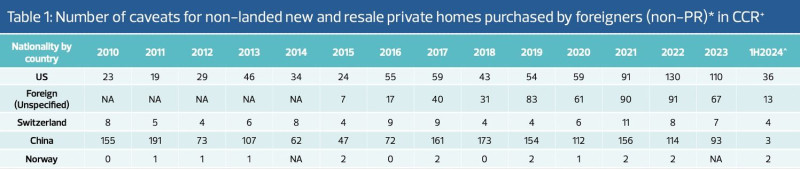

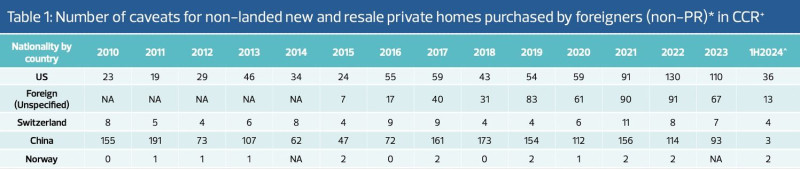

US buyers to lead foreign demand in Singapore for third straight year

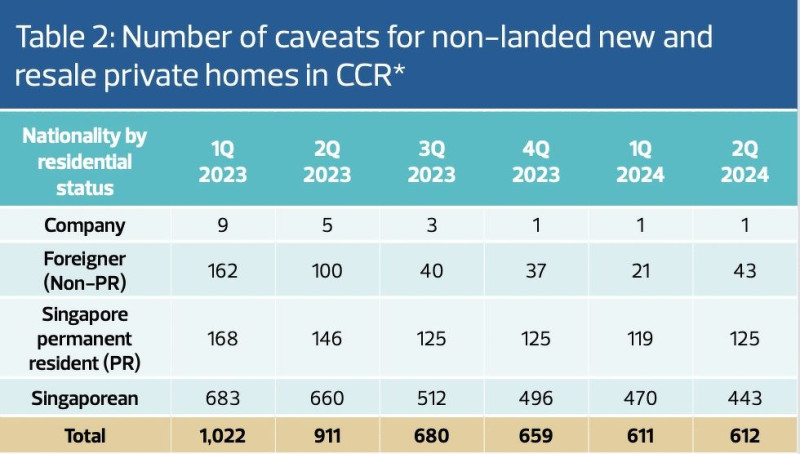

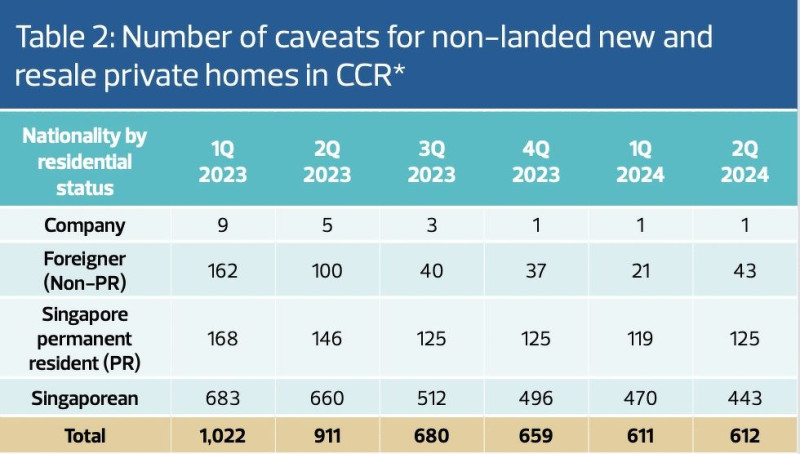

1H2024 saw just 64 residential property purchases by foreigners (non-permanent residents) in the Core Central Region (CCR). In 1Q2024, the number of foreign purchases of both new and resale non-landed homes was 21. The figure doubled to 43 in 2Q2024, bringing the total to 64 for 1H2024. According to PropNex Research, US buyers made up 56% (36 caveats) of these transactions (see Tables 1 and 2).

Only by country by year, based on top 5 entries in 1H2024; Source: PropNex Research, URA Realis (1H 2024 till 24 June)

*Only by nationality, residential status and by quarter; Source: PropNex Research, URA Realis (2Q2024 till June 24, 2024)

Transactions by US buyers in the CCR have started to climb since 2019. In 2022, the number of US buyers hit 130 transactions, leapfrogging Chinese buyers who bought 114 units over the same period.

Ismail Gafoor, CEO of PropNex, attributes the spike in the number of home purchases by US citizens to the fact that they enjoy the same stamp duty treatment as Singaporeans under the free trade agreement (FTA) between the two countries. Nationals and permanent residents of Iceland, Liechtenstein, Norway, and Switzerland are also accorded similar stamp duty treatment under their respective FTAs with Singapore, he adds.

Read also: OPINION: Is it time to review ABSD rates?

