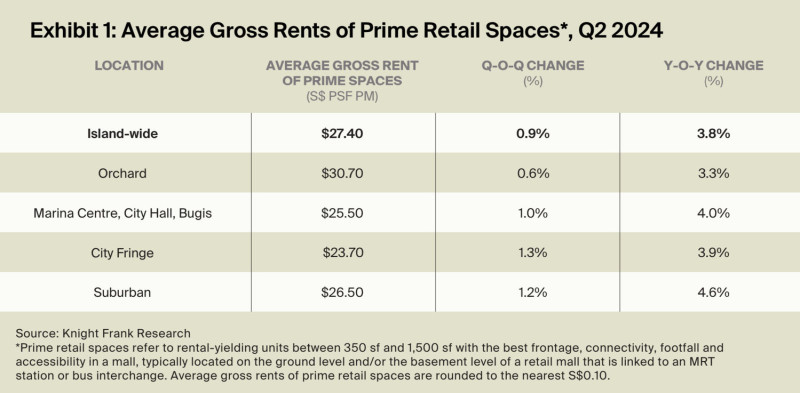

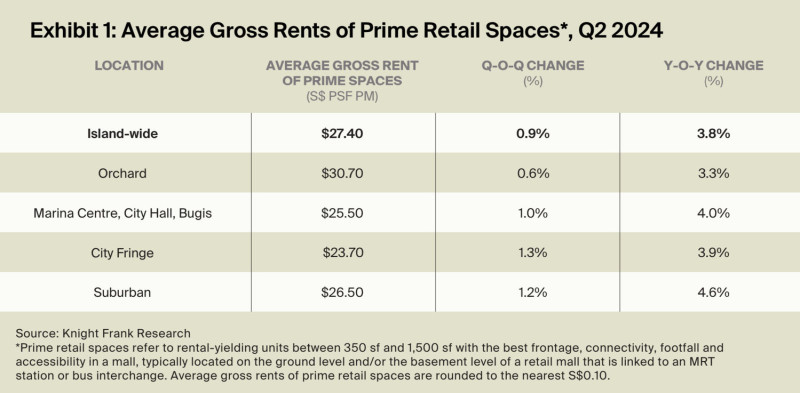

SINGAPORE (EDGEPROP) - The average prime retail rents islandwide grew by 0.9% q-o-q and 3.8% y-o-y to reach $27.40 psf per month (psf pm) in 2Q2024, according to a July Knight Frank retail report. The growth comes despite lower tourist arrivals following a short-lived boom due to high-profile concerts in the first quarter of the year.

While Taylor Swift and Coldplay concert-goers boosted visitors to a peak of nearly 1.5 million in March, tourist arrivals stabilised last quarter, with 1.4 million visitors recorded in April and 1.3 million visitors recorded in May and June respectively.

Singapore’s total retail sales (excluding motor vehicles) fell from $3.5 billion in March to $3.3 billion in April, in tandem with the lower visitor arrivals. Nonetheless, May saw a rebound to $3.6 billion, driven by food and alcohol spending. Retail activity appears to have readjusted to sustainable levels in 2Q2024, following the concert-heavy months in 1Q2024, notes Ethan Hsu, Knight Frank’s head of retail.

Read also: Prime office rental growth slows in 1H2024, up 0.7% q-o-q in 2Q2024: Knight Frank

Advertisement

Advertisement

Prime retail spaces in the city-fringe saw the highest rental growth in 2Q2024, rising 1.3% q-o-q to $23.70 psf pm. Prime rents in suburban areas climbed 1.2% q-o-q to $26.50 psf pm, followed by the Marina Centre, City Hall and Bugis area (up 1% q-o-q to $25.50 psf pm) and the Orchard area (up 0.6% q-o-q to $30.70 psf pm).

Knight Frank defines prime retail spaces as rental-yielding units of 350 to 1,500 sq ft with the best frontage, connectivity, footfall and accessibility in a mall, such as ground- or basement-floor retail mall units linked to an MRT station or bus interchange.

As of 1H2024, prime rents islandwide have grown 1.5%, supported by the post-pandemic recovery and new openings by local and foreign brands. This includes British footwear retailer Hunter which opened its first store in Singapore at Plaza Singapura and French sportswear brand Hoka’s opening in Ion Orchard. The F&B sector was joined by newcomers Ipoh Town, a Malaysian traditional coffee shop at Jewel Changi Airport; and Kebuke, a Taiwanese bubble tea chain at Taste Orchard.

While the retail sector in Singapore remains attractive to retailers, Hsu notes that inflation and a strong Singapore dollar have tempered growth as retailers face rising operating costs.

