Kheng Leong’s 32 Gilstead: One of just two new projects launched in the CCR in 2Q2024

Luxury boutique development 32 Gilstead was launched in April without much fanfare. Developed by Kheng Leong Co, the low-rise project is tucked away in a quiet residential enclave off Newton Road and Dunearn Road in prime District 11.

Every unit at 32 Gilstead has a frontage of up to 14.7m, spanning the entire width of the living, dining and lounge bar (Photo: Samuel Isaac Chua/EdgeProp Singapore)

So far, three units have been sold at prices ranging from $14.4 million ($3,431 psf) for a 4,198 sq ft corner unit on the second floor, to $14.54 million ($3,455 psf) for a 4,209 sq ft corner unit on the third floor. URA data shows that two of the units were purchased by Singapore permanent residents (PRs) and the third, by a Singapore citizen. All three buyers are believed to be Chinese.

32 Gilstead is one of two new projects launched in the Core Central Region (CCR) in 2Q2024. The other is Skywaters Residences, which saw a lone 7,761 sq ft, 57th-floor penthouse sold for $47.34 million ($6,100 psf), based on a caveat lodged in May. According to URA data, it was to a “foreigner — unspecified”, but market sources reckon it is a Chinese national with US citizenship who enjoys the same stamp duty treatment as Singaporeans.

Read also: OPINION: Is it time to review ABSD rates?

Advertisement

Advertisement

Artist's impression of The Skywaters mixed-use development, which will be the tallest building in Singapore when completed in 2028 (Source: SOM/Bezier)

The 190-unit Skywaters Residences is part of The Skywaters mixed-use project (a redevelopment of the former 8 Shenton Way). When completed in 2028, it will be the tallest tower in Singapore at 63 storeys and 305m in height. At $6,100 psf, Skywaters Residences is the first 99-year leasehold residence to cross $6,000 psf.

The scale model of 32 Gilstead, designed by Ernesto Bedmar, with landscape design and bamboo garden by Shunmyo Masuno (Photo: Samuel Isaac Chua/EdgeProp Singapore)

“No one has done a bamboo garden of this scale in a residential development before, and we wanted a garden that is quiet and unobtrusive for the residents of these $14 million to $15 million homes,” says Wee Teng Yuan, deputy director of Kheng Leong. His father, Wee Ee Chao, is CEO and director of Kheng Leong, the Wee family-owned real estate firm incorporated in 1949. Ee Chao is also one of the sons of the late banker and businessman Wee Cho Yaw.

At 32 Gilstead, the clubhouse is carved out of one of the ground-floor units. It has a dining room that can seat up to 14 people. The other recreational facilities, such as the children’s pool, adults’ lap pool, and barbecue pit, are on the rooftop.

Read also: Goodwood penthouse sold for $32 million, seller made $16.4 million

Advertisement

Advertisement

Osaka-born, Singapore-based interior designer Koichiro Ikebuchi planned the interiors of 32 Gilstead. The living and dining areas will have timber flooring to give the homes a feeling of warmth, says Teng Yuan. The kitchen will have Italian porcelain tiles, Middle Eastern quartz countertops and top-end German brand Gaggenau kitchen appliances. The master bathroom will have Italian mosaic tiles and marble countertops, with ash wood laminate cabinetry.

The developer is giving home buyers the option of having timber partition doors separating the family room from the living room. Teng Yuan says this is ideal for those with children who enjoy entertaining at home. Behind the family room are the kitchen and the bedrooms.

