Landed home price growth slows down to 1.8% in 2Q2024

SINGAPORE (EDGEPROP) - In 2Q2024, landed home prices increased by 1.8%, marking the third consecutive quarterly rise in this residential segment, according to URA's latest transaction statistics. While prices are still rising, the pace has slowed compared to the 2.6% increase in 1Q2024 and the 4.6% increase in 4Q2023. Landed home prices have grown by 4.5% in the first half of this year, down from the 7% growth recorded in 1H2023.

Mohan Sandrasegeran, head of research and data analytics at SRI, notes that the more moderate pace of price increase in this segment indicates a more stable demand and supply balance in the market underpinned by consistent demand.

“The continued interest in landed properties, especially from private home upgraders and the underlying presence of high-net-worth individuals, contributes to (this) sustained demand,” he says.

Read also: SRI unveils partnership with UK agency Hamptons to boost its international project offerings

Advertisement

Advertisement

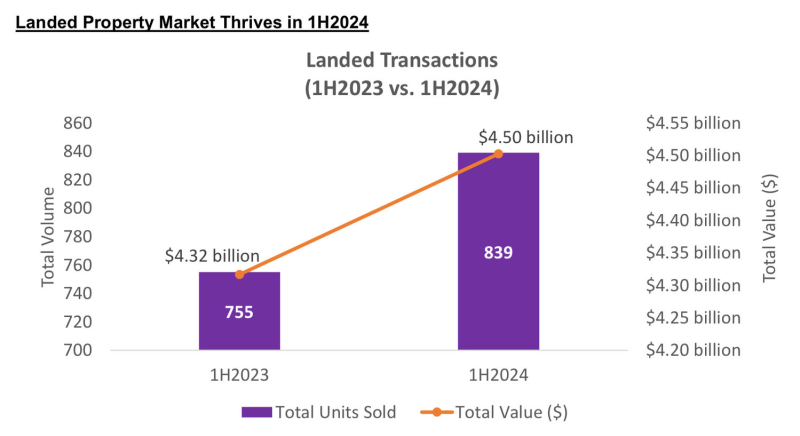

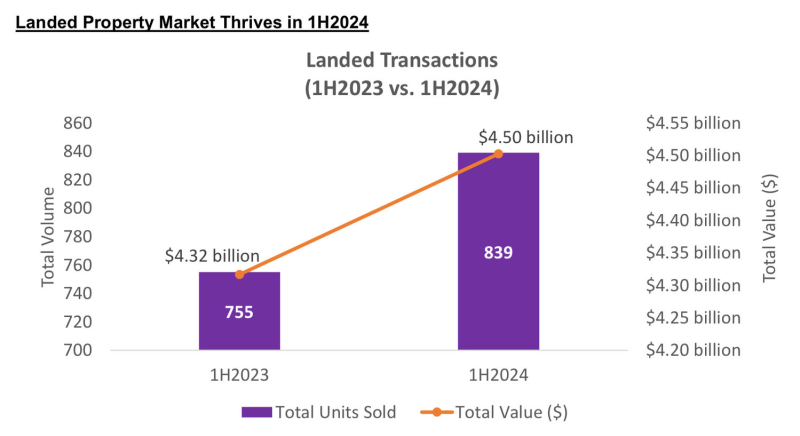

Landed transactions in 1H2023 and 1H2024 (Photo: SRI Research, URA Realis as of July 8)

The total sales value of landed property transactions in 1H2024 stood at $2.6 billion. This is 18.3% higher than the $2.2 billion recorded in 2H2023, based on transaction data compiled by Knight Frank.

Nicholas Keong, head of the residential and private office at Knight Frank, attributes the increase in total sales value in the landed segment to a higher preference for new landed homes by boutique developers over existing, older landed homes.

“Older landed homes, especially those situated in adjoining decently sized landed plots, have been acquired by smaller developers who sub-divide (the plot), preferring to redevelop these homes into at least five new homes for sale,” says Keong.