Data from the Accounting and Corporate Regulatory Authority show that retail and F&B business cessations totalled 2,631 in 2Q2024, exceeding the 2,502 businesses formed during the same period. This is a reverse from the previous quarter when there was a net increase of 295 new retail and F&B enterprises.

Amid this uncertain environment, Hsu believes prime retail rental growth will likely be slower for the rest of the year, as rising costs could potentially deter expansion by retailers and compel consolidation instead. Nonetheless, he believes rents are still on track to grow between 2% and 4% for the whole year, unchanged from his earlier projections.

Read also: Prime retail rents on Orchard Road rise 4.1% in 2023, eighth highest globally: Savills

Advertisement

Advertisement

As of 1H2024, prime rents islandwide have grown 1.5%, supported by the post-pandemic recovery and new openings by local and foreign brands. This includes British footwear retailer Hunter which opened its first store in Singapore at Plaza Singapura and French sportswear brand Hoka’s opening in Ion Orchard. The F&B sector was joined by newcomers Ipoh Town, a Malaysian traditional coffee shop at Jewel Changi Airport; and Kebuke, a Taiwanese bubble tea chain at Taste Orchard.

While the retail sector in Singapore remains attractive to retailers, Hsu notes that inflation and a strong Singapore dollar have tempered growth as retailers face rising operating costs.

Data from the Accounting and Corporate Regulatory Authority show that retail and F&B business cessations totalled 2,631 in 2Q2024, exceeding the 2,502 businesses formed during the same period. This is a reverse from the previous quarter when there was a net increase of 295 new retail and F&B enterprises.

Amid this uncertain environment, Hsu believes prime retail rental growth will likely be slower for the rest of the year, as rising costs could potentially deter expansion by retailers and compel consolidation instead. Nonetheless, he believes rents are still on track to grow between 2% and 4% for the whole year, unchanged from his earlier projections.

Read also: Prime retail rents on Orchard Road rise 4.1% in 2023, eighth highest globally: Savills

Advertisement

Advertisement

As of 1H2024, prime rents islandwide have grown 1.5%, supported by the post-pandemic recovery and new openings by local and foreign brands. This includes British footwear retailer Hunter which opened its first store in Singapore at Plaza Singapura and French sportswear brand Hoka’s opening in Ion Orchard. The F&B sector was joined by newcomers Ipoh Town, a Malaysian traditional coffee shop at Jewel Changi Airport; and Kebuke, a Taiwanese bubble tea chain at Taste Orchard.

While the retail sector in Singapore remains attractive to retailers, Hsu notes that inflation and a strong Singapore dollar have tempered growth as retailers face rising operating costs.

Data from the Accounting and Corporate Regulatory Authority show that retail and F&B business cessations totalled 2,631 in 2Q2024, exceeding the 2,502 businesses formed during the same period. This is a reverse from the previous quarter when there was a net increase of 295 new retail and F&B enterprises.

Amid this uncertain environment, Hsu believes prime retail rental growth will likely be slower for the rest of the year, as rising costs could potentially deter expansion by retailers and compel consolidation instead. Nonetheless, he believes rents are still on track to grow between 2% and 4% for the whole year, unchanged from his earlier projections.

Read also: Prime retail rents on Orchard Road rise 4.1% in 2023, eighth highest globally: Savills

Advertisement

Advertisement

As of 1H2024, prime rents islandwide have grown 1.5%, supported by the post-pandemic recovery and new openings by local and foreign brands. This includes British footwear retailer Hunter which opened its first store in Singapore at Plaza Singapura and French sportswear brand Hoka’s opening in Ion Orchard. The F&B sector was joined by newcomers Ipoh Town, a Malaysian traditional coffee shop at Jewel Changi Airport; and Kebuke, a Taiwanese bubble tea chain at Taste Orchard.

While the retail sector in Singapore remains attractive to retailers, Hsu notes that inflation and a strong Singapore dollar have tempered growth as retailers face rising operating costs.

Data from the Accounting and Corporate Regulatory Authority show that retail and F&B business cessations totalled 2,631 in 2Q2024, exceeding the 2,502 businesses formed during the same period. This is a reverse from the previous quarter when there was a net increase of 295 new retail and F&B enterprises.

Amid this uncertain environment, Hsu believes prime retail rental growth will likely be slower for the rest of the year, as rising costs could potentially deter expansion by retailers and compel consolidation instead. Nonetheless, he believes rents are still on track to grow between 2% and 4% for the whole year, unchanged from his earlier projections.

Read also: Prime retail rents on Orchard Road rise 4.1% in 2023, eighth highest globally: Savills

Advertisement

Advertisement