Advertisement

Advertisement

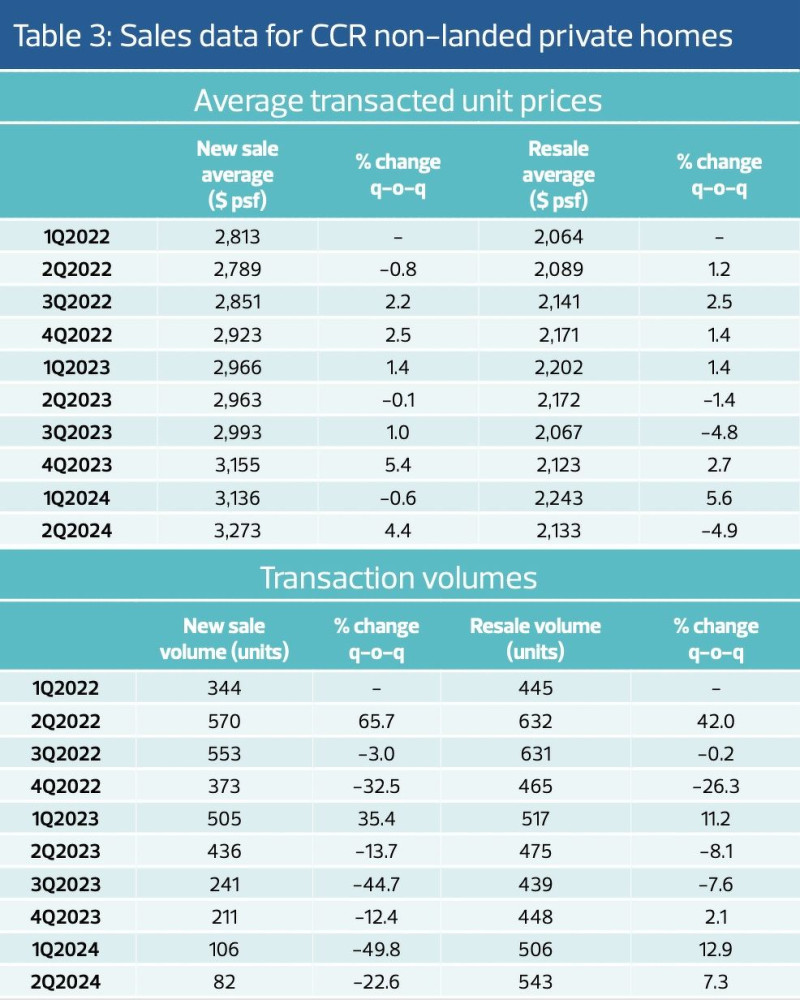

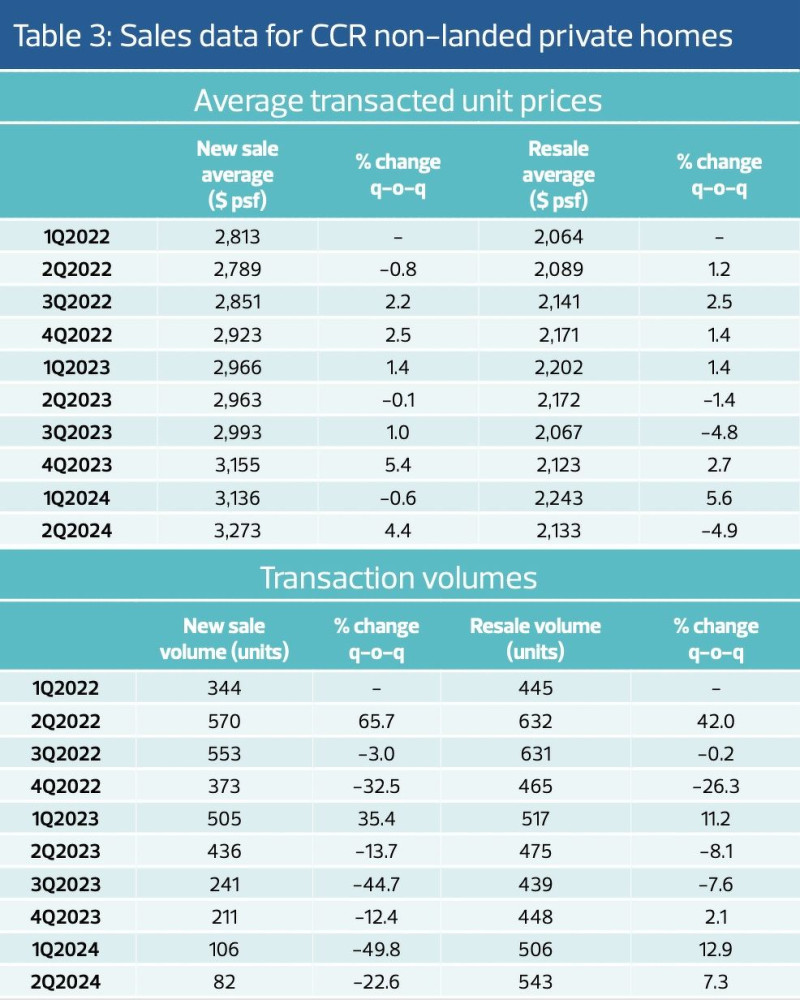

While the market outlook will remain relatively muted for the rest of the year, Gafoor notes that the average transacted prices of non-landed private homes in the CCR have held up even after the hike in additional buyer’s stamp duty (ABSD) in April 2023.

Source: PropNex Research, URA Realis (2Q2024 data till June 24, 2024)

Based on caveats lodged, the average price of a new sale of non-landed homes in the CCR was $3,273 psf in 2Q2024, higher than before the ABSD hike in April 2023 (see Table 3 “Average transacted unit prices”). Meanwhile, the average resale price of non-landed private homes in the CCR was $2,133 psf in 2Q2024, down slightly from the $2,172 psf in 2Q2023.

However, PropNex’s Gafoor observes that new sales of non-landed homes in the CCR dropped significantly (see Table 3, “Transaction volumes”), partly due to fewer launches in the segment following the property cooling measures.

According to PropNex, potential upcoming launches in the CCR in 2H2024 could include the 683-unit Marina View Residences, the 186-unit Aurea at the former Golden Mile Complex, and the 367-unit The Collective at One Sophia. Meanwhile, in the Rest of Central Region, new launches such as the 366-unit Union Square Residences could come online in 2H2024, adds Gafoor.