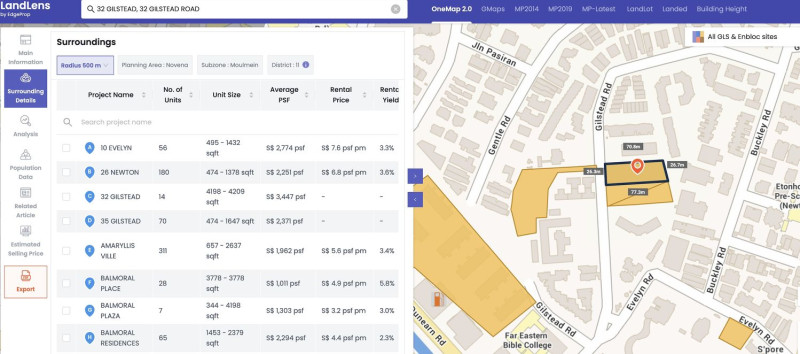

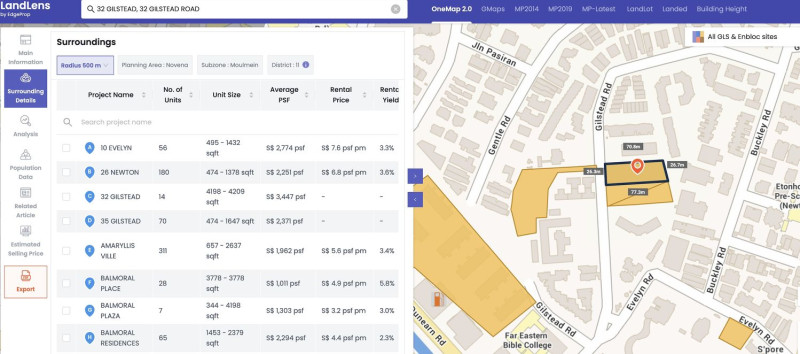

Units at 32 Gilstead are around 4,200 sq ft, larger than the sizes of units in neighbouring condos (Source: EdgeProp Landlens, URA Realis)

Artist's impression of the freehold 15 Holland Hill, where all 57 units have been fully sold as of August 2023 (Source: Kheng Leong)

Of 67 units sold since the relaunch of The Residences at W Singapore, Sentosa Cove, 45 (67%) were purchased by Singaporeans (Photo: Samuel Isaac Chua/EdgeProp Singapore)

Another example is the 228-unit The Residences at W Singapore, Sentosa Cove. The 99-year leasehold condo across the street from Quayside Isle and the One-degree 15 Marina was relaunched in early April at an average price of $1,780 psf. Of 67 units sold since the relaunch, 45 (67%) were purchased by Singaporeans. Based on caveats lodged, the median price of the units sold is about $1,800 psf. Foreigners accounted for just three units.

Still, developer sales in the CCR declined to 83 units in 2Q2024 from 106 units in 1Q2024, notes Chia Siew Chuin, JLL head of residential, research & consultancy. Overall sales of non-landed homes in the CCR above $3,000 psf fell to 104 units in 2Q2024 from 125 units in the previous quarter, she adds.

Another telling sign of weakness in the CCR is the dearth of transactions above $10 million. In the non-landed segment, there were 10 such transactions in 2Q2024 (including the three deals at 32 Gilstead), down from 17 over the same period the previous year. “At this price range, Singaporeans or newly minted Singapore citizens can purchase landed properties, which are still regarded as more prestigious,” says Chu.

Designers renowned in the luxury space

The freehold 32 Gilstead, on the other hand, has three adjoining five-storey blocks. Each block contains just one unit per floor: a four-bedroom apartment with sizes from 3,821 to 4,291 sq ft. Every unit at 32 Gilstead has a frontage of up to 14.7m, spanning the entire width of the living, dining and lounge bar. The living room adjoins a 9m-long balcony with views of the bamboo garden. The granite and glass façade of 32 Gilstead bears the hallmarks of Argentinian architect Ernesto Bedmar. He is known for designing luxury bungalows in Singapore’s prime districts and villas in Delhi and Jakarta. Japanese Zen Buddhist monk and landscape designer Shunmyo Masuno is designing a bamboo garden with walking trails, reflective pools, seating areas, and stones from Japan. The garden will occupy about half the site.

‘Ultra-large format homes’

Construction is underway at 32 Gilstead, which is scheduled for completion in 1Q2026. “When it comes to higher-end projects, seeing is believing,” says Teng Yuan. “With just 14 units, every sale is important.” The project offers “ultra-large format, bespoke homes, with a strong emphasis on quality”, says Marcus Chu, CEO of ERA Singapore. ERA and PropNex are the joint marketing agencies for 32 Gilstead. Kheng Leong purchased the 43,458 sq ft freehold site at 32 and 34 Gilstead Road for $70 million ($1,611 psf) in December 2021 from the Teo family of Super Group. In September 2021, Kheng Leong inked a deal to purchase the 34-unit, freehold apartment block, 21 Anderson, from the Chiu family-controlled, Hong Kong-listed Far East Consortium International for $213 million. Kheng Leong will be refurbishing and reconfiguring the interiors of the former 21 Anderson into a new 18-unit luxury condo, which is expected to be launched sometime next year. In recent years, Kheng Leong has also developed other luxury projects, such as the 57-unit freehold 15 Holland Hill in prime District 10 and the 56-unit freehold Meyer House in District 15 in a joint venture with Singapore-listed UOL Group. Meyer House was launched in May 2019 and was fully sold by July 2022. Units at 15 Holland Hill were released for sale in April 2020, and the project was fully sold by August 2023. Read also: Ticket sizes for CCR condos drop 20% in 5 months Advertisement Advertisement