High-value transactions spike

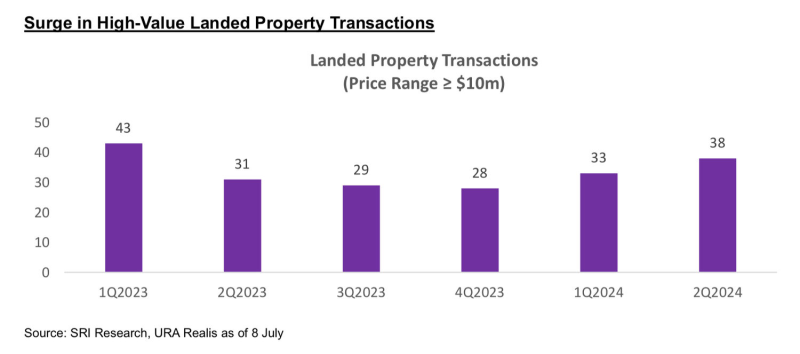

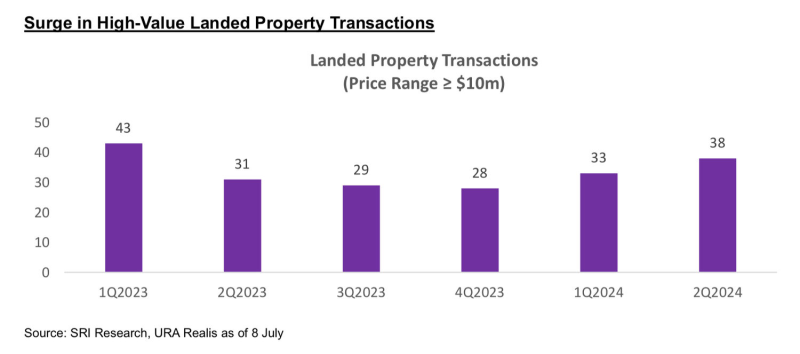

According to data compiled by SRI, the number of landed property transactions priced at $10 million and above increased from 33 units in 1Q2024 to 38 units in 2Q2024. This marks the highest quarterly increase in sales within this price range since 1Q2023, when 43 high-value units were transacted.

The peak in these high-value transactions has been supported by demand from affluent buyers seeking long-term investment opportunities and prestigious addresses, buoyed by the limited supply of high-end landed properties, says Sandrasegeran.

Sandrasegeran noted that following this trend, the Good Class Bungalow (GCB) market saw at least 10 caveated transactions in the first half of 2024, up from seven during the same period in 2023. This uptick comes after a quieter year for GCB market activity in the previous year, influenced by a money laundering scandal and high interest rates.

Read also: Owner sale listings jump 84.6% y-o-y in first two months of 2024, opening prices more than doubled

Advertisement

Advertisement

In terms of absolute price, the largest transacted GCB in 1H2024 was the sale of a 19,554 sq ft GCB at Ford Avenue for $39.5 million ($2,020 psf) in March. According to news reports, the buyer is Grace Wee Jingsi, the youngest child of United Overseas Bank CEO Wee Ee Cheong.

Other noteworthy GCB deals that occurred over the first six months of this year were a Bin Tong Park GCB that was reportedly purchased by the daughter of Chinese metal tycoon Xiang Guangda at $84 million ($2,988 psf) and a GCB in the Gallop Road/Woollerton Park area bought by the wife of Forrest Li, founder of Sea Limited, at $42.5 million, or $2,544 psf.

Sandrasegeran and Keong expect a positive outlook for the high-end landed residential market for the rest of this year, as buying sentiment is expected to be buoyed by a more favourable economic outlook and high buyer confidence in Singapore’s property market. Demand for landed homes is expected to benefit from high-net-worth individuals and newly-minted Singapore citizens.

Keong expects landed home prices to continue rising over the next six months, with many sellers holding firm on their price premiums for sought-after properties. He also notes that the scarcity of available landed properties in the resale market will further bolster price growth throughout the year.

Sandrasegeran adds: “As buyers seek larger living spaces and more exclusive residences, the landed property market is expected to remain resilient. This demand is particularly strong among private home upgraders and high-net-worth individuals, who value landed properties' long-term investment opportunities and luxurious living spaces.”

In terms of absolute price, the largest transacted GCB in 1H2024 was the sale of a 19,554 sq ft GCB at Ford Avenue for $39.5 million ($2,020 psf) in March. According to news reports, the buyer is Grace Wee Jingsi, the youngest child of United Overseas Bank CEO Wee Ee Cheong.

Other noteworthy GCB deals that occurred over the first six months of this year were a Bin Tong Park GCB that was reportedly purchased by the daughter of Chinese metal tycoon Xiang Guangda at $84 million ($2,988 psf) and a GCB in the Gallop Road/Woollerton Park area bought by the wife of Forrest Li, founder of Sea Limited, at $42.5 million, or $2,544 psf.

Sandrasegeran and Keong expect a positive outlook for the high-end landed residential market for the rest of this year, as buying sentiment is expected to be buoyed by a more favourable economic outlook and high buyer confidence in Singapore’s property market. Demand for landed homes is expected to benefit from high-net-worth individuals and newly-minted Singapore citizens.

Keong expects landed home prices to continue rising over the next six months, with many sellers holding firm on their price premiums for sought-after properties. He also notes that the scarcity of available landed properties in the resale market will further bolster price growth throughout the year.

Sandrasegeran adds: “As buyers seek larger living spaces and more exclusive residences, the landed property market is expected to remain resilient. This demand is particularly strong among private home upgraders and high-net-worth individuals, who value landed properties' long-term investment opportunities and luxurious living spaces.”

In terms of absolute price, the largest transacted GCB in 1H2024 was the sale of a 19,554 sq ft GCB at Ford Avenue for $39.5 million ($2,020 psf) in March. According to news reports, the buyer is Grace Wee Jingsi, the youngest child of United Overseas Bank CEO Wee Ee Cheong.

Other noteworthy GCB deals that occurred over the first six months of this year were a Bin Tong Park GCB that was reportedly purchased by the daughter of Chinese metal tycoon Xiang Guangda at $84 million ($2,988 psf) and a GCB in the Gallop Road/Woollerton Park area bought by the wife of Forrest Li, founder of Sea Limited, at $42.5 million, or $2,544 psf.

Sandrasegeran and Keong expect a positive outlook for the high-end landed residential market for the rest of this year, as buying sentiment is expected to be buoyed by a more favourable economic outlook and high buyer confidence in Singapore’s property market. Demand for landed homes is expected to benefit from high-net-worth individuals and newly-minted Singapore citizens.

Keong expects landed home prices to continue rising over the next six months, with many sellers holding firm on their price premiums for sought-after properties. He also notes that the scarcity of available landed properties in the resale market will further bolster price growth throughout the year.

Sandrasegeran adds: “As buyers seek larger living spaces and more exclusive residences, the landed property market is expected to remain resilient. This demand is particularly strong among private home upgraders and high-net-worth individuals, who value landed properties' long-term investment opportunities and luxurious living spaces.”

In terms of absolute price, the largest transacted GCB in 1H2024 was the sale of a 19,554 sq ft GCB at Ford Avenue for $39.5 million ($2,020 psf) in March. According to news reports, the buyer is Grace Wee Jingsi, the youngest child of United Overseas Bank CEO Wee Ee Cheong.

Other noteworthy GCB deals that occurred over the first six months of this year were a Bin Tong Park GCB that was reportedly purchased by the daughter of Chinese metal tycoon Xiang Guangda at $84 million ($2,988 psf) and a GCB in the Gallop Road/Woollerton Park area bought by the wife of Forrest Li, founder of Sea Limited, at $42.5 million, or $2,544 psf.

Sandrasegeran and Keong expect a positive outlook for the high-end landed residential market for the rest of this year, as buying sentiment is expected to be buoyed by a more favourable economic outlook and high buyer confidence in Singapore’s property market. Demand for landed homes is expected to benefit from high-net-worth individuals and newly-minted Singapore citizens.

Keong expects landed home prices to continue rising over the next six months, with many sellers holding firm on their price premiums for sought-after properties. He also notes that the scarcity of available landed properties in the resale market will further bolster price growth throughout the year.

Sandrasegeran adds: “As buyers seek larger living spaces and more exclusive residences, the landed property market is expected to remain resilient. This demand is particularly strong among private home upgraders and high-net-worth individuals, who value landed properties' long-term investment opportunities and luxurious living spaces.”