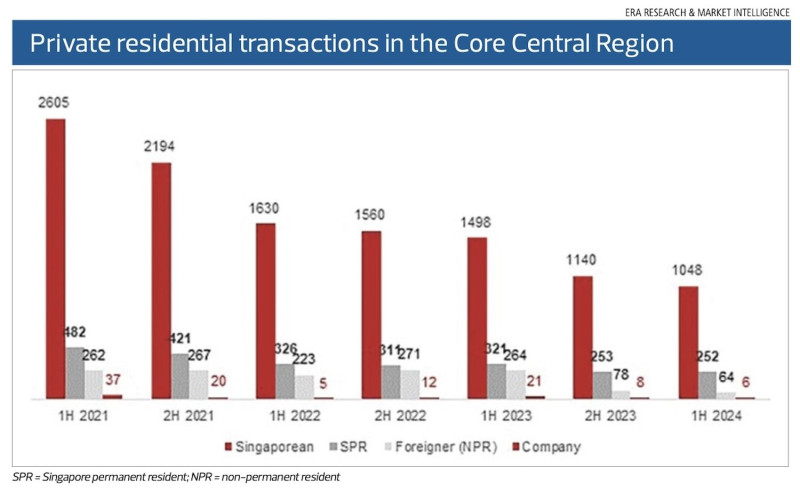

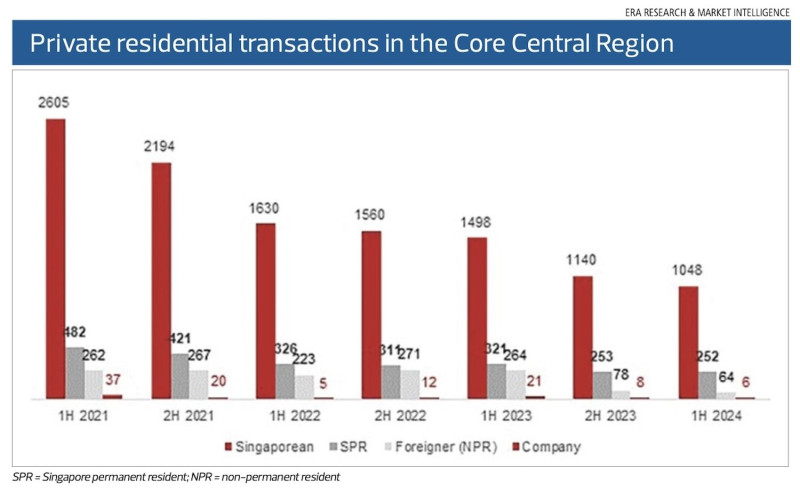

ABSD’s dampening effect on CCR

The doubling of the additional buyer’s stamp duty (ABSD) rate for foreign buyers to 60% has undoubtedly dampened the appetite for luxury homes in Singapore, particularly in the CCR. Since the ABSD rate doubled in April 2023, the number of homes purchased by foreigners in the CCR plunged 75.8% to just 64 units in 1H2024, from 264 in 1H2023, according to ERA’s data. Chu notes that Singaporeans are increasingly making up a significant proportion of buyers. In 1H2024, the proportion of Singaporeans buying CCR homes reached 76.5%, up from 71.2% in 1H2023. Price adjustments in some projects have also made it attractive for Singaporeans to enter the CCR market. A prime example is the 192-unit Cuscaden Reserve in District 10. Since the relaunch of the 99-year leasehold condo in March at prices from $2,900 psf, about 94 units have been taken up. The average transacted price of $3,059 psf is about 15.6% lower than the $3,625 psf transacted when the project was first launched in September 2019. Of the 94 units sold, 72 (76.6%) were purchased by Singaporeans, while foreigners accounted for just six purchases.